ETF full name: JPMorgan BetaBuilders Canadian ETF (BBCA)

Segment: large-cap equities

ETF provider: JP Morgan Chase

| HYEM key details | |

| Issuer | JP Morgan Chase |

| Dividend | $0.36 |

| Inception date | 7 August 2018 |

| Expense ratio | 0.19% |

| Management company | JP Morgan Chase |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 20.85% |

| Investment objective | Replication |

| Investment geography | Canada |

| Benchmark | Morningstar Canada Target Market Exposure Index |

| Leveraged | N/A |

| Median market capitalization | $64.40 billion |

| ESG rating | AAA (8.69/10) |

| Number of holdings | 84 |

| Weighting methodology | Weighted average market cap |

About the BBCA ETF

The JPMorgan BetaBuilders Canadian ETF has been in existence since 7 August 2018. BBCA provides neutral coverage of stocks primarily traded in the Toronto Stock Exchange. The fund aims to replicate the Morningstar Canada Target Market Exposure Index.

The index includes 85% of this market and weighs companies based on free-float market capitalization. The BBCA intends to replicate the index constituents as closely as possible. If this is not possible, the fund will use a representative sampling method instead. Rebalancing occurs quarterly, while reconstitution occurs semi-annually.

BBCA Fact-set analytics insight

The BBCA fund has a market cap of $64.40 billion and total assets under management of $5.68 billion. The fund follows a market-cap-weighted scheme and has an expense ratio of 0.19%.

BBCA performance analysis

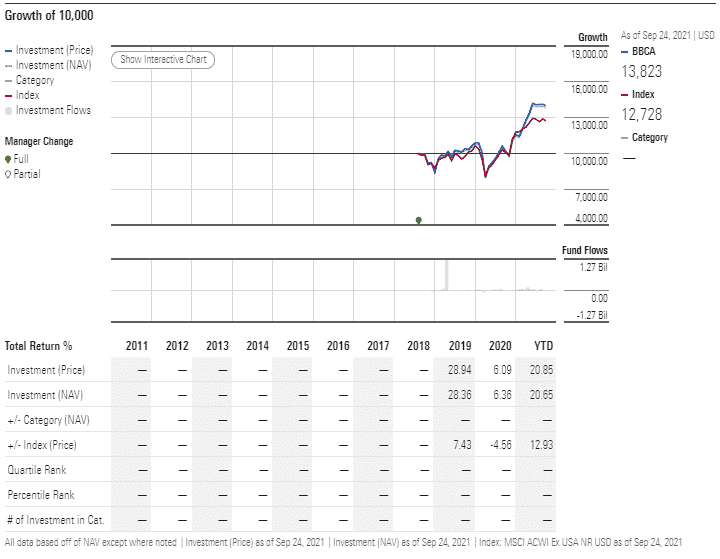

The lack of small-caps in BBCA does not have a significant effect on the fund’s performance. The BBCA fund has an annualized return of 20.65%. The last dividend payment, which was in September 2021, came to $0.36 and a year-to-date dividend yield of 1.59%.

Furthermore, the fund has a price-earnings ratio of 15.40. The JPMorgan BetaBuilders Canadian ETF share price has increased by 35.99% over 52 weeks. The projected growth rate, as seen in the above chart, has exceeded the benchmark index.

The fund has an MSCI ESG rating of AAA, which is a score of 8.69 out of 10.

BBCA ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| BBCA Rating | A+ | C

/ 85 |

Quintile 1

(2nd percentile) |

N/A | 5.1 / 10 |

| BBCA ESG Rating | 9.95 / 10 | AAA

(8.69 / 10) |

N/A | N/A | N/A |

BBCA key holdings

The BBCA has a total of 84 holdings, with 89.63% being Canadian and 10.37% US. In terms of the top five sectors: 37.46% is in financials, 13.08% energy, 12.53% technology, 11.56% industrials, and 10.21% in basic materials.

The table displays the fund’s top ten holdings.

| Ticker | Holding name | % of assets |

| SHOP | Shopify, Inc. Class A | 8.70% |

| RY | Royal Bank of Canada | 7.54% |

| TD | Toronto-Dominion Bank | 6.25% |

| BAM.A | Brookfield Asset Management Inc. Class A | 4.28% |

| ENB | Enbridge Inc. | 4.24% |

| BNS | Bank of Nova Scotia | 3.92% |

| CNR | Canadian National Railway Company | 3.70% |

| BMO | Bank of Montreal | 3.43% |

| CM | Canadian Imperial Bank of Commerce | 2.71% |

| TRP | TC Energy Corporation | 2.52% |

Industry outlook

The BBCA gives good returns and is considered a profitable investment option. Analysts forecast an increase long term and the share price to reach $325 by 2026, therefore providing a return of more than 405% for a five-year investment. If you look for stocks with good returns, PT Bank Central Asia Tbk can be a profitable investment option.

Comments