On the top of the head, it might seem like the era of artificial intelligence is still futuristic. Wrong! The AI era is here with us, but not in the robotics that most people think of when AI comes up.

Almost every facet of our lives has an element of artificial intelligence attached to it. The only difference being the complexity of the underlying technology. Thus, IBM’s diagnostics tech Watson, autonomous vehicles, airplane autopilot systems, smart homes, google maps, Alexa, Apple’s Siri, and the numerous e-commerce systems in use daily.

AI technology is in a constant flux state, and even with the backing of some tech industry giants, it is a market with more than average volatility. As such, rather than investing in individual AI equities, investors look into AI exchange-traded funds to mitigate against the volatility of individual AI equities.

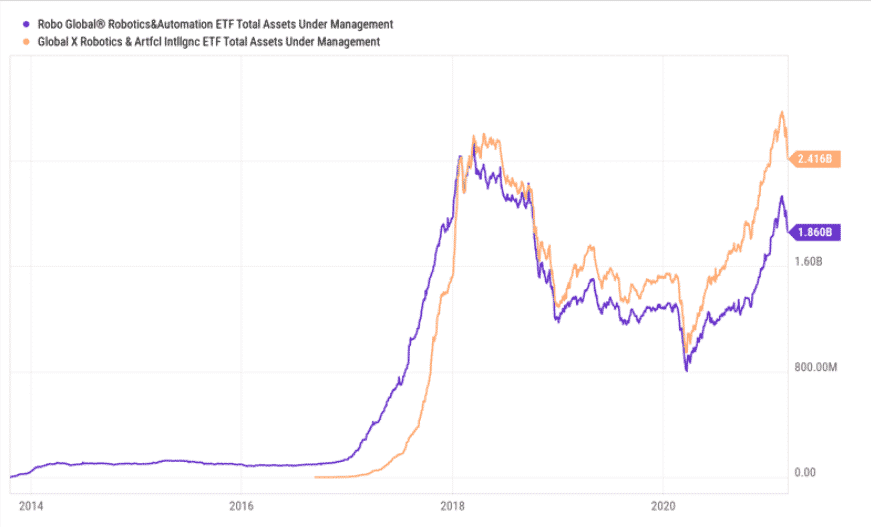

A diver into the AI ETF universe reveals five funds as the top dogs of this tech niche sharing approximately $5 billion in assets under management between them. Among these top five bigwigs, two are constantly fighting for supremacy as the ultimate alpha AI ETF, Global X Robotics and Artificial Intelligence ETF (BOTZ), and ROBO Global Robotics and Automation Index ETF (ROBO).

BOTZ vs. ROBO overview

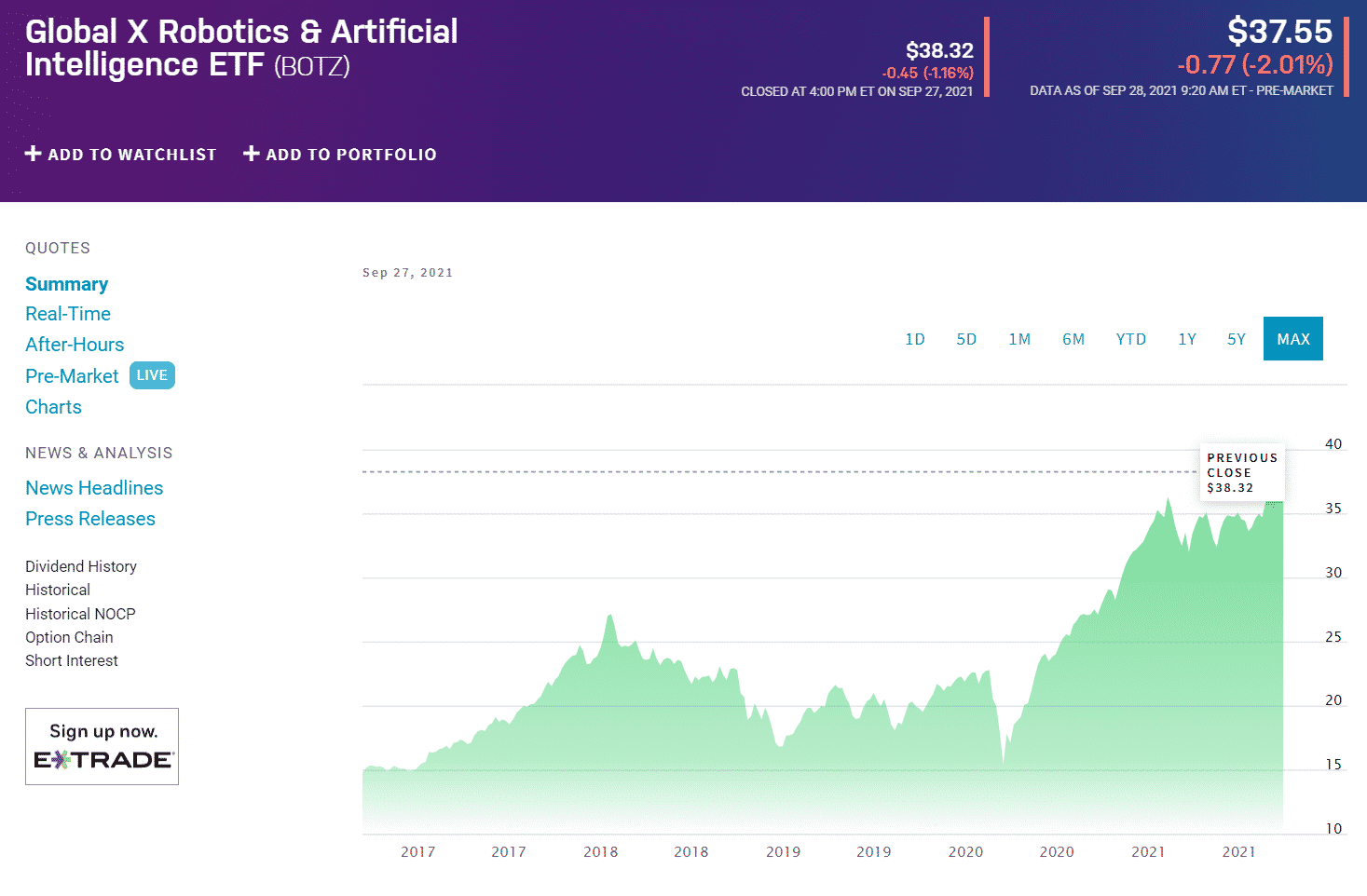

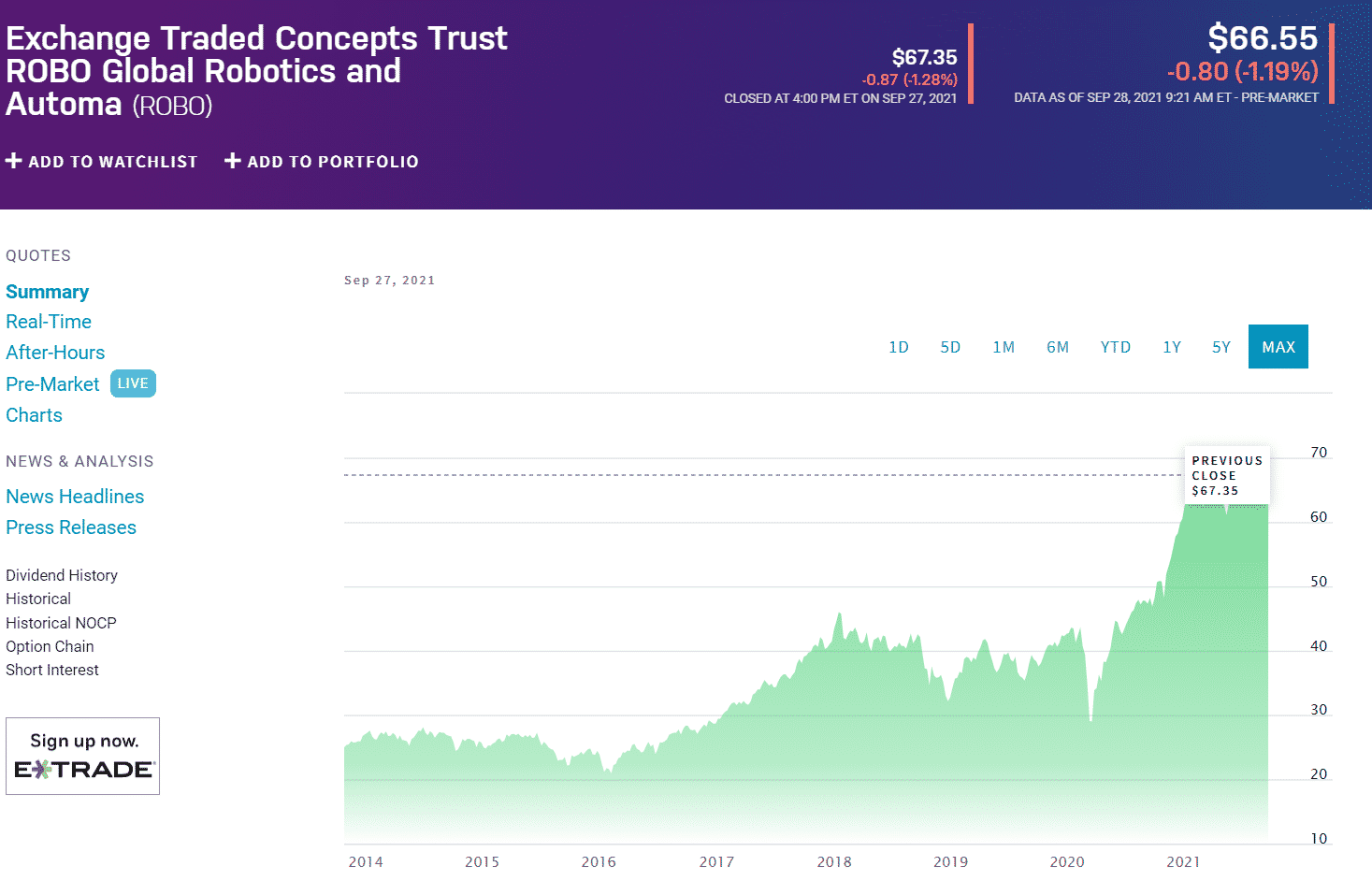

It is not just by happenstance that both BOTZ and ROBO are the most sought AI ETFs. They are the oldest artificial intelligence ETFs to kick-off, with ROBO being three years older than BOTZ; ROBO launched in 2013, and BOTZ launched in 2016.

ROBO vs. BOTZ сhart since inception

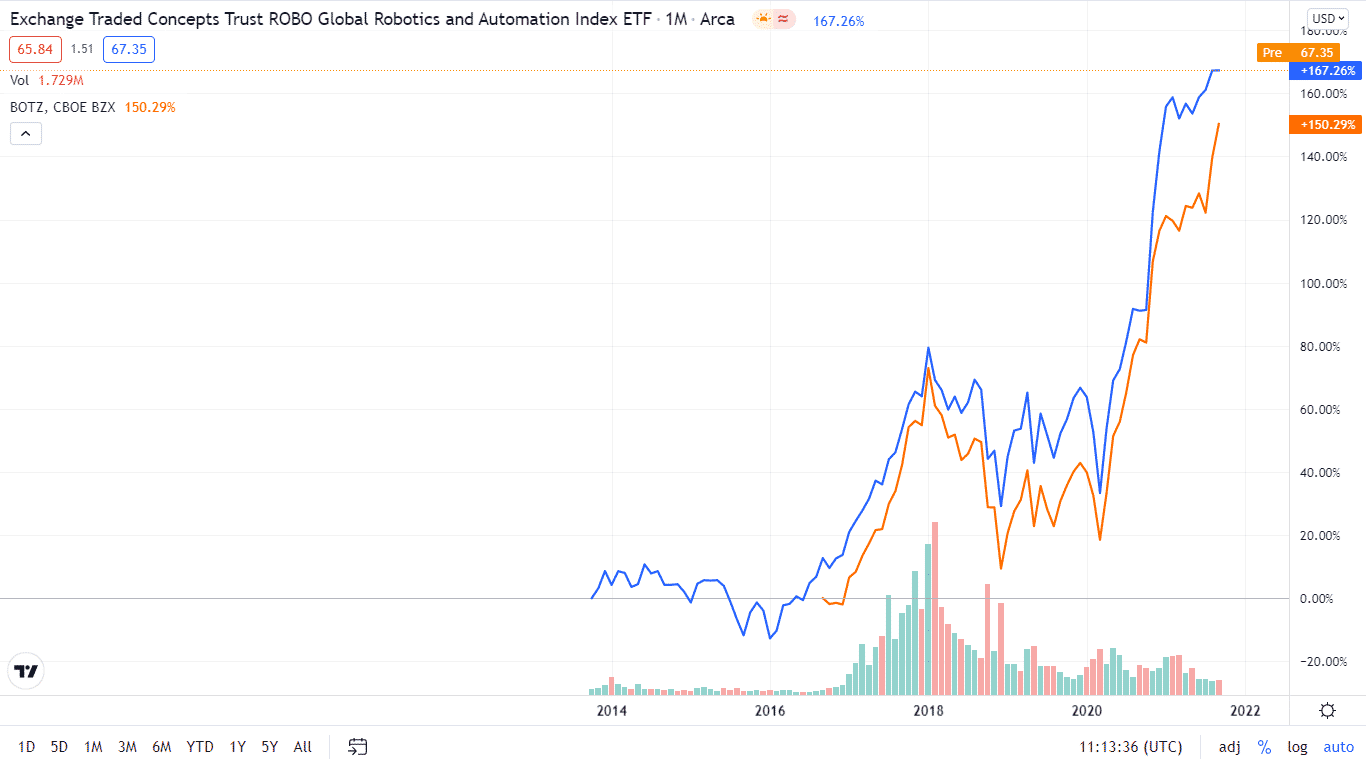

Unlike other sectors, the artificial intelligence ETF market has broken the norm. An analysis of the ETF market reveals that the best performing ETFs in a sector are the pioneers. For the AI ETF market, it seems BOTZ did not get the memo with its launch timed to perfection resulting in it outperforming its predecessor.

Whereas ROBO took three years to get to the $100 million assets under the management mark, BOTZ capitalized on the global investor change in sentiments regarding AI investing in 2017 to surge ahead of ROBO, a position it has held on to tightly to date.

Despite at first glance seeming pretty similar, the traction and the historical performance of these two ETFs reveals that they are fundamentally different, facilitating two choice ETFs for AI investors. Below we delve deeper into the individual indicators to find out if we have a clear winner.

BOTZ vs. ROBO price

When writing this article, the BOTZ ETF price was trading at the $37.55 range, while the ROBO ETF trading price range was $66.52.

BOTZ vs. ROBO expense ratio

In most cases, investors are such a hang-up on the price of an investment asset that they forget there are other associated costs coupled to an investment vehicle. An ETF’s expense ratio is one of the primary indicators for consideration when choosing between ETFs. It represents the fees paid to the ETF issuer for managing the investors’ stake in an ETF; the administrative and operational expenses.

In this metric, BOTZ yet again begs to be chosen as the AI ETF investment of choice. BOTZ expense ratio currently stands at 0.68%, while ROBO’s expense ratio stands at 0.95%.

It implies that BOTZ investors’ part with $68 for every $10,000 invested, with a ROBO investor having to part with $95 for every $10,000 invested annually. Therefore, an investment in BOTZ saves an investor $27 annually, $10 shy of the price of a single BOTZ share.

BOTZ vs. ROBO index tracked and underlying holdings

Both these ETFs track different indices investing at least 80% in the holdings of their composite index. ROBO tracks the performance of the ROBO Global Robotics and Automation Index, while BOTZ tracks the performance of the Global Robotics & Artificial Intelligence Thematic Index.

While the tracked composite index looks similar, BOTZ is more specific since it exposes investors to global organizations deriving significant revenues from adopting and utilizing artificial intelligence.

On the other hand, ROBO holdings only have to derive a portion of their revenues from AI-related activities to qualify as holdings.

| Holdings | |||

| Total BOTZ 37 | Total ROBO 87 | ||

| Top 10 holdings | Weighting | Top 10 holdings | Weighting |

| Upstart Holdings, Inc. | 10.94% | Brooks Automation, Inc. | 2.10% |

| Keyence Corporation | 8.60% | iRhythm Technologies, Inc. | 1.84% |

| NVIDIA Corporation | 8.25% | Intuitive Surgical, Inc. | 1.66% |

| Intuitive Surgical, Inc. | 8.03% | Airtac International Group | 1.65% |

| ABB Ltd. | 7.32% | iRobot Corporation | 1.65% |

| Fanuc Corporation | 6.52% | Harmonic Drive Systems Inc. | 1.64% |

| OMRON Corporation | 5.15% | Kardex Holding AG | 1.64% |

| SMC Corporation | 4.69% | Cognex Corporation | 1.61% |

| Daifuku Co., Ltd. | 4.44% | Keyence Corporation | 1.59% |

| Yaskawa Electric Corporation | 4.30% | Daifuku Co., Ltd. | 1.55% |

| Total | 68.24% | Total | 16.93% |

In terms of the number of holdings, ROBO holds a significant advantage over BOTZ. ROBO has 87 holdings, while BOTZ has 37 holdings.

They both have global exposure, but ROBO has superior diversification given its more extensive holding base. In addition, while BOTZ is market-cap weighted, ROBO is equally weighted with a 2% weight capping for any individual holding.

As a result, the top ten holdings for BOTZ account for 68.24% of the total weighting, while ROBO top ten holdings account for only 16.93% of the total ETF weighting. A deeper dive into these holdings reveals that both deal in growth stocks, but where ROBO is skewed towards mid-cap equities, BOTZ business is towards large-cap stocks.

BOTZ takes the upper hand for focused investment on these metrics, while ROBO pulls clear for diversification purposes.

BOTZ vs. ROBO performance

The ultimate goal of investing is to get returns on investment for wealth creation and accumulation.

A look at the chart above shows that cumulatively, ROBO has a higher return than BOTZ. However, it is worth noting that ROBO has three more years since inception to BOTZ yet the difference in their cumulative earnings is a measly 17%. A breakdown of the last three years paints a different picture.

| Period | BOTZ | ROBO |

| 4 week return | 4.70% | 0.39% |

| 13 week return | 8.45% | 2.73% |

| 26 week return | 17.19% | 7.73% |

| YTD return | 15.83% | 10.61% |

| 1 year return | 41.31% | 44.00% |

| 3 year return | 71.93% | 61.88% |

A comparison of the periods that the two ETFs have been in existence shows that BOTZ is the better artificial intelligence investment vehicle, a fact supported by their respective assets under management value, BOTZ $2.92 billion and ROBO $1.92 billion.

Final thoughts

Depending on individual investment objectives, and risk tolerance levels, both BOTZ and ROBO are ahead of their AI peers and excellent investment picks. However, given the indicators under review above, BOTZ carries the day as the superior AI ETF.

Comments