The 2008 financial meltdown and the Covid-19 pandemic revealed that not all blue-chip companies have the financial muscle to weather the market storms and volatilities. In addition, some of the leading blue-chip companies currently were small-cap equities within the last three decades. Not all small-cap organizations will be the next Tesla, Amazon, or Meta, making it a high-risk investment.

It is for this particular headache that small-cap ETFs exist. They expose investors to a basket of high-growth probability equities coupled to significant return potential, albeit at a relatively higher risk. The good news is that historically, especially after financial distress, small-cap ETFs have shown to outperform their large-cap counterparts.

What is the composition of small-cap ETFs?

The definition of small equity firms may vary depending on the metrics at play. However, small equity firms have a market capitalization of between $300 million and $2 billion for investment purposes. As such, small-cap ETFs comprise equities that fall under the small-cap classification, with some funds including firms that fall outside the $300 million to $2 billion brackets for diversification purposes.

The best small-cap value ETFs for growth in 2022

The global community and economy are not yet entirely out of the woods regarding the coronavirus pandemic. However, mass vaccinations and resumption of normalcy in travel and economic activities have Kickstarter economic resurgence. Although all sectors of the economy were affected, small-cap ETFs in the post-pandemic world offers the most exciting growth potential in addition to value, and the ETFs below provide portfolio diversification for profitability come 2022.

№ 1. Invesco S&P SmallCap Value with Momentum Fund (XSVM)

Price: $6.18

Expense ratio: 0.39%

Dividend yield: 0.83%

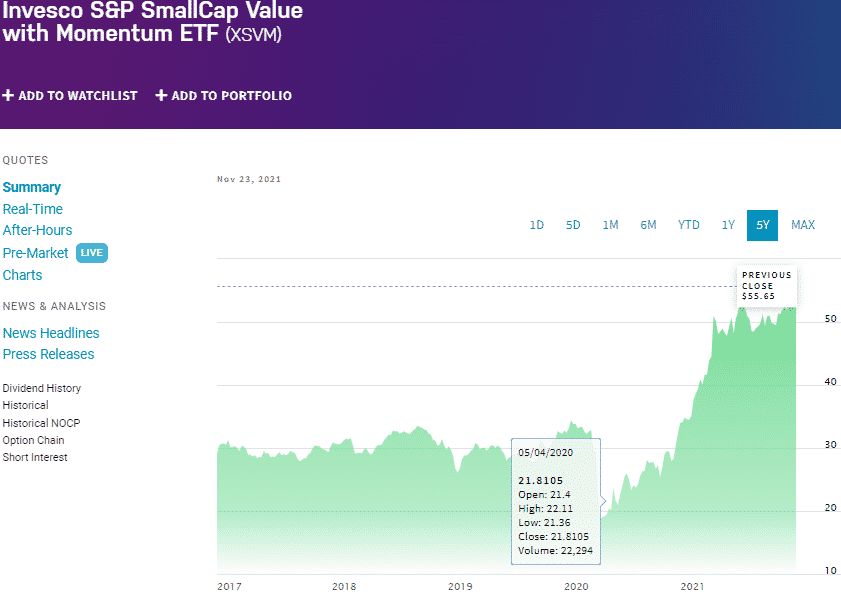

XSVM chart

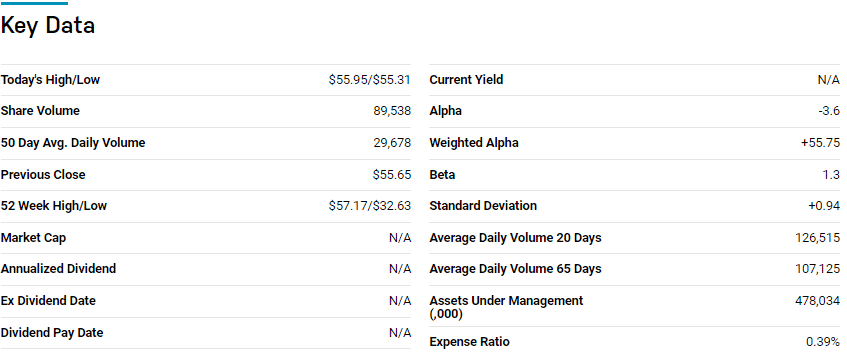

The Invesco S&P SmallCap Value with Momentum ETF tracks the performance of the S&P SmallCap 600 High Momentum Value Index, intending to replicate its performance as closely as possible net of expenses. It invests at least 90% of its net assets in the securities of its composite index to achieve its objective.

XSVM investors gain exposure to the best a hundred and twenty equities that are undervalued but exhibit strong price momentum. The underlying holdings weighting basis is the equities value scores.

The top three holdings of this ETF are:

- Veritiv Corp. — 2.77%

- United Natural Foods, Inc. — 2.00%

- Group 1 Automotive, Inc. — 1.77%

XSVM has 536.46 million in assets under management, with an expense ratio of 0.39%. In the current year, this ETF has recorded returns of 60.59% to lead the small-cap market. A look at the historical performance reveals that it has been a consistent performer; 5-year returns of 109.75%, 3-year returns of 93.18%, and pandemic year returns of 68.88%.

These returns and constant rebalancing ensure that this fund always provides value for investors for portfolio growth, making it ideal for Covid-19 post-pandemic investing come 2022.

№ 2. Vanguard Small Cap Value ETF (VBR)

Price: $183.45

Expense ratio: 0.07%

Dividend yield: 2.23%

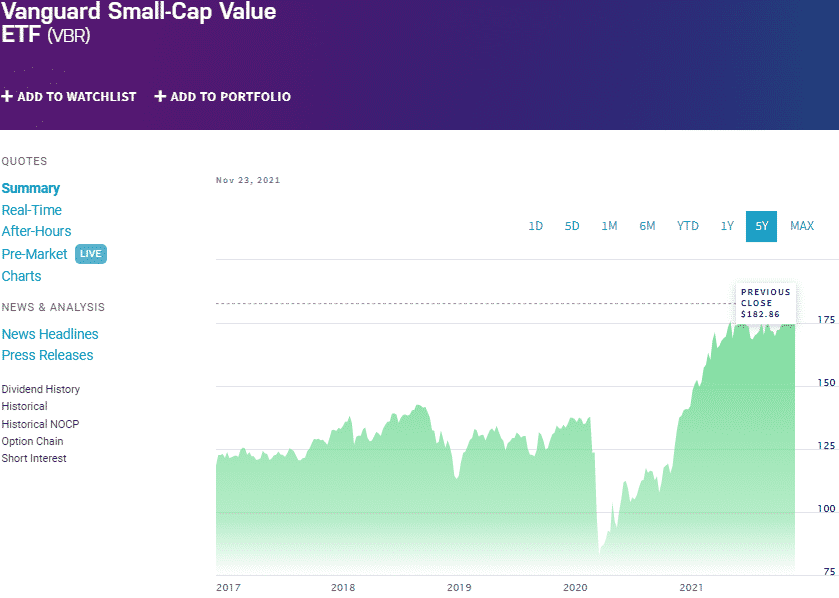

VBR chart

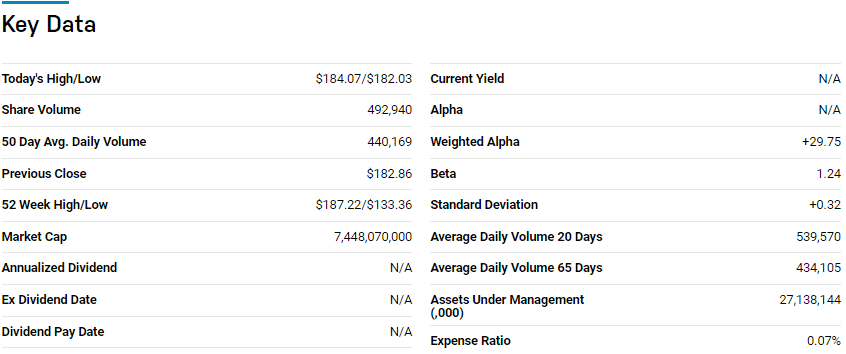

Vanguard Small-Cap Value Fund tracks the performance of the CRSP US Small Cap Value Index, intending to replicate its performance as closely as possible net of expenses. It invests at least 95% of its net assets in the securities of its composite index to achieve its objective. VBR investors gain exposure to the best US equities exhibiting value characteristics.

VBR ETF is ranked N 1 among the best 24 small value ETFs by USNews, for long-term investing.

The top three holdings of this ETF are:

- US Dollar — 0.68%

- Diamondback Energy, Inc. — 0.61%

- VICI Properties Inc. — 0.57%

VBR boasts an impressive asset under management portfolio, $27.24 billion, with investors coughing up just $7 annually for a $10000 investment. VBR returns might not be as phenomenal as those of the XSVM, but they are not meager; 5-year returns of 71.33%, 3-year returns of 53.68%, pandemic year returns of 38.09%, and year to date returns of 30.50%.

In addition, investors get to enjoy annual dividend yields to the tune of 1.53%. The mix and weighting of this small-cap ETF result in a relatively more stable fund despite its value-oriented investment strategy.

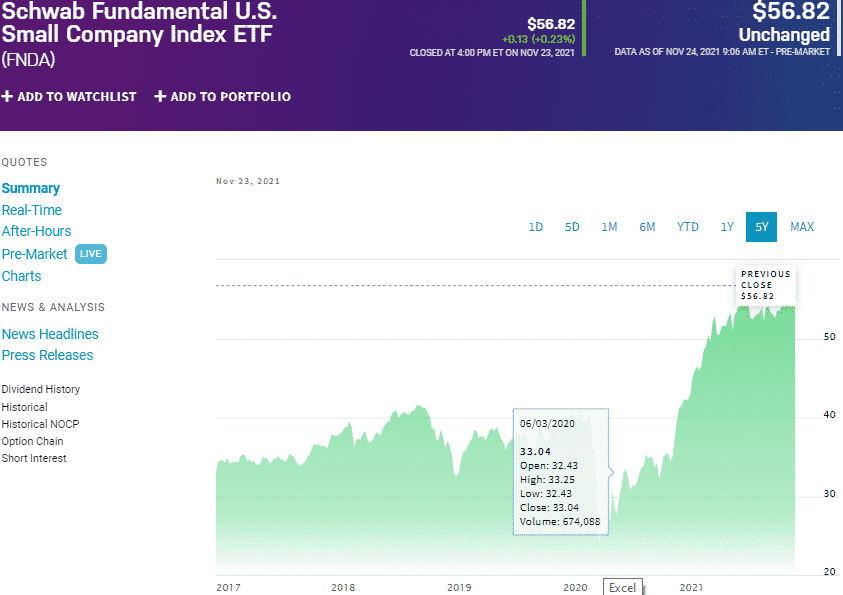

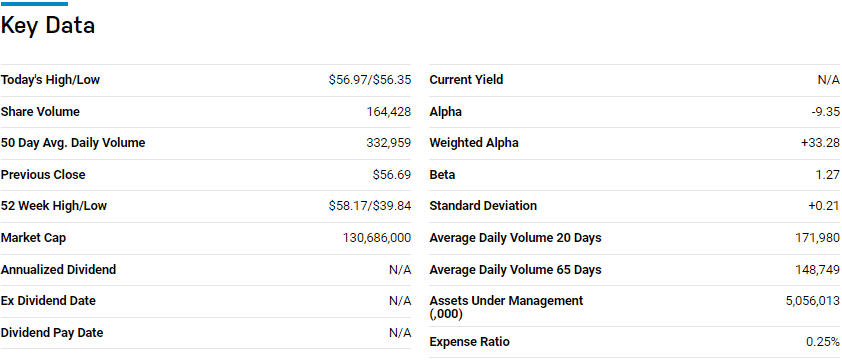

№ 3. Schwab Fundamental US Small Company Index Fund (FNDA)

Price: $56.82

Expense ratio: 0.25%

Dividend yield: 0.90%

FNDA chart

Schwab Fundamental US Small Company Fund tracks the performance of the Russell RAFI™ US Small Company Index, intending to replicate its performance as closely as possible net of expenses. It invests at least 90% of its net assets in the securities of its composite index to achieve its objective.

FDA is ranked No 16 among the best 59 small blend value ETFs by USNews, for long-term investing.

The top three holdings of this ETF are:

- Dillard’s, Inc. Class A — 0.70%

- SM Energy Company — 0.64%

- Chico’s FAS, Inc. — 0.40%

FDA ETF has $5.07 billion in assets under management, with an expense ratio of 0.25%. This ETF provides an alternative to value investing by concentrating on small-cap companies with the best fundamentals compared to their peers; profit margins, book value, and revenue growth.

This complex numbers strategy will be the defining factor post-pandemic in an inflation-rising environment characterized by rising prices. The historical performance also puts a strong case for pro-FNDA investing; 5-year returns of 82.67%, 3-year returns of 62.32%, pandemic year returns of 41.67%, and year-to-date returns of 33.14%.

Final thoughts

Small-cap ETFs offer alternate portfolio diversification: offer investors an avenue to access broad markets and industries at reduced risk due to their low expense ratio. Besides, trading and investing in ETFs offer excellent liquidity on a wide range of ETF investment choices at relatively low minimum investment requirements. As such, the ETFs above are in pole position to benefit come 2022 and provide the best value to investors.

Comments