The beauty of the exchange-traded fund world is an investment instrument for every market participant. Traditionally, income investors had only high yield stocks and other fixed-income assets for ensuring a regular and consistent income from investments.

However, the ETF world has revolutionized this by bringing diversification to income investing. There now exists funds that bring together a basket of high yield dividend equities and other dividend-paying investment assets to trade as one greatest asset.

The question then is, should investors pocket their ETF dividends, or should they reinvest them?

In this guide, we answer:

- Do ETFs pay dividends?

- What are dividend reinvestment plans?

- Why should ETF investors reinvest their dividends?

Do ETFs pay dividends?

The question of whether funds pay dividends is a resounding yes. Nevertheless, the oracle of Omaha says, “Never invest in a business that you do not know about.” It is why we first need to define dividend ETFs.

An ETF is an investment asset that acts as a basket of economically like assets and trades. Therefore, dividend-paying ETFs comprise a basket of assets that have demonstrated the ability to pay dividends consistently over not less than five years. This category, therefore, includes funds that have assets in their holdings known to pay dividends regularly and with an increasing yield consistently.

Further, a look into dividend-paying ETFs will reveal that their holding base is primarily made up of blue-chip companies known for their dividend-paying stocks coupled to carefully selected mid-cap and small-cap equities with over five years, consistently paying dividends. These dividends are either.

Qualified

Attract taxation at the capital gains rate owed by the ETF 60 days before the ex-dividend date, and an investor owns ETF shares 121 days before the 60 days requirement period.

Non-qualified

They are taxed at a nominal tax rate because they don’t meet the 60 days or 121-day holding period.

These dividend-paying ETFs then provide a consistent income to an investor for expenditure, other investment projects, or reinvestment in the same assets. So, how do you reinvest dividends from funds? Reinvestment provides an excellent portfolio growth option without committing extra capital.

ETF dividend reinvesting

Unlike mutual funds and stocks, ETF dividend reinvesting requires some finesse. However, it is still available only in two ways:

Dividend reinvestment plans

The ETF and investment world is evolving tremendously, but not all funds provide a reinvestment option for their investors. Relatively new to the ETF world, a dividend reinvestment plan, DRIP, is a program offered to investors by their broker or ETF provider, allowing their dividend payments to be automatically used to buy more stake in the fund.

Much like the standing orders in a bank account, DRIPs offer convenience while reinvesting dividends, but on the other hand, they lose control on when and how to reinvest. For example, different brokers have differing DRIP programs; dividend pooling for substantial reinvestment at pre-agreed upon intervals or total share dividend reinvesting only with remainder dividend income deposited to investor accounts as cash.

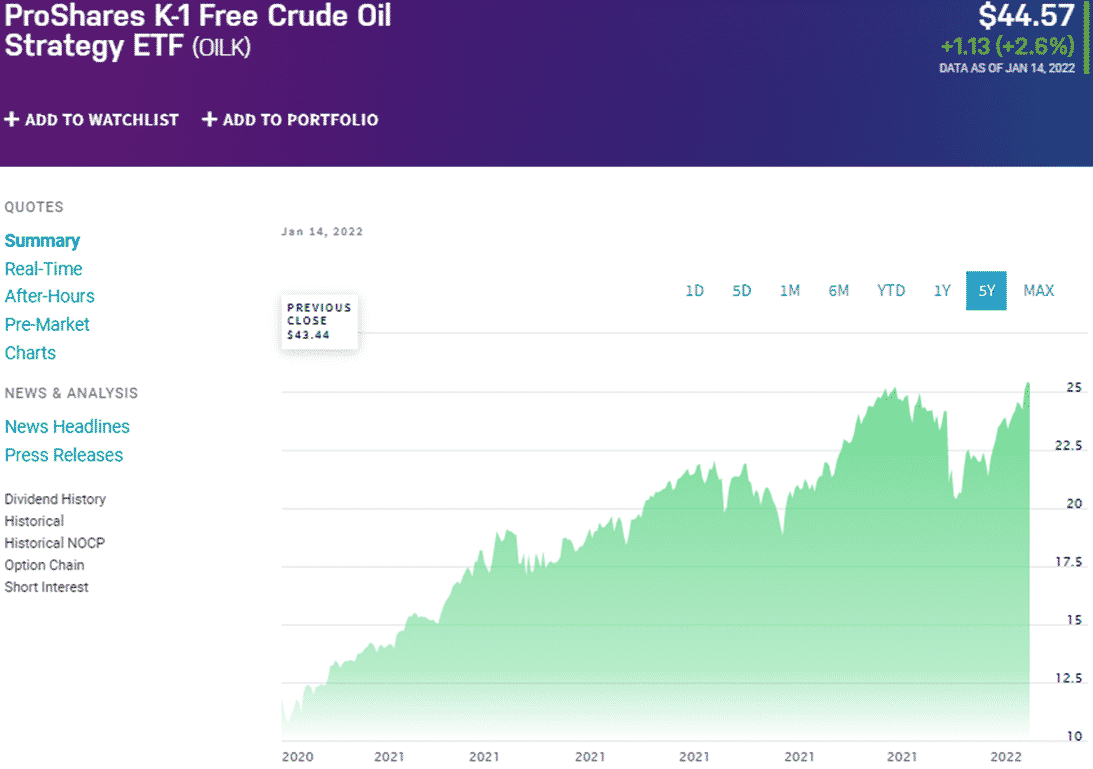

OILK performance chart

For example, the ProShares K-1 Free Crude Oil Strategy ETF, OILK, pays quarterly dividends of $6.17 to the share. With an investment of $10000, this would be approximately 224 shares of OILK ETF.

These shares would attract a dividend of $1382.08 quarterly, and if reinvested for a year, they would result in 124 more shares of the OILK ETF, upwards of 55% growth in the initial investment. A DRIP plan is done once dividends are paid out every quarter depending on broker-specific requirements without any other investor input once the plan is in place.

Manual reinvesting

The second option available for reinvestment for dividend ETF investors is manual reinvesting. It is an ideal option not offering DRIPs since, in most cases, it attracts commissions, which are an extra cost to the investor. It involves the investor buying extra shares of the same ETFs once the fund distributes its dividends, similar to a new investment transaction.

The advantage of manual reinvesting is greater control over the dividends.

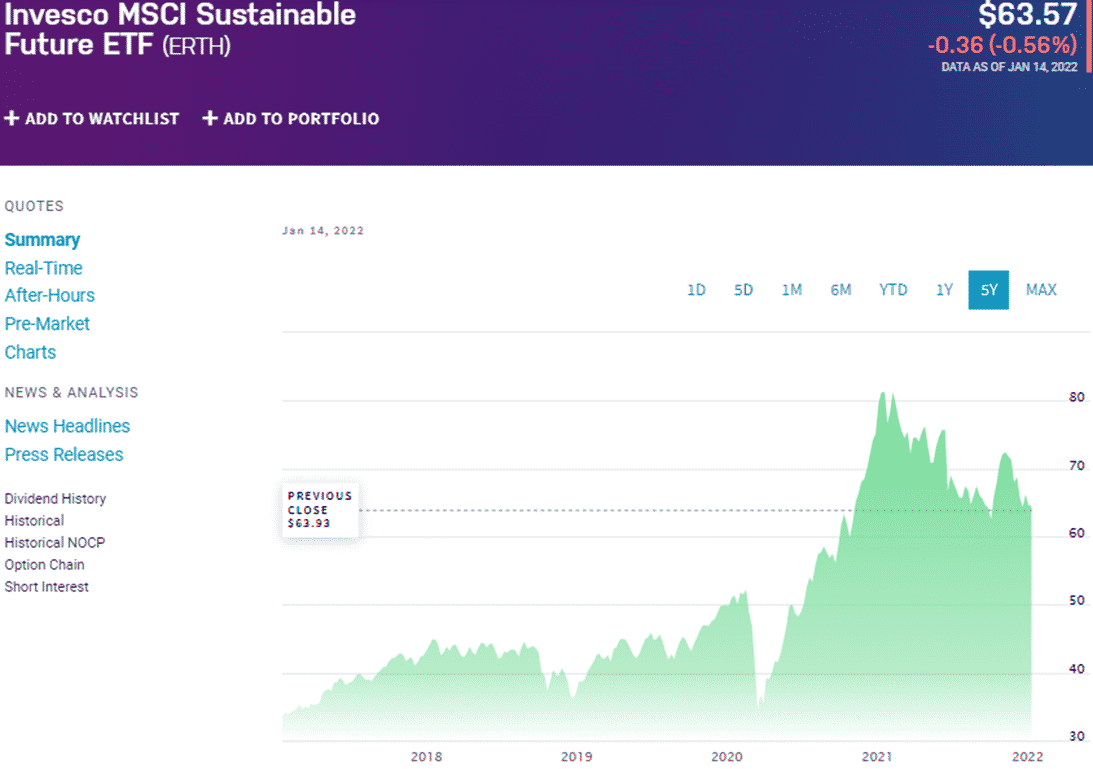

ERTH performance chart

With manual reinvesting, an investor would have chosen to forego investing in the ERTH ETF in March 2020 when it was bearish and chose another investment. However, an investor utilizing DRIP would have no choice in the matter.

What are the benefits of ETF dividend reinvestment?

Similar to mutual funds and stocks dividend reinvesting, ETF dividend reinvesting accrues the following positives to investors.

Share price discount

ETF providers sometimes offer discounts to investors buying shares via dividend reinvesting hence incurring a fraction of the capital cost incurred by other investors.

Compounding effect

Dividend reinvesting in bullish ETFs results in a compounding effect of the returns and an accelerated portfolio growth.

Hassle-free investing

Taking advantage of DRIPs provides a stress-free investment plan in assets already minting money via dividends payouts.

Lower portfolio risk

Dividend reinvesting facilitates dollar-cost averaging investment strategy, which leads to reduced investment risk in the long run.

Reduce investment cost

Most DRIPs and brokers offering ETF dividend reinvestment do so at zero commissions.

What are the challenges of ETF dividend reinvestment?

ETF dividend reinvesting might sound flowery, but even a rose has thorns. The following challenges have to be put into consideration to ensure the best out of ETF dividend reinvesting.

Unbalanced portfolio

Close portfolio monitoring is required to ensure dividend reinvestment does not result in a portfolio skewed towards dividend-paying ETFs hence losing portfolio diversification.

Differing plans

Different providers and brokers provide tailor-made reinvestment plans necessitating the need for individual plans to make informed reinvestment decisions.

Inflexible reinvestment schedules

Investors using DRIPs cannot take advantage of prevailing market conditions since these plans are on a clock.

Final thoughts

Unless one is cash strapped, ETF dividend reinvesting is an excellent portfolio growth strategy with the potential to provide higher consistent income and financial freedom down the road. All investors have to do is ensure they understand the reinvestment plans offered and choose between DRIPs and manual reinvesting accordingly to ensure they make the most of their dividends.

Comments