The e-commerce industry is one of the leading actors of the ongoing technological revolution. The Covid-19 pandemic boosted the popularity of this sector as more people engaged in online purchases and transactions. Moreover, the e-commerce arena will most likely continue its growth due to its remarkable intrinsic potential and the transforming dynamics of today’s era.

According to Statista, global e-commerce sales climbed from $2,382 billion in 2017 to $4,891 billion in 2021. The industry has been on a consistent uptrend, and this increase of 140% in 3-4 years manifests promising prospects of this domain.

Correspondingly, investors are actively acquiring e-commerce investment products to secure long-term profits. Do you want to know an effective way to benefit from the e-commerce boom?

Read this article to learn about the e-commerce ETFs, a collection of e-commerce stocks, their advantages, and the top e-commerce ETFs to consider buying in 2022.

Three things to know about e-commerce ETFs before starting:

- They are a basket of e-commerce stocks that offer diversified exposure to various online sales companies.

- They like XWEB and IBUY have shown outstanding performance in recent years due to the industry’s exploding user base.

- Such funds mitigate the volatility risk of individual stocks investment.

E-commerce ETFs: how do they work?

These ETFs refer to a collection of stocks of companies linked to the online buying and selling of items via the internet. E-commerce marketplaces and direct sellers operate online shopping platforms and facilitate goods and money transactions.

Moreover, these stocks also incorporate e-commerce software providers and logistics companies that provide marketing or sales software and delivery services.

E-commerce ETFs allow investors to capitalize on a variety of e-commerce businesses and avoid dependency on one company. As a result of this diversification, investors who capitalize on these ETFs encounter fewer risks

and more exposure to tech-savvy companies.

What to check before choosing e-commerce ETFs?

E-commerce platforms have made it possible for traditional sellers and businesses to expand their services globally. The convenience and ease of online shopping have accentuated this sphere’s popularity, where billions of consumers are taking advantage of this technology.

However, aggressive competition reinforces the need to evaluate the stocks and ETFs before investing in them carefully. First of all, you should check the income statement and revenue of the relevant e-commerce platform. This financial data can indicate the company’s level of sales and earned commissions.

Next, you should determine the profit margin and competitive advantage of the business. Consistent higher margins point to the stability and growth potential of the company. Moreover, examine the platform’s developmental projects and pace of innovations.

In addition, try to avoid the companies that conduct their activities through h

igh debts with no stable way of paying back.

Best e-commerce ETFs to buy in 2022

Due to the surging popularity of the e-commerce industry, many e-commerce ETFs are in circulation among investors. Here, we have discussed the best e-commerce ETFs to buy in 2022.

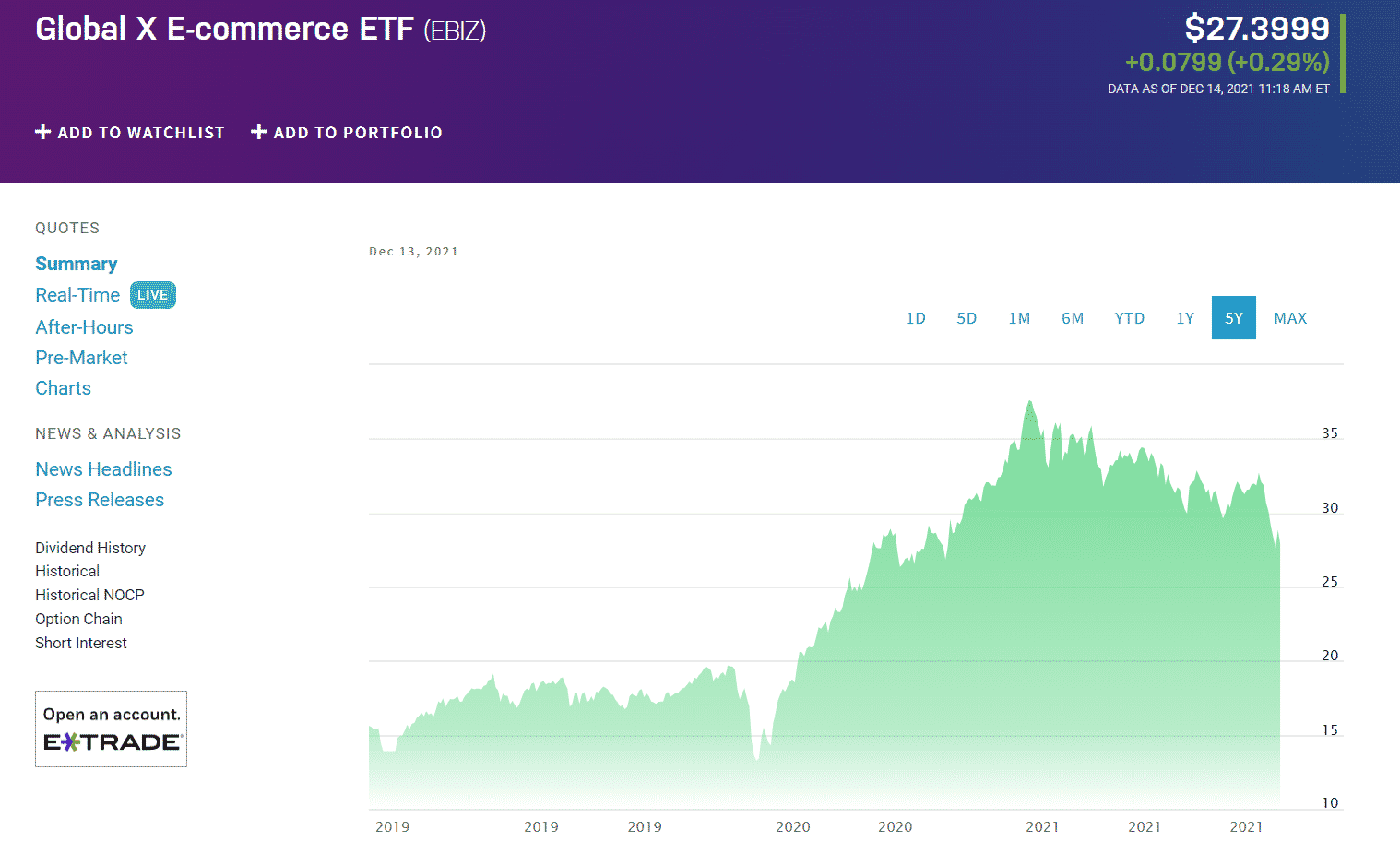

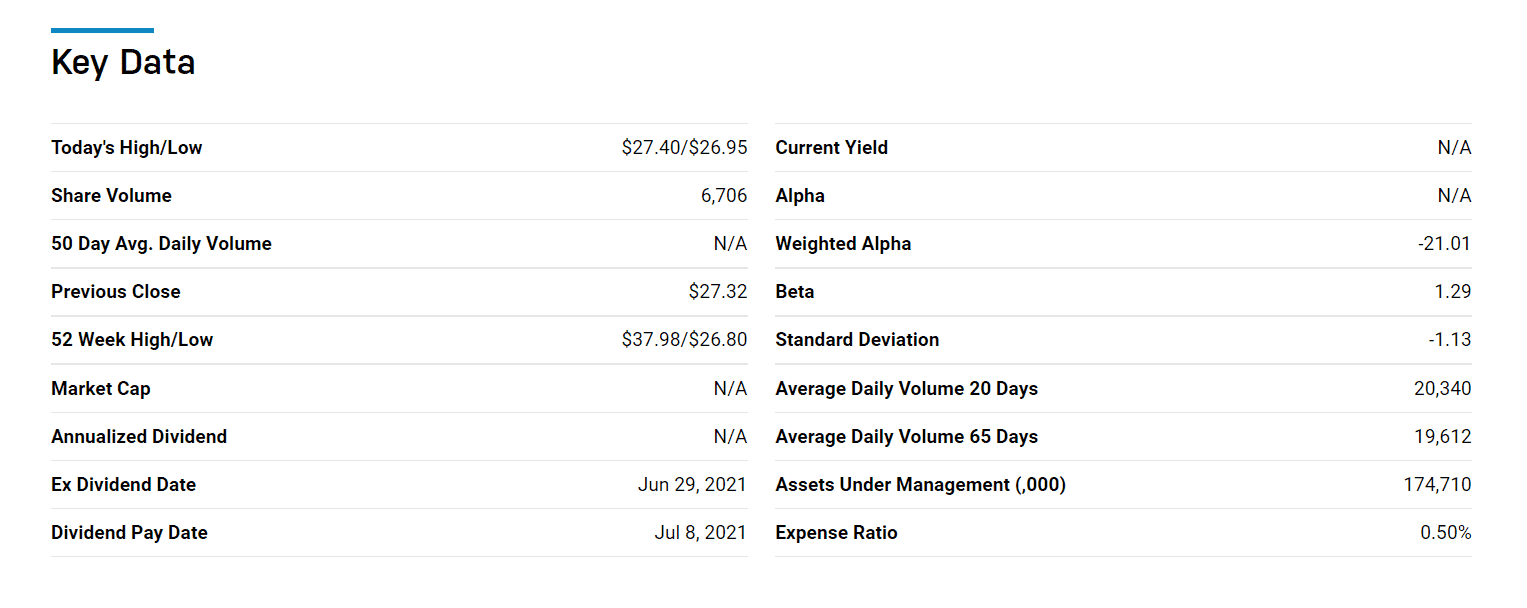

1. Global X E-commerce ETF (EBIZ)

Price: $27.39

Expense ratio: 0.50%

Global X E-commerce price chart

Global X E-commerce ETF tracks the performance of the Solactive E-commerce Index, which includes companies operating the online purchasing or selling platforms and distribution of e-commerce software. The index statement indicates its focus on the companies that would benefit from the e-commerce revolution.

Global X E-commerce ETF has total net assets of $174.5 million, with around 6.2 million shares outstanding. According to the fund’s quarter-end (average annualized) report, the NAV growth of one year and since inception stands at 11.71% and 28.35%.

- Etsy Inc. — 6.16%

- Williams-Sonoma Inc. — 5.45%

- JD.com Inc-ADR — 5.28%

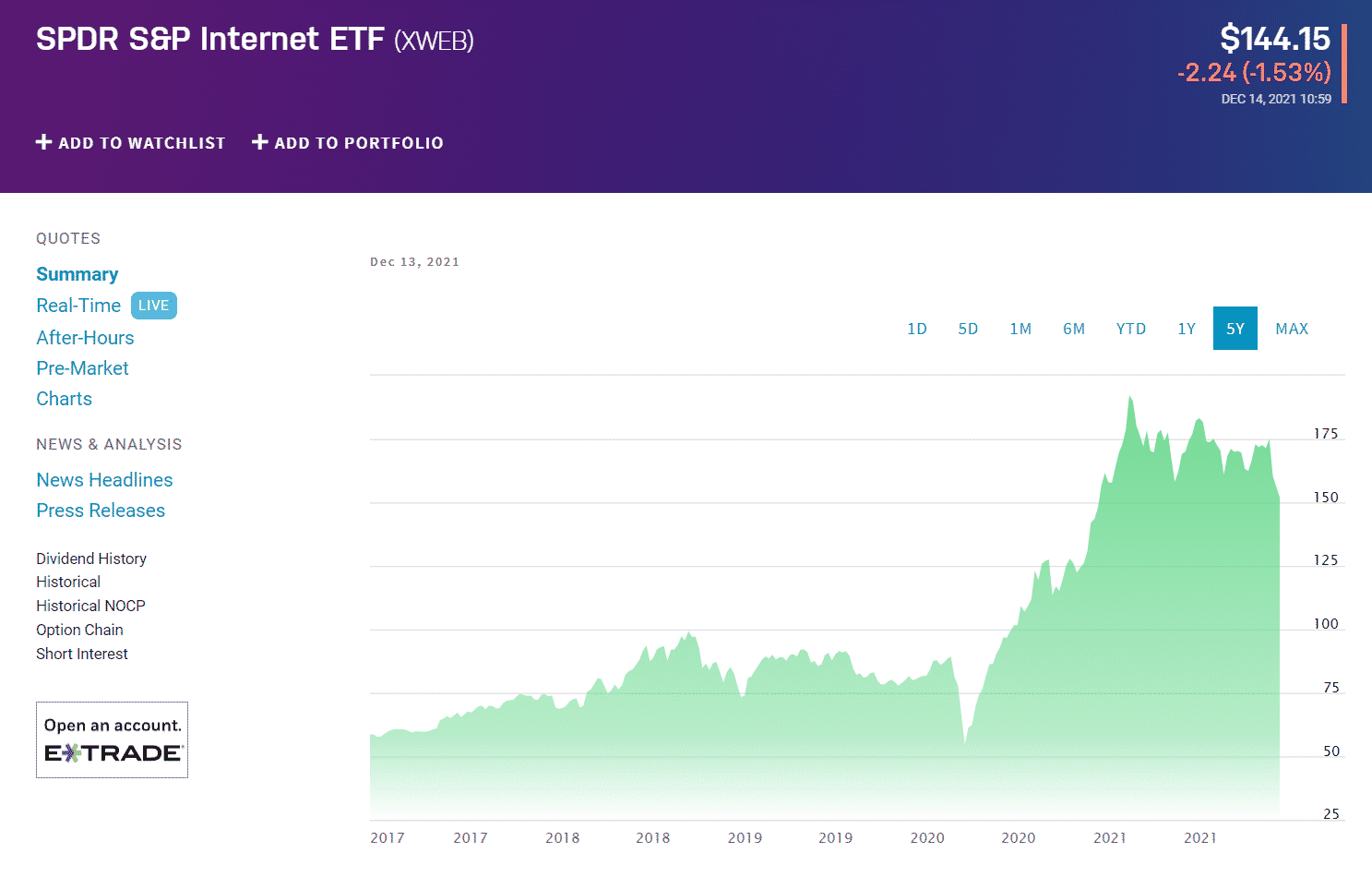

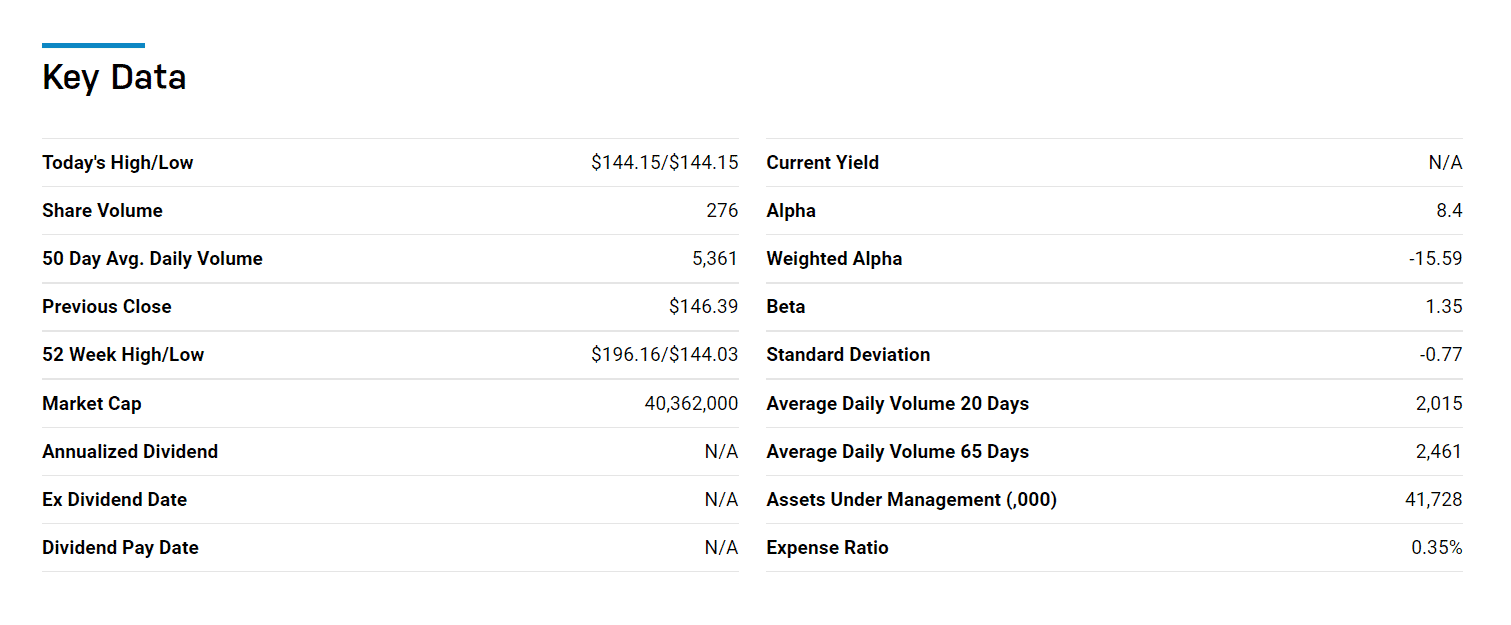

2. SPDR S&P Internet ETF (XWEB)

Price: $144.15

Expense ratio: 0.35%

SPDR S&P Internet ETF price chart

SPDR S&P Internet ETF seeks the investment results of a modified equal-weighted S&P Internet Select Industry Index. This index is a component of the parent S&P Total Market Index and deals with the internet services, interactive media, and direct marketing retail industries.

SPDR S&P Internet ETF has about $41.73 million assets under management and 280,000 outstanding shares. The fund’s quarter-end report demonstrated a remarkable one-year and five-year NAV growth of 37.88% and 25.45%, respectively.

- DigitalOcean Holdings Inc. — 2.50%

- Snowflake Inc Class A — 2.43%

- CarGurus Inc Class A — 2.36%

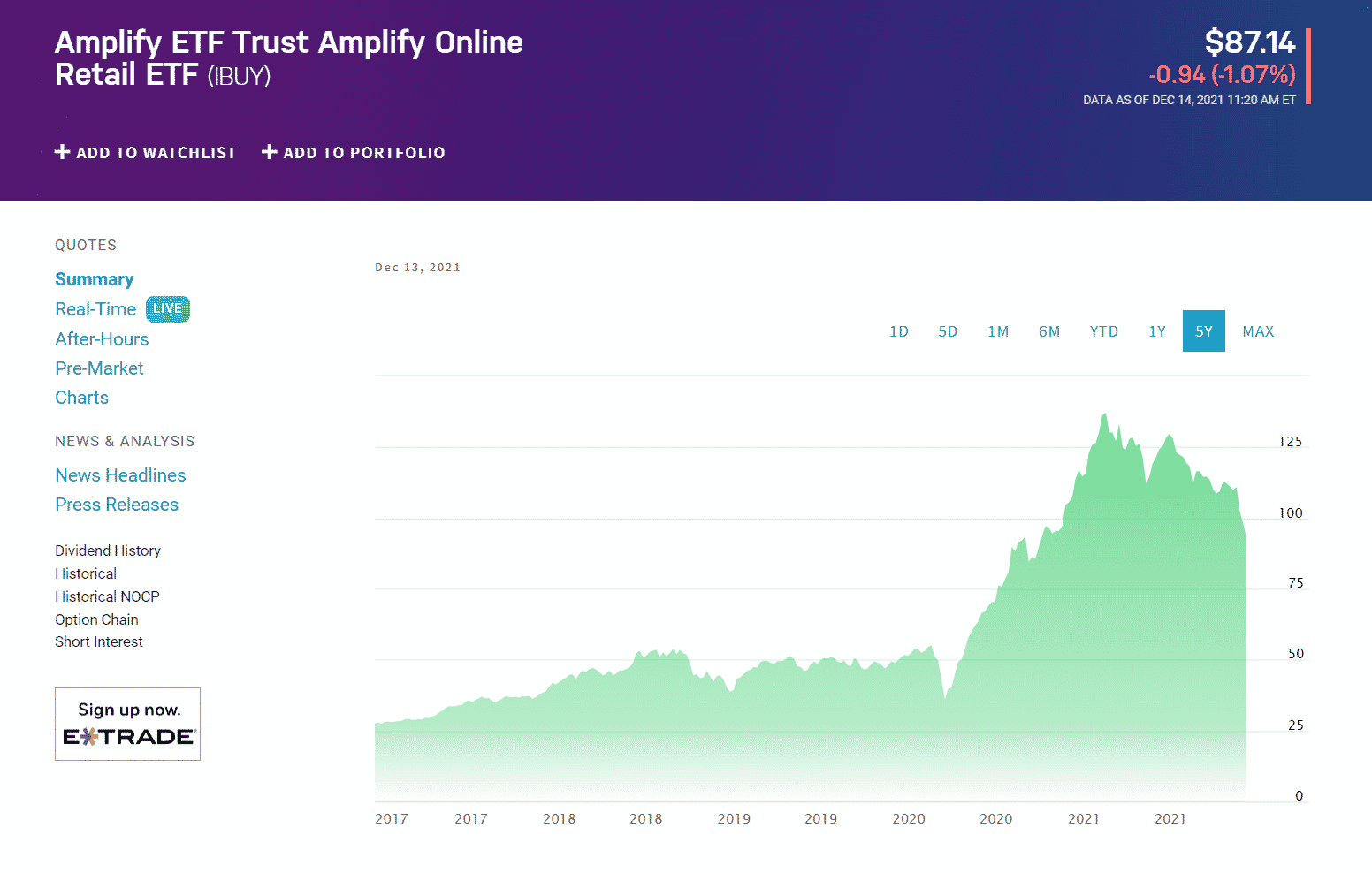

3. Amplify Online Retail ETF (IBUY)

Price: $87.14

Expense ratio:0.65%

Amplify Online Retail ETF price chart

Amplify Online Retail ETF imitates the performance of the EQM Online Retail Index. This index consists of small-cap to large-cap publicly traded companies that procure 70% of their revenue from the e-commerce domain.

Amplify Online Retail ETF has total net assets of $648 million and 7 million outstanding shares. According to the fund’s quarter-end (annualized average%) report, the NAV growth of one year and since inception stands at an exceptional 24.42% and 31.30%, respectively.

As of December 2021, IBUY consists of 79 holdings, and the top three stocks along with their asset percentages are as follows:

- Amazon Inc. — 2.13%

- Expedia Group Inc. — 2.10%

- Airbnb Inc. — 2.10%

Final thoughts

The e-commerce sector has witnessed remarkable growth for the last three or four years due to the shifting dynamics of public interest. Moreover, e-commerce businesses are further flourishing with the introduction of creative and new technologies like drones delivery and voice ordering.

Correspondingly, investors are actively trying to benefit from the e-commerce advancement by investing in e-commerce stocks and ETFs. Exchange-traded funds diversify the investments and supply the benefits of numerous stocks; however, investors should determine their financial goals and risk tolerance before engaging in this sphere.

Comments