If you want to ball like the super-rich, Warren Buffett being at the forefront, then you need to invest in exchange-traded funds, “Put 90% of your investment income in indices and exchange-traded funds, and only 10% in government bonds.”

This guide seeks to answer the following questions:

- What is an exchange-traded fund?

- What ETFs’ variations are there?

- What are some of the pro-investor considerations for ETF investing?

What is an exchange-traded fund?

By definition, an exchange-traded fund is a basket of investment assets, of like economic characteristics, traded intraday at the stock exchange just like regular stocks. By virtue of being a pool of different investment assets under one vehicle, ETFs provide investors with instant diversification and reduced portfolio risk at a relatively cheaper cost than individual investment assets.

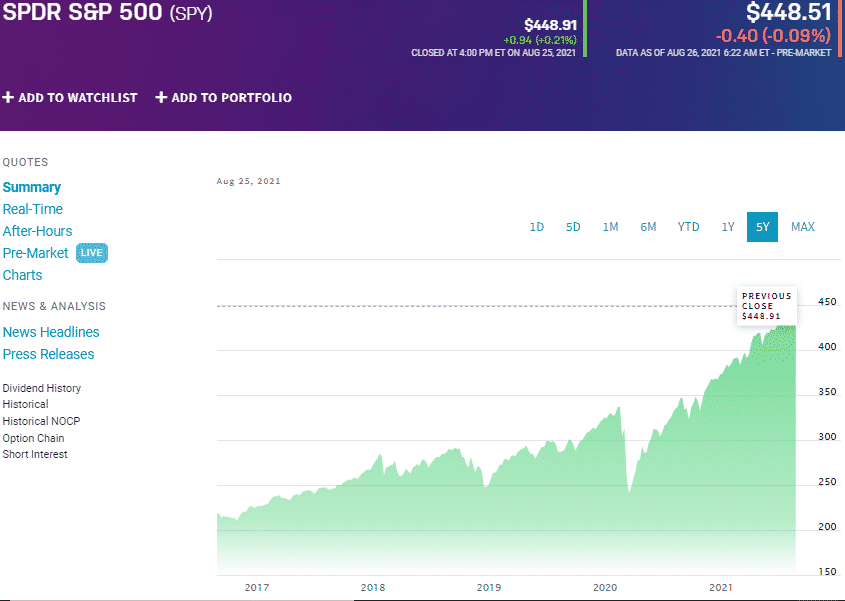

The result has been the phenomenal growth of ETFs as one of the top investment vehicles and the most exchanged investment asset globally. For example, to own a single share in Apple, Microsoft, Amazon, Facebook, and Google Class A shares would cost an investor cumulatively $6959.52. Assuming such an investor is after diversifying their portfolio by investing in the top 500 equities in the US, a better option would be to invest in the SPY fund at $448.91.

With the initial $6959.52 investment, the investor would purchase 15.5 shares while exposing the investor to not five companies but 500 of the largest US companies by market capitalization. In addition, the investor would only part with $6.26 as an expense annually.

SPDR S&P 500 (SPY)

In addition to the cost benefits and diversification, exchange-traded funds represent either the entire economic spectrum or an economic niche. In the long run, the economy ought to grow. Investors have come to love the ease of trading and investing in ETFs because they do not have to time the market to make money but buy and hold them for long enough.

For example, the SPY has rewarded its investors with 18.58% returns on their investments in the last three years, and since inception, 9.96% returns.

Exchange-traded funds variations

The popularity of the ETF is not only due to their cost efficiencies and promises of returns. They are also famous due to an ETF variation for every type of investor and situation.

The available ETF variations are as below.

№ 1. Exchange-traded products (ETP)

An exchange-traded product is any investment vehicle that tracks the performance of an index, commodity, basket of underlying holdings, or any financial instrument. ETP prices are determined by the market forces of supply and demand. Hence they trade intraday just like stocks. Therefore, long-term investors can buy the exchange-traded products and hold them over the long haul, while intraday traders get a piece of the pie by trading in contract for differences, CFDs.

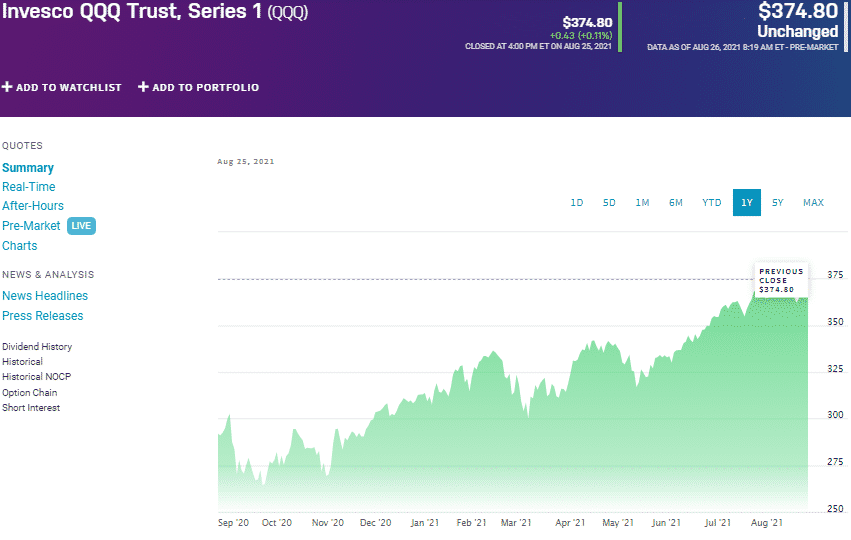

Invesco QQQ Trust, Series 1 (QQQ)

The Invesco QQQ trust tracks the Nasdaq 100, exposing investors to the top 100 non-financial domestic US companies and international firms.

№ 2. Exchange-traded notes (ETN)

ETN represents a much narrower and less popular niche of the exchange-traded products universe. Similar to ETFs, exchange-traded notes, ETN, track an underlying index. However, where ETFs are a basket of underlying assets, ETNs comprise unsecured debt instruments. The other primary difference is in how they trade; ETFs trade throughout the day and pay regular interests, while ETNs pay the primary principal and the returns on the maturity of the ETN.

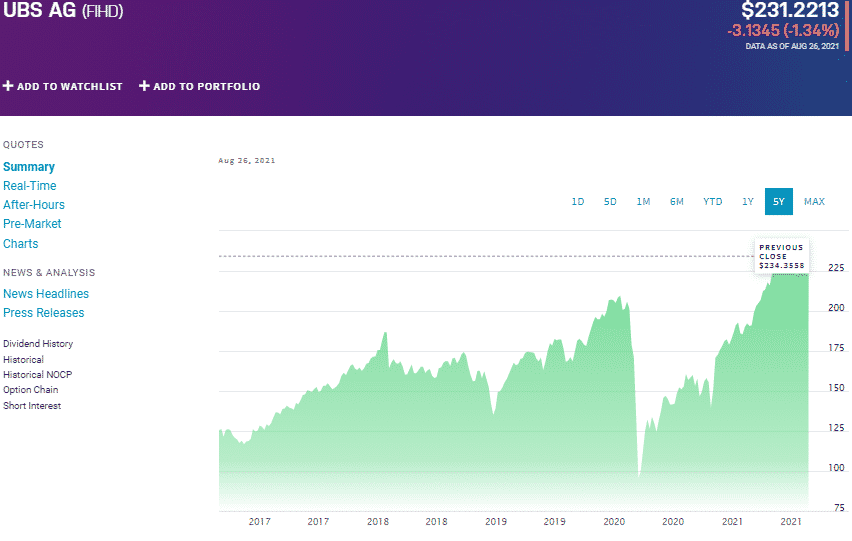

UBS AG (FHID)

For example, the UBS AG FI Enhanced Global High Yield ETN, FHID, is a pool of unsecured securities issued by UBS AG. It reduces the risk associated with ETNs by investing in international unsecured debts tied to high-grade, high yield dividends of large and mid-cap equities.

№ 3. Leveraged ETFs

One of the best features of an ETF is its manageable volatility. Nevertheless, for investors seeking the thrill of intraday trading and volatility, we have leveraged ETFs.

Leveraged ETFs are a pool of investment assets that utilize derivatives and loans instead, just equities of the underlying assets they track. The objective of these ETFs is to give investors amplified returns compared to the tracked index, typically either 2:1 or 31:1 ratio.

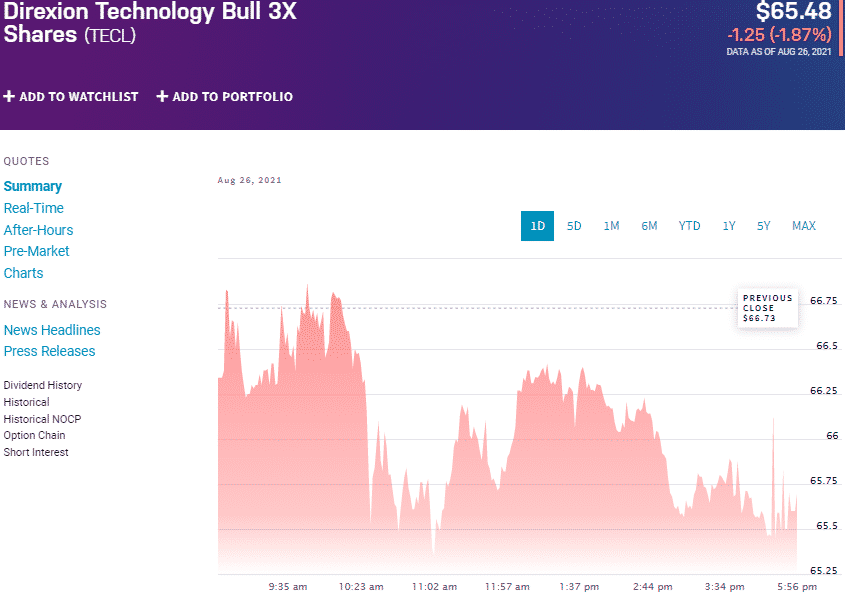

Direxion Technology Bull 3X Shares ETF (TECL)

An investor in the Direxion Technology Bull 3X Shares ETF gains exposure to the leading technology firms. This leveraged ETF tracks the technology select sector ETF and seeks to outperform it by 300%.

When dealing in leveraged ETFs, remember they seek daily amplified returns; they take advantage of intraday volatility. They should, therefore, not be used for long-term portfolio investment.

№ 4. Inverse ETFs

The general rule of thumb is that exchange-traded funds are long-term investment vehicles. Banking on the economy in the long-haul growing does not mean that the sailing is smooth and the ETF won’t experience a market downturn. The question is, is there a way to make money off an ETF in times of market downturn to ensure the compounded returns at the end are even better?

Through inverse ETFs, investors have a hedge asset against held assets in times of a bearish market rather than deal in individual stock sell-offs and the associated costs. Inverse ETFs comprise derivatives of the underlying index holdings, with the sole objective of making profits off their decline.

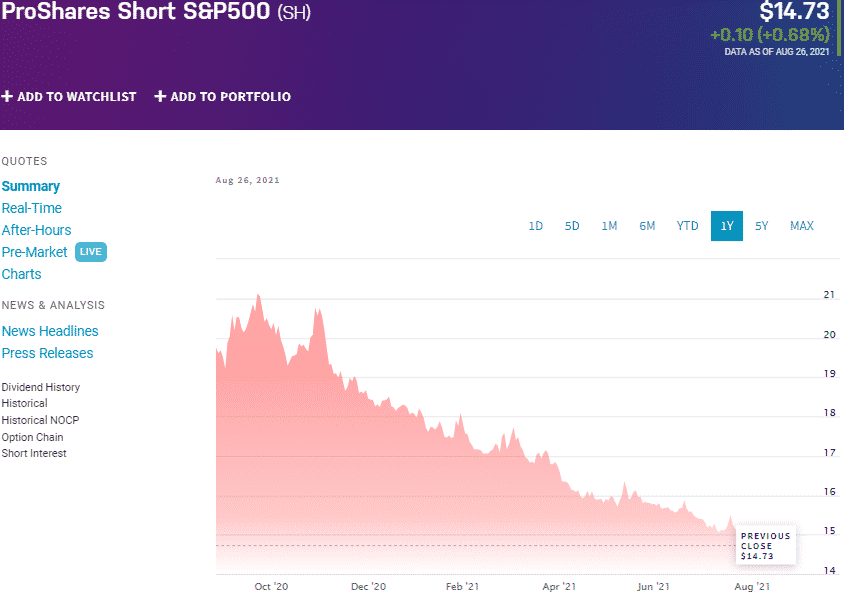

ProShares Short S&P 500 (SH)

Suppose the S&P 500 is in a momentary decline, and you hold its shares. How would you mitigate against potential losses? The ProShares Short S&P 500 is the answer. These inverse ETFs track the performance of the S&P 500 index with a view of giving similar returns, but in the opposite direction.

Final thoughts

The popularity of ETFs is only going to grow as the world populace seeks financial freedom and wealth accumulation in cost-effective ways and within acceptable risk levels. The evolving of the ETF markets to the variants herein discussed that cater to each investor interest will only add fuel to an already global investment phenomenon, ensuring further acceleration of adoption.

Whatever your risk appetite, money management rules, and investment objectives, you can be sure there is an ETF just for you.

Comments