Last week saw the SPY close in the red, but Friday afternoon trading proved a lifesaver to somewhat cut the weekly downward slide.

Would the SPY accelerate downwards after a second straight losing week, or would it rally back to winning ways?

Monday’s opening gap up of 0.2% to have the SPY start its trading at $454.52 was not at par with the previous weeks, and given the failings of the last two weeks after a gap up, bullish investors were jittery about committing. However, this would prove to be the exception in the previous weeks and the lowest that the SPY would record for the week.

Inflation coupled with supply bottlenecks has led to increasing prices, calling for the FED to tighten or accelerate stimulus withdrawal. Powell also recently doubled down on his statements that inflation is transitory, raising some concerns about the state of the economy.

Despite all this, the economic data expected for the week was positive, quelling the rising jitters and resulting in all the US indices posting bullish runs. The SPY rallied from its slide of last week to post a midweek gap of 1%. It trades in the pivotal levels between $464.60 and $469.73 for the rest of the week.

Tapering is expected to end as early as March of 2022, and with impending rate hikes, investors are looking for future contracts to hedge their investments. The SPY weathered all this mixed news to finish the week in the positive, +2.95%.

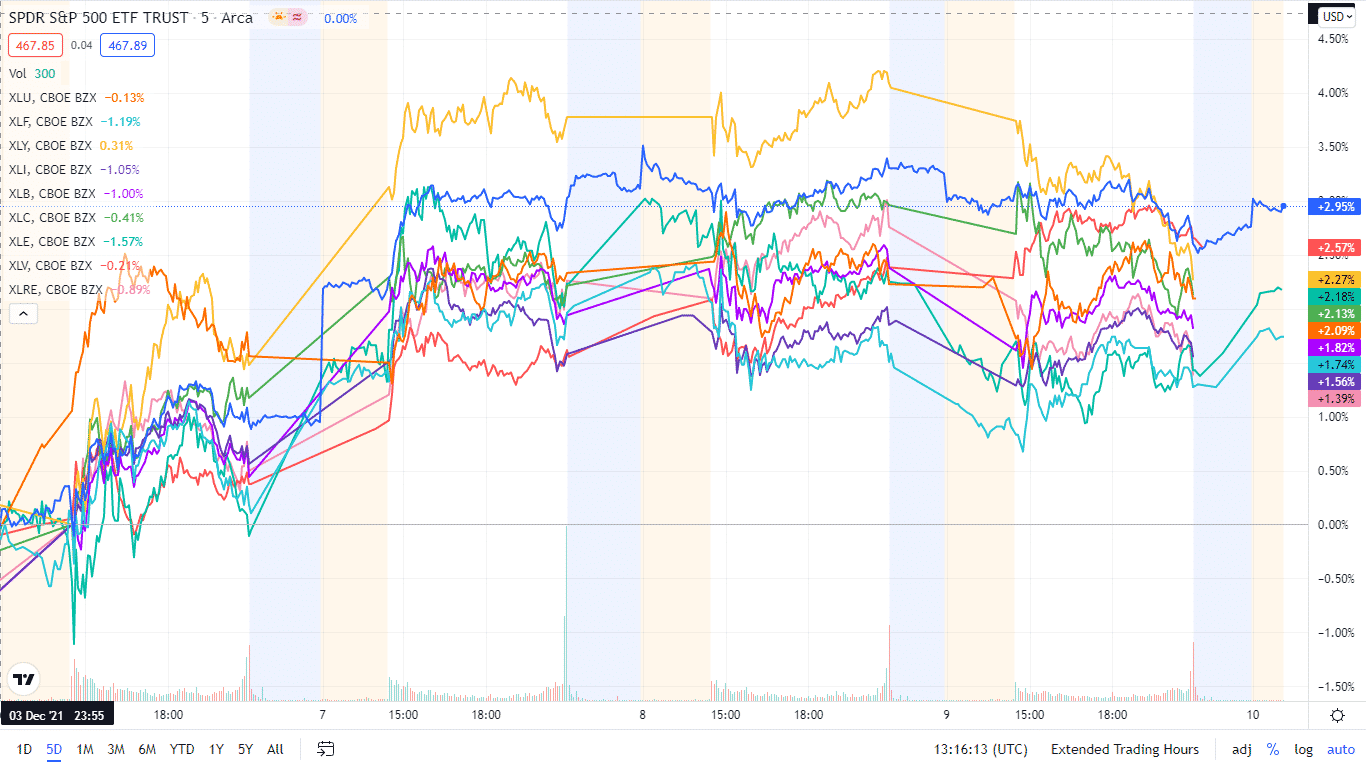

The game of musical chairs continues among the individual S&P 500 sectors. However, for the first time in a long while, all of them finished the week in the green.

Top gainers of the current week

Information Technology sector

The Omicron virus might be sweeping across the globe, but the information technology sector is thriving on the back of people subscribing on platforms that ensure they don’t lose touch with loved ones. The result is an inflow of investments in the information technology sector to close the week as the SPY top dog at +3.83%.

Energy sector

With developed economies releasing emergency fuel stockpiles, there is some sanity in the sector resulting in more controlled prices. Investors have also started channeling investments to the clean energy sector in line with the zero-emission mission spearheaded by the developed economies.

Materials Sector

As we approach the festive season, demand for items increases, and with rising inflation, the materials sector is ripe for returns reaping for those who dare. As such, the materials sector experienced investment inflows to close the week at + 2.85%.

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week, using their corresponding ETFs, with all sectors finishing in the green.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Information Technology | XLK | +3.83% with the accompanying information technology select sector ETF |

| 2. | Energy | XLE | +2.91% with the accompanying energy select sector ETF |

| 3. | Materials | XLB | +2.85% with the accompanying materials select sector ETF |

| 4. | Healthcare | XLV | +2.78% with the accompanying healthcare select sector ETF |

| 5. | Communication Services | XLC | +2.76% with the accompanying communication services select sector ETF |

| 6. | Industrial | XLI | +2.65% with the accompanying industrial select sector ETF |

| 7. | Financial Services | XLF | +2.49% with the accompanying financial select sector ETF |

| 8. | Real Estate | XLRE | +2.22% with the accompanying real estate select sector ETF |

| 9. | Consumer Discretionary | XLY | +2.03% with the accompanying consumer discretionary select sector ETF |

| 10. | Utilities | XLU | +1.98% with the accompanying utilities select sector ETF |

| 11. | Consumer Staples | XLP | +1.85% with the accompanying consumer staples select sector ETF |

Comments