At the height of the coronavirus, cessation of movement and closure of industries hit the automobile industry and lost close to 70 million units. In 2021 as the world resurged from the ravages of Covid-19, this industry recovered to post $2.3 trillion revenues for the year, with 2022 expected revenues being in the $3.8 trillion range.

Couple this with increased demand for low carbon emissions, and the automobile industry will be at the core of this revolution, presenting a host of investment opportunities. However, the geopolitical tension due to the Ukraine-Russia war means supply chain bottlenecks for this industry’s inputs setting a volatile stage for individual stocks.

Nevertheless, the top-down support that both developed and emerging markets are giving to accelerate this revolution means that this industry will grow in the long-term, and these three auto ETFs stand to gain the most.

Auto ETFs for gains in 2022: how do they work?

Before the current fad on green technologies got its current updraft, the automotive industry had already started producing electric vehicles to take advantage of the efficiencies in going electric. The ETF world has exchange-traded funds that pool together equities in the automobile industry; manufacturers of heavy commercial vehicles, trucks, cars, vans, and suppliers of automobile-based technologies and spare parts.

The best auto ETFs for a rev up

There is no denying that the global automotive industry is one of the most significant corners of the economy. Historically, the auto industry has consistently outperformed the broader market in a growing economy. Driving has become a culture the entire globe, with automakers in a race to comply with the specific regional requirements while taking advantage of the ever-increasing demand for cars. As the globe continues its resurgence from the coronavirus, the three auto ETFs below have enough potential to rev up and push your portfolio returns some significant miles.

№ 1. Amplify Lithium and Battery Technology ETF (BATT)

Price: $16.62

Expense ratio: 0.59%

Dividend yield: 0.17%

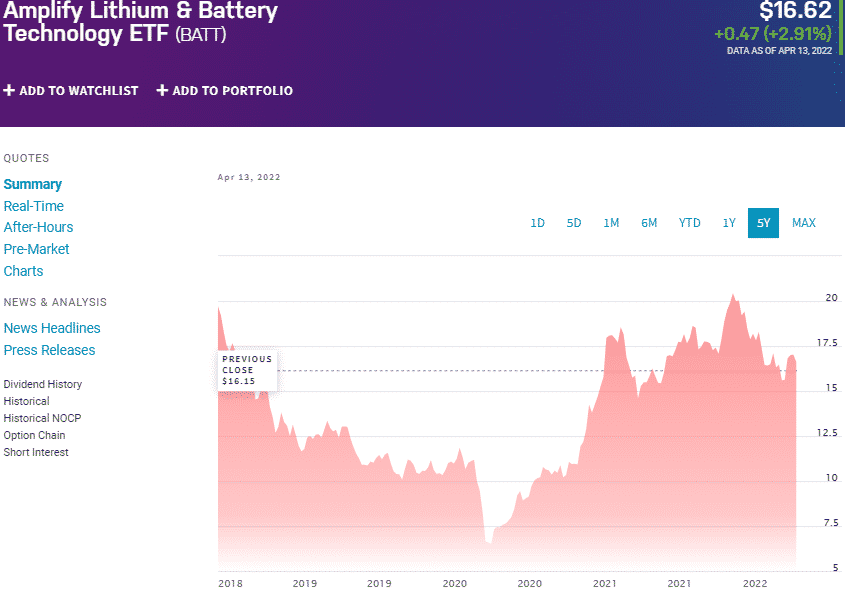

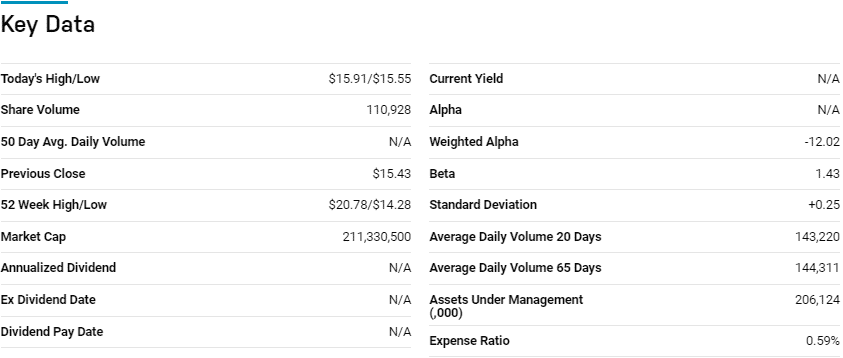

BATT price chart

Amplify Lithium & Battery Technology fund tracks the yield performance and total returns of the EQM Lithium & Battery Technology Index, net of expenses, and fees. It invests at least 80% of its total assets in the underlying holdings of its composite index, offering diversified global exposure to equities deriving at least 50% of its revenues from the development, production, and utilization of Lithium-ion battery technology.

The top three holdings of this ETF are:

- BHP Group Limited Sponsored ADR — 8.58%

- Tesla Inc. — 7.26%

- Contemporary Amperex Technology Co., Ltd. Class A — 5.51%

The BATT ETF has $214.5 million in assets under management, with an expense ratio of 0.59%. This ETF indirectly plays the automobile industry by having 80% of its weighting assigned to mining companies exploring and converting EV battery inputs. In comparison, the remaining 20% is allotted to EV automakers. The result is a fund with diversification across the automotive value chain, making it not only resilient in the market downturns and a consistent returns provider; 3-year returns of 32.79% and 1-year returns of 8.44%.

№ 2. First Trust NASDAQ Global Auto Index Fund (CARZ)

Price: $53.95

Expense ratio: 0.70%

Dividend yield: 0.72%

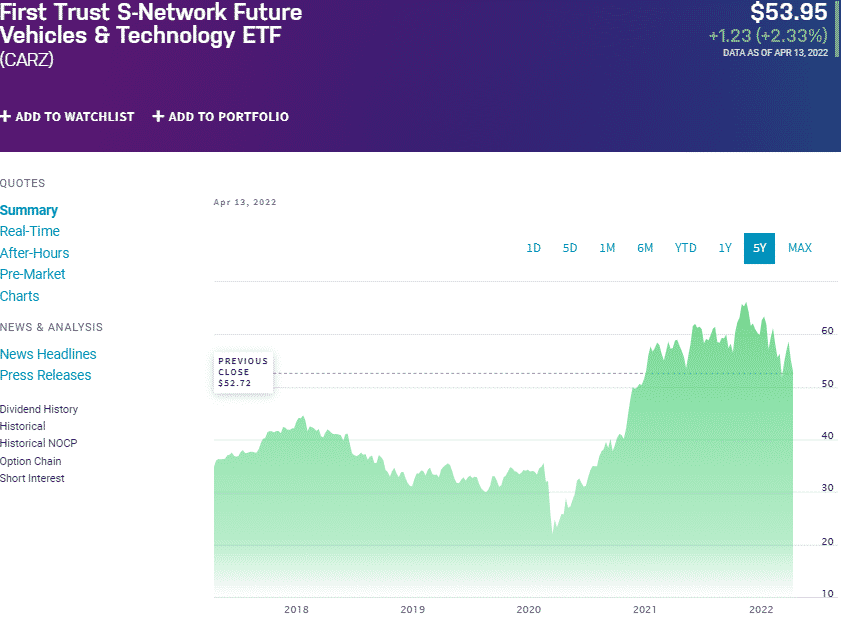

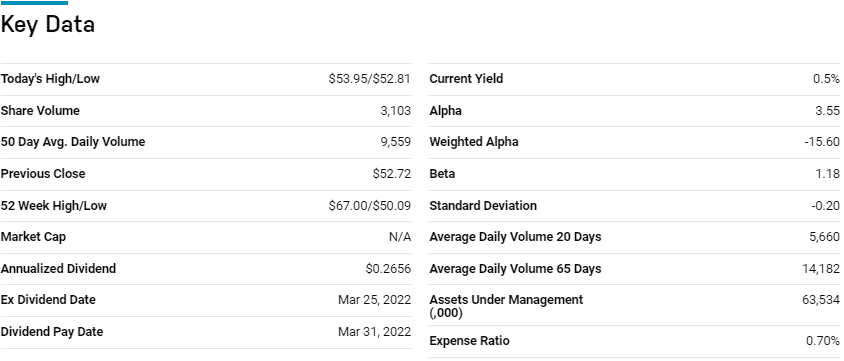

CARZ price chart

The First Trust NASDAQ Global Auto Index Fund tracks the performance of the S-Network Electric & Future Vehicle Ecosystem Index. It invests at least 90% of its total assets in common stocks making up its composite index and associated ADRs. The result is a fund exposing investors to global equities involved in electric and autonomous vehicle manufacturing and enabling technologies or materials.

The top three holdings of this global automotive fund are:

- Apple Inc. — 5.40%

- Tesla Inc — 5.31%

- Alphabet Inc. Class A — 5.11%

CARZ ETF has $63.5 million in assets under management, with investors’ parting with $70 annually for every $10000 invested. This ETF is one of the few pure-play automotive funds, and its global net and pretty even weighting mitigate against concentration risk while providing geographical diversification.

The result is a fund that has provided more than average returns for investors except for the last 12-months, which provides a chance to buy the dip; 5-year returns of 68.20%, 3-year returns of 61.67%, and 1-year returns of -6.63%.

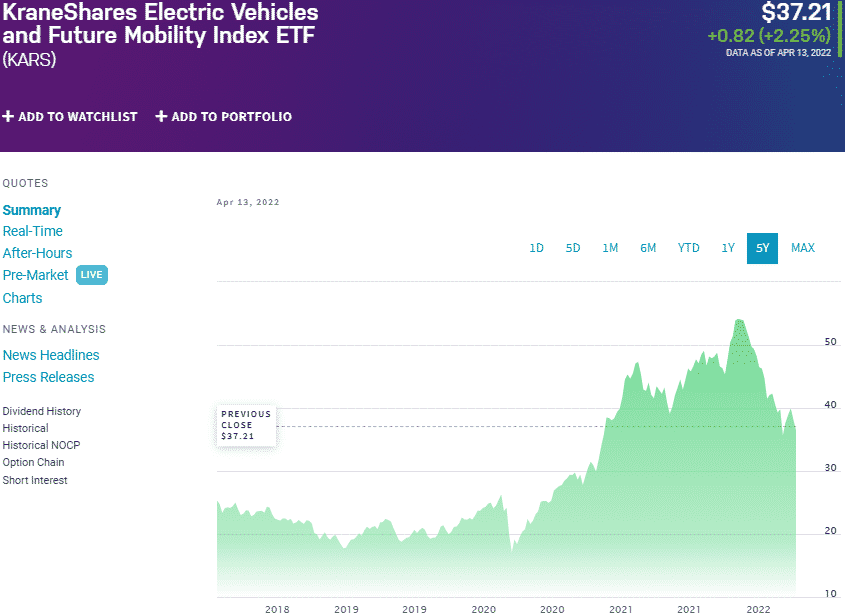

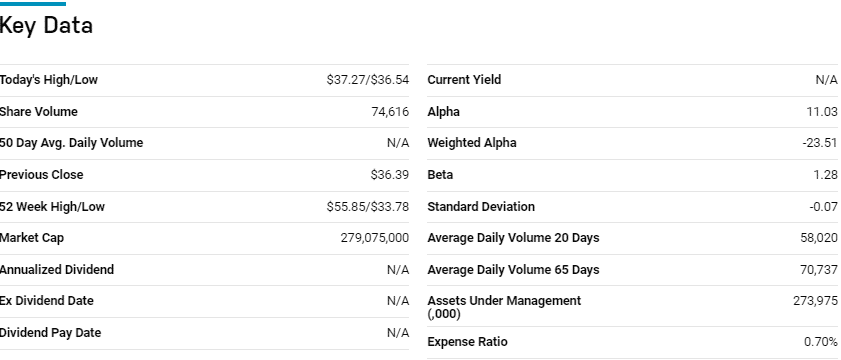

№ 3. KraneShares Electric Vehicles and Future Mobility ETF (KARS)

Price: $37.21

Expense ratio: 0.70%

Dividend yield: 0.11%

KARS price chart

The globe is all about green technologies and zero carbon emissions when it comes to technology and energy. The automobile industry straddles both the technology and energy sectors. With both developed and emerging markets accelerating their support for going green, it is time to consider the KraneShares Electric Vehicles and Future Mobility ETF.

It tracks the total return and yield performance of the Bloomberg Electric Vehicles Index, net of fees and expenses. It invests at least 80% of its total assets in the holdings of its composite index, including the associated ADRs, GDRs, and other instruments of similar economic characteristics.

The top three holdings of this auto ETF are:

- Tesla Inc — 5.83%

- Analog Devices, Inc. — 5.12%

- Contemporary Amperex Technology Co., Ltd. Class A — 4.91%

The KARS ETF has $274.0 million in assets under management, with investors having to part with $70 for every investment worth $10000 annually. A tap into all the next generation and disruptive technologies in the automotive industry means going forward.

This ETF will have several verticals to generate significant returns; electric vehicles, hydrogen fuel, energy storage technologies, lithium and copper mining, and autonomous navigation technology. Historical returns are not a guarantee of future earnings.

However, the historical performance shows that as the adoption of EVs and autonomous vehicles accelerates; it has some severe legroom for growth; 3-year returns of 80.94% and 1-year returns of -8.13%.

Final thoughts

The automotive industry has historically been one of the sectors that gauge consumer spending habits and economic health. This highlights how significant this sector is and its contribution to the global GDP. With new technologies and innovations changing the automotive industry and consumer behavior, the expected CAGR of approximately 4% to 2030 presents investment opportunities in this sector, with the three ETFs above standing to gain the most and rev up.

Comments