Last week saw the SPY close in the red with Friday as its worst trading day of the week after the announcement by WHO that the Omicron Covid variant might be the most transmissible strain.

Would the market jitters continue and lead to further slide, or would the SPY start a Santa Season?

Monday’s opening gap up of 1.2% to have the SPY start its trading at $462.61 was a welcome sight to investors given the Friday slide frenzy since each week that opens with a gap up has the SPY in the green at the weekend. It was not to be since this, and the subsequent bullish run to the $466.36 level on the positive sentiments would be the only positives for the week.

WHO has indicated that Covid-19 fourth wave is here with us fueled by the Omicron variant. It has been categorized as the most transmissible variant so far. As a result, jitters spread possible extended lockdowns over the holiday season, with some European countries already implementing some form of restricted movement. The benefitting equities and sectors were those in support of stay-at-home plays replicating the same performance as was exhibited at the start of the coronavirus. In addition, travel-related stocks which had already started picking up pace suffered the brunt of this news.

With Powell staying at the helm for another four years, he doubled down on his comments about inflation rates being transitory to now say that it has proved to be more consistent and persistent than earlier forecasted.

The existing price pressures due to both inflation and existing supply chain disruptions have the FED rethinking its stand and considering tighter monetary policies, especially in light of the holiday shortages. Add the fact that policymakers are skeptical and calling for Biden to look into the country’s debt ceiling to avoid the government not honoring its debts. The reason for the arrested slide might be that investors love buying the deep. You have a very volatile market, which could derail economic resurgence. As a result, the musical chairs among the S&P 500 sectors continue.

Top gainers of the current week

Information Technology sector

The new strain of the coronavirus might result in border closures if some of the European country actions are to be followed. As a result of the stay at home plays coupled to information technology thrive, this sector resulted in a weekly change of +1.23%.

Real Estate sector

The real estate sector continues to thrive in this inflation-rising environment and jitters of a slowing down economy to result in another week in the green, +0.48%.

Losers of the current week

Sectors that had the worst the trading week were:

Healthcare Sector at — 1.35%

Consumer Staples at — 1.85%

Communication Services at — 2.30%

With the new coronavirus variant and the FED doubling their stance on the inflation rates, investor jitter soared, and the sectors above took the brunt of the bearish trading week. Expectations are for the markets to react the same way as the delta variant, jitters increase for a short while and the markets to recollect and the earnings season to continue.

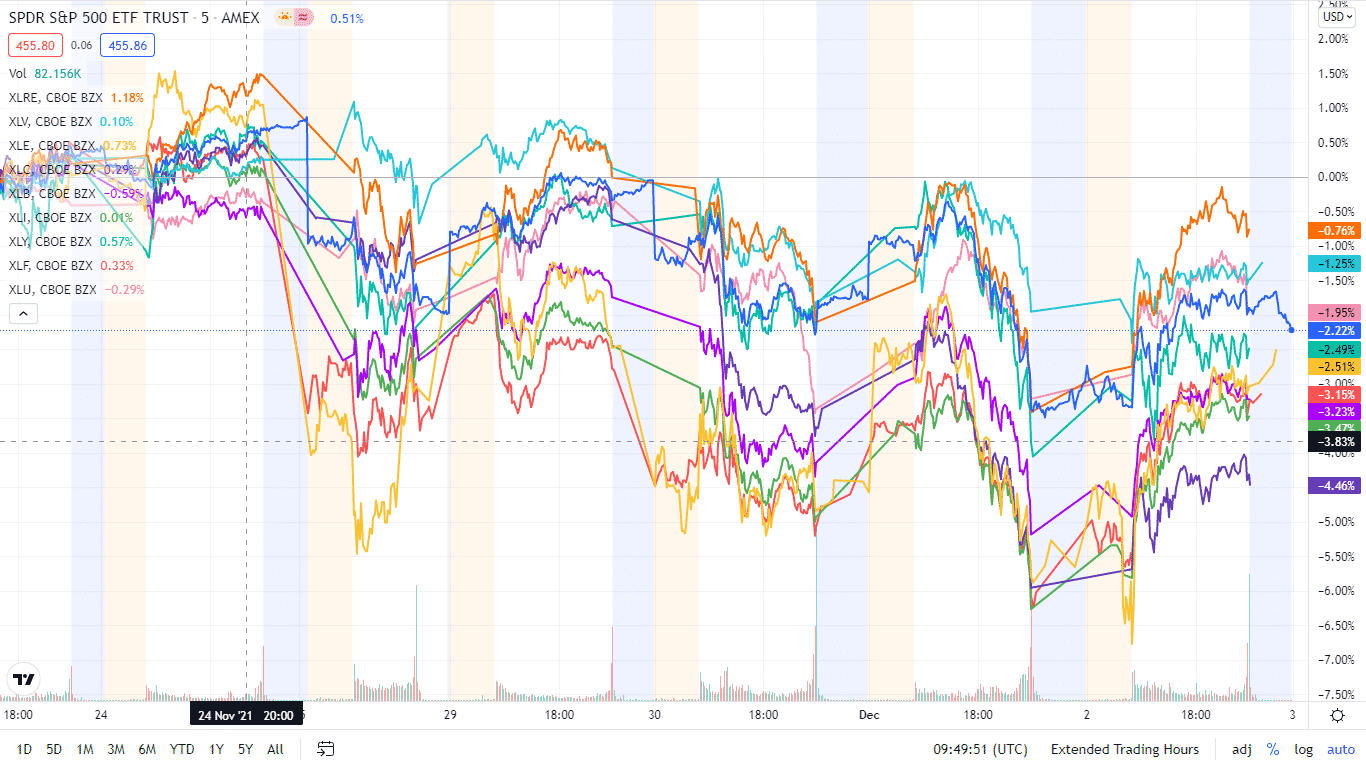

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week, using their corresponding ETFs, with only two sectors being in the green.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Information Technology | XLK | +1.23% with the accompanying information technology select sector ETF |

| 2. | Real Estate | XLRE | +0.48% with the accompanying real estate select sector ETF |

| 3. | Utilities | XLU | -0.05% with the accompanying utilities select sector ETF |

| 4. | Energy | XLE | -0.08% with the accompanying energy select sector ETF |

| 5. | Financial Services | XLF | -0.44% with the accompanying financial select sector ETF |

| 6. | Consumer Discretionary | XLY | -0.72% with the accompanying consumer discretionary select sector ETF |

| 7. | Industrial | XLI | -0.94% with the accompanying industrial select sector ETF |

| 8. | Materials | XLB | -1.16% with the accompanying materials select sector ETF |

| 9. | Healthcare | XLV | -1.35% with the accompanying healthcare select sector ETF |

| 10. | Consumer Staples | XLP | -1.85% with the accompanying consumer staples select sector ETF |

| 11. | Communication Services | XLC | -2.30% with the accompanying communication services select sector ETF |

Comments