As silver is often referred to, the poor man’s gold is globally accepted as a store of value substitute for gold. Unlike its more famous cousin, gold, silver is also an industrial metal. In times of economic uncertainty and rising inflation, investors are in the market for hedge assets, and in the commodity market, silver ranks pretty high as an inflation-hedge asset.

Silver will be among the metals driving economic resurgence with the world recovering from coronavirus. Silver makes it an ideal investment not just to provide a hedge against inflation and portfolio growth and value. To put this to perspective, silver has consistently outperformed gold in the bullish metal markets-price of silver in 2020 rose by 48% compared to gold’s 25%.

What are silver miners’ ETFs?

Investors can either buy silver equities or exchange-traded funds when investing in silver. The problem of investing in individual equities is the volatility of commodity markets forcing one to try and time the markets, which is a loser’s strategy. The prudent way to invest in silver is through funds. They are investment assets comprising investment vehicles of like economic characteristics. For silver funds, they comprise all equities within the silver value chain.

However, here we look at a corner of this value chain that allows investors to gain indirect exposure to the prices of silver. Silver miners’ ETFs in the mining and industrial use of silver, such as the medical field, energy, and motor vehicle, or a combination of these two categories. The dual role of silver makes silver ETFs one of the most sought-after precious metal funds resulting in relatively better liquidity and market stability.

Top 3 silver miners ETFs or the runner-up metal

Since the pandemic’s start, the markets have experienced unprecedented market movements and volatilities. This situation calls for investment assets with minimum correlation to the equities market to hedge against volatility and ensure portfolio earnings.

Add to this the ever-rising inflation currently and what investors need is an asset that plays dual roles of volatility and inflation hedging. All these tailwinds are conspiring to take silver on a bullish run, and the silver miners’ funds below are in pole position to make serious returns for investors.

№ 1. iShares MSCI Global Silver & Metals Miners ETF (SLVP)

Price: $12.34

Expense ratio: 0.39%

Dividend yield: 3.55%

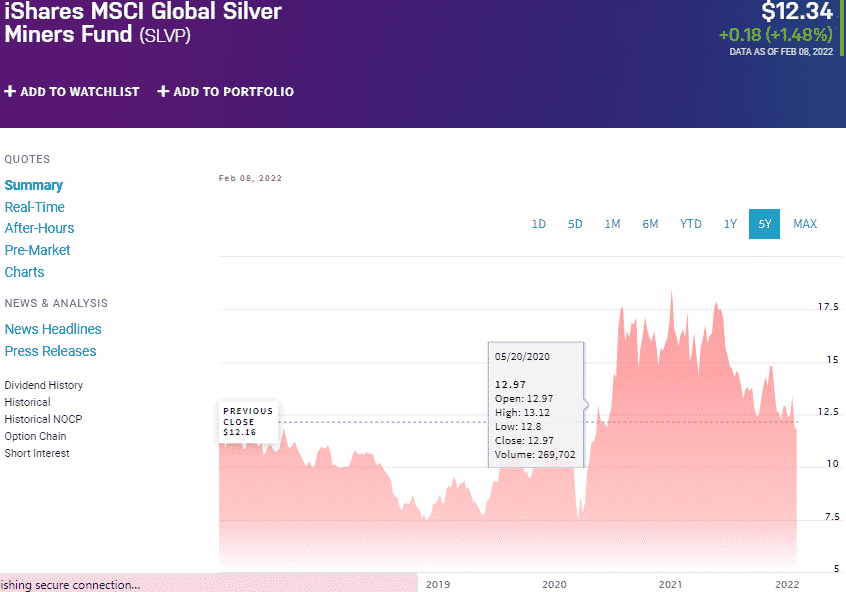

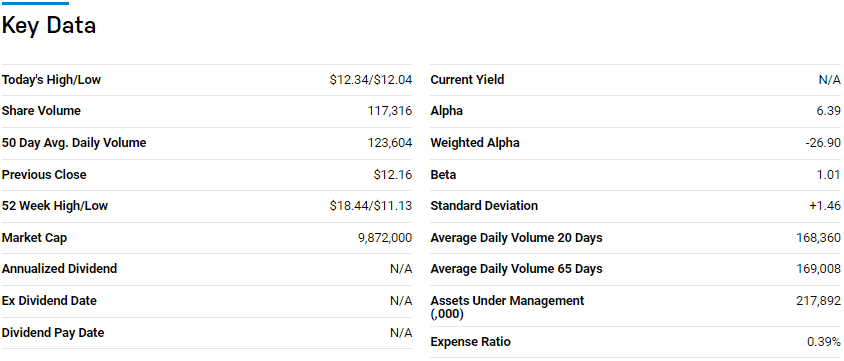

SLVP chart

This fund tracks MSCI ACWI Select Silver Miners Index, investing at least 80% of its funds in the holdings of its underlying index and other investments assets of like economic characteristics. This non-diversified fund exposes investors to the 25 top silver mining and exploration companies domiciled in developed and emerging markets.

In 13 of the best precious metal exchange-traded funds, SLVP is ranked № 2 for long-term investing.

The top three holdings of this precious metal fund are:

- Pan American Silver Corp. – 18.15%

- Hecla Mining Company – 10.08%

- Newmont Corporation – 8.85%

This SLVP fund has $217.8 million in assets under management with an expense ratio of 0.39%. This fund provides a diversified play on silver since its underholding’s equities include gold miners and base metal miners such as zinc and copper. The last half a decade has been one of mixed returns for this ETF, but it is a great play on the rising demand for this industrial metal as the economy resurges and its demand soars; 5-year returns of -0.31%, 3-year returns of 41.79%, and 1-year returns of -24.81%.

№ 2. Global X Silver Miners ETF (SIL)

Price: $34.31

Expense ratio: 0.65%

Dividend yield: 2.20%

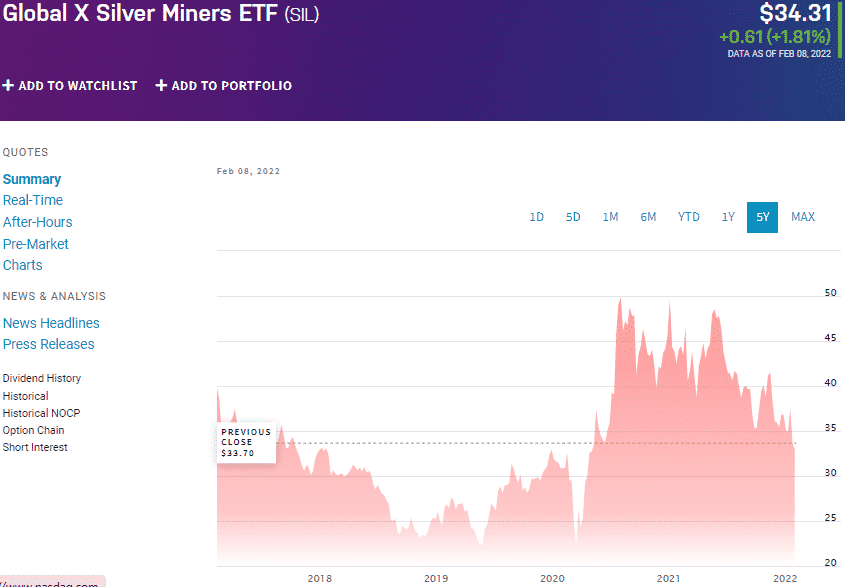

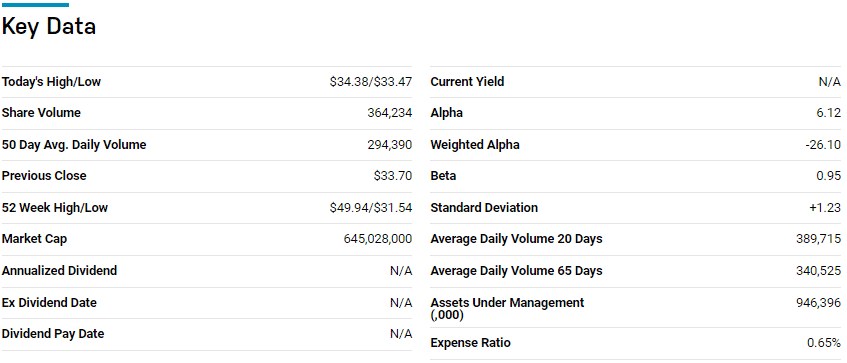

SIL chart

This fund tracks Solactive Global Silver Miners Total Return Index, investing at 80% of its funds in holdings of its composite index and ADRs and GDRs coupled to these holdings. This ETF exposes investors to global companies primarily involved in the exploration and mining of silver.

In a list of 13 of the best equity precious metal exchange-traded funds, SIL is ranked № 4 for long-term investing.

The top three holdings of this precious metal fund are:

- Wheaton Precious Metals Corp – 25.83%

- Polymetal International Plc – 9.94%

- Pan American Silver Corp. – 9.25%

The SIL ETF boasts $946.3 million in assets under management with an expense ratio of 0.65%. This ETF is a leveraged play on the prices of silver without dealing with future-based strategy nuances. This ETF tends to outperform the silver prices and is a great play as this metal gains focus in post-pandemic economic resurgence. Despite experiencing mixed returns in the last five years, 5-year returns of -11.63%, 3-year returns of 32.21%, and 1-year returns of -22.16%.

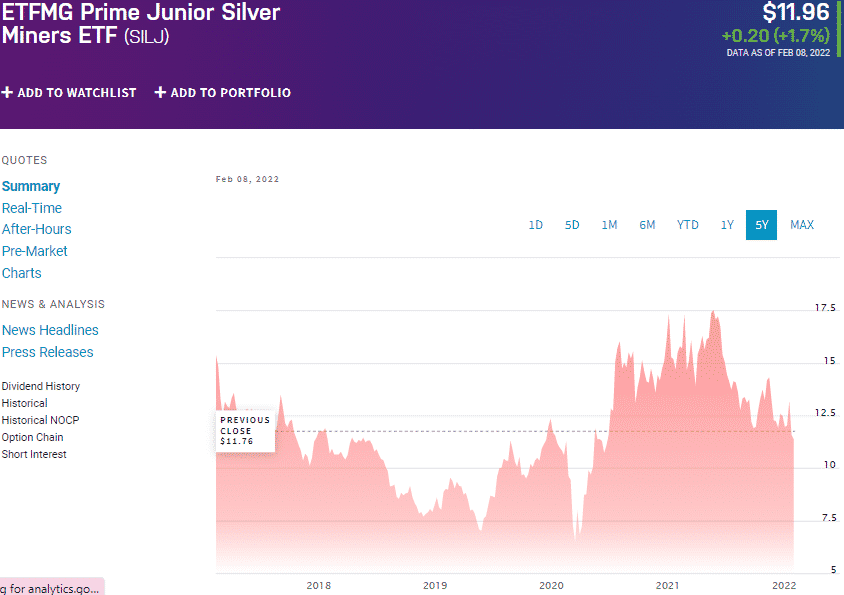

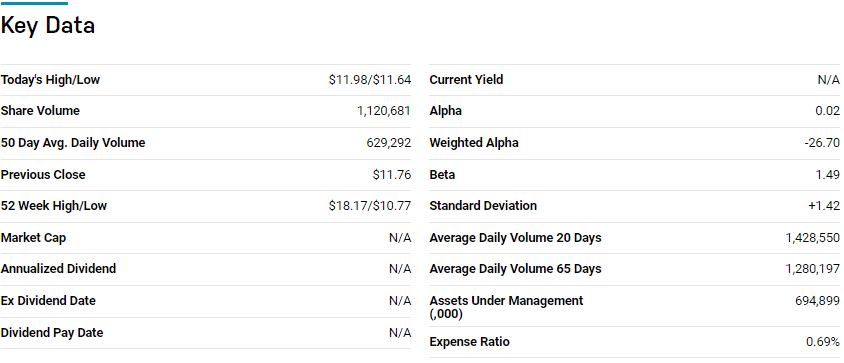

№ 3. ETFMG Prime Junior Silver Miners ETF (SILJ)

Price: $11.96

Expense ratio: 0.69%

Dividend yield: 1.39%

SILJ chart

The fund tracks Prime Junior Silver Miners & Explorers Index, investing at 80% of its funds in holdings of its composite index and ADRs and GDRs coupled to these holdings. This ETF exposes investors to global small-cap companies primarily involved in the exploration, mining, and refining of silver.

In a list of 13 of the best equity precious metal exchange-traded funds, SILJ is ranked № 5 for long-term investing.

The top three holdings of this precious metal fund are:

- First Majestic Silver Corp. – 12.48%

- Pan American Silver Corp. – 10.55%

- MAG Silver Corp. – 8.69%

SILJ ETF has $694.9 million in assets under management with an expense ratio of 0.69%. This fund combines small and micro-cap pureplay and non-pureplay silver equities providing both value and growth attributes to a portfolio.

Despite this diversification, the last five years have mixed returns for this fund just like the others on this list; 5-year returns of -23.59%, 3-year returns of 32.97%, and 1-year returns of -24.31%. Nevertheless, its constitution provides the most significant potential for returns, given its value and growth attributes.

Final thoughts

Industrial and currency use of metal makes it one of the best assets to hedge against inflation and market uncertainty. The ETFs above provide an avenue for investors to invest in this metal as its demand kicks up a gear, fueled by an economic resurgence in a post-pandemic world.

Comments