The consistency of leading social media players might blind one to the growth of this industry. However, this industry has not even scratched the surface despite having been around for some time now. Social media players are no longer overly reliant on advertising to generate revenues by incorporating money-minting streams such as e-commerce, video games, and digital payments into these platforms.

At present, approximately 4.6 billion of the world population is active in the social media space. It is no wonder then that the expected CAGR growth is 8.2%.

What is the composition of social media ETFs?

ETFs are investment vehicles made up of a pool of assets with like economic characteristics. Thus said, social media ETFs comprise investment assets in the social media space. Therefore, they consider firms providing social media networking, organizations facilitating file sharing, organizations providing other web-based applications for use in social media platforms, and all organizations providing ancillary services to this industry niche.

Social media ETFs worth watching and buying in 2022

As technology evolves and internet connectivity gets to the farthest corners of the globe, the world will finally have become an actual global village. The coronavirus pandemic also highlighted the need for people to connect with their loved ones meaningfully even without physically meeting, kick-starting the next phase of evolution for the social media space. With Facebook already rebranding and changing its name to Meta in preparation for this next phase, the social media ETFs below allow investors to also cash in on this frontier.

№ 1. Global X social media ETF (SOCL)

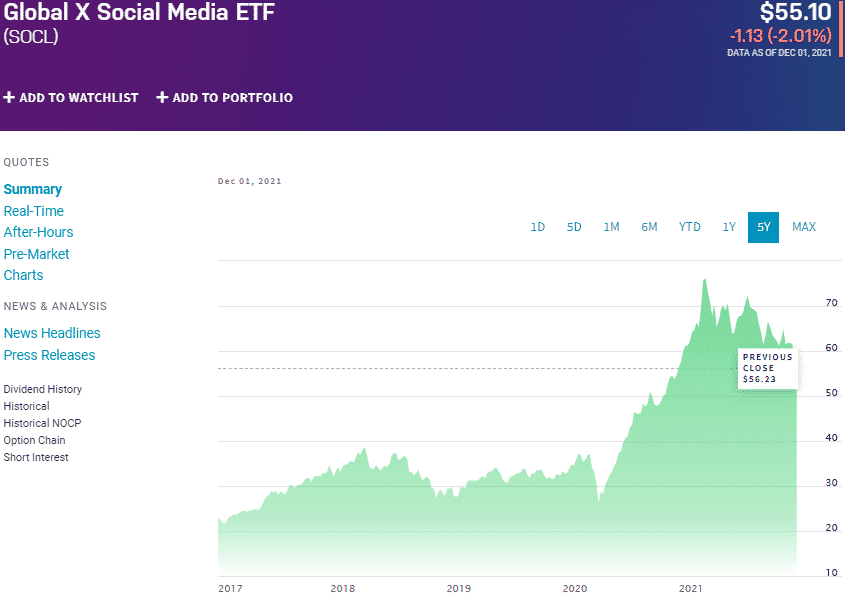

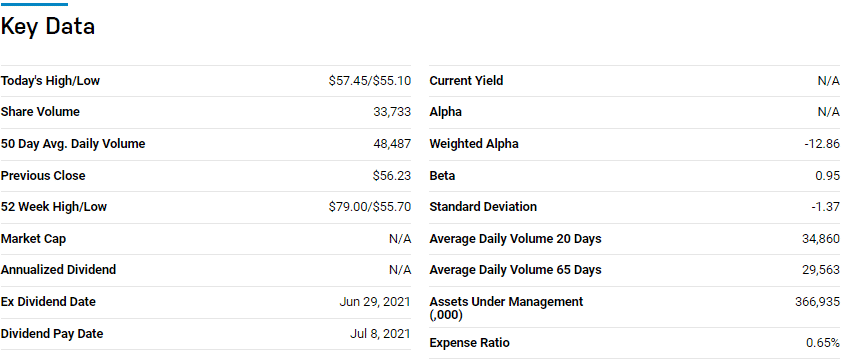

Price: $55.10

Expense ratio: 0.65%

Dividend yield: N/A

SOCL chart

Global X social media ETF is the first pure-play social media ETF available to investors in 2011. It tracks the Solactive social media Total Return Index, investing at least 80% of its total assets in the securities of its composite index, as well as its ADRs and GDRs.

SOCL investors gain exposure to the most liquid equities operating in the social media space, which explains why it is ranked No 24 by USNews, among 101 technology ETFs for long-term investing.

The top three holdings of this ETF are:

- Meta Platforms Inc. Class A — 11.41%

- Tencent Holdings Ltd. — 10.20%

- Snap, Inc. Class A — 6.93%

Despite being the original social media ETF, the SOCL ETF has only $371.4 million in assets under management, with investors having to cough up $65 annually for a $10000 investment. The pandemic year and this year have seen the social media industry deal with a lot of political pressure regarding user-generated content.

The result has been severe undervaluation of the sector as evidenced by the pandemic returns of -1.14% and current year-to-date returns of -8.98%. However, a dig further back shows that the SOCL is a proven money minter; 5-year returns of 146.99%, 3-year returns of 91.58%, and 293.85% since inception.

With semi-annual rebalancing and global exposure to all thing’s social media, this ETF is worth watching closely.

№ 2. VanEck social sentiment fund (BUZZ)

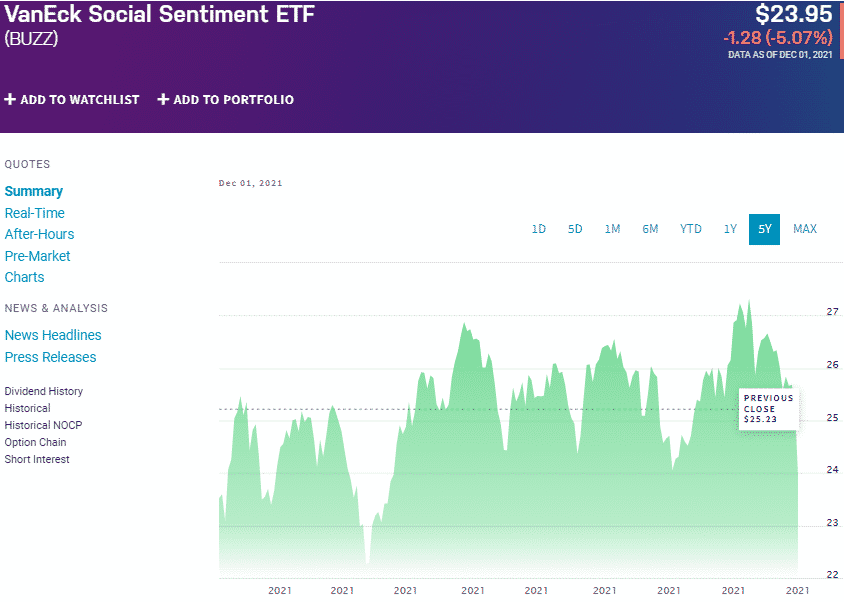

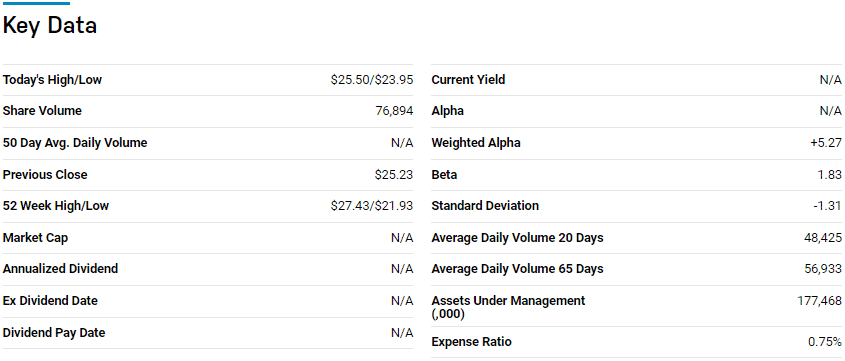

Price: $23.95

Expense ratio: 0.75%

Dividend yield: N/A

BUZZ chart

The VanEck social sentiment ETF tracks the performance of the BUZZ NextGen AI US Sentiment Leaders Index, intending to replicate its performance as closely as possible net of expenses. It invests at least 80% of its assets in the securities of its composite index to achieve its objective. BUZZ investors gain exposure to US equities with the most positive sentiments according to social media, blogs, news articles, and other alternative datasets. Holdings’ selection is via a proprietary quantitative model by the index provider.

The top three holdings of this ETF are:

- Novavax, Inc. — 3.50%

- Advanced Micro Devices, Inc. — 3.39%

- Moderna, Inc. — 3.39%

Despite launching in March 2021, BUZZ already boasts $177 million in assets under management, with investors coughing up $75 annually for a $10000 investment. Social media and mobile technology have flipped the page on how the investment world interacts with stocks; Elon Musk’s twits in the past 12 months have been the reason for movement in some corners of the equity market.

With traction-gaining ground on the use of artificial technology in picking stocks, and social media proving a powerful tool for market sentiments, BUZZ is in a strategic position to leverage both worlds for profitability.

№ 3. Invesco Dynamic Media ETF (PBS)

Price: $48.84

Expense ratio: 0.63%

Dividend yield: 0.52%

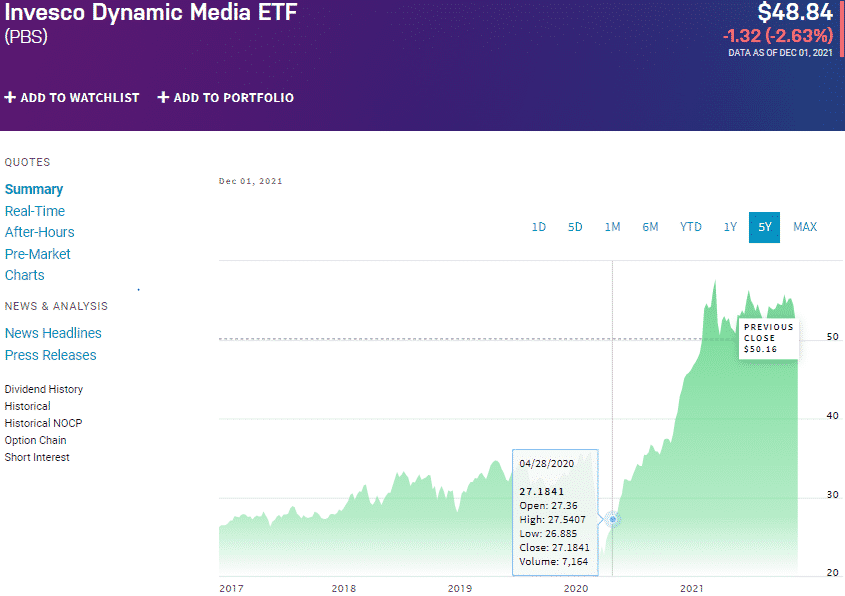

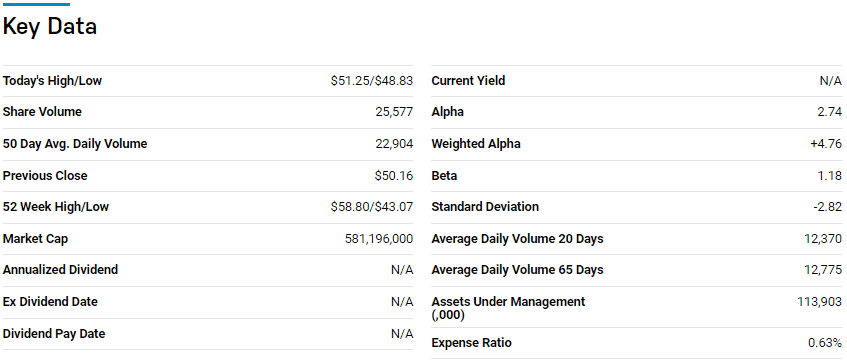

PBS chart

Invesco active media ETF tracks the performance of the Dynamic Media Intellidex Index, intending to replicate its performance as closely as possible net of expenses. It invests at least 90% of its assets in the securities of the tracked index, exposing investors to companies involved in the development, manufacture, marketing, sales, and distribution of goods and services in the media industry.

PBS ETF is ranked No 14 among the best 35 consumers cyclical ETFs by USNews, for long-term investing.

The top three holdings of this ETF are:

- Netflix, Inc. — 6.14%

- Spotify Technology SA — 5.62%

- Alphabet Inc. Class A — 5.31%

PBS ETF has $113.9 million in assets under management, with an expense ratio of 0.63%. This ETF provides an alternative to social media investing by concentrating on this industry’s equipment infrastructure and ancillary services. Historical performance is no guarantee of future returns but can act as a reference point. PBS puts a strong case its consideration; 5-year returns of 95.36%, 3-year returns of 64.44%, pandemic year returns of 16.56%, and year-to-date returns of 9.18%.

Final thoughts

Social media has proven to be a powerful tool for personal interactions and meme sharing and to advance serious causes. The problem comes in picking a single that will flourish, especially in light of the political pressures that plague this industry. The ETFs above solve this problem by having the diversification needed to thrive despite the challenges in this industry.

Comments