At the height of the pandemic, the year 2020, the global transportation sector was valued at $6.2 trillion. Since the coronavirus vaccine administration and the opening up of borders, experts estimate this industry to grow at a CAGR of 3.4%.

Why such a low number for one of the core sectors of the economy?

The transport sector accounts for almost a quarter of the CO2 emissions globally. Despite the global appetite for zero greenhouse emissions, the world cannot do without the heavy fossil-reliant transportation industry. However, all the niches making up the global transportation industry are racing to ensure minimal emissions, creating many investment opportunities. So, should I invest in this industry?

These three transportation ETFs expose investors to significant profits as this industry evolves and the ongoing governmental and private investment inflows to revamp this sector post-pandemic.

Transportation ETFs: how do they work?

The transportation sector is vast and interacts with all the other sectors by being responsible for the movements of goods and people. Transportation ETFs comprise equities in air transport, road transport, marine transport, rail transport, transportation infrastructure, auto parts, and ancillary transportation services, deriving significant revenues from transportation activities.

Top 3 transportation ETFs for profitability

The first rule of investing is never to put all your eggs in one basket. Not many sectors crisscross the economic divide like the transport sector. The coronavirus pandemic showed just how vital this sector is, with the ramifications of cessation of movement being felt even today, more than 12-months since mass vaccination. With the globe trying to recover from the ravages of the coronavirus, expanding economies set the stage for excellent upside potential for transportation equities, and these three ETFs offer diversified exposure to the resulting profits.

№ 1. iShares US Transportation ETF (IYT)

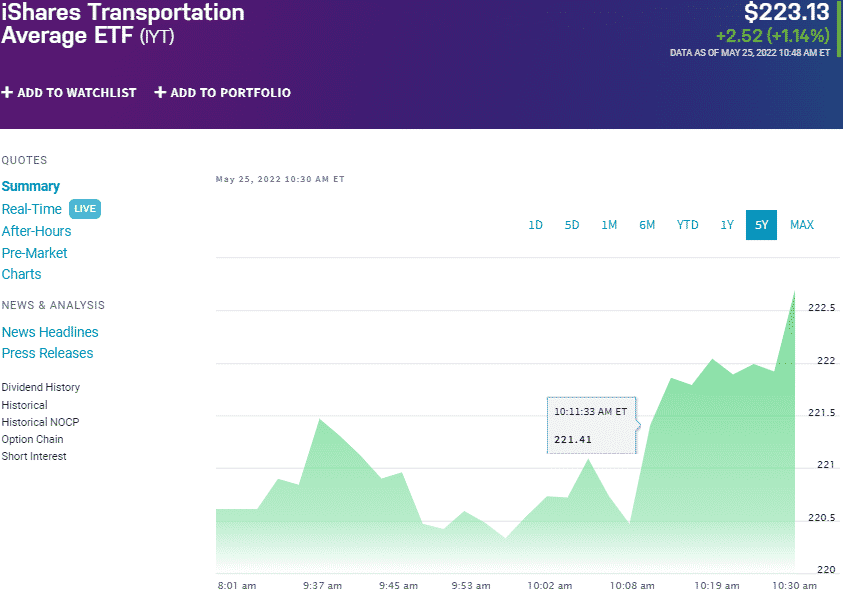

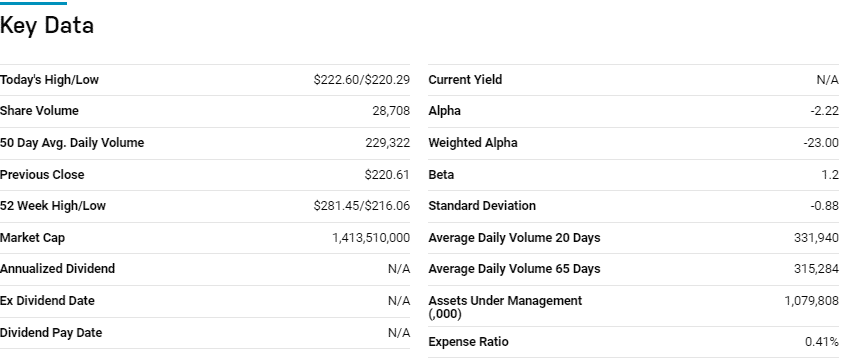

Price: $222.13

Expense ratio: 0.41%

Dividend yield: 0.73%

IYT chart

Invest in the transportation sector, and that portfolio is incomplete without the iShares US Transportation ETF. It tracks the total returns performance of the S&P Transportation Select Industry FMC Capped Index, net of expenses, and fees. To ensure minimal returns deviation, it invests at least 80% of its total assets in the components of its tracked index and other securities of like economic characteristics to the tracked index holdings. It exposes investors to publicly traded US equities, drawing significant revenues from the transportation industry.

The top three holdings of this non-diversified ETF are:

- Union Pacific Corporation – 19.03%

- United Parcel Service, Inc. Class B – 17.45%

- CSX Corporation – 6.76%

The IYT ETF, a pioneer fund in the transportation segment, boasts $1.04 billion in assets under management, with an expense ratio of 0.41%. The ultimate transportation ETF fund exposes investors to all the transport niches; air, marine, rail, road, and disruptive transportation technology.

The inclusion of disruptive transportation tech equities ensures this fund’s relevance even as pressure piles on the transportation sector to reduce its carbon emissions. Inclusion of the largest transportation industry players results in a highly liquid and resilient fund; 5-year returns of 43.54, 3-year returns of 24.56%, and 1-year returns of -18.49%.

№ 2. First Trust Nasdaq Transportation ETF (FTXR)

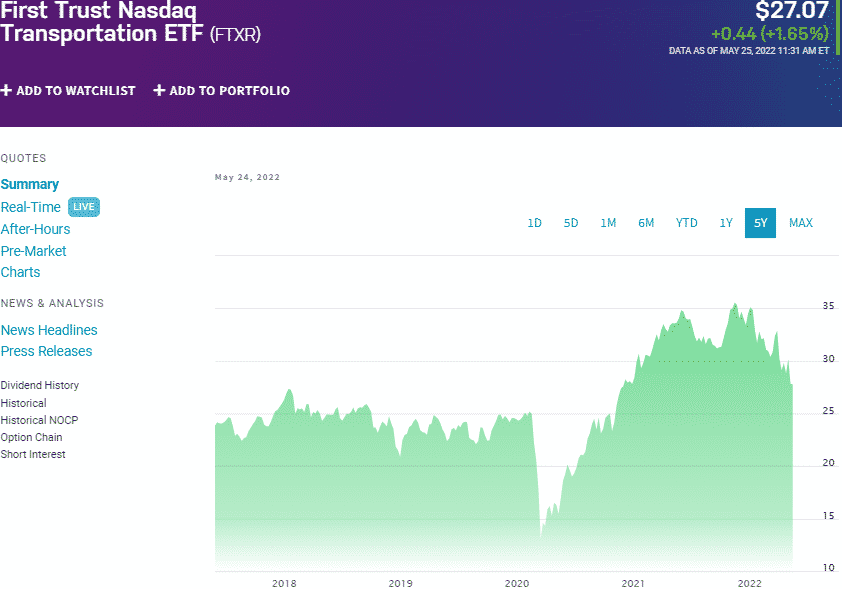

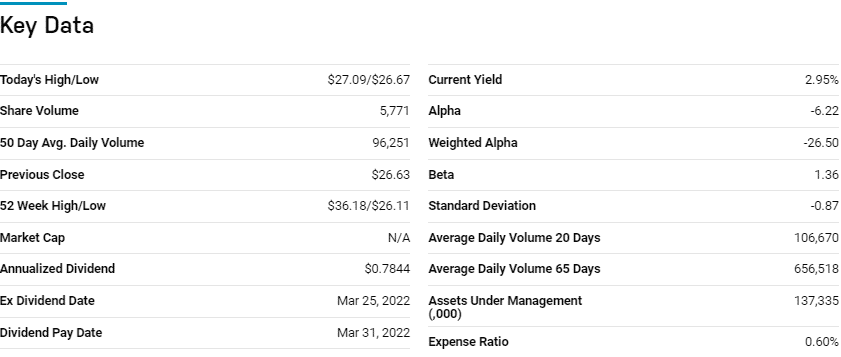

Price: $27.07

Expense ratio: 0.60%

Dividend yield: 0.57%

FTXR chart

The First Trust Nasdaq Transportation ETF tracks the investment results of the Nasdaq US Smart Transportation IndexTM, net of expenses and fees. It invests at least 90% of its net assets in the holdings of its composite index and all depository receipts associated with the tracked index. This non-diversified fund exposes investors to the most liquid US publicly traded transportation equities.

FTXR ETF is ranked № 14 by US News among 31 of the best industrial ETFs for long-term investing.

The top three holdings of this transportation ETF are:

- PACCAR Inc – 8.26%

- Union Pacific Corporation – 8.17%

- CSX Corporation – 8.11%

The FTXR ETF has $137.3 million in assets under management, with investors’ parting with $60 annually for every $10000 invested. This fund is yet another diversified play on the entire transportation industry.

In addition to this diversification, the thirty equities making up this fund are screened on multiple factors: liquidity, volatility, growth potential, and value creation. The result is a fund that has consistently awarded investors with returns, except for the last 12 months; 5-year returns of 21.29%, 3-year returns of 20.47%, and 1-year returns of -20.05%.

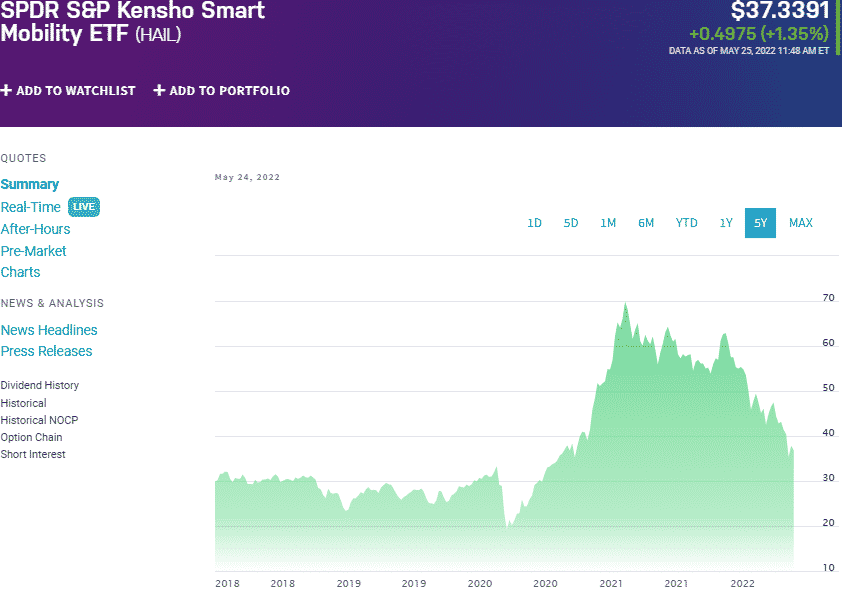

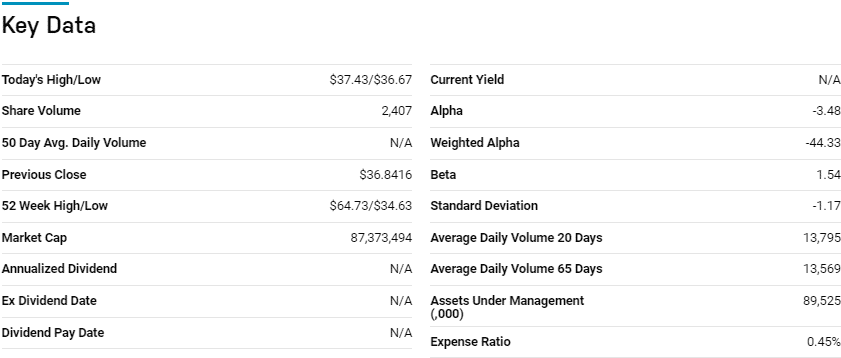

№ 3. SPDR S&P Kensho Smart Mobility ETF (HAIL)

Price: $37.33

Expense ratio: 0.45%

Dividend yield: 2.28%

HAIL chart

Given the global appetite for green technology and zero emissions, the transportation sector has no option but to evolve and move from fossil fuels. The SPDR S&P Kensho Smart Mobility ETF is the fund that exposes investors to this global shift. It tracks the investment results of the S&P Kensho Smart Transportation Index, investing at least 80% of its total assets in the composite index holdings and all associated depository receipts.

The top three holdings of this non-diversified ETF are:

- Allison Transmission Holdings, Inc. – 2.24%

- Meritor, Inc. – 2.14%

- Qualcomm Incorporated – 1.92%

The HAIL ETF has $88.6 million in assets under management, with an expense ratio of 0.47%. This ETF is a diversified play on both the transportation sector and geographically since it includes US-listed equities domiciled in the global developed and emerging markets investing in intelligent transportation.

This fund is among the most evenly distributed transportation ETFs to spice things up. Top all of this up with interest in all the disruptive transportation technology, Electric vehicles, intelligent supply chain and logistics systems, drone technology, and autonomous transport optimized systems, and this fund is bound to accelerate profits; 3- year returns of 48.13%, and 1-year returns of -37.49%.

Final thoughts

The global economy is almost entirely open, with all countries ramping up efforts to ensure post-pandemic levels. The transportation sector is in the eye of this storm with significant upside potential. The three ETFs herein are in pole position to drive profits, both as the economy expands and the transportation sector evolves.

Comments