What are AI ETFs?

To define the AI ETFs, we first have to lay down the groundwork and answer artificial intelligence (AI). AI is a branch of technology and science that aims to develop complex algorithms and machines that could simulate human intelligence. It looks to create devices that could think and act just like you or me in simple terms.

How far off the science is from that goal is a topic for another day, but there is an undeniable interest throughout the markets as more and more people look to make money off this promising tech niche.

If you are optimistic regarding the sector’s growth as a whole but feel reluctant to pick and choose specific stocks that are likely to profit and lead the industry, then an AI ETF might be just the thing for you.

What are the benefits of AI ETFs?

There are multiple benefits to buying artificial intelligence exchange-traded funds, splitting them into two categories.

-

Benefits of AI ETFs over AI stocks

Before deciding to invest in a stock, you should know its intrinsic value. In other words to be familiar with the inner workings and how the shares could perform in the future. That way, you can get to know the actual value of a stock and not just its price. Doing so will enable you to obtain a more substantial profit in the future.

With AI shares, the value and price might be difficult to discern, as the technology around it can be overwhelming for investors. With AI being one of the most complicated and advanced branches of technology, letting others, like fund managers, determine what companies stand to win in the future could be the best option for you.

-

Benefits of AI ETFs over other ETFs

We are not saying that AI is the only way to go when it comes to AI versus other ETFs. You should only invest in AI funds if you are confident this niche will further develop and grow, and not if you’ve only heard that it is the golden goose of the future.

In simple terms, AI outperformed the general market in the past year, and the niche’s future seems prosperous.

How to be part of the AI ETF market?

With the AI ETFs, the steps to become a part of the market are the same as any other sector. It includes finding a brokerage that offers such funds, deciding and analyzing the funds to assess whether the fund is a decent fit for your goals and portfolio, and lastly, the purchase.

All that said, let’s see what are some of your options for AI ETFs?

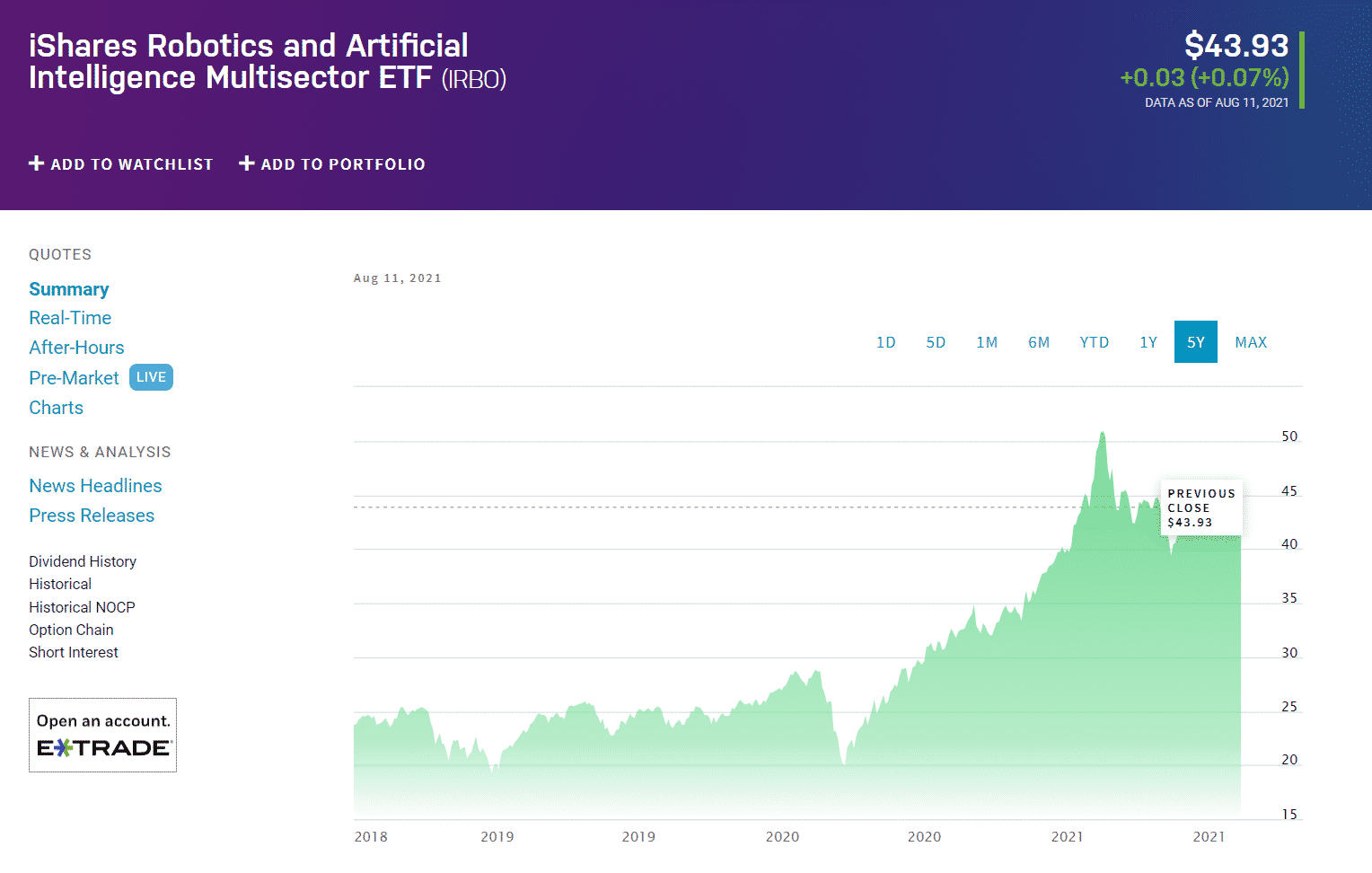

№ 1. iShares Robotics and Artificial Intelligence Multisector ETF IRBO

iShares Robotics and Artificial Intelligence Multisector ETF IRBO chart

The IRBO ETF tracks an index that offers exposure to companies looking to profit from developments in AI. To allow inclusion in the benchmark, they need to obtain 50% of their revenue from one of the 22 sub-industries exposed to robotics. To be eligible, a company can also have a 20% market share in the field or reap $1 billion in annual revenue from one sub-sector.

More than half of the fund’s holdings are US-based, with Japan, China, and Hong Kong following closely. It boasts a BBB MSCI rating of 5.63/10. Its annual return came in at 35.78%, at an expense ratio of 0.47%.

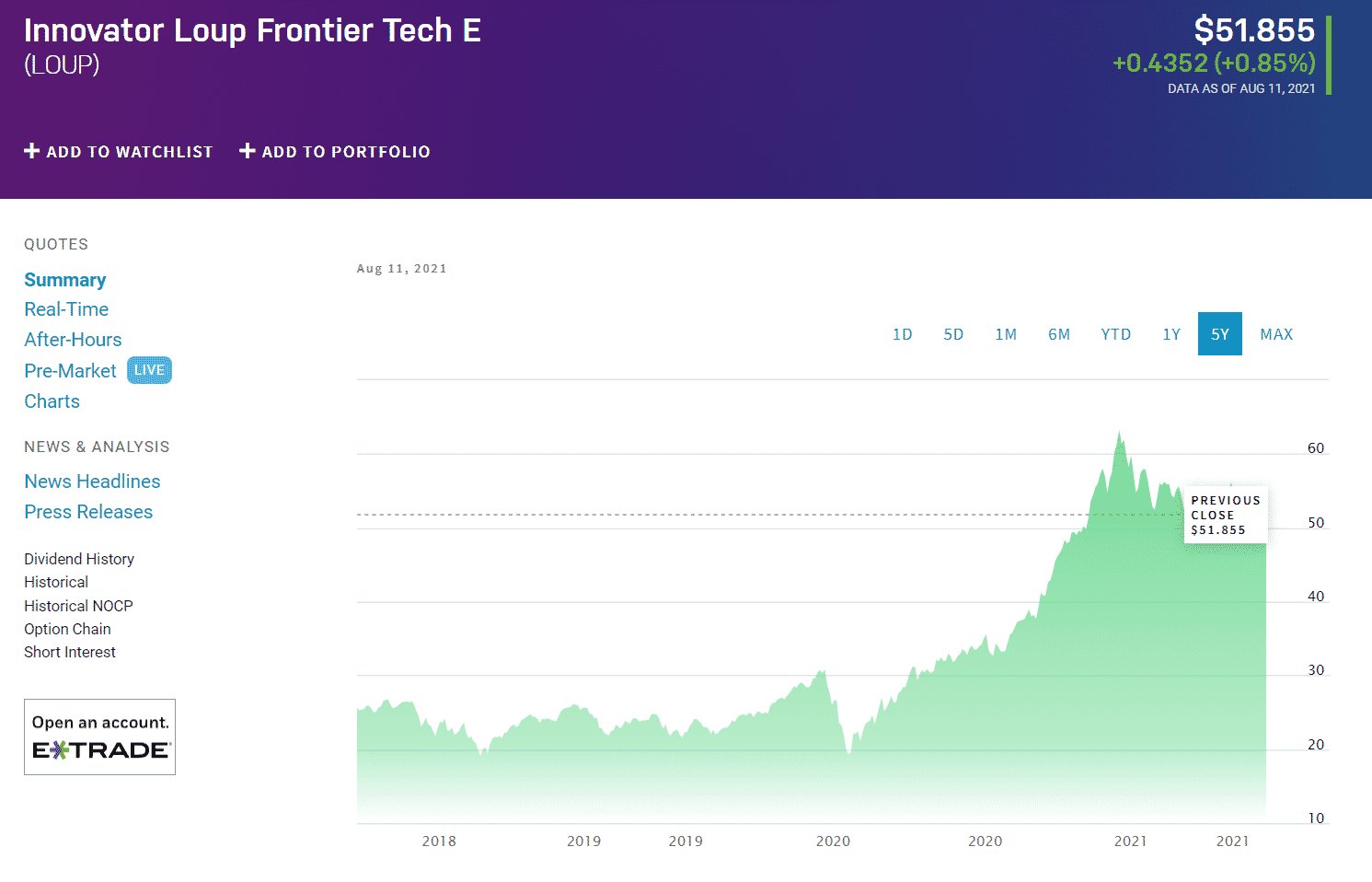

№ 2. Innovator Loup Frontier Tech ETF LOUP

Innovator Loup Frontier Tech ETF LOUP chart

The LOUP ETF is on the pricier side, with its expense ratio at 0.7%, but it can be worth it if it falls in line with your goals and the rest of your portfolio. The fund lists companies in AI and robotics, autonomous vehicles, virtual and augmented reality, and consumer perception.

To enable inclusion in the underlying benchmark, the firms rely on said industries for at least half of their yearly revenue. Interestingly enough, the ETF excludes the mammoths of the industry to avoid a prevalence of a single stock. So the companies with a market cap of over $250 billion cannot make their way to this list.

The LOUP ETF has a BB 4.14/10 MSCI ESG rating, while its annualized return amounted to 56.41%. It lists 32 holdings, 64% of which have headquarters in the United States.

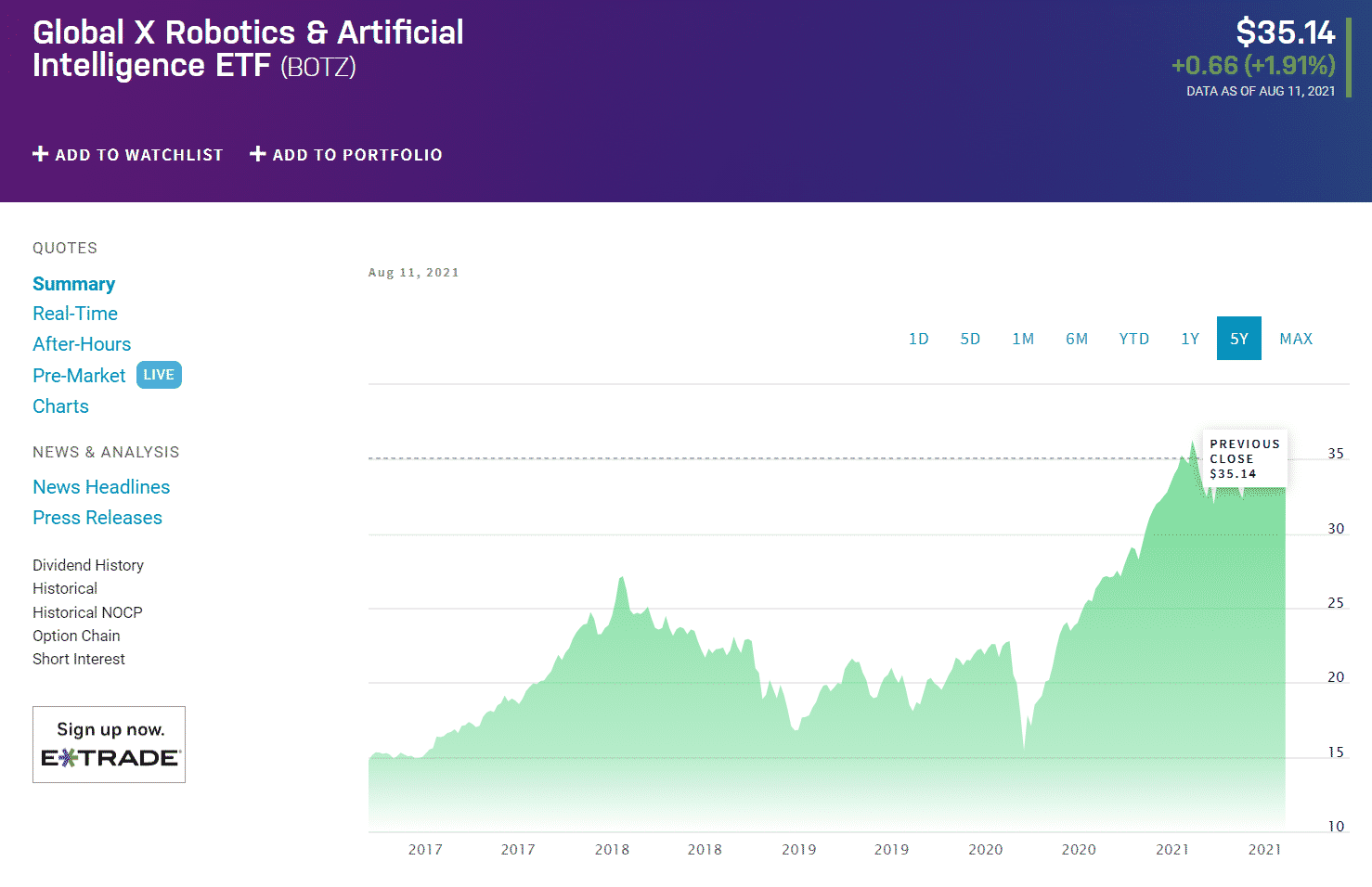

№ 3. Global X Robotics & Artificial Intelligence ETF BOTZ

Global X Robotics & Artificial Intelligence ETF BOTZ chart

Now with the BOTZ ETF, it is all about the bots. The main criterion for the inclusion in the fund itself is the revenue share that the company gets from one of the two fields: robotics and artificial intelligence.

The BOTZ ETF is a technology and industry fund, and it boasts 37 holdings. Fund reconstitutions and rebalances come about once a year. Its annual return amounted to 32.4%, while its expense ratio stood at 0.68%. Out of the three funds we mentioned here today, and there are six in the United States, excluding those with a market capitalization of under $50 million, the BOTZ ETF has the highest MSCI ESG rating. Its grade settled at double-A 7.3/10.

How to profit from AI ETFs?

AI has been a significant driver of both innovation and profit in the past couple of years, and the expectation is that it will grow in the future. Before deciding to jump into the field and start buying all the AI stocks and funds, you can get your hands on them. Be sure to examine the main features of each investment.

It comes with no remarkable difference from other investments you have made in the past. Be sure to analyze the funds’ pros and cons. Some funds have higher expense ratios; some rely on smaller-cap firms. Some of them invest in different industries, not really that closely related to the AI niche itself. Even though this is AI and robotics, try not to make any automated decisions. Puns aside, as always, do your research, be sure to start small, and pick one fund of your liking.

Comments