Kevin O’Leary and fellow global investment billionaires have demystified the key to their wealth, prudent investment in dividend-paying assets. Historically, stocks’ popularity was due to their dividend-paying attribute.

Currently, the most exchanged investment asset globally is exchange-traded funds. Therefore, identifying ETFs that pay high dividends fits the billionaires’ proposed investment strategy for accelerated wealth accumulation and prudent investing with high dividend payouts. In the investment space, these ETFs are known as dividend aristocrat ETFs.

What are dividend aristocrat ETFs?

To understand the composition of dividend aristocrats’ ETFs, we first define dividends. Dividends are the share of an organization’s profits paid out to equity owners for their investment. Share dividends inform the financial stability of an organization.

Dividend aristocrats’ ETFs comprise equities with a history of consistent dividend payouts and expanding dividend yield year on year, usually five years and above. As such, most dividend aristocrat ETFs comprise dividend-paying established blue-chip companies.

The best dividend aristocrat ETFs for attractive gains

Rising interest rates, geopolitical risks, and rampant inflation have resulted in purchasing power erosion. On this backdrop, the markets have taken a beating, with most equities in bearish territory, necessitating the need for an investment strategy to cushion against dwindling returns. Dividend aristocrat ETFs provide this cushion by achieving instant diversification and more than average dividend payouts.

These three dividend aristocrat ETFs provide the necessary outcome to navigate the current economic turmoil while also excellent for long-term investing.

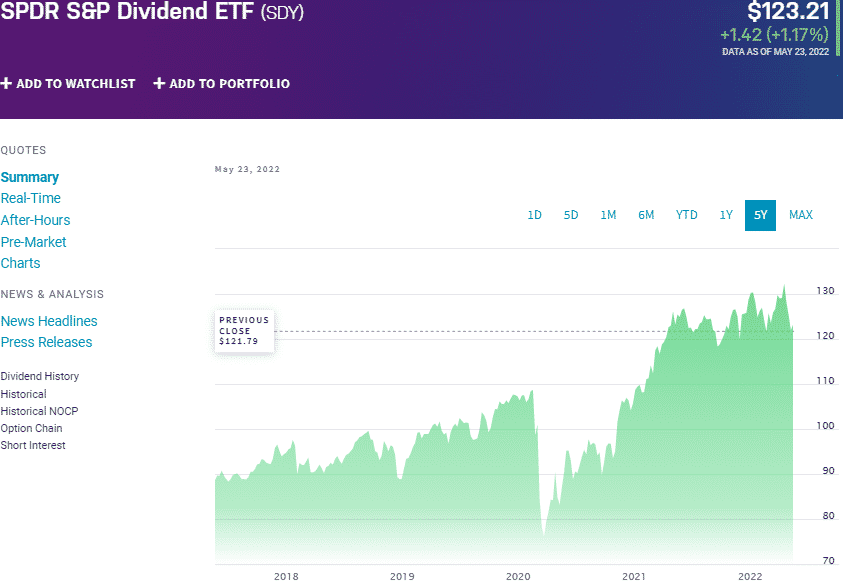

№ 1. SPDR S&P Dividend ETF (SDY)

Price: $123.21

Expense ratio: 0.35%

Annual dividend yield: 2.70%

SDY chart

The SPDR S&P Dividend ETF tracks the total return performance of the S&P High Yield Dividend Aristocrats Index, net of expenses and fees. It invests at least 80% of its net assets in the holdings making up its composite index to ensure minimal performance variation to the tracked index. The result is a fund that exposes investors to US equities with the highest dividend-yielding companies forming the Composite 1500 Index over the last twenty consecutive years.

In a list of 122 large value funds, the SDY ETF is ranked № 33 for long-term investing.

The top three holdings of this dividend aristocrat ETF are:

- Leggett & Platt, Incorporated – 2.06%

- Amcor PLC – 1.98%

- International Business Machines Corporation – 1.98%

The SDY ETF is one of the largest and most liquid dividend aristocrat funds boasting $20.68 billion in assets under management at an expense ratio of 0.35%. Compared to other significant funds in the dividend aristocrat niche, this fund has a concentrated holding base, a hundred and four equities.

However, an even weighting mitigates against concentration risk while concentration on the large value equities with a history of increasing dividend payouts of over twenty years ensure consistent income and revenues in the future; 5-year returns of 59.30%, 3-year returns of 34.18%, 1-year returns of 0.30%, and an annual dividend yield of 2.70% which is coupled to a dividend rate of $3.41.

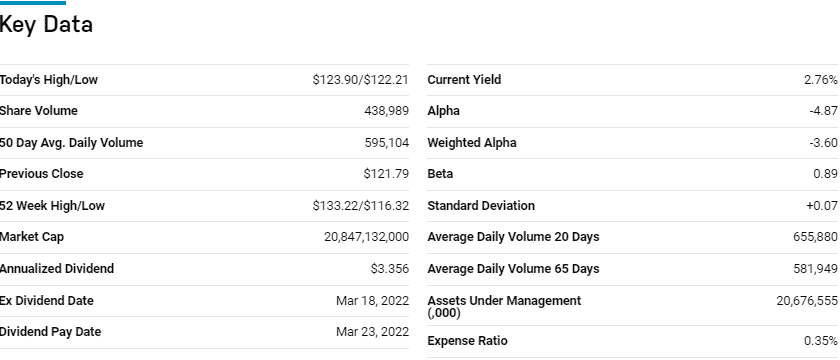

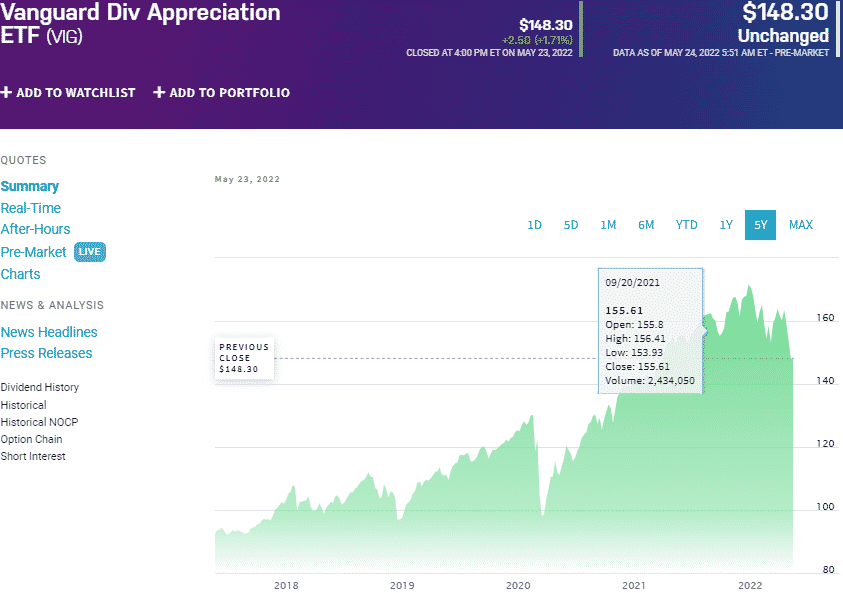

№ 2. Vanguard Dividend Appreciation Fund (VIG)

Price: $148.30

Expense ratio: 0.06%

Annual dividend yield: 1.53%

VIG chart

The Vanguard Dividend Appreciation ETF tracks the performance of the S&P US Dividend Growers Index, net of expenses and fees. It utilizes an indexing investment strategy to ensure minimal performance divergence and invests all of its assets in the holdings, making up the composite index. As a result, it exposes investors to US companies with a track record of expanding dividend yields for the last ten consecutive years.

In a list of 232 large blends ETFs, the VIG ETF is ranked № 60 for long-term investing.

The top three holdings of this dividend aristocrat ETF are:

- UnitedHealth Group Incorporated – 3.88%

- Microsoft Corporation – 3.88%

- Johnson & Johnson – 3.85%

Vanguard is a pioneer in numerous ETF niches. Its flagship dividend aristocrat ETF, VIG, is the largest and most liquid dividend fund with $60.87 billion in assets under management, at a relatively low expense ratio of 0.06%.

Concentration on large-value equities with a track record of increasing dividend payouts, a pretty even weighting across its holding base of over two hundred equities, and incorporation of equities from all sectors ensures compounding effect and higher portfolio return; 5-year returns of 76.37%, 3-year returns of 38.19%, 1-year returns of -3.86%, and an annual dividend yield of 1.53%, coupled to a dividend rate of $2.55.

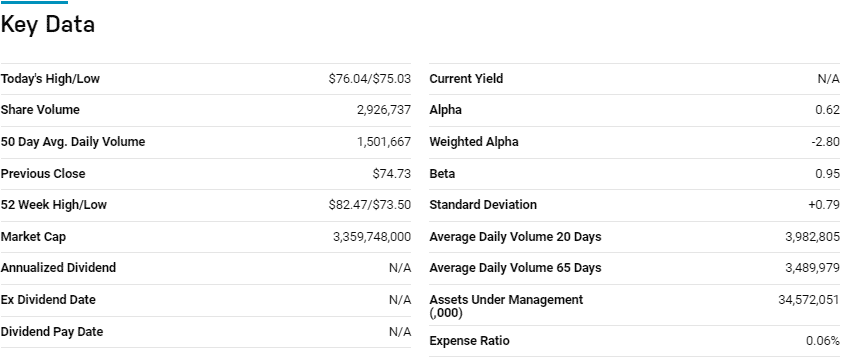

№ 3. Schwab US Dividend ETF (SCHD)

Price: $75.15

Expense ratio: 0.06%

Annual dividend yield: 2.83%

SCHD chart

The Schwab US Dividend ETF tracks the total return performance of the Dow Jones U.S. Dividend 100 Index, net of expenses and fees. It invests at least 90% of its total assets in the tracked index underlying holdings, exposing investors to the US publicly traded high-dividend paying equities with the best fundamentals.

In a list of 122 large value ETFs, the SCHD ETF is ranked № 39 for long-term investing.

The top three holdings of this dividend aristocrat ETF are:

- Merck & Co., Inc. – 4.86%

- Amgen Inc. – 4.34%

- Pfizer Inc.– 4.27%

The SCHD ETF is a significant player in the dividend aristocrat niche boasting $34.42 billion in assets under management, with a relatively low expense ratio of 0.06%. Focusing on the highest dividend-paying equities with the best fundamentals ensures a fund that can weather a market downturn.

In addition to this, the equity screening methodology takes into account the dividend growth and dividend yield, exposing investors to significant dividend payouts and returns; 5-year returns of 97.06%, 3-year returns of 60.98%, 1-year returns of 1.47%, and an annual dividend yield of 2.83%, coupled to a dividend rate of $2.23.

Final thoughts

Dividend aristocrat ETFs bring regular and more than average dividend payouts to a portfolio, providing an excellent wealth accumulation avenue. The three dividend aristocrat ETFs herein, in addition to consistent income, ensure a balanced portfolio capable of weathering returns erosion in bearish markets.

Comments