November is here, and so is the looming start day for FED tapering, and the economy shows signs of slowing down.

Would the SPY continue its bullish trend and set more records, or would the bubble burst?

Investors awaited Monday’s market opening with apprehension. Which direction would the SPY take? It replicated the previous Monday opening with a 0.3% gap that saw the SPY start trading at $461.17. it would be another week of upward momentum for the SPY.

The only bearish move for the SPY was on Monday after opening, and this was arrested by the previous week’s resistance level now turned support, $458.28. Despite analysts saying that equities are seriously overbought, the earning season has aligned to the general expectations, pushing the markets higher. This resilience is attributable to more than 80% of the SPY holdings posting higher earnings than expected despite the supply bottlenecks and the slowest annualized GDP growth so far of 2%.

The FED still insists that the current inflation is transitory despite running double the 2% FED approximation for spurring economic growth. The labor sector has also defied the FED expectations and experienced the lowest job uptake so far despite record job openings. All these factors result in higher prices of inputs, low business inventories, and ultimately increased consumer prices.

Nevertheless, the earnings season is in full swing, and investor jitters seem to have taken a backseat propelling the SPY to another record weekly change, +2.12%, after closing the October month with the most significant monthly change since March, +6.06%.

Top Gainers of the current week

Consumer Discretionary sector

Supply chain bottlenecks and the looming holidays have consumer product prices going up, and the rampaging inflation rates are no help. The consumer discretionary sector is thriving off this chaos and again comes up on top in the game of musical chairs among the individual SPY sectors with a +4.21% weekly change.

Information Technology sector

Despite Amazon posting less than expected Q3 earnings, other Tech giants have reported unprecedented Q3 returns resulting in more inflows in the sector resulting in a 2.9% weekly change.

Materials sector

The materials sector is experiencing a shortage of inputs and labor shortages, resulting in very ripe opportunities for those operating at capacity. When demand exceeds supply, prices go up. The result is a +2.34% weekly change.

Losers of the current week

Sectors that dragged a record bullish week for the SPY behind were:

Energy sector at — 0.08%

Utilities sector at — 0.45%

Financial Services sector at — 0.70%

The G20 and OPEC meetings during the week have not yielded any results regarding the high crude oil and natural gas prices-highest since 2014. However, more and more countries are committing to the zero-emission mission despite capitalizing on the rising fuel prices.

As a result, investors are still skeptical about the energy sector resulting in it finishing the week in the red. It is accompanied by the materials sector and the financial services sector in the red zone.

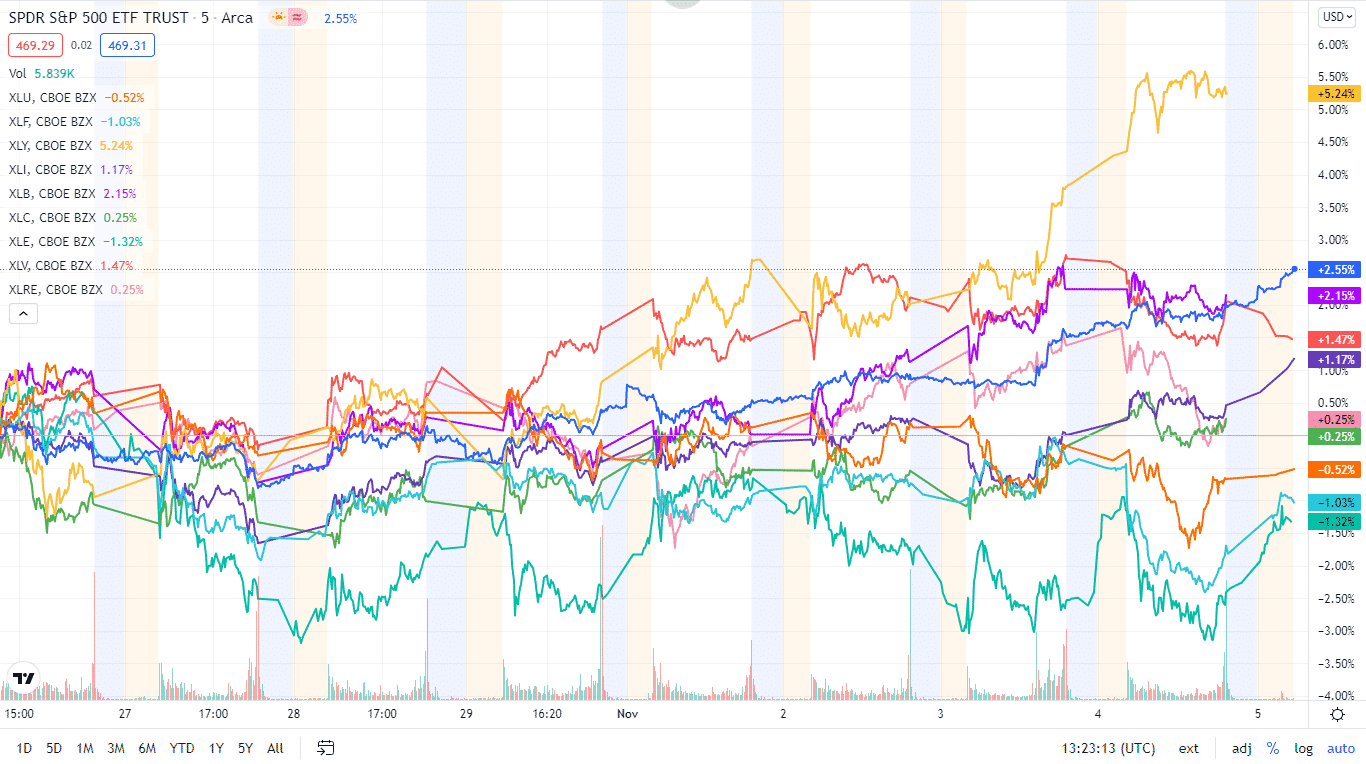

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week in the green by breaking down the individual sector performances using their corresponding ETFs.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Consumer Discretionary | XLY | +4.21% with the accompanying consumer discretionary select sector ETF |

| 2 | Information Technology | XLK | +2.90% with the accompanying information technology select sector ETF |

| 3. | Materials | XLB | +2.34% with the accompanying materials select sector ETF |

| 4. | Consumer Staples | XLP | +1.88% with the accompanying consumer staples select sector ETF |

| 5. | Industrial | XLI | +0.84% with the accompanying industrial select sector ETF |

| 6. | Communication Services | XLC | +0.67% with the accompanying communication services select sector ETF |

| 7. | Real Estate | XLRE | +0.59% with the accompanying real estate select sector ETF |

| 8. | Healthcare | XLV | +0.36% with the accompanying healthcare select sector ETF |

| 9. | Energy | XLE | -0.08% with the accompanying energy select sector ETF |

| 10. | Utilities | XLU | -0.45% with the accompanying utilities select sector ETF |

| 11. | Financial Services | XLF | -0.70% with the accompanying financial select sector ETF |

Comments