After a second straight week of losses compared to the August bullish run, this would be the make-or-break week for the SPY, depending on the FED’s sitting results.

Would the SPY break the September equity market curse driven by good news from the FED sitting, or would it slide lower?

Monday morning was a mirror image of the previous two Mondays, confirming the ongoing investor jitters in the face of slowing down economic recovery.

After a Monday markdown opening price of 1.2% to start trading at $435.58, it was yet another downhill race of prices to the $430.14 range, which served as the July pivot level. Luckily for the SPY investors, this level proved its mettle to buoy up prices, sparing bullish investors further agony early in the week.

Come Wednesday, and the long-awaited FED meeting happened. Would there be good news or bad? The good news is that the FED feels that tapering measures have been met with a hawkish view of November start if next month’s labor reports are positive. Couple this to the expectation of rate hikes in early 2022 if the inflation rates exceed 2.4%, and they acted as the lifeline bullish investors needed to push the SPY back to the $444.87 region.

Investors seem to have taken the FED’s views and statements as a sign that the economy is still on course for recovery. Combined with their commitment to combat inflation, the ember needed to spur the SPY prices to trade above its 50-day moving average on Friday, $441.10 region, closing the gap created earlier in the week.

Among the individual S&P 500 sectors, the game of musical chairs is still afoot, with some sectors proving to be unmovable.

Gainers of the current week

Energy sector

The energy sector refused to be bullied off the top spot for a second week in a row. With Biden’s affirmations of infrastructure-led development strategy and continuing rise in natural gas prices, this sector closed once again in the green, +3.82%.

Financial Services sector

The FED’s news that tapering will happen as soon as November combined with the promise of checking the inflation rate in early 2022 had inflows into the financial services sector for it to close at +1.66% for the week.

Information Technology sector

The continued slide in Chinese equities and crackdown on Chinese firms have the US information technology experiencing massive cash flows as the primary information technology market. This monopoly has this sector in the green for a second week running, closing at +0.88%.

Losers of the current week

Sectors that took the brunt of the FED’s good news were:

Consumer Staples sector at — 0.52%

Utilities sector at — 1.06%

Communication Services sector at — 1.40%

With a positive economic outlook, investors look to more aggressive sectors for investment purposes. Coupled with reflation plays, the sector above viewed as safe havens take the brunt of economic good news.

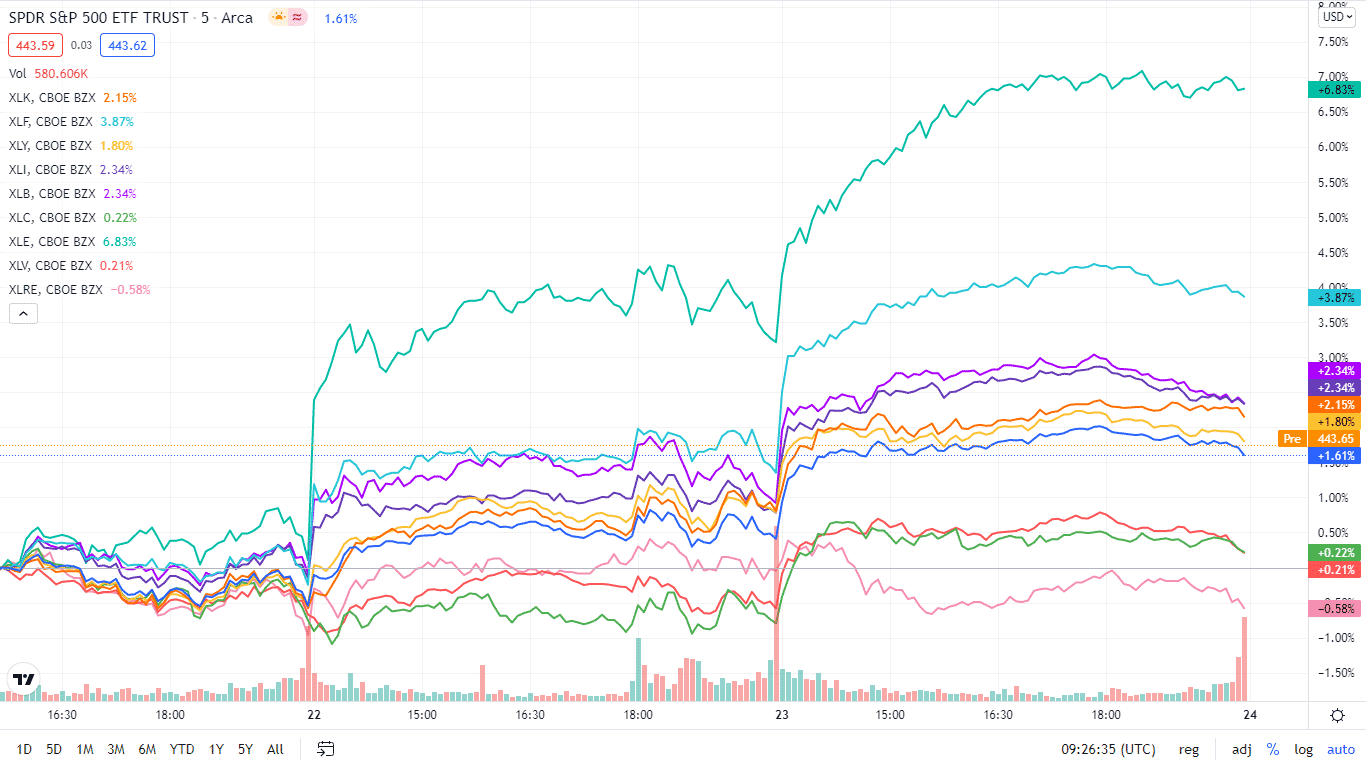

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week in the green by breaking down the individual sector performances using their corresponding ETFs.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Energy | XLE | +3.82% with the accompanying energy select sector ETF |

| 2. | Financial Services | XLF | +1.66% with the accompanying financial select sector ETF |

| 3. | Information Technology | XLK | +0.88% with the accompanying information technology select sector ETF |

| 4. | Industrial | XLI | +0.63% with the accompanying industrial select sector ETF |

| 5. | Materials | XLB | +0.25% with the accompanying materials select sector ETF |

| 6. | Healthcare | XLV | +0.02% with the accompanying healthcare select sector ETF |

| 7. | Consumer Discretionary | XLY | +0.00% with the accompanying consumer discretionary select sector ETF |

| 8. | Real Estate | XLRE | -0.30% with the accompanying real estate select sector ETF |

| 9. | Consumer Staples | XLP | -0.52% with the accompanying consumer staples select sector ETF |

| 10. | Utilities | XLU | -1.06% with the accompanying utilities select sector ETF |

| 11. | Communication Services | XLC | -1.40% with the accompanying communication services select sector ETF |

Comments