It is mid-Feb, and SPY’s earnings season seems to be beyond the horizon. Investors have had to contend with the SPY moving sideways for the last few weeks.

Would this be the week of reckoning, or would it prove favorable to bullish investors?

Monday market opening of 0.9% gap down to start the week’s trading at $437.49 was confirmation enough of another week for the SPY in the gutters. Coupled with escalating tension between Ukraine and Russia that caused the markets to tank at the close of the markets on Friday, things were not looking suitable for the markets. Since its opening, SPY moved sideways until late Tuesday, when the peace talks between the two countries started sparking a 1.3% gap up. The markets latched on this respite to trade higher for the remainder of the week but could not break the $445.9 resistance level.

With the peace talks gaining traction, it was back to the FEDs stance on interest rates. FED warnings on higher interest rates and tighter monetary policies, seeing investor jitters amplify and increased inflows into more cyclical and haven inclined sectors. The inflation data continues to be grim, which, combined with the intensifying Russia-Ukraine tension, reduced consumer confidence.

The results of all this uncertainty and worse than expected economic data saw the SPY experience its 29th lowest bullish sentiment since the introduction of this indicator. With the markets finally trading below the 200-day moving average, it seems like it’s time for the bears with a weekly change of -2.74% cementing this sentiment.

Top gainers of the current week

Consumer Staples sector

In a week with nothing to smile about for the bulls, the mounting consumer jitters saw inflows into haven sectors, with the consumer staples sector benefitting the most to end the week at +1.00% weekly change.

Consumer Discretionary sector

Pandemic data shows that the coronavirus and its effect will be a thing of the past soon, further providing a bullish tailwind for this sector in addition to its haven status. The result was a weekly positive change of +0.30%.

Losers of the current week

Sectors had hit in a week highly influenced by the Russian-Ukraine conflict and rising inflation the most were:

Communication Services sector at — 1.62%

Financial Services sector at — 2.17%

Energy sector at — 2.94%

An increased dovish outlook on the economy saw inflows into haven sectors, and the more aggressive sectors lose out. In addition, the Energy sector experienced its worst week in a while on the back of the tension between Russia and Ukraine, which are significant oil suppliers globally.

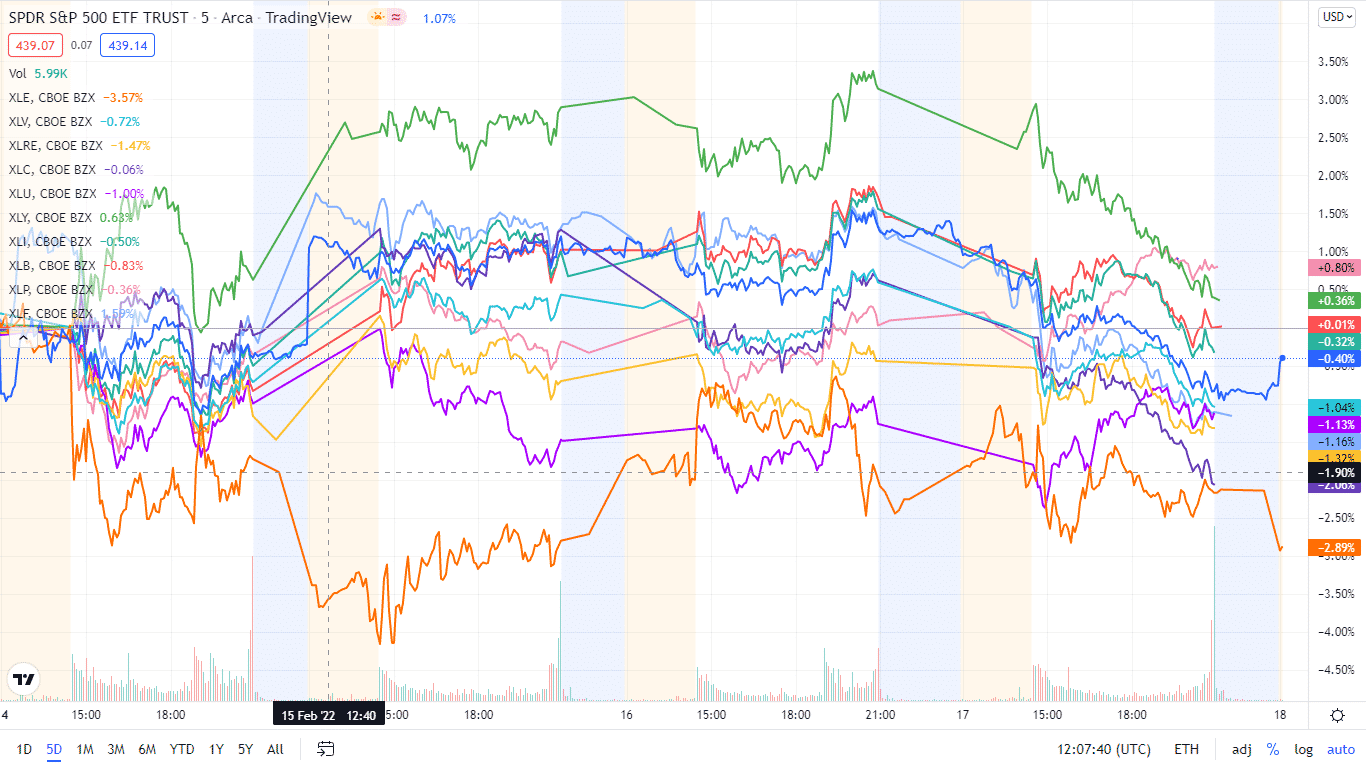

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week, using their corresponding ETFs. The SPY seems to be on very thin ice, and with just two sectors diminishing the week in the green, it might be time to get out of dodge and observe the markets keenly.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Consumer Staples | XLP | +1.00% with the accompanying consumer staples select sector ETF |

| 2. | Consumer Discretionary | XLY | +0.30% with the accompanying consumer discretionary select sector ETF |

| 3. | Materials | XLB | -0.07% with the accompanying materials select sector ETF |

| 4. | Industrial | XLI | -0.26% with the accompanying industrial select sector ETF |

| 5. | Information Technology | XLK | -0.62% with the accompanying information technology select sector ETF |

| 6. | Utilities | XLU | -1.11% with the accompanying utilities select sector ETF |

| 7. | Real Estate | XLRE | -1.35% with the accompanying real estate select sector ETF |

| 8. | Healthcare | XLV | -1.43% with the accompanying healthcare select sector ETF |

| 9. | Communication Services | XLC | -1.62% with the accompanying communication services select sector ETF |

| 10. | Financial Services | XLF | -2.17% with the accompanying financial select sector ETF |

| 11. | Energy | XLE | -2.94% with the accompanying energy select sector ETF |

Comments