Wall Street might have popularized exchange-traded funds creating biases towards US-domiciled ETFs. Still, with the global market hitting upwards of $19 trillion in assets under management, maybe it’s time to look abroad.

Investing in international ETFs provides geographical diversification and portfolio growth potential through exposure to emerging markets and economies.

What is the composition of an international ETF?

These funds are passively invested in an underlying benchmark index beyond the US borders. They can use either track indexes in developed economies or those in emerging economies. The result is either an ETF with cross-border exposure or one that is country-specific. It is always better to go for an international ETF with cross-border exposure to mitigate against country-specific political and economic risks.

It is worth noting that US-domiciled ETFs with more than 40% of their holdings across the US borders fall under the international ETFs’ umbrella.

The 7 best international ETFs

Historically, international ETFs have underperformed the broader US economy. However, as the world recovers from the clutches of the coronavirus and interest rates remain low to spur resurgence, these seven international ETFs have the diversification to mint a tidy profit and provide income through higher dividend yields.

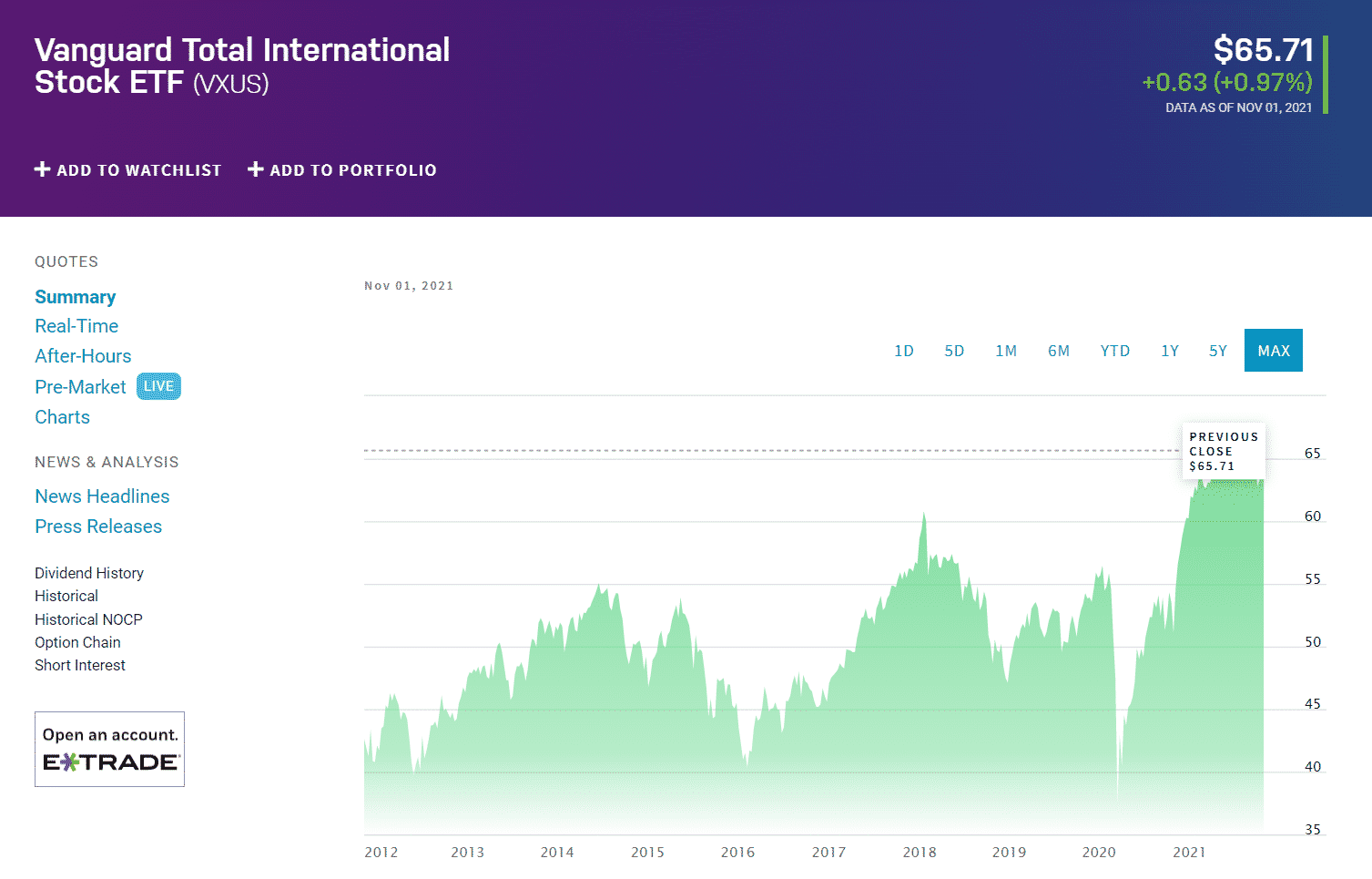

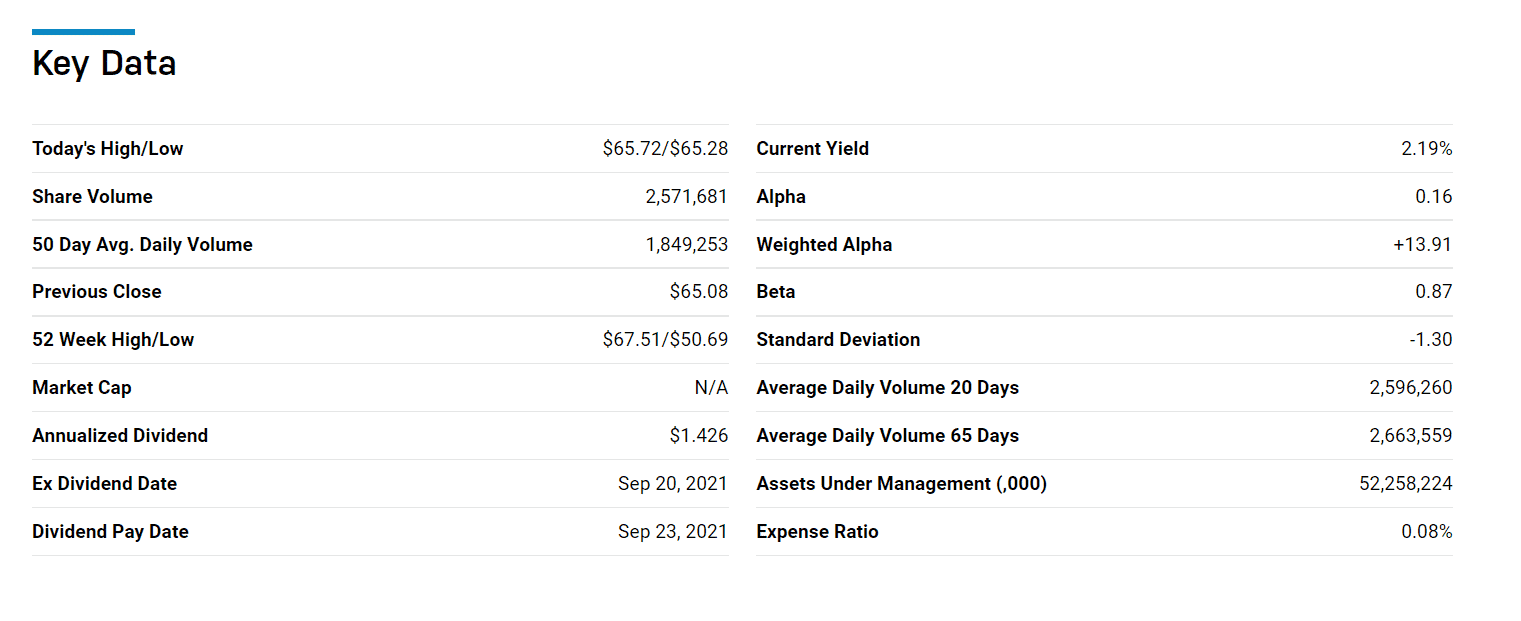

Vanguard Total International Stock ETF (VXUS)

Price: $65.71

Expense ratio: 0.08%

Annual dividend yield: 2.44%

VXUS chart

The Vanguard Total International Stock Fund tracks the FTSE Global All Cap ex US Index, float-adjusted market-weighted indexing giving exposure to companies in developed and emerging economies beyond the US borders. It invests all of its assets in the underlying holdings of its composite index.

VXUS ETF is ranked № 25 by US News analysts among seventy-nine of the best foreign large blend ETFs for long-term investing. With such a ranking, it comes as no surprise that its top three holdings are global household names:

- Alibaba Group Holding Ltd. — 2.01%

- Tencent Holdings Ltd — 1.50%

- Taiwan Semiconductor Manufacturing Co Ltd — 1.44%

VXUS ETF has $404.73 billion in assets under management, with a relatively low expense ratio of 0.08%. This ETF has outperformed its category and segment averages; 5-year returns of 62.68%, 3-year returns of 46.42%, and pandemic year returns of 31.82%.

With over 6000 holdings in its portfolio and a dividend yield of 2.44%, this ETF not only provides diversification but a chance for income investing in a post-pandemic world while avoiding US equities.

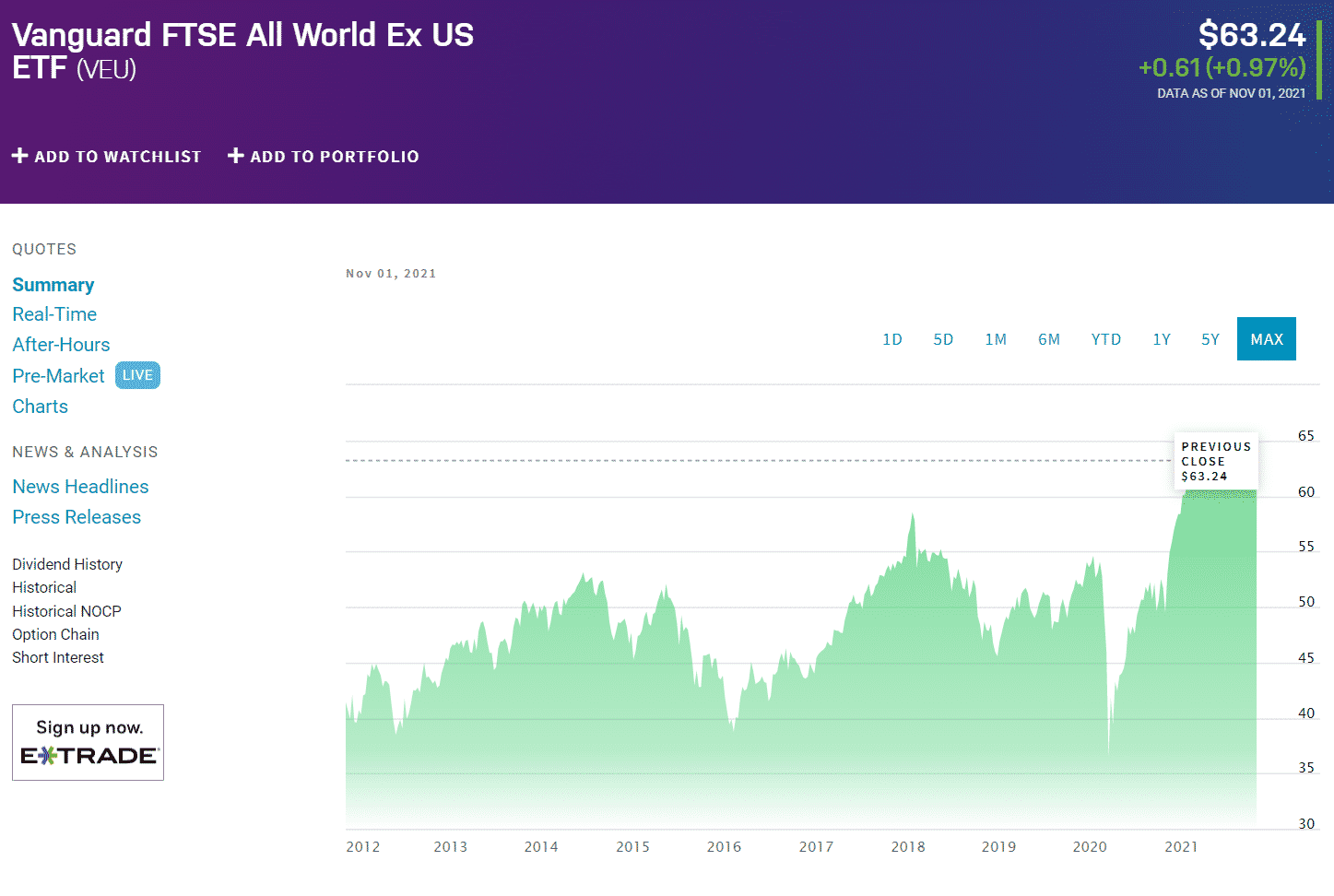

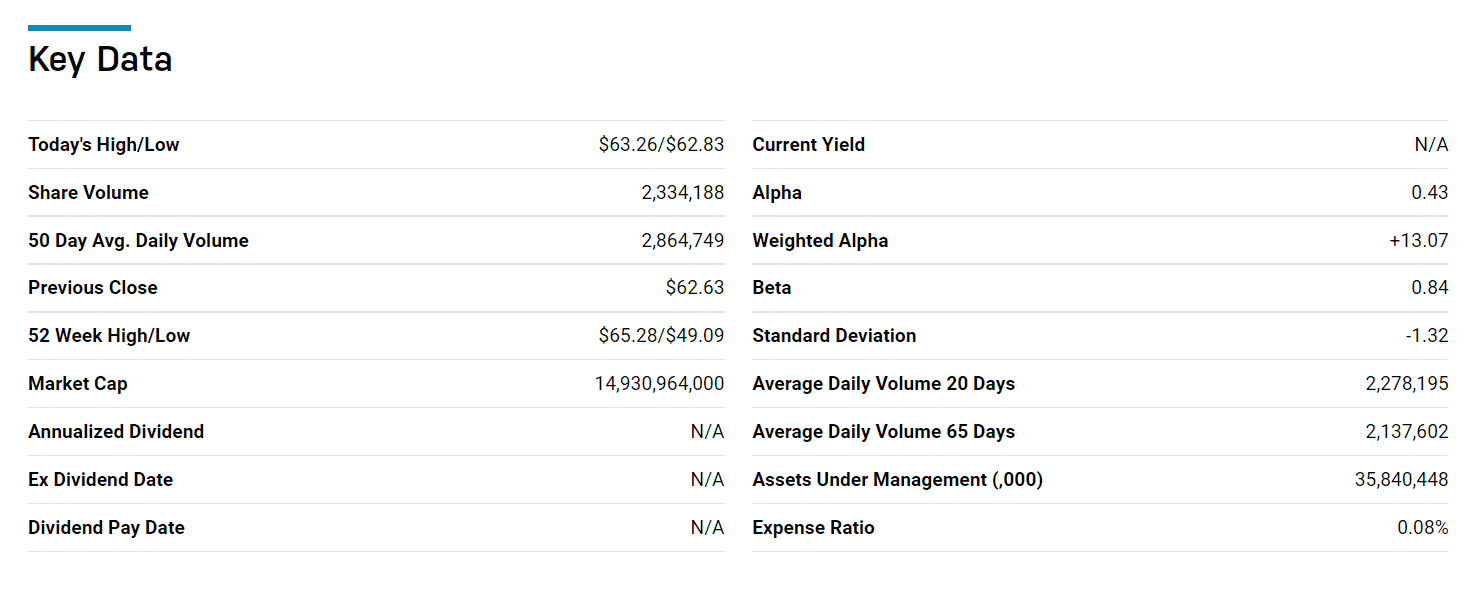

Vanguard FTSE All-World ex-US ETF (VEU)

Price: $63.24

Expense ratio: 0.08%

Annual dividend yield: 2.31%

VEU chart

The Vanguard FTSE All-World ex-US Index Fund tracks the FTSE All-World ex-US Index, investing all of its assets in the holdings of the composite index. It exposes its investors to the global developed and emerging economies outside the US borders.

VEU ETF is ranked № 23 by US News analysts among seventy-nine of the best foreign large blend ETFs for long-term investing. With such a ranking, it comes as no surprise that its top three holdings are global household names;

- Alibaba Group Holding Ltd. — 2.19%

- Tencent Holdings Ltd — 1.68%

- Nestle SA — 1.45%

VEU ETF has $53.64 billion in assets under management, with an expense ratio of 0.08%. This ETF has outperformed its category and segment averages; 5-year returns of 62.42%, 3-year returns of 45.91%, and pandemic year returns of 30.88%.

With over 3500 equities as part of its holding base spanning large-cap and mid-cap organizations in developed and emerging markets, VEU has legroom for growth in the post-pandemic world while its diversity mitigates against volatility.

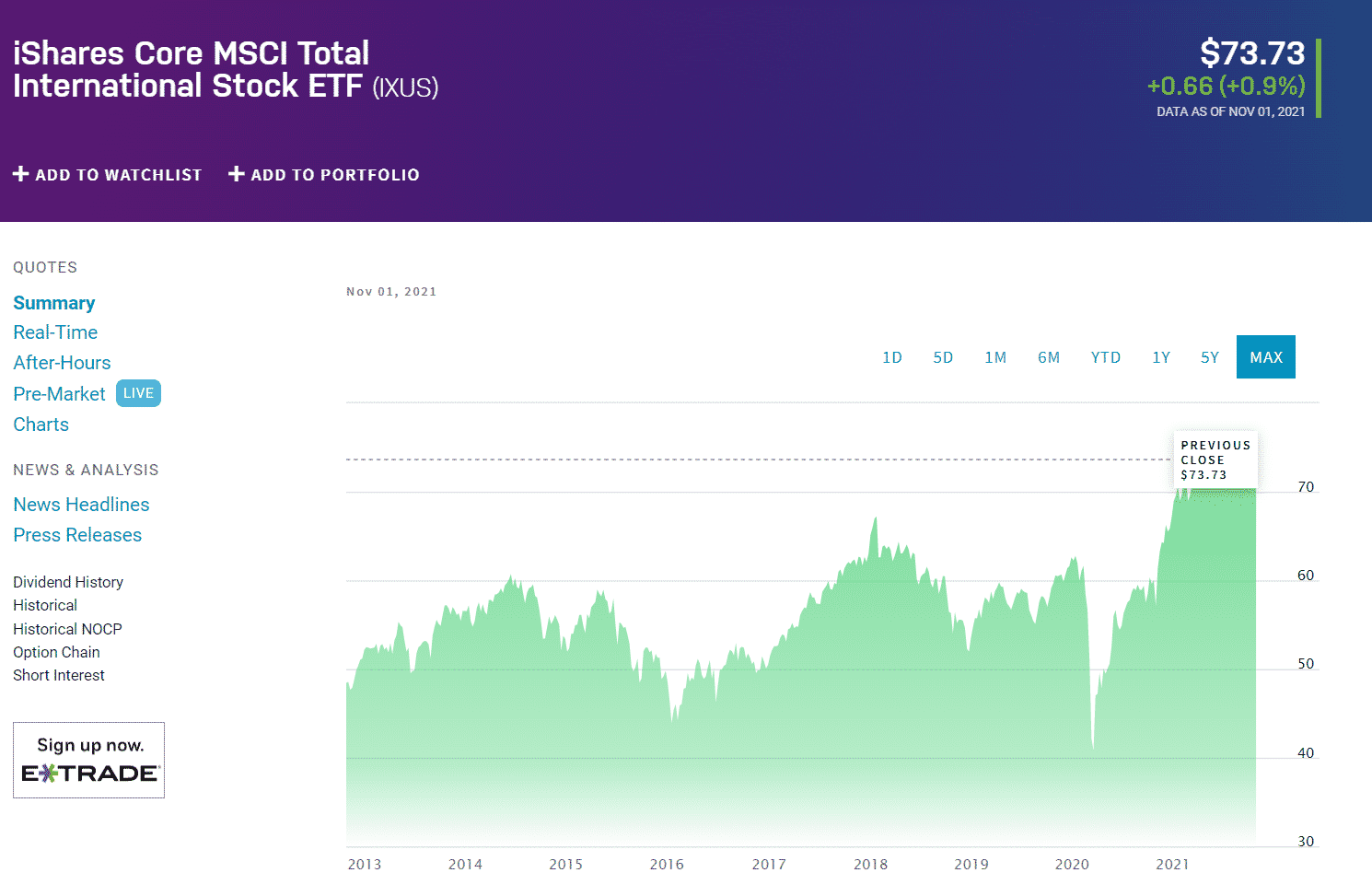

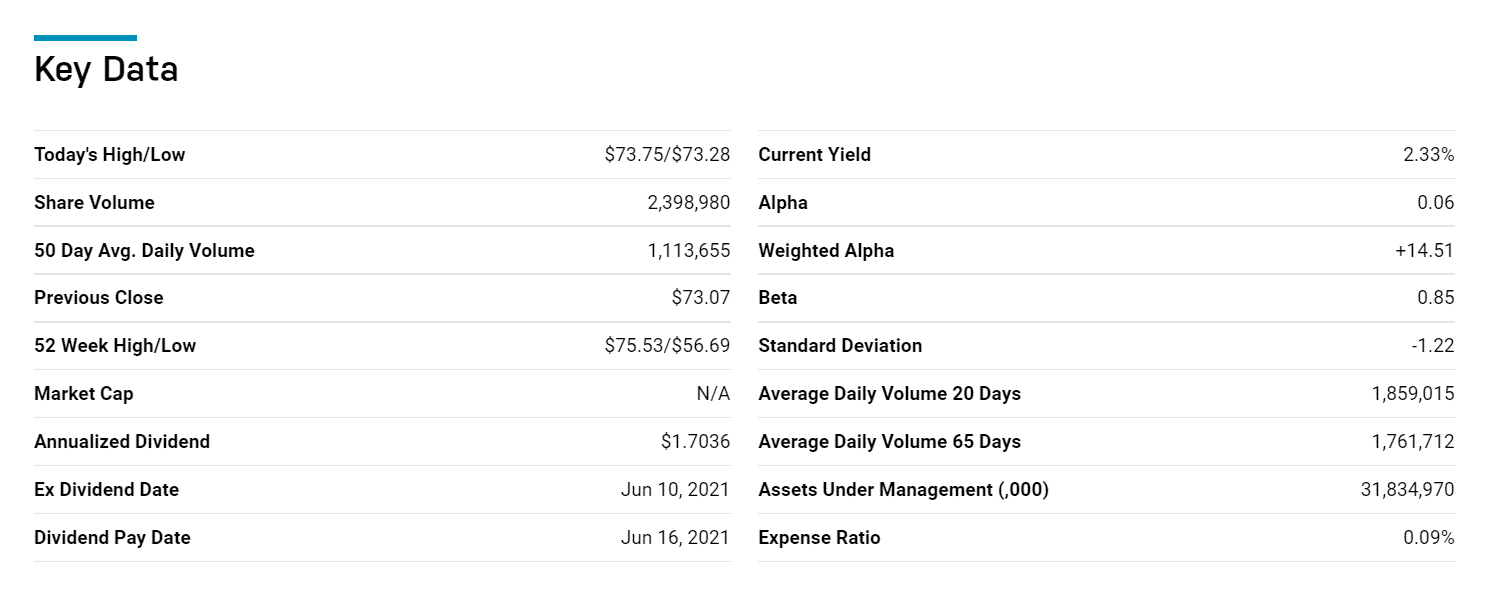

iShares Core MSCI Total International Stock Fund (IXUS)

Price: $73.73

Expense ratio:0.09%

Annual dividend yield: 2.13%

The iShares Core MSCI Total International Stock Fund seeks to replicate the performance of MSCI ACWI ex USA IMI Index, net of expenses and fees. Investors in the IXUS get exposure to developed and emerging economies through the fund invests at least 80% of its assets in the underlying holdings of the composite index, which is free-float market capitalization adjusted.

An evaluation of 77 foreign large blend exchange-traded funds by USNews has the IXUS at rank № 28. A look at the top three holdings reveals why this ETF is among the best international ETFs:

- Taiwan Semiconductor Manufacturing Co., Ltd. — 1.64%

- Nestle SA — 1.14%

- Tencent Holdings Ltd — 1.15%

IXUS ETF has $29.54 billion in assets under management, with an expense ratio of 0.09%. This ETF has outperformed its category and segment averages; 5-year returns of 63.40%, 3-year returns of 46.71%, and pandemic year returns of 31.80%.

Historical returns are not a guarantee of future returns, but with such consistency and a yield of 2.13%, this international ETF is worth having in the crosshairs come 2022.

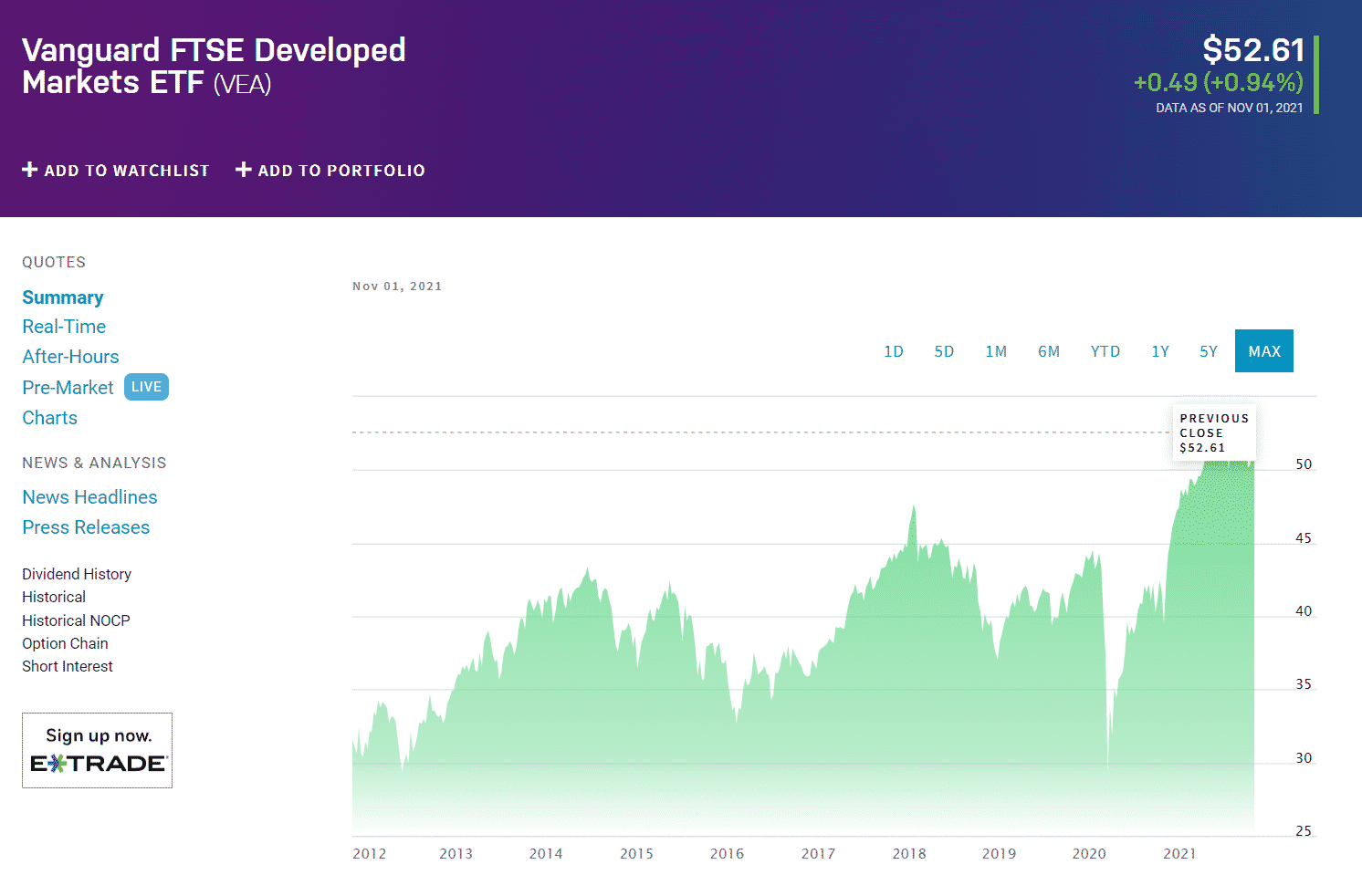

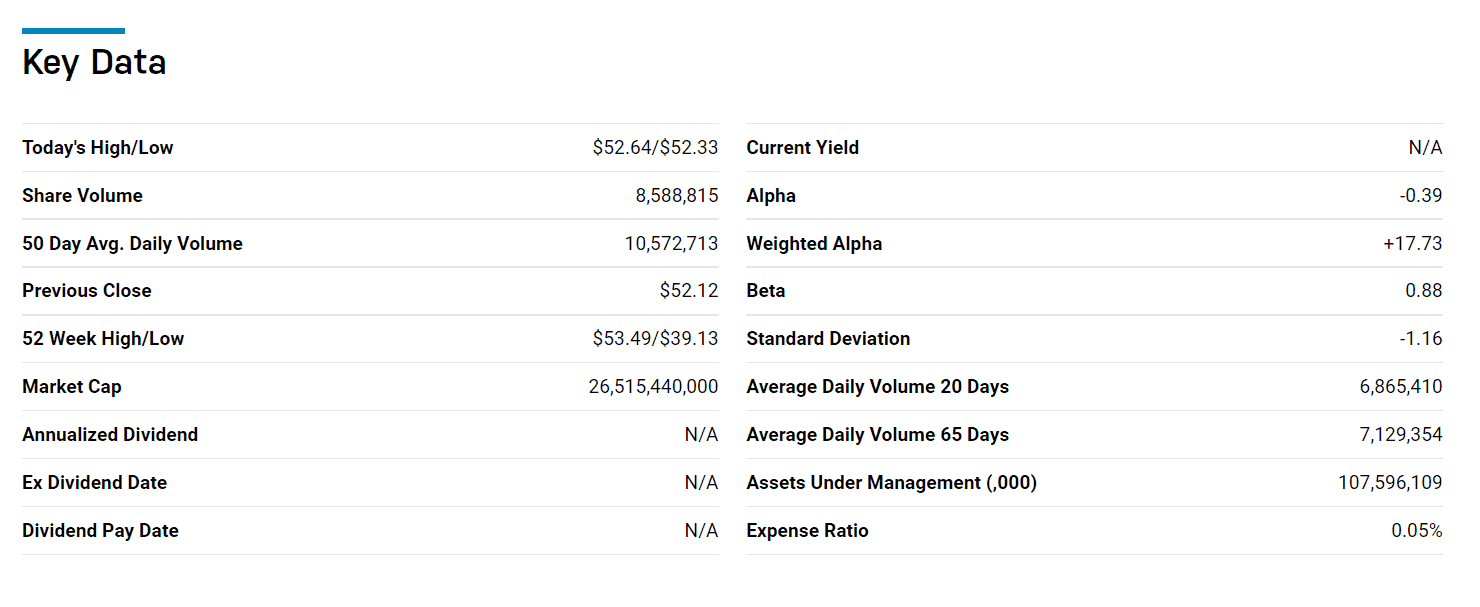

Vanguard FTSE Developed Markets ETF (VEA)

Price: $52.61

Expense ratio:0.05%

Annual dividend yield: 2.49%

VEA chart

The Vanguard FTSE All-World ex-US Index Fund tracks the FTSE All-World ex-US Index, investing all of its assets in the holdings of the composite index. It exposes its investors to the global developed and emerging economies outside the US borders.

VEU ETF is ranked № 23 by US News analysts among seventy-nine of the best foreign large blend ETFs for long-term investing. With such a ranking, it comes as no surprise that its top three holdings are global household names:

- Alibaba Group Holding Ltd. — 2.19%

- Tencent Holdings Ltd — 1.68%

- Nestle SA — 1.45%

VEA ETF has $157.48 billion in assets under management, with an expense ratio of 0.05%. This ETF has outperformed its category and segment averages; 5-year returns of 65.21%, 3-year returns of 46.58%, and pandemic year returns of 36.48%.

In addition to phenomenal returns, VEA investors also enjoy dividend yields of 2.49% annually.

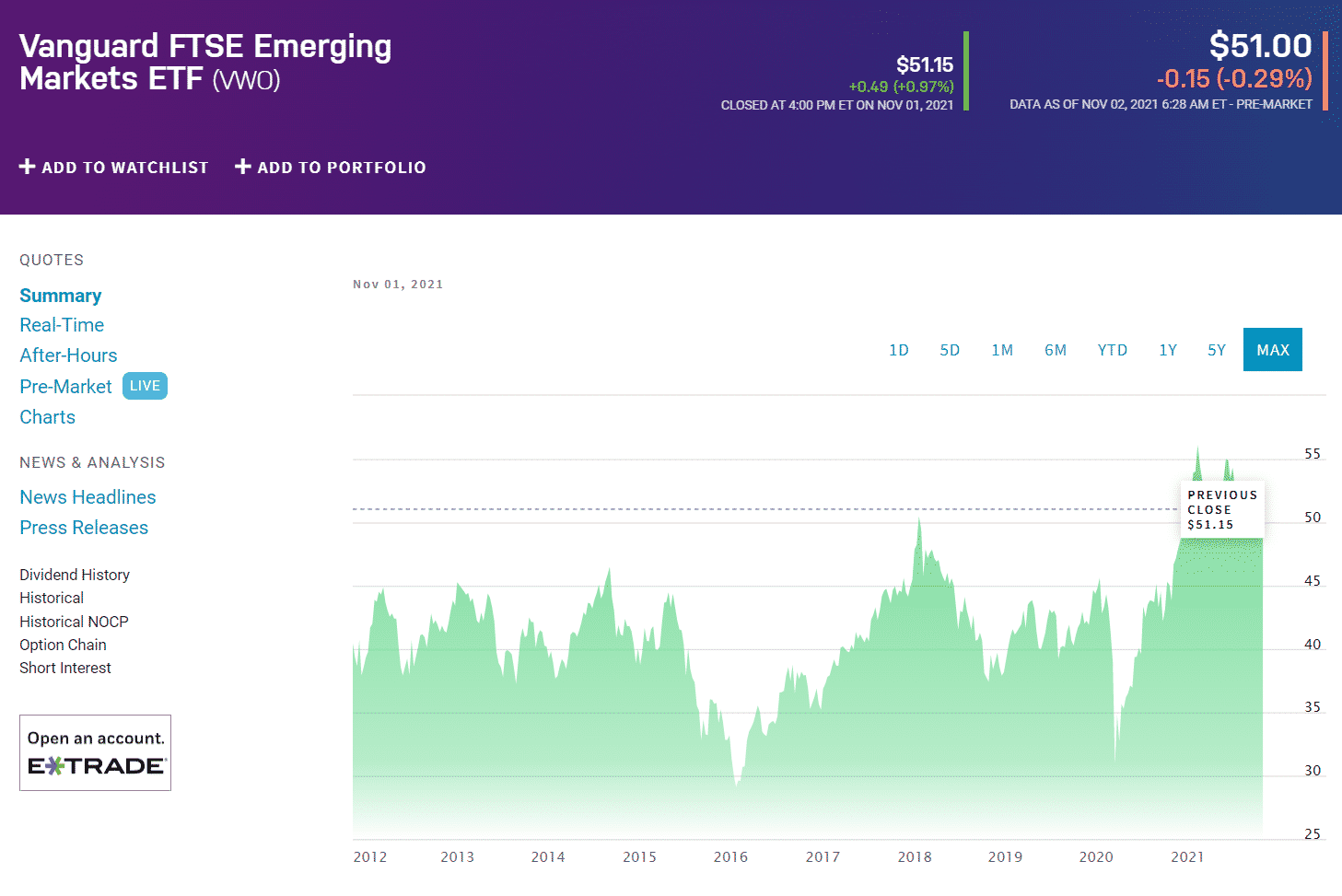

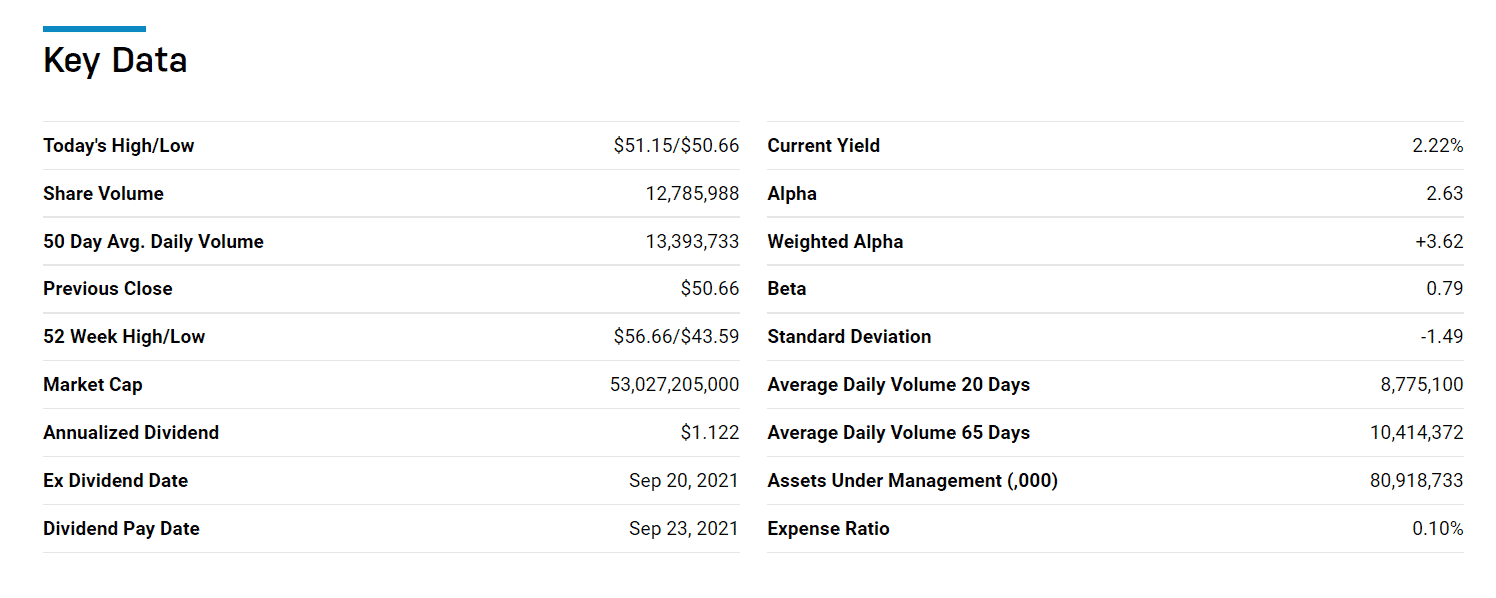

Vanguard FTSE Emerging Markets (VWO)

Price: $51.00

Expense ratio: 0.10%

Annual dividend yield: 1.98%

VWO chart

The Vanguard FTSE Emerging Markets Index Fund, tracks the FTSE Emerging Markets All Cap China A Inclusion Index. VWO invests in a representative sample of the composite index to replicate the performance of the tracked-index net.

VWO ETF is ranked № 16 by US News analysts among 78 of the best diversified emerging markets ETFs for long-term investing. With such a ranking, it comes as no surprise that its top three holdings are global household names:

- Taiwan Semiconductor Manufacturing Co., Ltd. — 4.85%

- Tencent Holdings Ltd — 4.48%

- Alibaba Group Holding Ltd. — 3.61%

VWO ETF has $117.28 billion in assets under management, with an expense ratio of 0.10%. This ETF has outperformed its category and segment averages; 5-year returns of 53.67%, 3-year returns of 46.46%, and pandemic year returns of 16.95%.

Post pandemic returns for this ETF have not been the best, current year-to-date returns of 2.70%, but it shows that they are in the dip and worth looking into come 2022 with accelerated economic recovery.

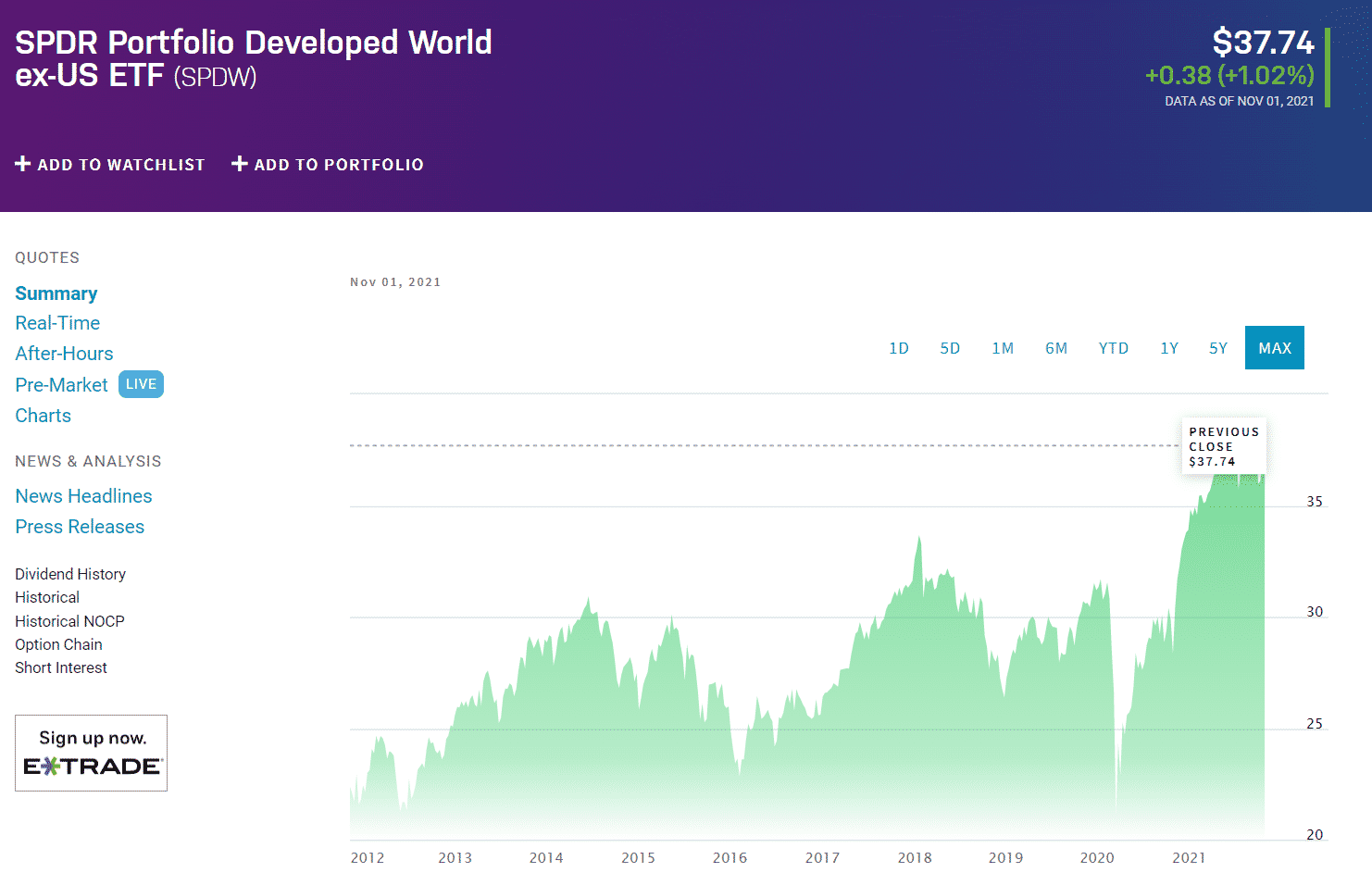

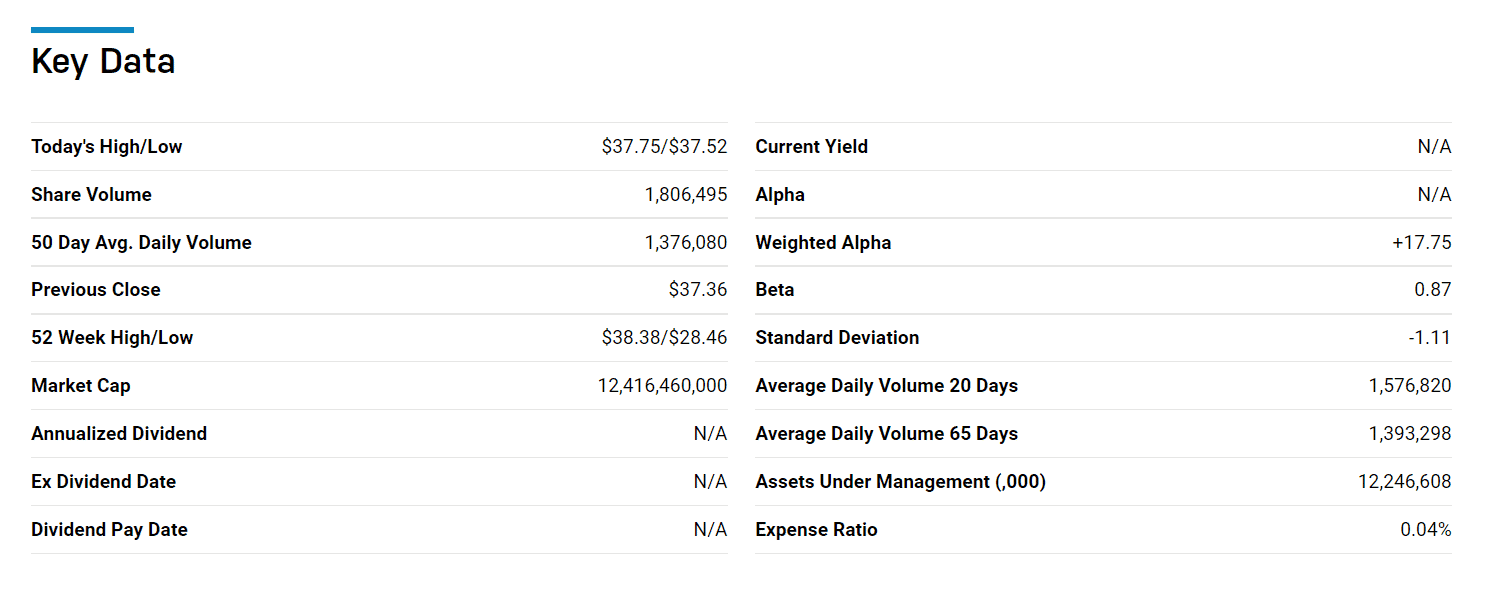

SPDR Portfolio Developed World ex-US Fund (SPDW)

Price: $37.74

Expense ratio: 0.04%

Annual dividend yield: 2.27%

SPDW chart

The SPDR Portfolio Developed World ex-US Fund tracks the S&P Developed Ex-US BMI Index, investing at least 80% of its assets in the holdings of the composite index. Through the SPDW, investors get exposure to the developed economies beyond the US borders.

SPDW ETF is ranked № 3 by US News analysts among 77 of the best foreign large blend ETFs for long-term investing. With such a ranking, it comes as no surprise that its top three holdings are global household names:

- ASML Holding NV — 1.42%

- Nestle S.A. — 1.40%

- Samsung Electronics Co., Ltd. Sponsored GDR — 1.22%

The SPDW ETF has $11.48 billion in assets under management, with an expense ratio of 0.04%. In the last five years, investors have enjoyed returns above the category average; 5-year returns of 64.54%, 3-year returns of 45.94%, and pandemic year returns of 34.38%

With post-pandemic year-to-date returns of 12.23% and annual dividend yields of 2.27%, this international ETF is worth a second look come 2022.

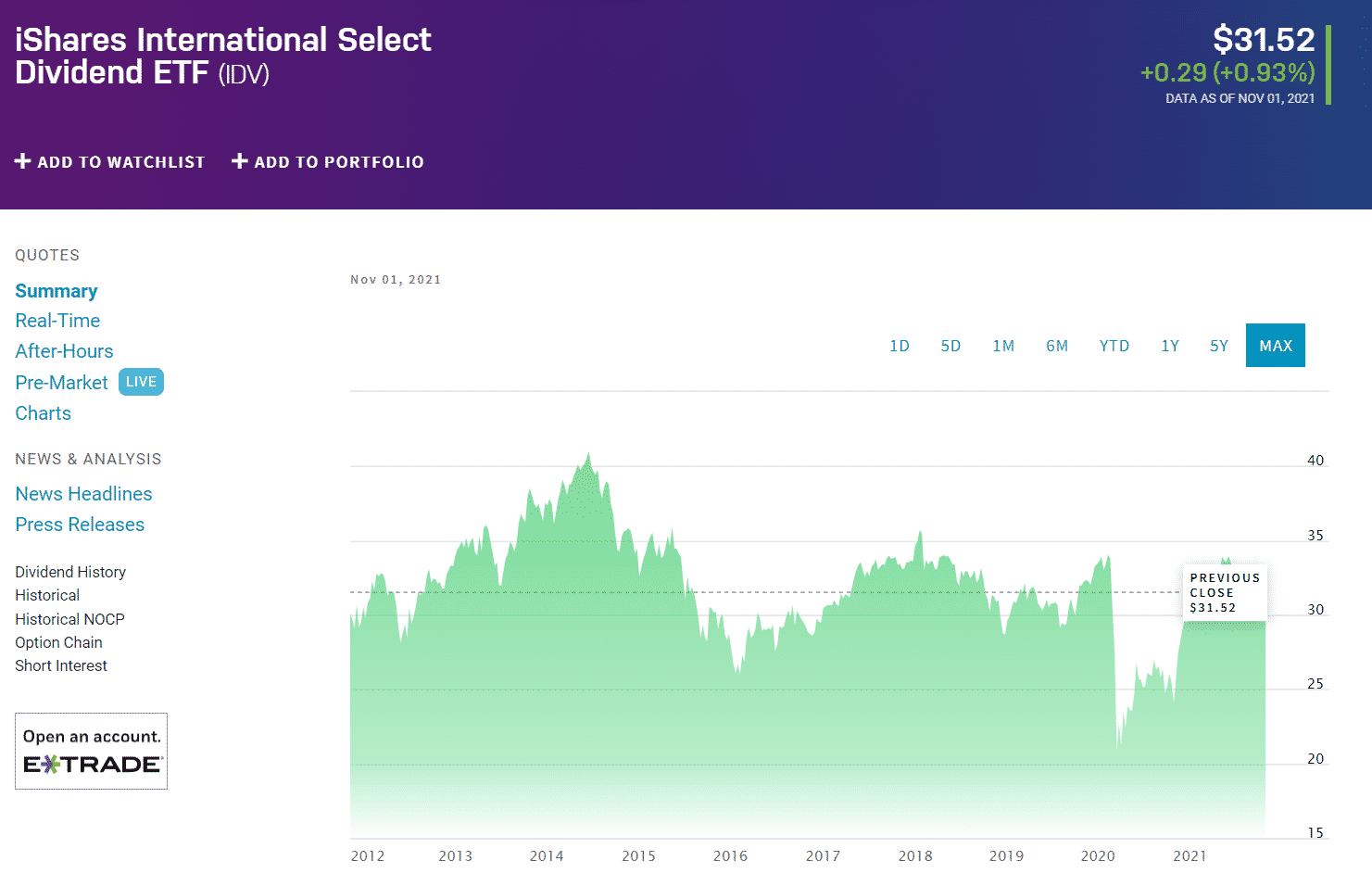

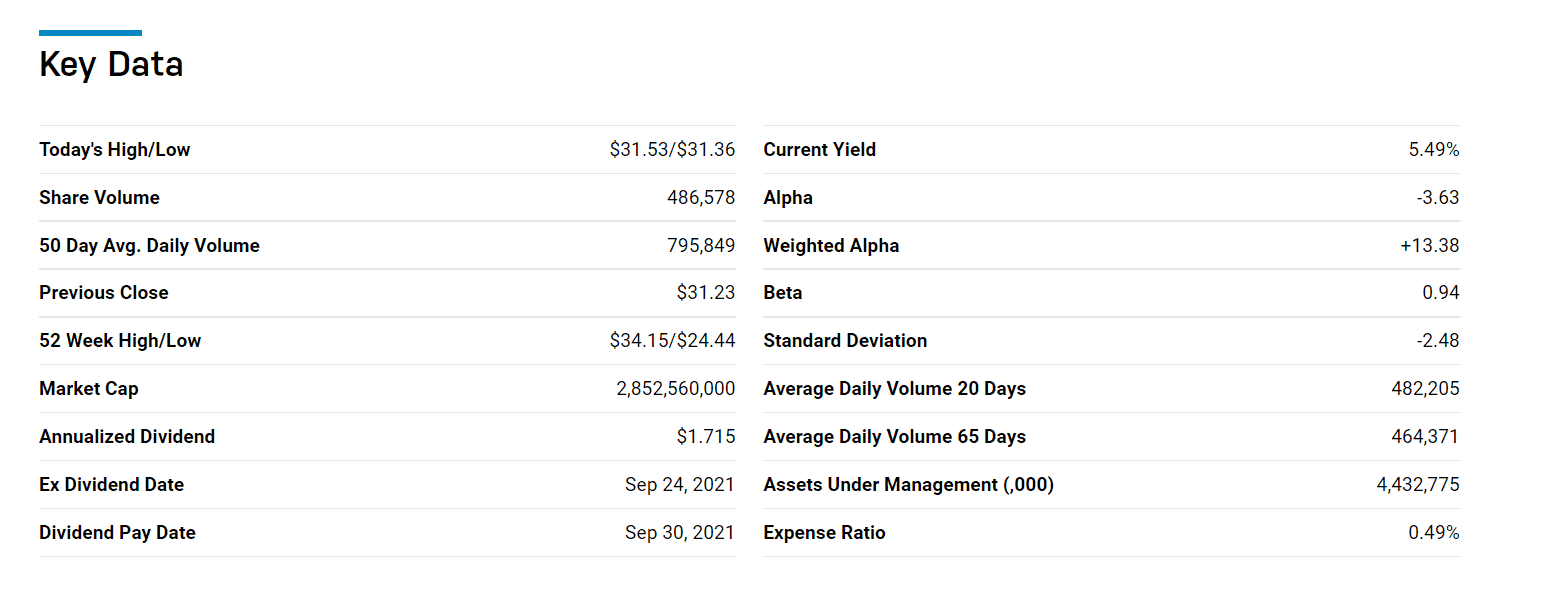

iShares International Select Dividend ETF (IDV)

Price: $31.52

Expense ratio: 0.49%

Annual dividend yield: 4.35%

IDV chart

The iShares International Select Dividend Fund seeks to replicate the performance of the Dow Jones EPAC Select Dividend Index, net of expenses and fees. IDV invests at least 80% of its total assets in the underlying holdings of its composite index and other securities with similar economic characteristics. Investors in the IDV get exposure to the best dividend-paying equities in developed economies outside the US borders.

An evaluation of 42 foreign large value exchange-traded funds by USNews has the IDV at rank № 19. A look at the top three holdings reveals why this ETF is among the best international ETFs:

- Rio Tinto plc — 6.11%

- British American Tobacco — 4.69%

- Naturgy Energy Group, SA — 5.65%

The IDV ETF has $4.42 billion in assets under management, with an expense ratio of 0.49%. In addition to offering geographical diversification, IDV ETF dividend yield is an excellent opportunity for 2022 income investing.

Final thoughts

As the world recovers from the covid19 pandemic, the international ETFs above provide a portfolio diversification option and a chance for investors to have a stake in the progress and prosperity of foreign nations.

Comments