In an age when we are almost dependent on computer chips and connectivity, cybersecurity is why organizations and most of the unaware global population sleep soundly at night. It is no wonder then that the global cybersecurity market is projected to grow upwards of $345 billion by 2026.

It is but a drop in the ocean compared to the fact that analysts forecast the global cost of cyber-hacks will be over $1 trillion by the close of 2021. When Yahoo servers were compromised in 2014, three billion accounts were impacted, resulting in losses upwards of $350 million.

Imagine the ramifications if this had been a financial institution or other high cashflow organization. The global community is experiencing an increased spurt of cyber terrorism and corporate hacking, driving the demand for cybersecurity services and, as a result, increased investment inflows to the sector.

Best cybersecurity ETFs: how do they work?

Cybersecurity ETFs comprise organizations in the information security industry, including identity access management, security services, infrastructure manufacture and protection, and all the ancillary services coupled to the industry. This pool of cybersecurity equities then tracks a particular index fund in the industry, intending to replicate its performance as closely as possible, net of expenses and fees.

What to consider before buying cybersecurity ETFs

Similar to other funds, investing in cybersecurity ETFs calls for consideration of the indicators below to enhance profitability chances:

- Liquidity

Invest in an ETF that trades in large volume for fast liquidation in times of market downturn.

An ETF’s expense ratio has a bearing on the net returns of an investment. Always account for all the expenses coupled to an investment asset to ensure the investment objectives align.

- Weighting

The technology sector has been shown to experience significant market whipsaws due to high volatility in the market. Invest in ETFs with a balanced weighting across its holdings to mitigate against concentration risk.

Which are the best cybersecurity ETFs to buy in 2022

The world is slowly recovering from the Covid-19 pandemic, with people resuming work necessitating robust cybersecurity measures. As the globe gears for full economic resumption in 2022, the following cybersecurity ETFs can hack out profits for investors.

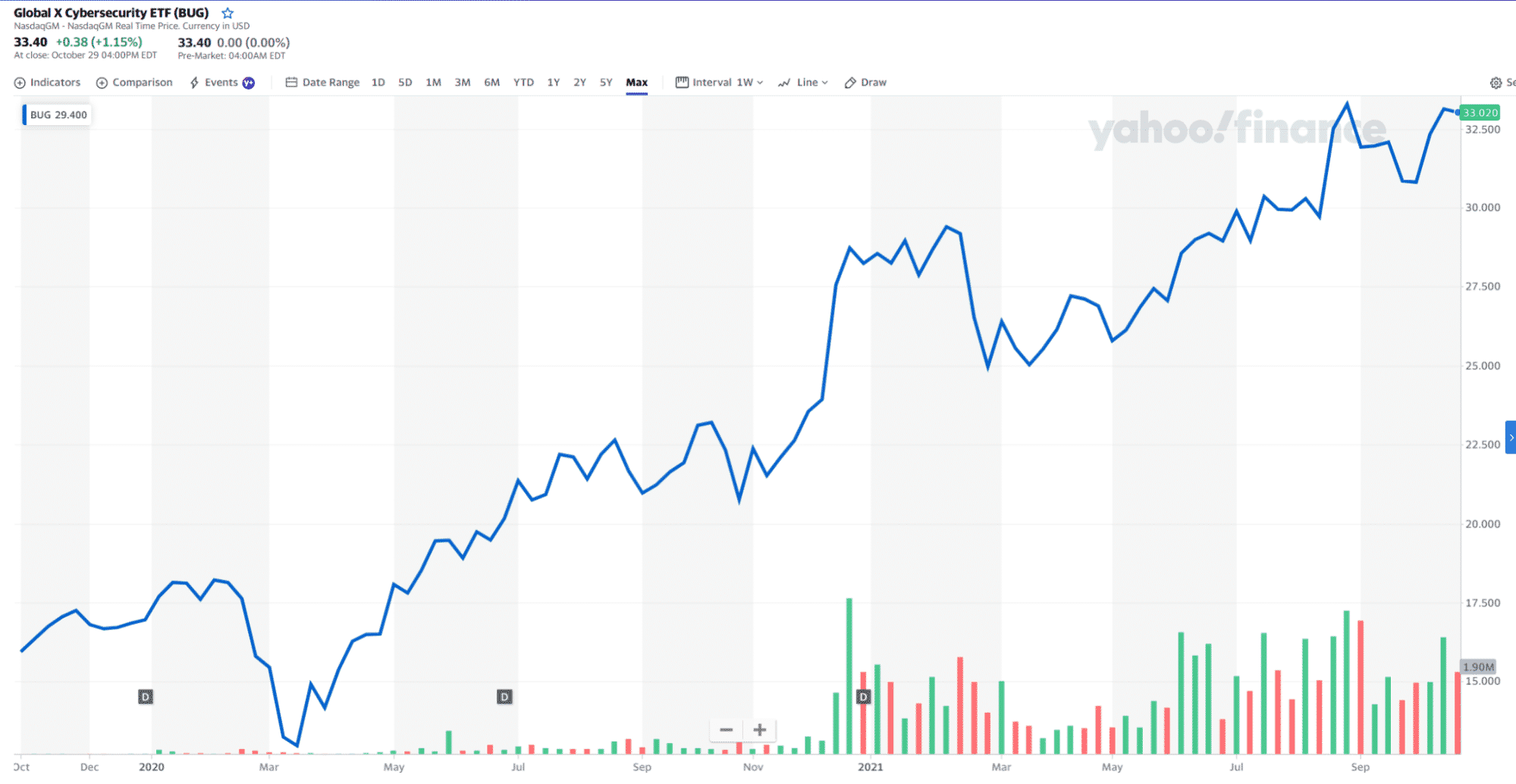

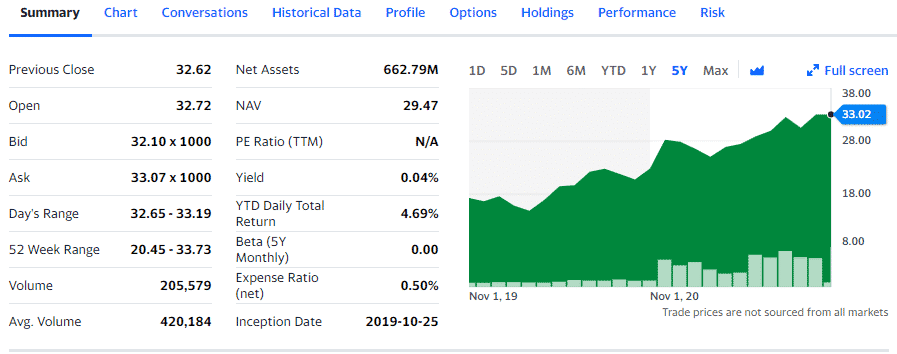

№ 1. Global X Cybersecurity ETF (BUG)

Price: $33.02

Expense ratio: 0.50%

Annual dividend yield: 0.07%

BUG chart

This ETF tracks the performance of the Indxx Cybersecurity Index, investing at least 80% of its total assets in the holdings of its composite index as well as its ADRs and GDRs. This non-diversified fund exposes investors to a universe of companies benefiting from the adoption of cybersecurity technology.

The BUG is ranked № 21 by USNews among its top 96 technology funds. This ranking is no mere fluke given that its top three holdings are;

- Zscaler, Inc. — 9.05%

- Fortinet, Inc. — 7.51%

- CrowdStrike Holdings, Inc. Class A — 7.37%

BUG ETF has $662.79 million in assets under management, with an expense ratio of 0.50%. With an inception date of 25th October 2019, this cybersecurity ETF chartered its course and outperformed the broader market while its peers dropped off during the pandemic, 1-year returns of 47.64%.

In its second year, BUG ETF has so far managed year-to-date returns of 15.51%, which is still above its category average. Focusing on cybersecurity growth stocks across the market-cap spectrum and with global exposure, this ETF has some serious legroom to stretch further as the cybersecurity space expands.

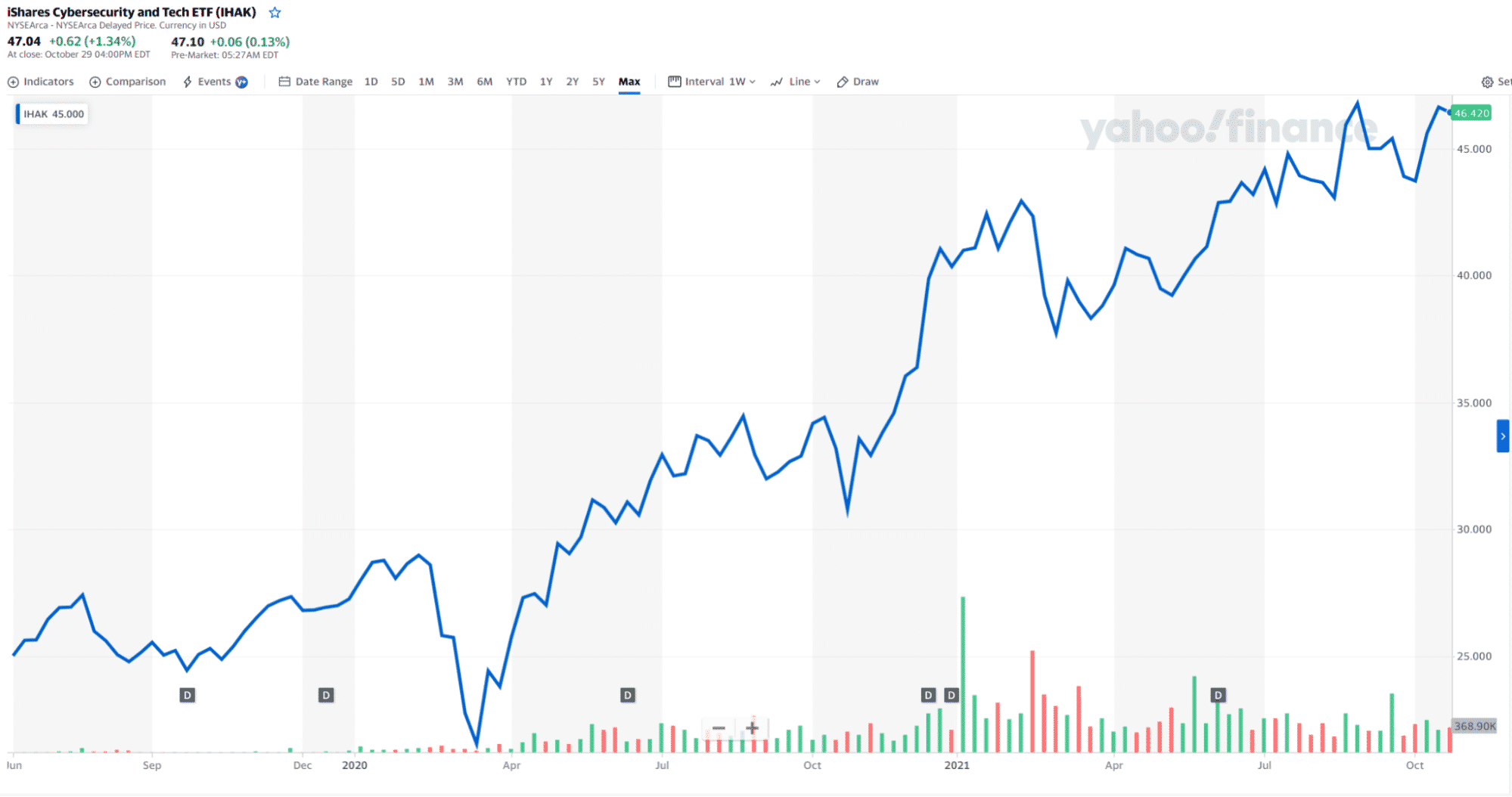

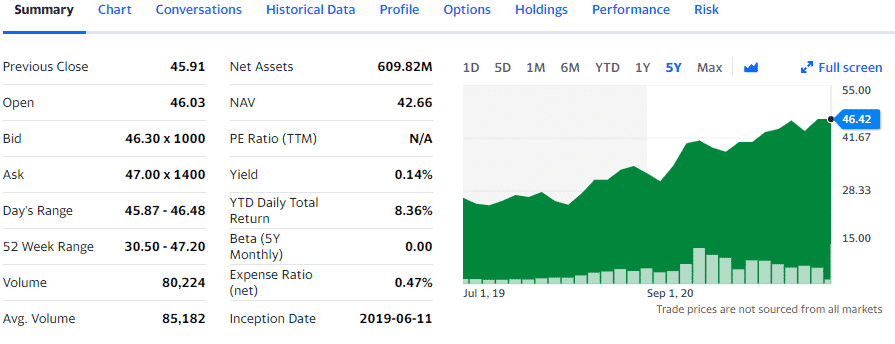

№ 2. iShares Cybersecurity and Tech ETF (IHAK)

Price: $46.42

Expense ratio: 0.47%

Annual dividend yield: 0.13%

IHAK chart

This ETF tracks the performance of the NYSE FactSet Global Cyber Security Index, investing at least 80% of its total assets in the holdings of its composite index and other investment assets of similar economic characteristics. The remaining 20% is invested in cash equivalents, options, futures, and swap contracts.

The IHAK ETF top three holdings are a replica of the BUG’s albeit with different weighting:

- Zscaler, Inc. — 6.34%

- Fortinet, Inc. — 5.44%

- CrowdStrike Holdings, Inc. Class A — 5.38%

IHAK has $609.82 million in assets under management, with an expense ratio of 0.47%. This ETF was also launched in 2019 but managed to shrug off the pandemic woes to close its first year of trading with 40.70% returns. With the average category year-to-date returns of 14.72% against IHAK’s 13.80%, it can be argued that this presents an opportunity for growth hence worth monitoring as a cybersecurity investment option in 2022.

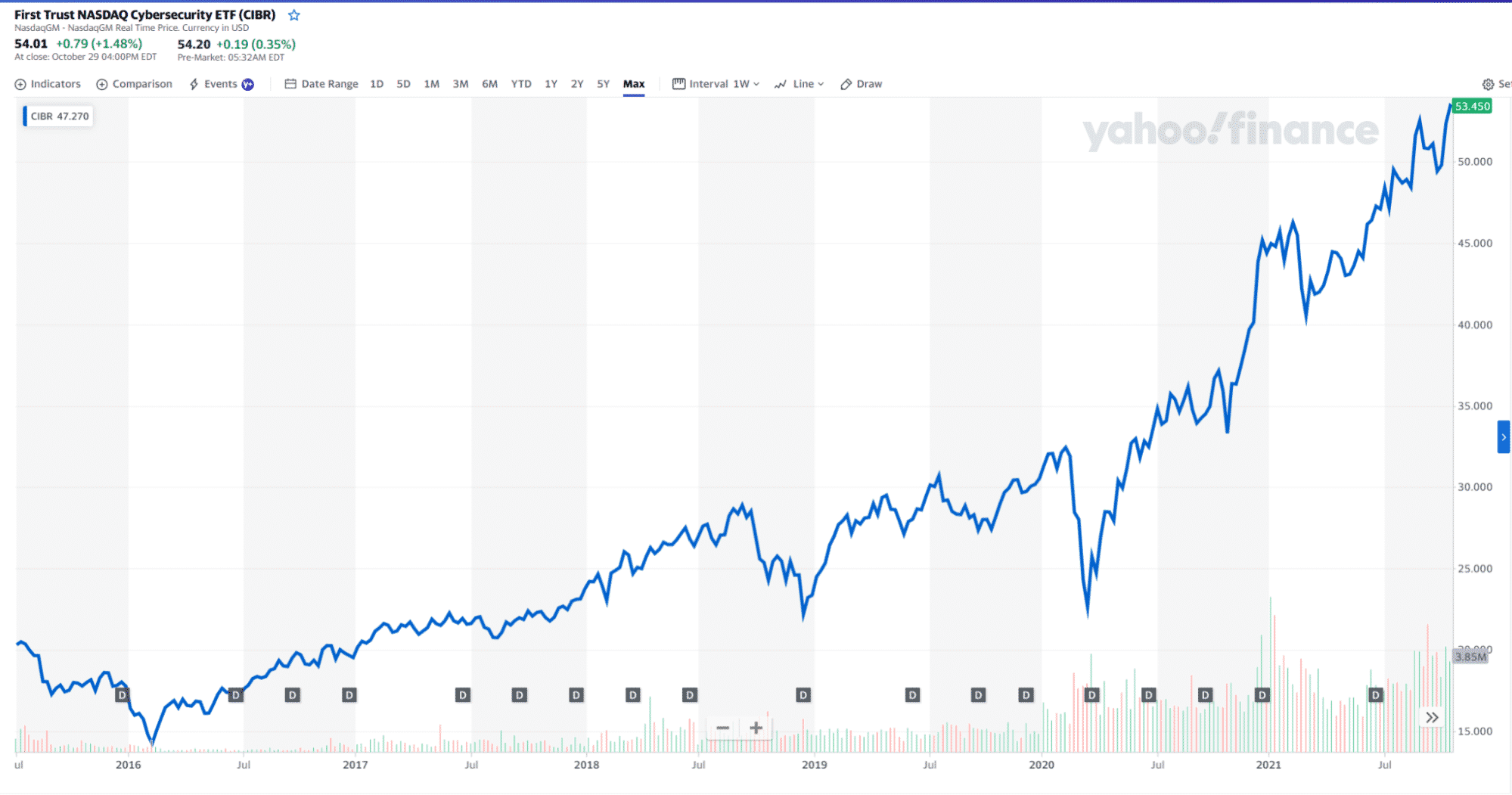

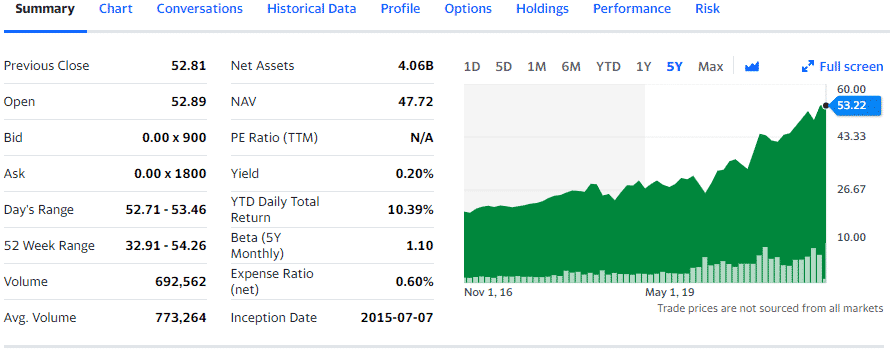

№ 3. First Trust Nasdaq Cybersecurity ETF (CIBR)

Price: $53.45

Expense ratio: 1.01%

Annual dividend yield: 0.11%

CIBR chart

This ETF tracks the performance of the Nasdaq CTA Cybersecurity Index, investing at least 90% of its total assets in the holdings of its composite index and their depository receipts. This non-diversified fund exposes investors to organizations classified by the CTA, Consumer Technology Association, as “Cybersecurity firms,” operating in the technology and industrial sectors.

CIBR is ranked № 25 by USNews among their top 96 technology funds. With such a ranking, what are the top three holdings of this ETF?

- Palo Alto Networks, Inc. — 6.25%

- Accenture Plc Class A — 6.15%

- CrowdStrike Holdings, Inc. Class A — 5.81%

CIBR is one of the largest cybersecurity firms boasting $4.06 billion in assets under management, with an expense ratio of 0.60%. With the advantage of having been in the market longer than the other cybersecurity ETFs on this list, the CIBR has quite the reputation for rewarding its investors; 5-year returns of 181.40%, 3-year returns of 122.55%, and pandemic year returns of 50.13%.

Given that CIBR has the best year-to-date returns currently, 19.07%, and with exposure to multi-cap growth equities, it is worth having on the crosshairs come 2022.

Final thoughts

Nowadays, a scroll down the latest headlines will almost certainly reveal a story about a hacked corporation. As the world moves more and more towards technology dependence, the cybersecurity industry will only grow to safeguard not only information but lives resulting in multitudes of investment opportunities. However, it starts with a post-pandemic economic resurgence, and the funds above are in place to hack portfolio profits in 2022.

Comments