Last week saw the SPY close in the green despite being dragged downwards by the Energy sector and a few other sectors. The result was a continuation of the SPY’s earnings season.

Would the new week continue the earnings season, or would the SPY slide downwards?

Monday’s opening gap up of 0.3% to have the SPY start its trading at $470.44 was a welcome sight to investors since each week that opens with a gap up has the SPY in the green at the weekend. It also coincided with the monthly resistance level giving observers something to ponder; would the resistance level finally yield?

In light of this hawkish opening, investor confidence had the SPY prices go on a bullish run that stretched the monthly resistance level to the $473.48 level before losing the momentum to break clear, and then the bears took over.

The Covid-19 fourth wave is already spreading, resulting in some European countries resuming total lockdown protocols with others adopting restricted movement for the unvaccinated. It has reverberated across the consumer discretionary sectors to have it in the negative for the week after several weeks of being the go-to investment sector. Despite this looming crisis, experts are forecasting a solid ending to the fourth-quarter earnings season.

Powell stays at the helm for another four years meaning that the FED’s stance regarding inflation and monetary policies will remain unchanged. As a result, SPY prices for the week continued oscillating between the monthly support level of $466.23 and the resistance level of $470.94, although bullishly inclined.

As much as the economic resurgence has slowed down, the economic standstill between China and the US seems to be on the brink of thawing with Biden meeting Xi. This meeting results in the placement of structures that will act as guardrails to mitigate economic risks and enhance global stability. As a result, investors are still bullish on the equity markets resulting in the SPY finishing the week in the green, +0.03-at the time of writing this article.

Top gainers of the current week

Energy sector

Leading world economies led by the US have agreed to tap into their oil stockpile to force the fuel price downwards. It will not be immediate, but it definitely will go a long way in arresting the upward trajectory of oil and gas prices. The result is a weekly positive change of +5.93%.

Financial Services sector

With Powell staying at the FED helm, tapering is expected to remain on course. An interest rate hike is expected in early 2022, resulting in increased inflow into the financial services sector resulting in a +2.76% weekly change.

Real Estate sector

The real estate sector continues to thrive in this inflation-rising environment due to its inflation-protected feature resulting in another week in the green, +1.87%.

Losers of the current week

Sectors that had the worst the trading week were:

Information Technology sector at — 0.65%

Consumer Discretionary sector at — 1.00%

Communication Services sector at — 1.42%

Higher treasury notes yield before thanksgiving tilted the scales moving investments from the technology and cyclical sectors, resulting in the industries above experiencing the worst slide for the week.

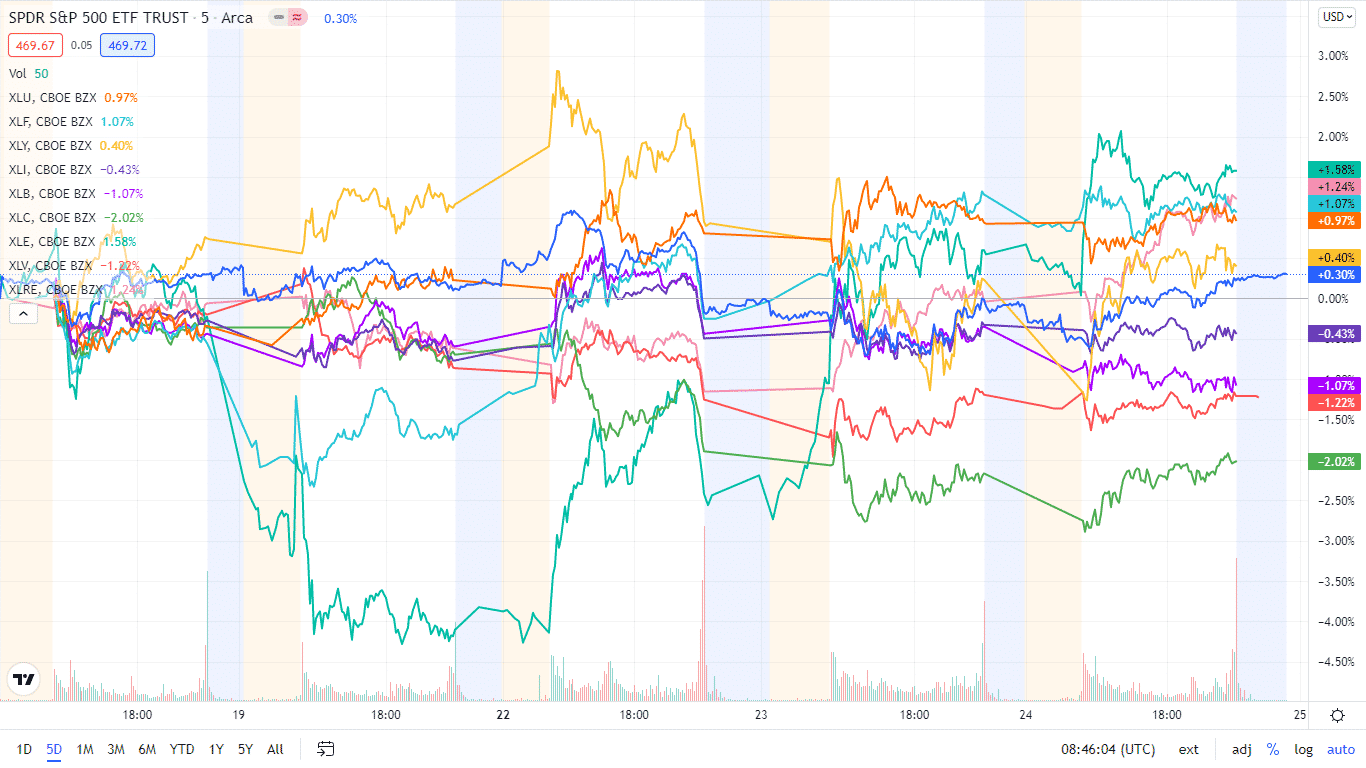

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week, using their corresponding ETFs, and despite some closing in the red, they are still within touching distance of record high.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Energy | XLE | +5.93% with the accompanying energy select sector ETF |

| 2. | Financial Services | XLF | +2.76% with the accompanying financial select sector ETF |

| 3. | Real Estate | XLRE | +1.87% with the accompanying real estate select sector ETF |

| 4. | Consumer Staples | XLP | +1.19% with the accompanying consumer staples select sector ETF |

| 5. | Utilities | XLU | +0.65% with the accompanying utilities select sector ETF |

| 6. | Industrial | XLI | +0.33% with the accompanying industrial select sector ETF |

| 7. | Healthcare | XLV | -0.42% with the accompanying healthcare select sector ETF |

| 8. | Materials | XLB | -0.50% with the accompanying materials select sector ETF |

| 9. | Information Technology | XLK | -0.65% with the accompanying information technology select sector ETF |

| 10. | Consumer Discretionary | XLY | -1.00% with the accompanying consumer discretionary select sector ETF |

| 11. | Communication Services | XLC | -1.42% with the accompanying communication services select sector ETF |

Comments