There has been no technology since the launch of the internet of things. There has been no technology to disrupt all industries. Since its invention, the internet of things has made investors rich while being the worst nightmare for others. With its evolution from Web 1.0 to Web 2.0 and now the much-anticipated Web 3.0, internet investing opportunities have never been in short supply.

Web 3.0 will genuinely result in the world becoming a global village while changing every facet of our lives. There are tech giant growth equities to give you exposure to this next evolution of the internet of things, new equities that will flourish, and those that will drop off. Rather than try and pick which one will thrive with no certainty, why not invest in the following three internet ETFs and gain exposure to the entire internet growth.

What is the composition of internet ETFs?

Internet ETFs comprise equities that derive a significant percentage of their revenues from internet-related activities; search engines, online selling, online advertising, and cloud computing and storage. The norm is for the under holdings in the internet ETFs to derive at least 50% of revenues from the internet of things and related activities.

The best internet funds for 2022

The beauty of the internet and the world we live in is that everything is undergoing digitization online. For the last three decades, those bold enough to invest wisely in the internet of things for the previous three decades have made significant returns and achieved financial freedom because of the upside potential attached to internet equities. As the world moves towards augmented and virtual reality, supported by Web 3.0, the following internet of things evolution, these three ETFs give you a dynamic way to play this evolution and the resulting growth.

№ 1. First Trust Dow Jones Internet Index ETF (FDN)

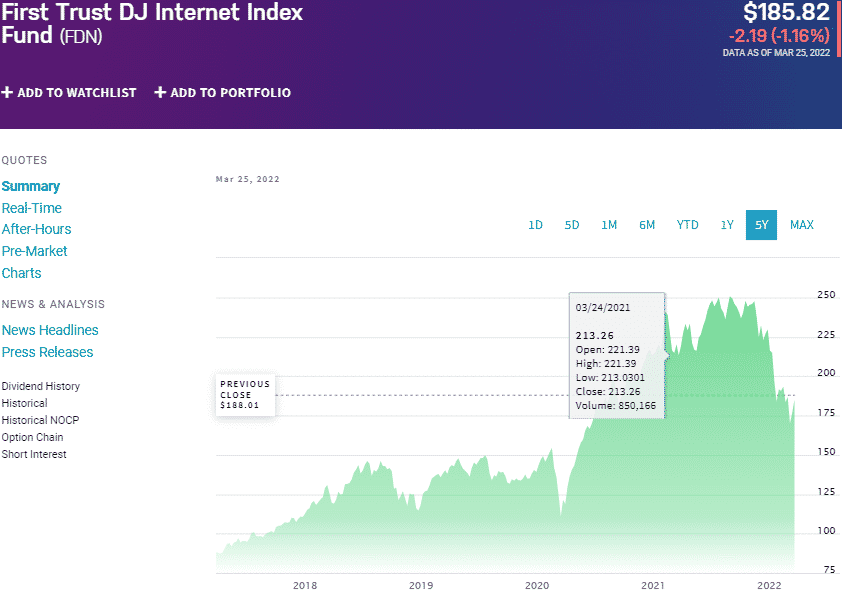

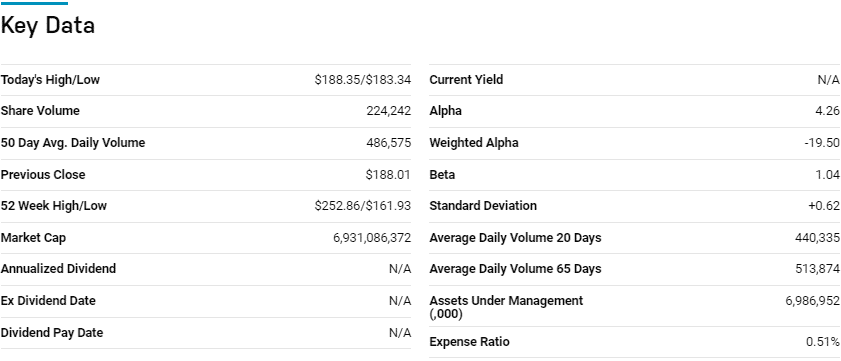

Price: $185.82

Expense ratio: 0.51%

Annual dividend yield: N/A

FDN chart

The First Trust Dow Jones Internet Index ETF tracks the performance of the Dow Jones Internet Composite Index, exposing investors to the largest and most actively traded US companies in the internet space. It invests at least 90% of its total assets in the tracked index underlying holdings, combining two composite indices, the Dow Jones Internet Commerce Index and the Dow Jones Internet Services Index.

In a list of 111 global technology funds, the FDN ETF is ranked № 13 for long-term investing.

The top three holdings of this non-diversified ETF are:

- Amazon.com, Inc. – 9.88%

- Meta Platforms Inc. Class A – 6.54%

- Alphabet Inc. Class A – 5.02%

The FDN ETF has $6.93 billion in assets under management, at a relatively low expense ratio of 0.51%. Combining tech equities with consumer equities operating in the internet spaces provides a particular fund with broad exposure to the internet but diverse in focus, eliminating sector and single holding concentration risk. With a twist towards large growth tech stocks, this internet fund has been a consistent returns provider; 5-year returns of 116.45%, 3-year returns of 36.28%, and 1-year returns of -11.84%.

№ 2. Global X Internet of Things ETF (SNSR)

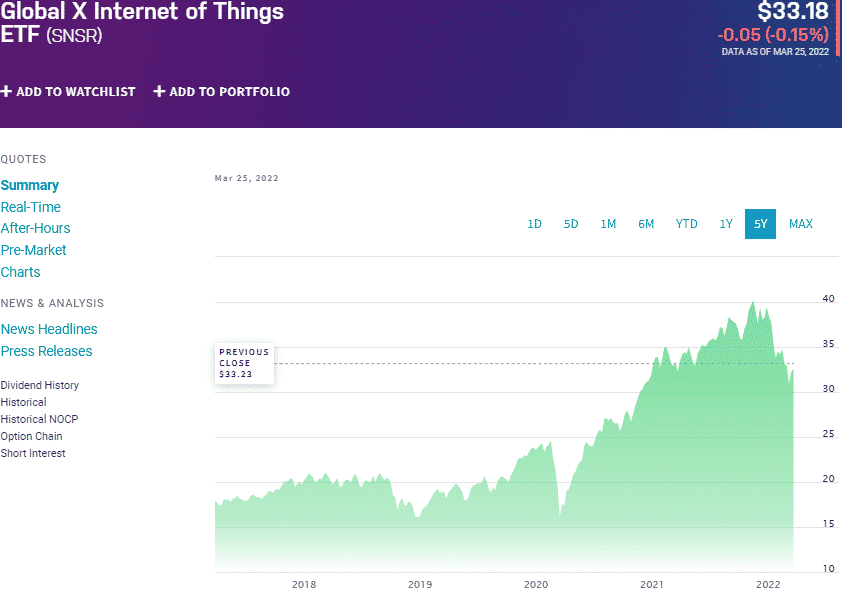

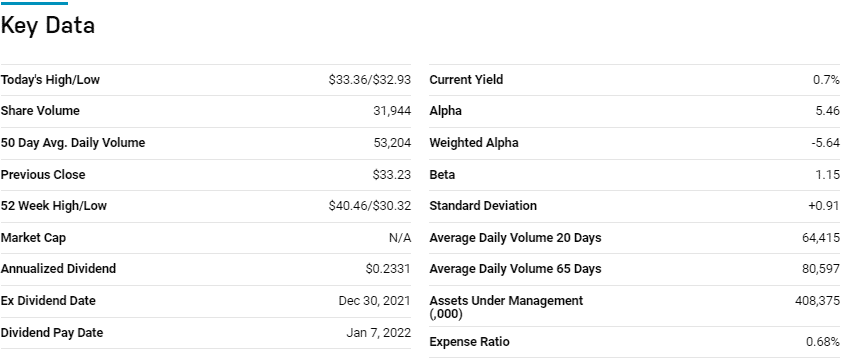

Price: $33.18

Expense ratio: 0.68%

Annual dividend yield: 0.29%

SNSR chart

The Global X Internet of Things ETF tracks the performance of the Indxx Global Internet of Things Thematic Index, net of expenses and fees. It invests at least 80% of its total assets in the tracked index underlying holdings, exposing investors to developed economies’ equities facilitating the running of the internet of things; energy control devices, home automation, wearable technology, smart metering, connected automotive technology, networking infrastructure and software, and sensors. It also includes all equities critical to the Internet of Things ecosystem.

The top three holdings of this non-diversified ETF are:

- STMicroelectronics NV – 7.56%

- DexCom, Inc. – 6.71%

- Advantech Co., Ltd. – 6.04%

The SNSR ETF has $410.1 million in assets under management, with an expense ratio of 0.68%. Exposure to all companies involved in all things internet in developed economies and a pretty even weighting guided by weight caps results in a fund that can consistently provide returns; 5-year returns of 94.24%, 3-year returns of 83.82%, and 1-year returns of 3.36%.

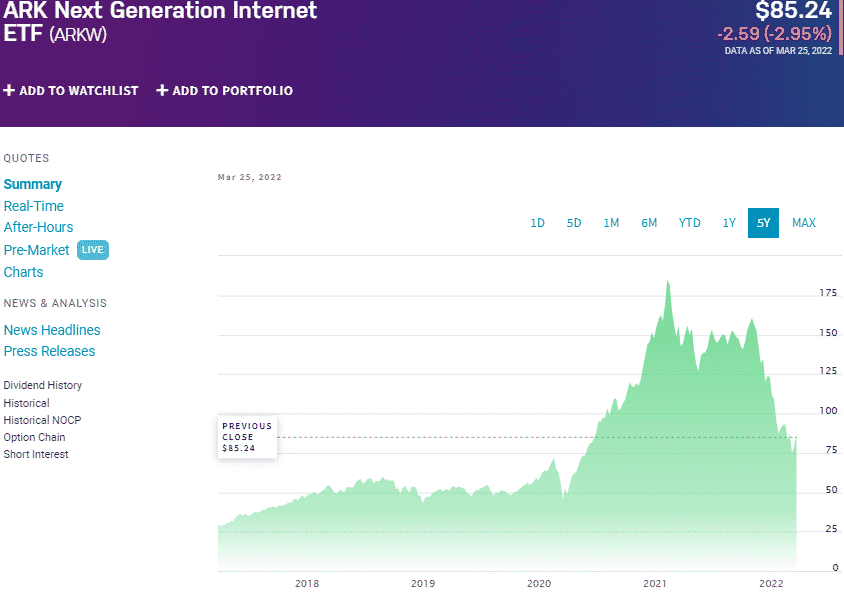

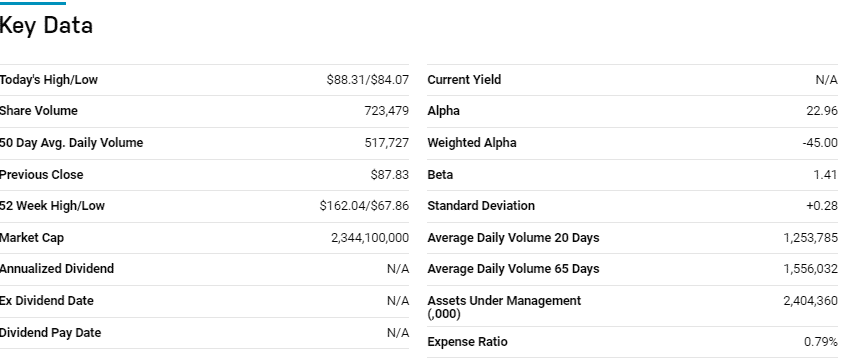

№ 3. ARK Next Generation Internet ETF (ARKW)

Price: $85.24

Expense ratio: 0.79%

Annual dividend yield: 1.23%

ARKW chart

Everyone who has been in the market long enough to have significant experience will tell you that picking stocks to beat the market is futility. However, Cathy Wood and Co at ARK investment have been proving the investment world wrong on this belief.

From this team, investors can invest in the next disruptive technology based on the internet of things with the ARK Next Generation Internet ETF. This actively managed fund seeks long-term capital growth by investing at least 80% of its total assets in investment securities, facilitating the next generation of internet technology.

The top three holdings of this global internet fund are:

- Tesla Inc. – 9.52%

- Coinbase Global, Inc. Class A – 8.52%

- Grayscale Bitcoin Trust – 7.41%

The ARKW ETF has $2.40 billion in assets under management, with a relatively low expense ratio for an actively managed fund of 0.79%. ARK is known for high-conviction bets, and this ETF is no exception. Its diversified exposure on the internet front also ensures it can make money off all internet-related opportunities; mobile technology, social media platforms, cloud computing, e-commerce, artificial intelligence, the metaverse, big data, and financial technology platforms.

Except for 2021, when the market volatilities hammered ARK investment ETFs, the ARKW fund has outperformed the broader segment and its category; 5-year returns of 262.84%, 3-year returns of 78.06%, and 1-year returns of -36.70%.

Final thoughts

The jury is unsure which economy will lead the pack in the next internet revolution. However, the truth is that current internet technologies have resulted in a global village for many. As it gears towards the adoption of Web 3.0, it will provide numerous opportunities to make multi-internet millionaires.

With the three ETFs herein, you not only get instant and diversified exposure to the internet of things as it is at present but also a chance to make significant monies with Web 3.0.

Comments