Automic Trader is a fully-automated Forex expert advisor that claims to deliver a monthly profit of 20% to 30% with low risk. It can trade in multiple pairs and according to the vendor, you don’t need prior trading experience to earn profits with this EA.

The parent organization behind this robot is called LeapFX. It is a US-based company with its headquarters located in New York. We don’t know when the company was founded and the vendor has chosen not to reveal the identities of the team members. Other systems developed by this team include Easy Money X-Ray Robot, DynaScalp, AX Trader, The Fund Trader, and Trade Explorer.

Purchasing this system gives you full access to the trading software that is customized with optimum settings. Before you start trading, you need to select a risk level you are comfortable with.

The vendor provides you with a detailed setup guide containing the best recommendations. Automic Trader has account protection features that the seller has highlighted on the website. Nevertheless, since they have not elaborated on it, we cannot determine whether it is effective or not.

Trading strategies and currency pairs

This EA deals in six different currency pairs, namely USD/JPY, USD/CAD, GBP/JPY, EUR/USD, EUR/GBP, and AUD/USD. These currencies are known for trending well and on average, they move 100 pips daily. The EA identifies the early beginnings of trends for each pair according to volatility and momentum.

If the entry criteria are satisfactory, the EA triggers the trade automatically. After that, it manages the trades using a dynamic auto adapting system. The seller has not properly explained how the trading scheme works, and this is not a sign of reliability. Many Forex traders look for strategy insight to decide whether the system would be compatible with their trading style. Therefore, this might deter many of them from investing.

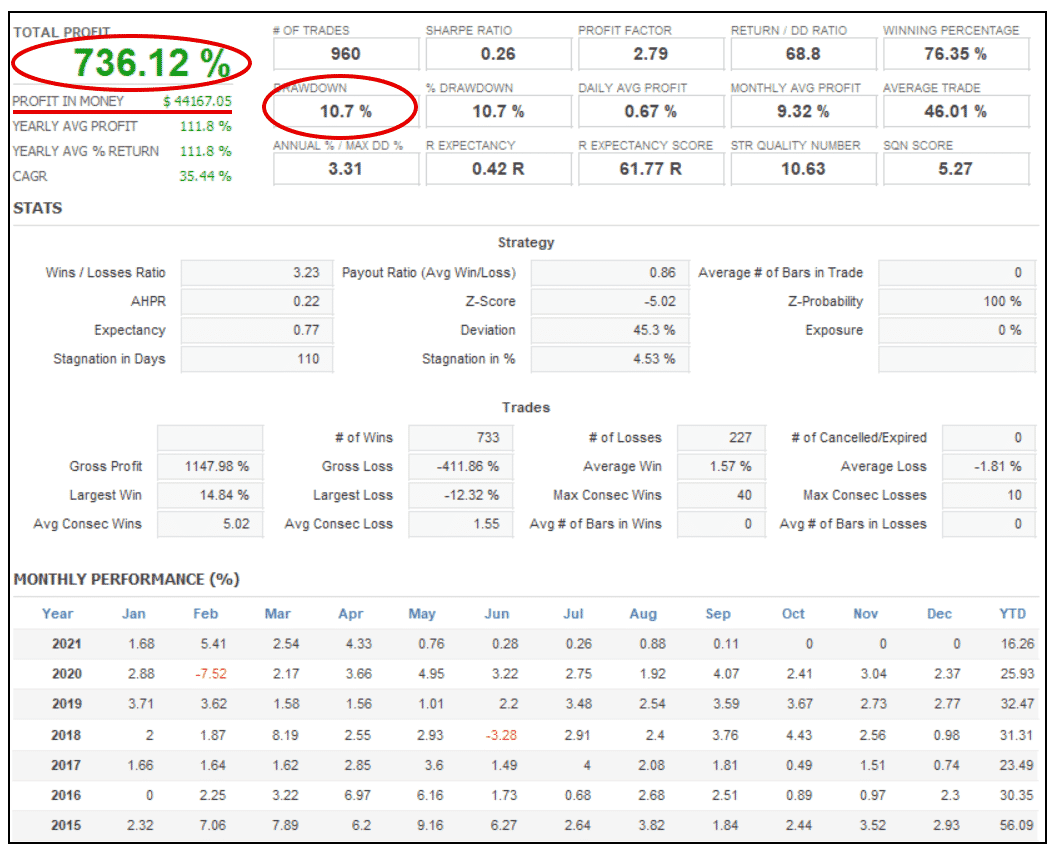

Backtesting results for Automic Trader

This backtest was conducted from 2015 to 2021. Automic Trader conducted 960 trades during this time period, winning 733 out of them. The win rate for this backtest was thus 76.35% and the total profit generated was $44167.05.

There were 40 maximum consecutive wins and 10 maximum consecutive losses during the testing period. The profit factor was 2.79 while the drawdown was 10.7%. Here, we should mention that the vendor has not revealed the modeling quality and type for this backtest, which raises questions about its authenticity.

Automic Trader trading statistics

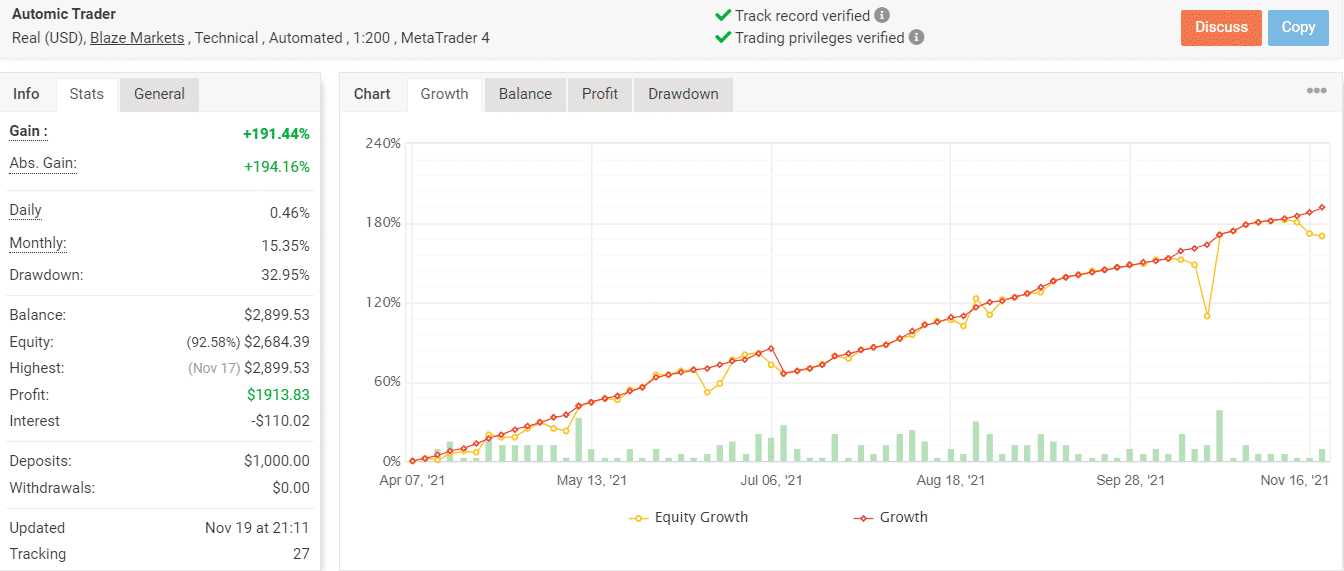

Growth chart of Automic Trader

This live trading account on Myfxbook was launched on April 07, 2021. To date, the EA has placed only 241 trades through this platform. This essentially means the robot hasn’t had to deal with various market conditions. As such, we cannot consider it a robust system.

The win rate for this account currently stands at 78% and the total profit is $1913.83. Its daily and monthly profits are 0.46% and 15.35% respectively, while the drawdown is 32.95%. We think the drawdown is quite high and it’s an indication of a high-risk strategy. The profit factor for this trading account was 2.65.

Pricing and refund

There are two pricing plans for this Forex EA. The 1-year membership plan costs $497 while the lifetime membership plan costs $697. None of the plans are cheap compared to other systems on the market. Every customer gets access to full customer support and free updates. The vendor offers a 30-day money-back guarantee for both plans. Additionally, if you fail to make a profit after six months, the company gives you your money back plus $100 for free.

What else you should know about Automic Trader

The vendor has shared the official email on the website. Also, there is a contact form that you can use to get in touch with the support team. However, the website does not have a live chat feature, which means customer support is slow.

We were unable to find any customer review for this EA on websites like Quora, Myfxbook, Trustpilot, and Forexpeacearmy. Clearly, the robot does not have much of a reputation. Without verified reviews, it becomes difficult to trust this system.

Comments