In the near term, there is no technology sector with the potential for growth and money-making like the 5G tech. To enjoy the best telecommunications services currently, you have to be using a 5G connection.

For this reason, analysts expect this market to grow at the compounded annual growth rate, CAGR, of 29.4%, from now to 2026. The expectation is for every corner of the globe to be connected by the internet, and 5G technology is laying the groundwork to make the world an actual global village.

With the global appetite for latent-free internet almost becoming a basic need, this technology is expected to grow upwards of four times compared to previous connectivity transformations. The good news is, you don’t have to scour out a plethora of screening sites trying to identify either telecommunications or industrial equities in the 5G ecosystem with the potential to grow.

5G ETFs: how do they work?

An exchange-traded fund is a pool of tradable securities with similar economic characteristics. As such, 5G ETFs comprise organizations in the telecommunication industry providing 5G connectivity, those in the industrial sector providing 5G-related equipment, and all firms providing ancillary services to this sector. The ETF tracks an index made up of organizations in the sector with a view of replicating its performance, ideally with minimal deviation.

What to consider before buying 5G ETFs?

ETF investing is one of the low-risk investing strategies to adopt, but if done with the blinds on can also result in losses. Before investing in 5G ETFs, the considerations below are key.

- Liquidity

It is a gauge of how much an ETF is exchanged daily, facilitating easy and fast liquidation on a need basis.

- Diversification

All sectors experience volatility, more so the technology sector. Ensuring a diversified holding base for an ETR ensures relatively low volatility.

5G ETF to buy for reduced portfolio volatility

The most inexpensive and hassle-free approach to investing in this technology niche and diversifying your portfolio for reduced volatility is through 5G ETFs rather than individual stocks. With Bank of America estimating that the 5G ecosystem is in its third year, and the average investment cycle for the wireless network is ten years, the three ETFs below are in pole position to provide portfolio balance.

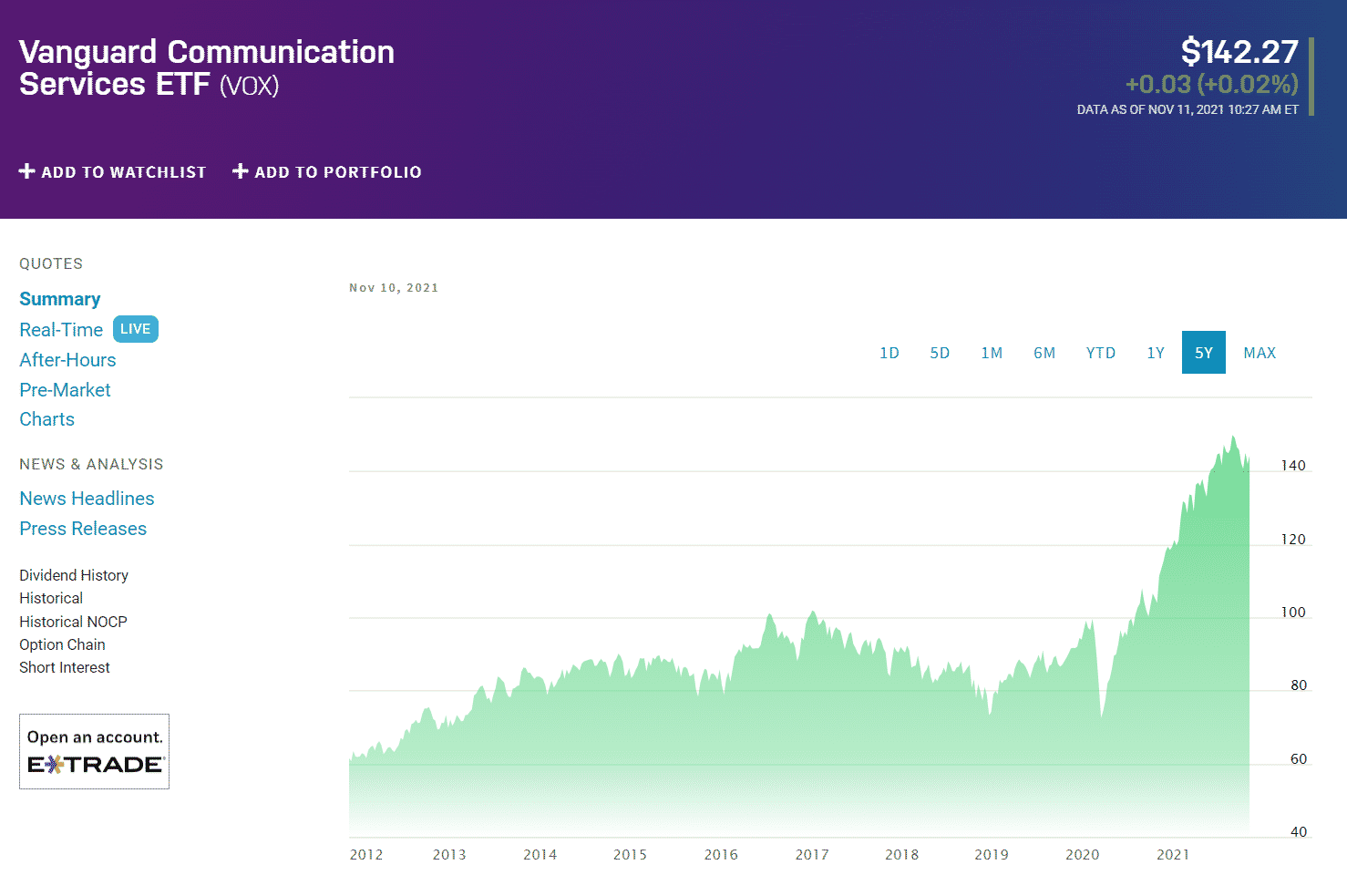

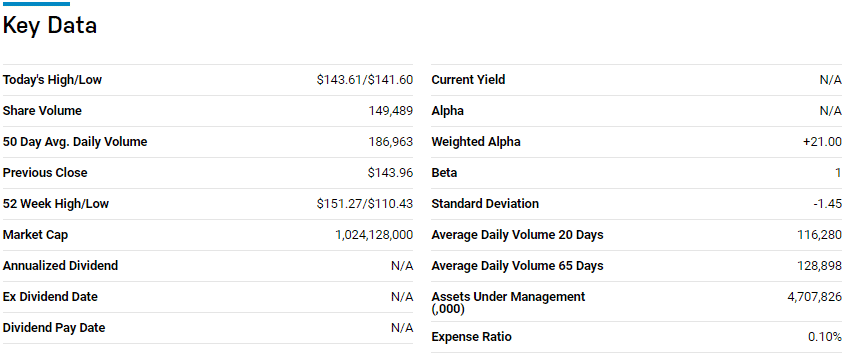

№ 1. Vanguard Communication Services ETF (VOX)

Price: $142.27

Expense ratio: 0.10%

Dividend yield: 0.71%

VOX chart

The Vanguard Communication Services ETF tracks the performance of the MSCI US Investable Market Index (IMI)/Communication Services 25/50, investing all of its assets in the underlying holdings of the composite index.

The underlying holdings have to be classified as communication services equities by the GICS. Through VOX, investors get to play the 5G sector in the most liquid and hassle-free way by gaining exposure to the best 5G equities, a combination of mid, large, and small-cap firms.

The top three holdings of this non-diversified ETF are:

- Meta Platforms. Class A — 17.12%

- Alphabet Inc. Class A — 11.49%

- Alphabet Inc. Class C — 161.05%

VOX has $4.71 billion in assets under management, with an expense ratio of 0.10%. VOX’s historical returns show that its mix of equities reflects the overall 5G market sentiment since they are very close to the category average; 5-year returns of 70.81%, 3- year returns of 80.77%, and pandemic year returns of 29.79%.

The equity mix in this ETF ensures exposure to the entire 5G value chain, ensuring the potential for returns and portfolio volatility reduction.

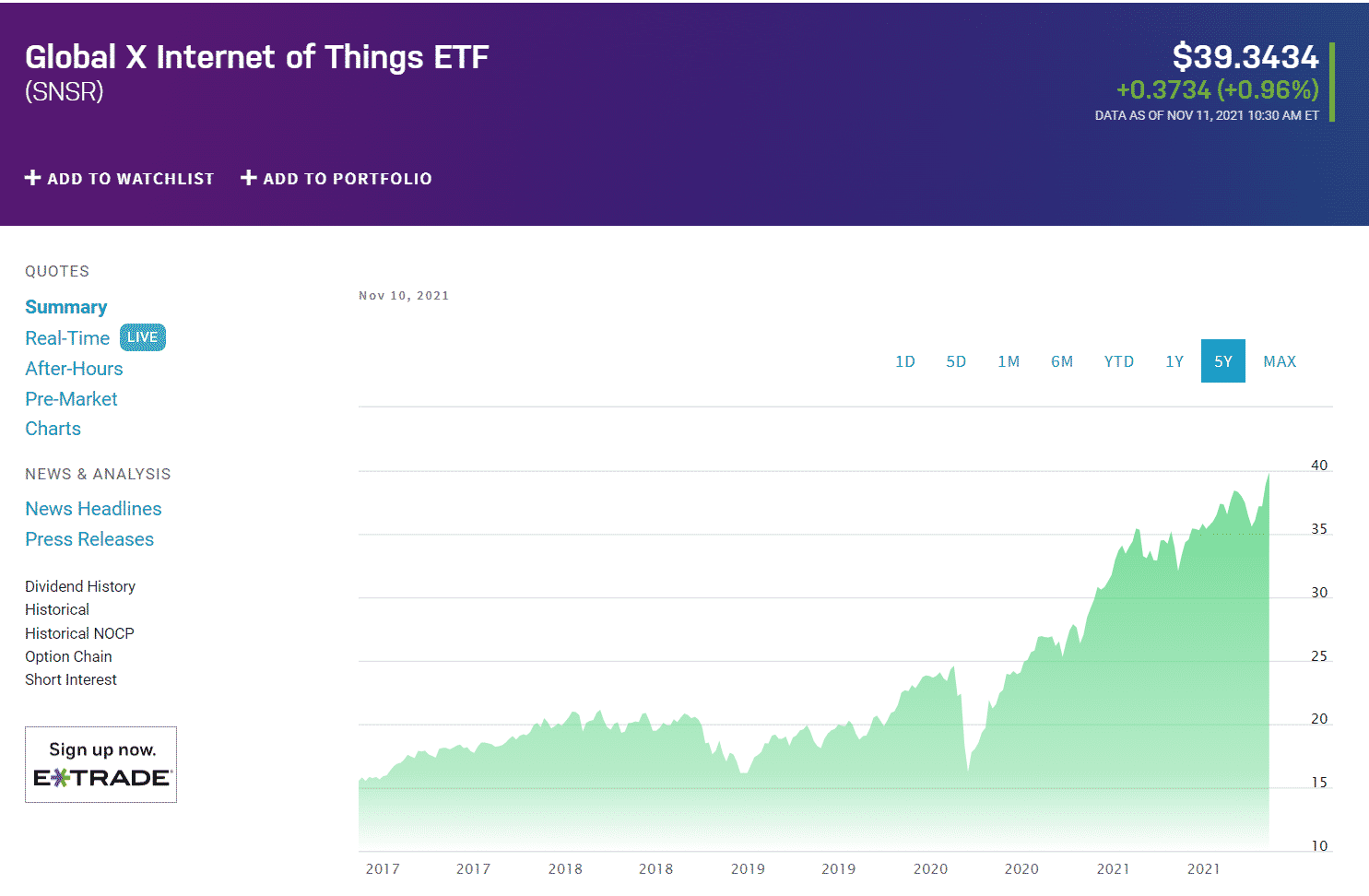

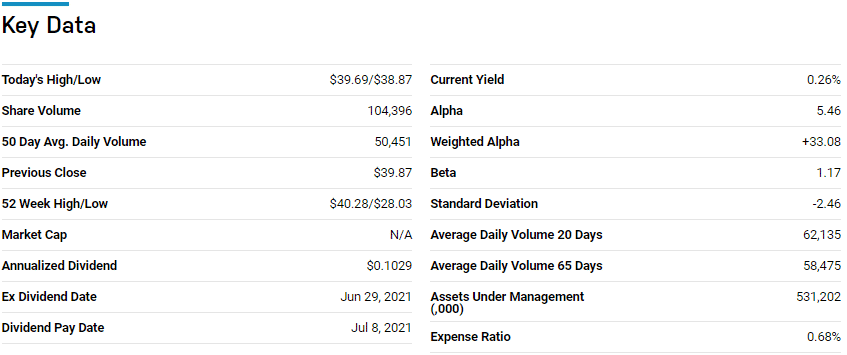

№ 2. Global X Internet of Things ETF (SNSR)

Price: $39.34

Expense ratio: 0.68%

Dividend yield: 0.29%

SNSR chart

This fund tracks the performance of the Indxx Global Internet of Things Thematic Index, investing at least 80% of its total assets in the securities of the tracked index. Investors gain exposure to organizations in the developed economies dabbling in the internet of things and associated services; wearable technology, smart metering, home automation, autonomous technology, networking infrastructure and software, sensors, and energy control devices.

The top three holdings of this ETF are:

- DexCom, Inc. — 7.90%

- STMicroelectronics NV — 7.56%

- Garmin Ltd. — 5.45%

SNSR has $531.20 million in assets under management, with investors parting with $68 annually for every $10000 invested. Focused on holdings in all the developed economies as long as you are utilizing the internet of things, this ETF performance shows how the internet continues to be the next frontier; 5-year returns of 167.83%, 3- year returns of 119.22%, and pandemic year returns of 38.36%.

Always ahead of the category average in earnings, this ETF is worth looking into for both returns and reduced portfolio volatility.

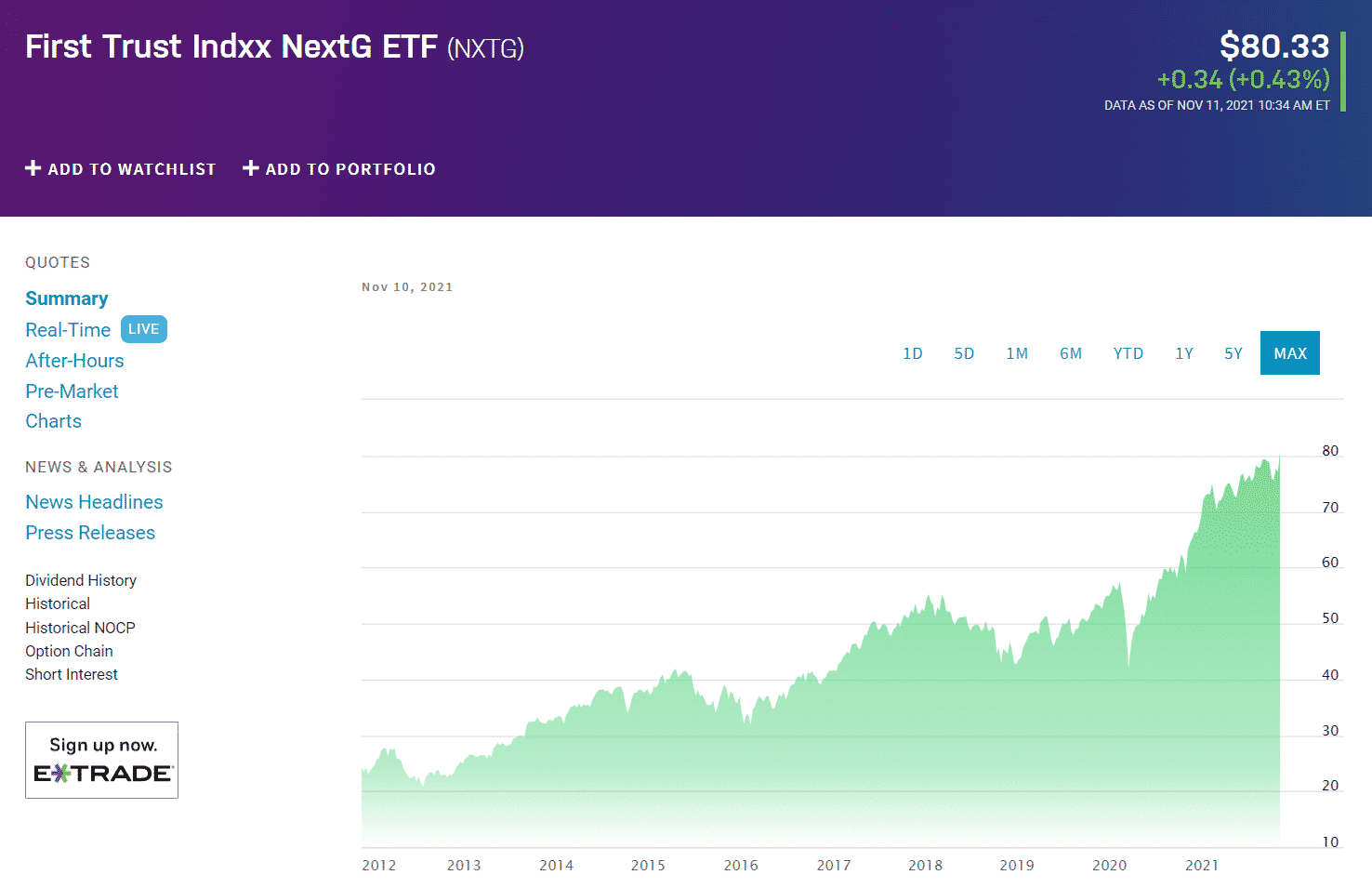

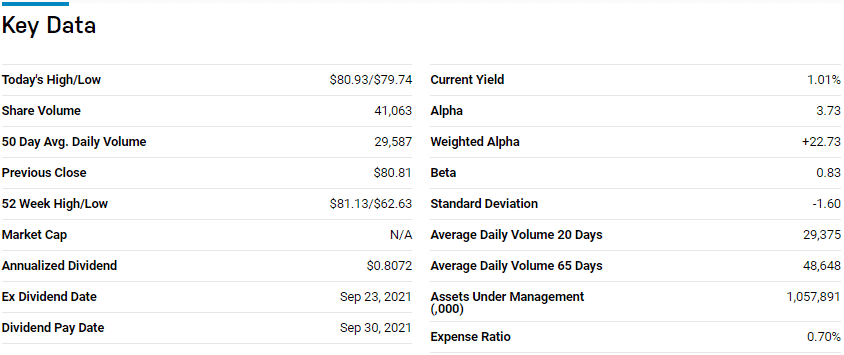

№ 3. First Trust Indxx NextG ETF (NXTG)

Price: $80.33

Expense ratio: 0.70%

Dividend yield: 0.82%

NXTG chart

First Trust Indxx NextG ETF tracks the performance of the Indxx 5G & NextG Thematic Index, investing at least 90% of its net assets in the assets and depository receipts of its composite index holdings. Investors get exposure to companies devoted to the research, development, and application of 5G technology and other emerging digital cellular technologies.

The top three holdings of this ETF are:

- Advanced Micro Devices, Inc. — 2%

- NVIDIA Corporation — 1.93%

- Xilinx, Inc. — 1.75%

NXTG has $1.06 billion in assets under management, with investors parting with $70 annually for every $10000 invested. Focused on the next generation digital technology, this ETF’s returns are always way above the category average; 5-year returns of 111.74%, 3-year returns of 77.83%, and pandemic year returns of 29.48%.

NXTG provides portfolio stability by indirectly playing the 5G segment through firms involved in hardware manufacturers for Big Telecom stocks upgrading their networks and devices for consumers to stay connected.

Final thoughts

The 5th generation mobile network is currently the most advanced global wireless, offering uniformity in user experience, higher-quality data speeds, enhanced reliability, broader network capacity, ultra-low latency, and increased availability.

It can connect devices, equipment, and objects under one wireless network without compromising performance or efficiency, and the ETFs above are in pole position for returns.

Comments