Exchange-traded funds result from pooling together investment assets with the same economic characteristics and selling them under the same banner as one investment instrument. The result is that a diversified asset, low cost, can give returns in the long run, and all these with reduced risk levels compared to individual investment assets.

Since the introduction of the first exchange-traded fund in 1993, the ETF market has grown, in just three decades, from $0 market value to over $5.5 trillion in valuation. According to Barron’s Kim, “ETFs have been the single most disruptive invention in the investment world in the last 25 years,” a phenomenon similar to what the internet invention did.

So, are ETFs the holy grail of the investment world? No asset is the holy grail, but ETFs come close. Most ETFs track either the whole economy or a niche that is bound to grow in the long run, hence profitability.

Before you venture into ETF investing, let’s take a look at the advantages and considerations of ETFs.

Exchange-traded funds advantages over stocks

Exchange-traded funds are pools of like investment assets exchanged under one common banner. On the other hand, stocks refer to equities of corporations issued to investors in exchange for capital for expansion and operations, with investors in return enjoying a share of the profits.

Although both ETFs and stocks have high liquidity and trade intraday, the following advantages make the former a better investment vehicle.

№ 1. Diversification

In creating a portfolio, diversification is of the utmost importance. A diversified portfolio comprises different investment assets such as bonds, stocks, mutual funds, and real estate. A single exchange-traded fund can provide this diversification. The skill is in ensuring for diversification purposes, the ETF chosen cuts across different economic sectors.

Diversification ensures that a single asset’s market downturn doesn’t decline the whole portfolio.

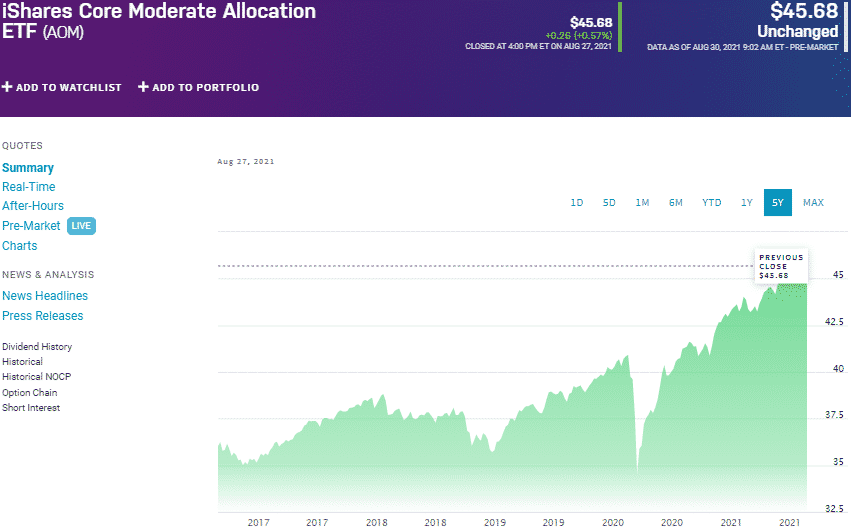

iShares Core Moderate Allocation ETF, AOM

Suppose you invest in the iShares Core Moderate Allocation ETF, AOM, you gain exposure to the corporate equity and bond market and the treasury bond market. For $45.68, an investor enjoys quarterly dividends of $0.19 to the share at an expense ratio of 0.25%.

A single share of Apple stock, an underlying holding of AOM, at present costs $148.84, with investors enjoying average yearly dividends of $0.85. However, a market downturn on the Apple shares would affect the single stock investor but would have a negligible effect on the AOM fund.

№ 2. Volatility

Stocks have long been known as high-risk, high-reward investment vehicles. This notoriety is primarily due to the volatility coupled to equities. At present, there are exchange-traded funds for each investor type, with some being so volatile that it is only advisable to trade them intraday. Nevertheless, most of the exchange-traded funds, being a basket of different assets, exhibit a laid-back, almost predictable volatility, especially in the long run.

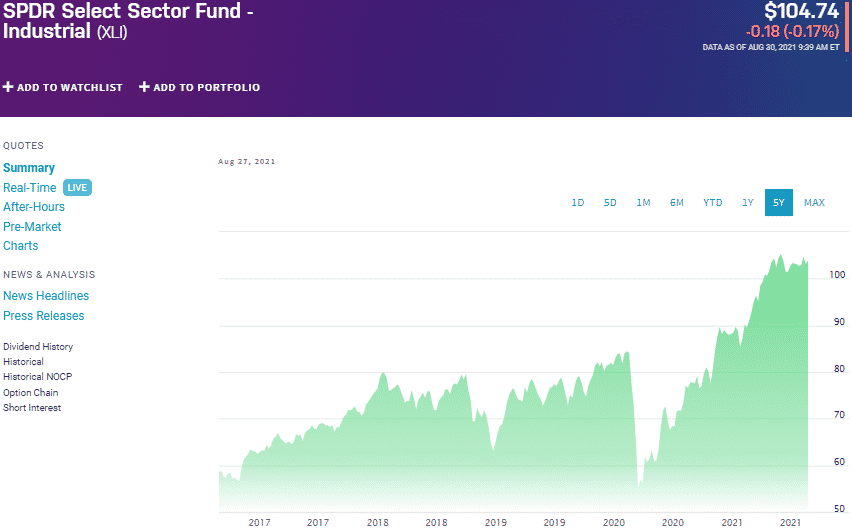

SPDR Select Sector Fund Industrial (XLI)

The industrial select sector fund, XLI, one of the most volatile SPY ETFs, has recorded trailing returns of 51.21% in the last year, 14.86% in the last three years, and 15.04% in the last five years.

Compare this to the General Electric single shares, an underlying XLI holding, and you get to understand why ETFs are the way to go. After more than three decades of consistent year-on-year EPS growth, investors in GE woke up to no returns in 2016, a phenomenon that has just turned the tide in the last financial year.

№ 3. Risk

The truth is that all investment assets have an element of risk that, if unmitigated, leads to financial ruin. By their composition, exchange-traded fund risk is relatively lower compared to individual stocks. However, by being a collection of different investment assets trading as one instrument, ETF underlying holdings with a high risk undergo dilution by those of lower risk. The result is an effectively lower ETF risk than when trading individual stocks.

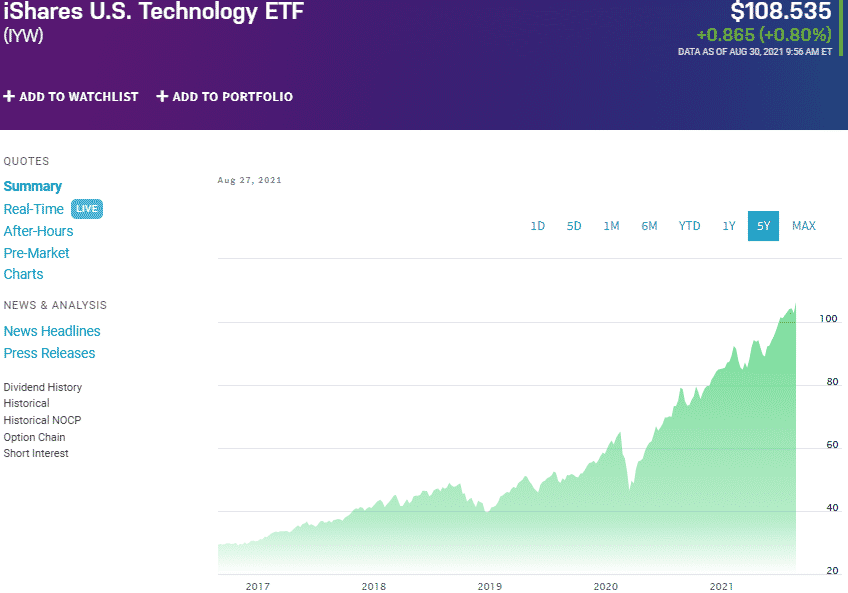

iShares US Technology ETF (IYW)

In a year that has seen some massive sell-offs in the tech industry at different times, the iShares US Technology ETF, IYW, has held steady to record year-to-date returns of 26.62%.

ETF considerations for enhanced wealth growth

Picking an ETF blindfolded will not result in the advantages above over someone who has taken care in picking their stocks. The indicators below have to be considered carefully before an investor enjoys all the benefits that ETFs have to offer.

№ 1. Cost

In general, exchange-traded funds are a more cost-effective investment vehicle than all other investment assets, stock included. However, different ETFs come with different expense ratios. Always go for an ETF with a very low expense ratio or no cost since the cost affects the net returns; ensure an alignment between the ETF cost elements and individual money management rules.

№ 2. Liquidity

Stocks’ primary advantage over ETFs is in their liquidity. Exchange-traded funds are traded intraday similar to stocks, but different ETFs differ in their liquidity. Always go for an ETF exchanged in high volumes. It ensures a quick exit in case of a market downturn or when in need of liquidation on short notice.

№ 3. Risk

Different ETF composition results in different investment risk. For example, leveraged ETFs are high-risk assets compared to conventional ones but not as much as leveraged inverse ones. Diversified ETFs also have a lower associated risk as compared to non-diversified ETFs. Pick an ETF that aligns with your risk tolerance levels and offers the ideal diversification, per the portfolio objectives.

Comments