Every investor knows the principle of asset diversification. Dividing your capital into different instruments is a direct way to reduce investment risk. Even if the profitability of one instrument falls, this does not lead the investor to a general financial disaster.

In practice, the following problems arise:

- It is difficult for a novice investor to figure out which instruments are better to include in a portfolio.

- Collecting a full-fledged diversified portfolio is a costly business.

- Difficult to control many instruments in a portfolio: monitor the situation on the exchange, reinvest funds in time, etc.

You can solve these problems with exchange-traded funds. In this article, you will find what it is and how it is beneficial for investors.

How ETF works?

An investment fund buys an extensive diversified portfolio of assets and then sells it piece by piece. For this, the fund issues its shares. That is, having bought one ETF share, an investor put money in several attractive instruments at once.

A simple analogy. Let’s say you want to try some exotic dish. The ingredients are expensive. Also, you are not sure how exactly this dish should be prepared. In this situation, it is easier to order it in a restaurant. There are all the necessary products in the kitchen. A professional chef has already prepared a large saucepan and will be happy to present you with a couple of plates. And this is not a luxury, but savings: one serving of the dish will cost you less than even the most profitable wholesale purchase.

The same happens with ETFs:

- First, the fund professionally prepares a “big pot” — analyzes risks and collects an investment portfolio.

- Then sells to each shareholder his “plate” — a share. All the “ingredients” are present — the share of all the assets of the fund.

Thus, ETFs are a convenient way to use multiple instruments at the same time. When choosing an exchange-traded fund, you need to consider the purpose of the investment, the investment horizon, and the permissible risks.

Investment purpose

The goal can be to create capital for large expenditures or create passive income. Investments in stocks or ETFs on a stock index are suitable for capital growth.

For passive income, experts recommend investing in dividend-paying ETFs or bonds.

Investment horizon

This is the term for which the investor invests money. The more time an investor has in reserve, the more he can take risks. On the contrary, the fewer the years before the goal, the less the risk is justified.

If you invest for 2-3 years, it is better to keep your investment portfolio in a bond ETF: their price fluctuates more diminutively than that of a stock ETF.

If the investments are for an intermediate-term, for example, five years, you can divide the portfolio between ETFs for stocks and bonds.

For long-term investments, that is, for ten years or more, the optimal instrument is ETF on stock indices. It is stocks that give the highest returns in the long term, but large price fluctuations characterize them.

Risks: is it safe to invest in an ETF?

Investing is always associated with risk. With a high expected return, risks are high — there is a possibility of a temporary decrease in the cost of capital or even loss of investment. Therefore, it is worth choosing an ETF based on your willingness to take risks.

If you are afraid of a fall in the value of an investment portfolio, it is better to keep most of your capital in a bond ETF. And vice versa: if you are ready to take risks, then pay more attention to ETFs on stocks.

What determines the performance of ETF shares

When deciding which assets will be included in their portfolio, ETFs most often rely on a specific stock index.

The index is not a number but a list — namely, a list of companies whose securities the stock exchange or the fund itself considers crucial.

The key indicator is the index value. This is already some hypothetical number, which is calculated in different ways for different indices. The absolute values of the index are not necessary. Only its fluctuations over time are essential: they reflect the general condition of the assets included in the index of companies. If securities become cheaper, the index falls — and vice versa.

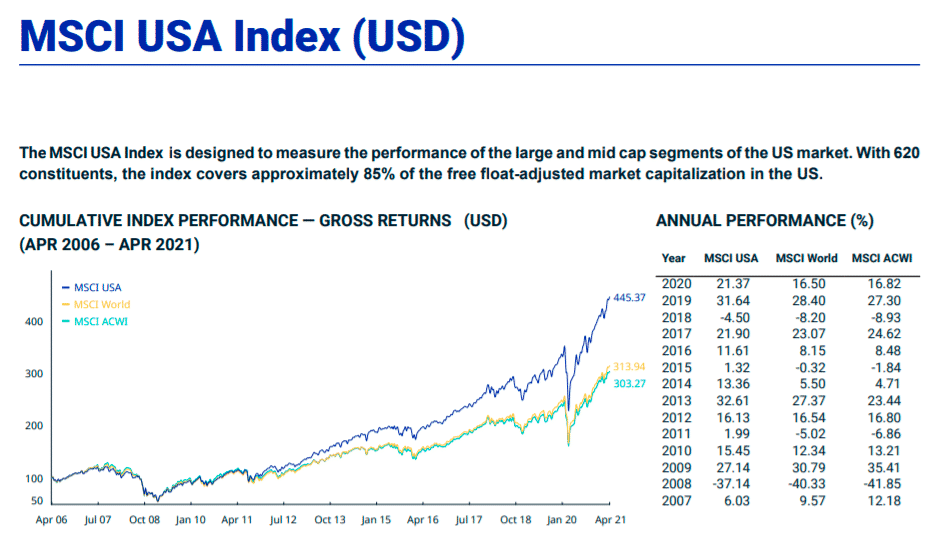

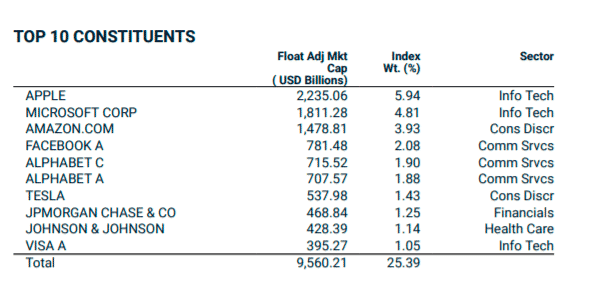

For example, the MSCI USA Index includes shares of 620 most significant US companies. Its value reflects the general state of the American stock market. The higher it is, the better and more expensive the shares are sold.

Having chosen an index, ETF funds buy securities from the companies it includes. There can be hundreds of them — you can find a complete list of assets for each fund on the provider’s website. Thus, the fund shareholders in each of them receive their share. So the share price is tied to the value of the index.

As you can see, when investing in ETFs, it is easy to track the return on your investment. For example, if the index rose by 10%, the ETF stocks rise in price by the same amount. You can also determine the exact dependence and profitability of shares from the fund’s documentation on the provider’s website.

Why diversify investments?

It is crucial to allocate capital to reduce risk: invest partly in stocks, partly in bonds.

The optimal proportions are individual. As Benjamin Graham writes in the book The Intelligent Investor, shares in the portfolio must be at least 25% and no more than 75%. The same is true for bonds.

Is there a basic model for investment diversification?

You shouldn’t invest all your funds in stocks of one country. In the stock of one industry or one company, it is even worse. A good option is to distribute money between ETFs for indices of several countries, for example, the US, UK, Germany, China.

Inside each such ETF, dozens and even hundreds of stocks from different sectors of the economy provide diversification of investments. The same can be done with the share of the investment portfolio, consisting of bonds.

Which ETF is better for newcomers not to invest in?

Some experts do not recommend investing in actively managed ETFs, inverse ETFs, and leveraged ETFs. They are riskier and do not allow you to calmly receive the average market return equal to the return on the index — and ETFs are helpful for this.

All things being equal, choose an ETF where the total under management is higher, and the management fees are lower.

Comments