If one is to make a buck in the investment world, one has to take calculated risks. At present, there is no investment asset as popular as exchange-traded funds. They have endeared themselves to the investment world by being low-risk, money-minting investment vehicles for the long haul.

In addition, there are upwards of 7500 choices of ETFs, ensuring that whatever your investment objective and strategy, you are covered. With an ETF, unlike other investment assets, once you identify and buy ETF shares, the fund manager deals with the investment hassle as you await your returns-the power of passive investing at its best.

With such a wide selection available to investors, what is the ideal number of exchange-traded funds to hold for profitability come 2022? Experts are divided on this question, but all data points to between five and ten. Why such a narrow range? Let’s dive into the reasoning behind this number.

ETF diversification

Don’t put all your eggs in one basket! It sounds like a cliché, but when it comes to finances and the investment world, experts advise that individuals should spread their investments across multiple assets to spread their risk, more so when dealing in stocks. The idea is to have different investment assets so that when one is in a market downturn, the other is thriving, and the overall portfolio return is positive. Due to its composition, an ETF is already a form of diversified investment vehicle. Do you still need to then diversify across the ETFs held?

Another driving factor for the popularity of ETFs has been the transparency in their composition and trading. The SEC provides for the ETF issuer to update the investors on any changes to the ETF composition, ensuring that they have visibility of what exactly they have invested in at any particular moment.

This feature, in turn, helps decide which ETFs to hold. For example, rather than hold two ETFs that track the S&P 500, an investor can choose one that exposes them to small-cap equities.

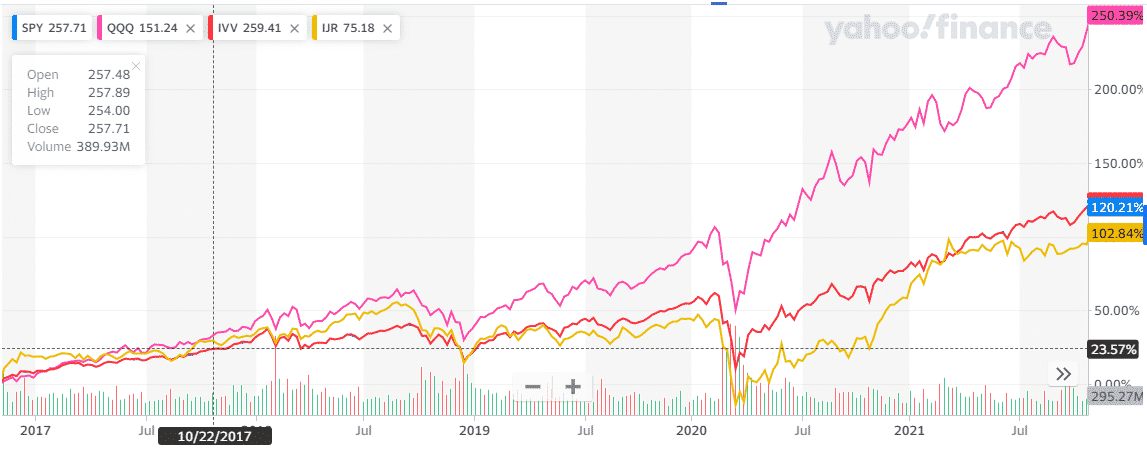

SPY, QQQ, IVV & IJR comparative chart

A look at the chart above shows that for the SPY and IVV, which are ETFs tracking the S&P 500, there is very minimal distinction between them. However, when it comes to the QQQ, which is tech-heavy, and the IJR, a small-cap ETF, the overall market movement might be the same, but there is a clear distinction between them.

It shows that investors have to be very careful when picking ETFs to ensure that they don’t have the same underlying holdings and hence are influenced by the same indicators.

Advantages of an All-ETF portfolio

There are quite a several advantages to having an ETF-exclusive investment portfolio as follows.

-

Investment security

The oracle of Omaha advocates for exchange-traded fund investing because they represent a sector of the economy that is bound to grow given enough time. Having an ETF-based portfolio chosen wisely means having a stake across the various economic sectors that are bound to make positive strides in the long term.

In addition, the diversification of exchange-traded funds spreads the inherent investment risk across its underlying holdings resulting in an investment vehicle capable of absorbing individual asset volatilities.

-

Hassle-free investing

The beauty of ETFs is that their managers have the headache of choosing where to invest hence freeing up investors’ time to screen for additional investment instruments. These managers are also responsible for the day-to-day administration and management of the funds.

Disadvantages of an All-ETF portfolio

There are quite some disadvantages linked to having an all-ETF portfolio.

-

Lack of control

Every ETF comes with a fund manager responsible for its management. Fund managers also make decisions on what to invest in and for how long. The fun of investing is having control over what to put your hard-earned money into. Investors transfer this function to the respective fund managers by investing in ETFs and are mere spectators awaiting returns on their investment.

-

Increased costs

Exchange-traded funds are one of the most cost-effective investment vehicles at present. Most ETFs have an expense ratio of less than 0.5%-$50 as expenses annually for an investment worth $10000. However, having different ETFs means cumulative expense ratios, which, if untracked, might eat up into the investor returns.

-

Need for an investment manager

As earlier demonstrated, it is straightforward to invest in different ETFs, but they expose investors to the same basket of holdings. It then calls for an investor to have a portfolio investment manager analyze the entire ETF portfolio to ensure it tells investors to different markets hence achieving diversification.

The other alternative has ETFs from the same issuer and, by default, enjoys the benefits of having an in-house fund manager to advise on which ETFs would best result in diversification. Many issuers also charge zero commissions for trading via their accounts, which bears the bottom-line portfolio.

Final thoughts

So, how many ETFs are ideal for getting rich come 2022? Before answering this question, it is of utmost importance to first appreciate that ETFs are long-term investment instruments. With that in mind, then we can say that according to experts, owning 5-10 ETFs diversified across multiple markets can result in return in the long run.

It is all about consistent returns over the long haul at a very low-risk rather than high-risk, high-return kind of portfolio. If not a financial expert, have in place a financial advisor or portfolio investment manager to ensure that all your ETFs are distinct enough to absorb the momentary shock of one but aligned to the overall investment objective.

Comments