Pop culture and Hollywood have painted a pretty grim picture regarding the age of robotics and artificial intelligence. In 2021, the global revenues from the robotics industries were valued at 43.8 billion, with the industry expected to grow at a CAGR of 17.45%. This growth is fueled by the immense cost and production efficiencies of digitizing manufacturing, industrial, and business processes.

Despite the numerous opportunities in this industry, most robotics organizations are started by one or two individuals with limited potential to be the next Tesla, given the complex requirements of this niche. How then do you make money off this futuristic industry? The answer is robotics ETF. They expose investors to the entire robotics industry and its growth potential, rather than sifting through tons of robotics equities trying to determine which one will thrive.

What is a robotics ETF?

It comprises equities involved in the production of robots, equities utilizing robotics significantly in their operations, and all ancillary service equities serving the first two categories. As such, these ETFs offer broad exposure, normally, to four key segments of the economy; Healthcare, Industrial, Consumer, and Defense.

Best robotics ETFs for 2022

The robotics market is one of the technological niches with the fastest growth rate and disrupting the status quo of life. As machine learning improves, cloud connectivity and sensor technology become the norm, and the cost of electricals and robotics-related hardware continues to go down, they provide the fuel to propel robotics growth acceleration. With robotics no longer a concept only for the manufacturing floor, the three ETFs below provide a great avenue to make profits with the new reality of our daily robotics-enabled life.

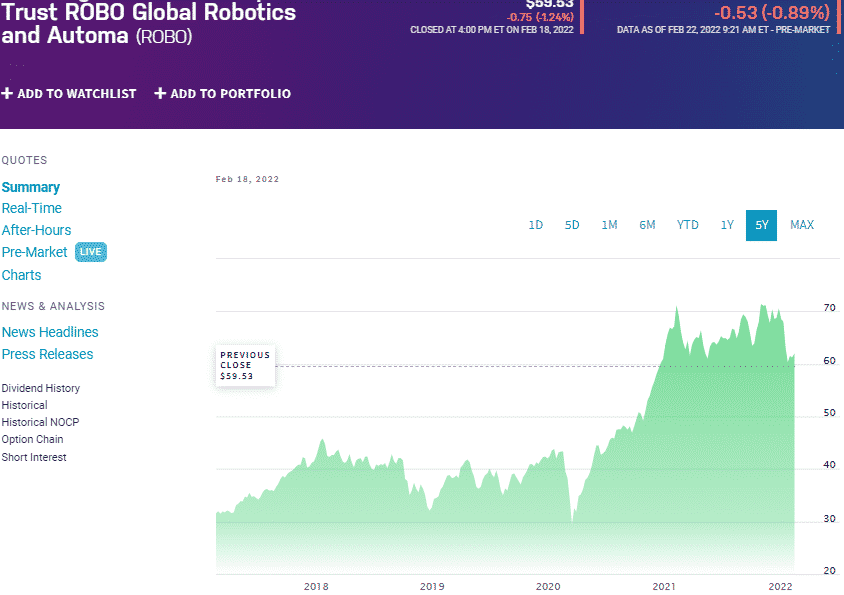

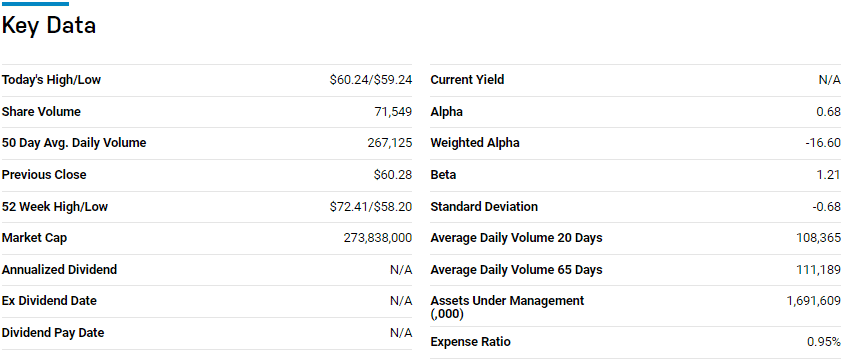

№ 1. ROBO Global Robotics and Automation Index ETF (ROBO)

Price: $59.53

Expense ratio: 0.95%

Dividend yield: 0.17%

ROBO chart

The ROBO Global X Robotics and Automation Index ETF tracks the performance of the OBO Global Robotics and Automation Index, investing at least 80% in the holdings of the tracked index, coupled to the index’s ADRs. It invests the remaining 20% in securities of similar economic characteristics to its composite index. Through ROBO, investors gain exposure to robotics equities and automation-related equities.

ROBO is ranked №1 by US News among nine global small/mid equity ETFs for long-term investing.

The top three holdings of this ETF are:

- Vocera Communications, Inc. – 2.24%

- iRhythm Technologies, Inc. – 1.94%

- Harmonic Drive Systems Inc. – 1.87%

As one of the pioneering robotics ETFs, ROBO ETF has amassed $1.69 billion in assets under management but has been unable to bring down its expense ratio, which stands at 0.95%. These ETFs pick the best 1000 robotics ETFs and then further screen them on revenue, growth potential, market cap, and ESG rating by using qualitative and quantitative indicators.

The result is a fund that has been able to withstand market whipsaws and consistently provide profits over the last half a decade; 5-year returns of 90.54%, 3-year returns of 56.21%, and 1-year returns of -13.69%. In the previous 12 months, the negative returns provide an opportunity to buy the ROBO dip and ride its next bullish run without fear of concentration risk-even weight distribution among its under holdings.

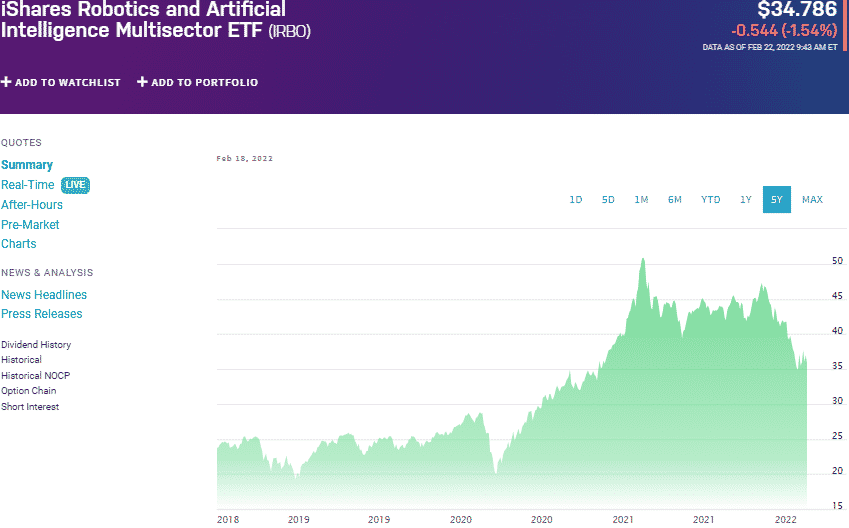

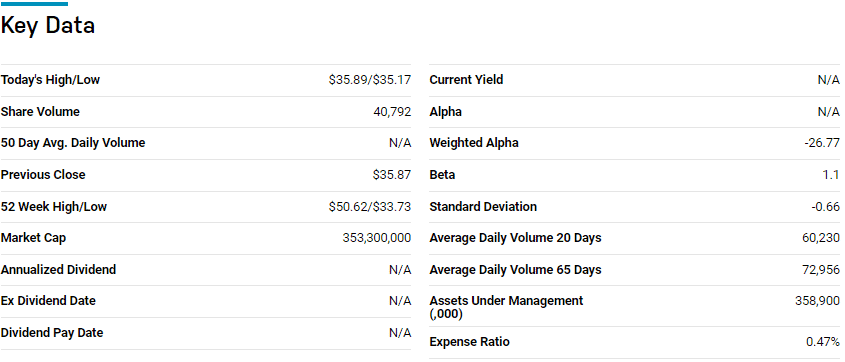

№ 2. iShares Robotics and Artificial Intelligence Multisector ETF (IRBO)

Price: $34.79

Expense ratio: 0.47%

Dividend yield: 0.56%

IRBO chart

Unlike the other iShares funds, the iShares Robotics and Artificial Intelligence Multisector ETF is not a pioneer of its industry. It is a diversified fund that exposes investors to all financial industries with significant interest in both robotics and artificial intelligence technology globally. This fund tracks the NYSE Factset Global Robotics and Artificial Intelligence index, investing a minimum of 80% in the holdings of its underlying index.

IRBO ETF is ranked №12 by US News among a hundred and five technological ETFs for long-term investing.

The top three holdings of this ETF are:

- Advanced Micro Devices, Inc. – 1.62%

- GoDaddy, Inc. Class A – 1.30%

- JOYY, Inc. Sponsored ADR Class A – 1.24%

The IRBO ETF has $358.9 million in assets under management, with an expense ratio of 0.47%. This ETF provides adequate diversification for consistent returns with interest beyond the US borders and across multiple industries. Couple to this a pretty even weight distribution across its holdings, and no wonder that except for its 12-month returns of -27.51%, IRBO, since its launch less than four years ago, has 3-year returns of 53.05%. A combination of developed and emerging market equities provides value and growth attributes to this fund and any portfolio fund.

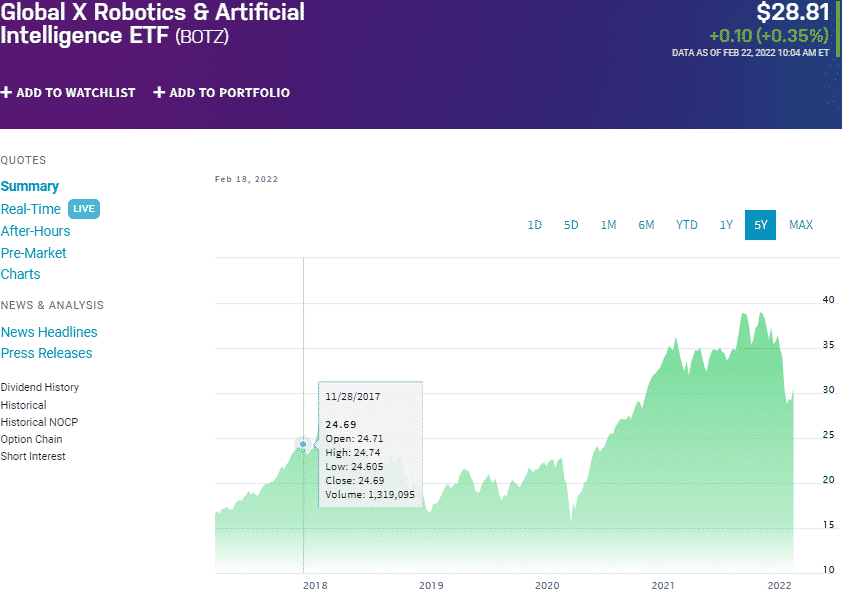

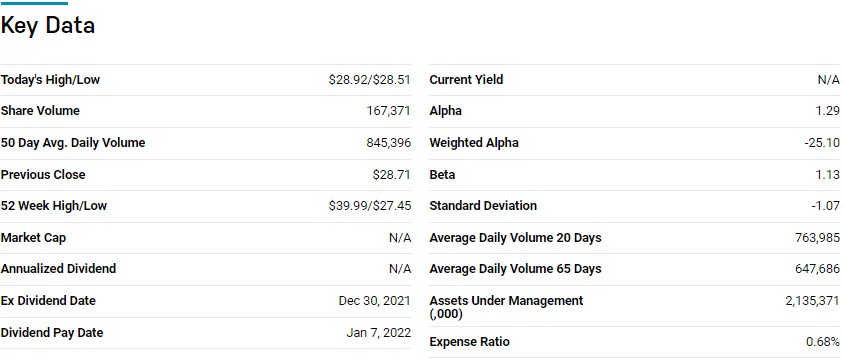

№ 3. Global X Robotics and Artificial Intelligence ETF (BOTZ)

Price: $28.81

Expense ratio:0.5%

BOTZ chart

They say that old is gold, and for the robotics niche, Global X Robotics and Artificial Intelligence ETF are yet another pioneer fund alongside ROBO. This fund tracks the performance of the Global Robotics & Artificial Intelligence Thematic Index, investing at least 80% in the holdings of the tracked index coupled to the underholding’s ADRs and securities. It exposes investors’ equities utilizing robotics and artificial intelligence technology in the developed global markets.

The top three holdings of this ETF are:

- NVIDIA Corporation – 11.16%

- ABB Ltd. – 8.82%

- Intuitive Surgical, Inc. – 8.13%

BOTZ ETF is among the largest robotics ETF with $2.15 billion in assets under management, with an expense ratio of 0.68%. This ETF comprises 37 of the best holdings on the cutting edge of robotics and automation in their respective industries.

Strategically positioned to ensure it benefits from all sectors of the economy adopting robotics, automation, and artificial intelligence technologies, this fund has proved to be a consistent returns provider; 5-year returns of 76.72%, 3-year returns of 48.18%, and 1-year returns of -18.79%.

As the global technology renaissance focuses on accelerated automation and robotics in 2022 post-pandemic, BOTZ holdings can be expected to be at the forefront and, as a result, generate significant returns.

Final thoughts

The robotics industry is quickly gaining attention and more focus, given the competitive advantages its adoption has given to firms and the hassle-free lifestyle it provides individuals. With this market poised to thrive in the foreseeable future, the three ETFs above offer an excellent investment starting point with the potential for significant returns.

Comments