75% of the world’s surface is covered by water. How did the United Nations recognize Water and Sanitation as a basic right? In addition to water being life, no single economic activity does not use water in one form or the other.

The result is an insatiable demand market with dwindling supply, especially for clean water due to the adverse climate change. Water is an economic resource taken for granted, but the market imbalance makes it one of the most intriguing investment assets globally.

The inelastic demand for water makes this market a golden goose, and rather than try picking stocks and timing the market, and the ETFs below expose you to the entire market.

What is the composition of water ETFs?

Such funds comprise organizations in the water value chain from the provision of the necessary infrastructure, water supply firms, organizations manufacturing equipment for water treatment and supply, and organizations involved in managing water supply networks.

Top water ETFs to buy in 2022

Data shows that by 2025 if things don’t change, two-thirds of the global population will experience adverse water shortages. This stress in water supply against an ever-rising demand will drive phenomenal inflows into this industry. The three ETFs below give investors exposure to this overflowing industry.

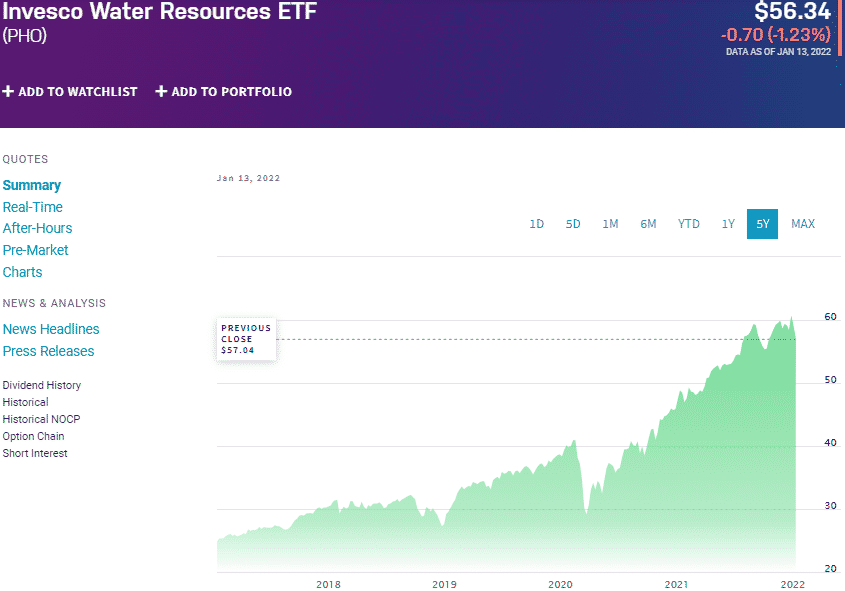

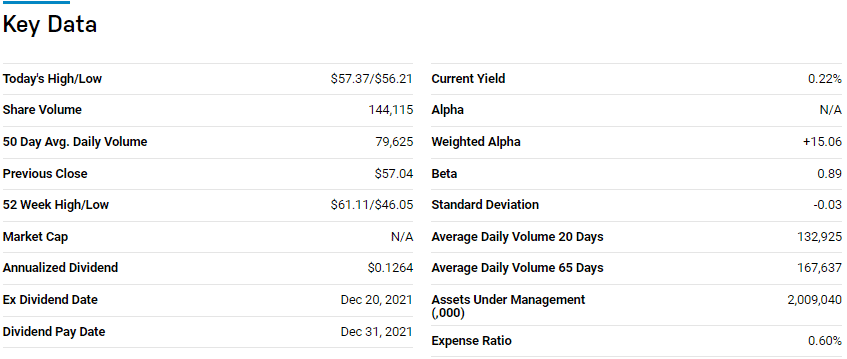

№ 1. Invesco Water Resources ETF (PHO)

Price: $56.34

Expense ratio: 0.60%

Dividend yield: 0.23%

PHO chart

This ETF tracks the performance of the NASDAQ OMX US Water IndexSM, investing at least 90% of its total assets in tracked index securities. It exposes investors to organizations whose core business is water preservation and purification product design for home, business, and industrial use.

The top three holdings of this ETF as of now are:

- Waters Corp. — 8.41%

- Ecolab Inc. — 8.20%

- American Water Works Company, Inc. — 8.00%

PHO has $1.999 billion in assets under management, with an expense ratio of 0.60%. This ETF provides investors with targeted exposure to the water industry by having a hand across the entire value chain. As demand for water rises, this ETF is expected to continue its record earnings season; 5-year returns of 132.89%, 3-year returns of 95.83%, and 1-year returns of 15.65%.

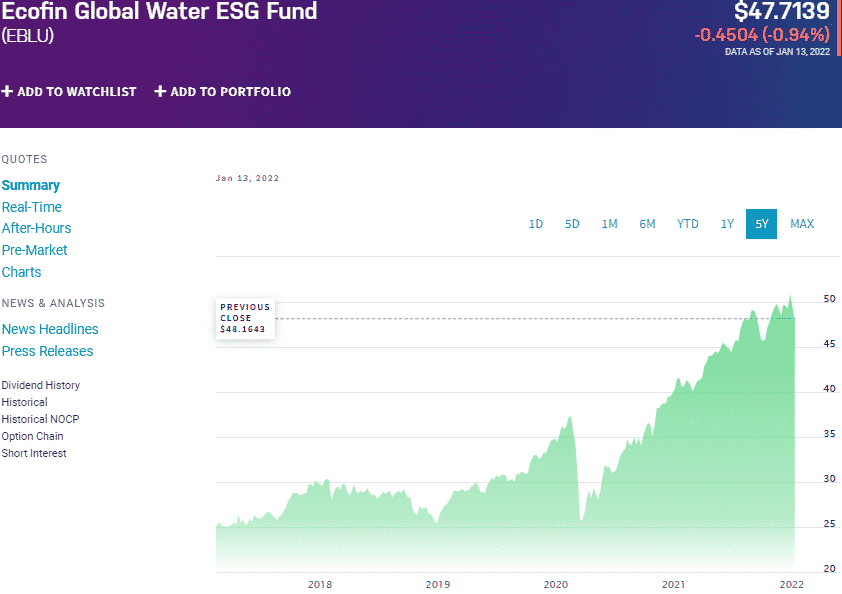

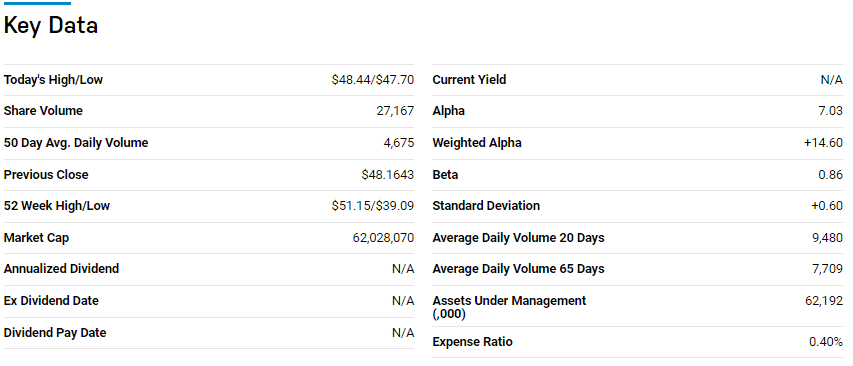

№ 2. Ecofin Global Water ESG ETF (EBLU)

Price: $47.71

Expense ratio: 0.40%

Dividend yield: 1.00%

EBLU chart

Ecofin Global Water ESG Fund tracks the Ecofin Global Water ESG Net Total Return IndexSM, exposing investors to water equities listed in exchanges in developed countries globally. It invests at least 80% of its total assets in the securities making up its benchmark index and other water companies.

The top three holdings of this ETF as of now are:

- Ferguson Plc. — 18.05%

- Ecolab Inc. — 7.49%

- American Water Works Company, Inc. — 7.32%

EBLU ETF has $62.2 million in assets under management, with an expense ratio of 0.40%. By including all cap-weighted water firms in the developed market, this ETF has been a consistent revenue generator for investors; 3-year returns of 89.68% and 1-year returns of 17.20%.

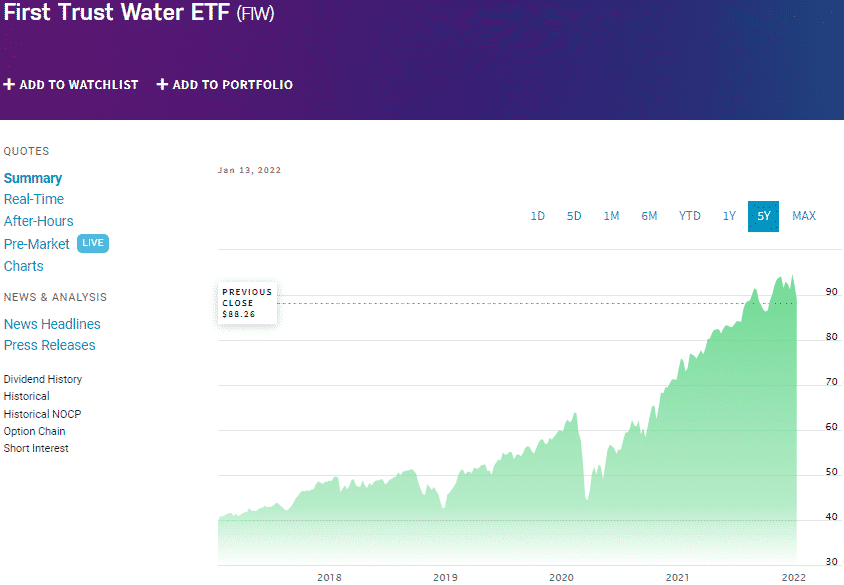

№ 3. First Trust Water ETF (FIW)

Price: $88.26

Expense ratio: 0.54%

Dividend yield: 0.39%

FIW chart

First Trust Water ETF tracks the ISE Clean Edge Water Index, investing at least 90% of its total assets in the securities making up its benchmark index and depository receipts. FIW investors get exposure to global companies generating revenues primarily from the potable and wastewater industry, including utility companies. However, this ETF has a skewness towards companies that make tech for water purification.

This water ETF is ranked №12 by USNews among 38 of the best natural resources funds for long-term investing.

The top three holdings of this ETF as of now are:

- Essential Utilities, Inc. — 4.22%

- IDEX Corporation — 4.07%

- Ecolab Inc. — 4.06%

FIW ETF has $1.51 billion in assets under management, with investors having to part with $54 for every investment worth $10000 annually. Despite having just 40 holdings, this ETF has a weight capping of 4% to any individual firm, mitigating concentration risk.

The water problem is not parsing due to water shortage but clean water. By prioritizing firms that deal with water purification, this fund has positioned itself to benefit from the expanding demand for clean and safe drinking water, fueled by the expanding global population.

The result is a fund that has been giving pretty tidy returns to investors; 5-year returns of 129.88%, 3-year returns of 96.52%, and 1-year returns of 16.62%.

Final thoughts

Water is what sustains the society, ecosystem, and economy. The bad news is that the destruction to the environment since the start of the industrial revolution has had adverse effects on the climate, making this resource that is taken for granted a scarce resource.

Throw in the global appetite for climate and environmental reclamation, and this corner of the investment market provides more than average upside potential. In addition to all this, the inelastic demand for this commodity has endeared it to investors as a hedge asset in times of economic uncertainty. These water ETFs are a great starting point for forward-thinking investors to ride this bullish run.

Comments