Index funds are not only popular among beginner investors but also seasoned players in the market. This popularity is attributable to their composition that exposes investors to a vast pool of investment assets under one ETF hence instant portfolio diversification at a lower cost and lower risk.

What is an Index exchange-traded fund?

Even from the name, it is easy to deduce what Index ETFs are. It is an exchange-traded fund that tracks a particular index, usually the leading market indices:

- S&P 500

- NASDAQ100

- Dow Jones Industrial Average

- Russell 2000, etc.

The goal of Index funds is to duplicate returns similar to those of its parent index, the long term. They are a creation of either investment firms, brokerage firms, or fund managers. The majority of Index ETFs are passively managed funds, which are rebalanced periodically as the underlying holdings are added and removed.

What are the benefits of Index ETFs?

The reasons why Index ETFs are such a mainstay for most investor portfolios are:

-

Diversification

By definition, an ETF is a basket or pool of investment assets. So investing in an Index ETF grants instant access to a broad range of investment assets.

-

Relatively low cost

ETFs are among the cheapest investment assets to own, more so for Index ETFs. Some Index ETFs charge as low as $0 to possess them, with the others charging as low as $3 yearly to own $10,000 worth of investment.

-

Lower risk

Index ETFs comprise different investment assets, hence providing more resilience in the face of market fluctuations than individual investment instruments.

-

Attractive returns

Index funds are known to fluctuate, but they have proved to be a stable source of income to their investors in the long run. For example, the average annualized return of the SPY, the S&P 500 Index ETF, since its inception is 9.96%.

How to be part of the Index ETF Market?

To be part of the Index ETF market, you need a broker. Available brokers fall into two categories, traditional call brokerage firms and online brokers that provide a platform for you to access your portfolio 24/7. Through these brokers, you can either invest in the Index ETFs or speculate about their price changes through a contract for differences or CFDs.

Once a broker has been chosen, being part of the Index ETF is a simple three-step process.

| Step 1 | Step 2 | Step 3 |

| Find a broker providing Index ETFs as part of their investment instruments. | Screen the ETF to ensure portfolio risk and return requirements align. | Invest or trade-in the Index ETF of choice. |

The top 3 index tracking ETFs

Index tracking ETFs provide investors with an opportunity to either invest in the whole economy, a particular industry, across a specific economic segment or create a portfolio that has a specific theme in mind.

The top three Index tracking ETFs, based on their expense ratio, returns, and risks, are as follows.

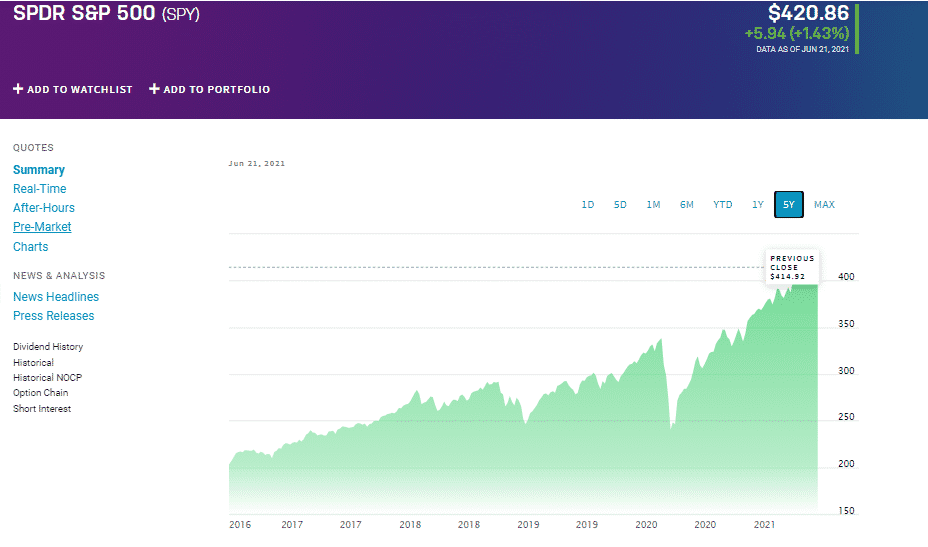

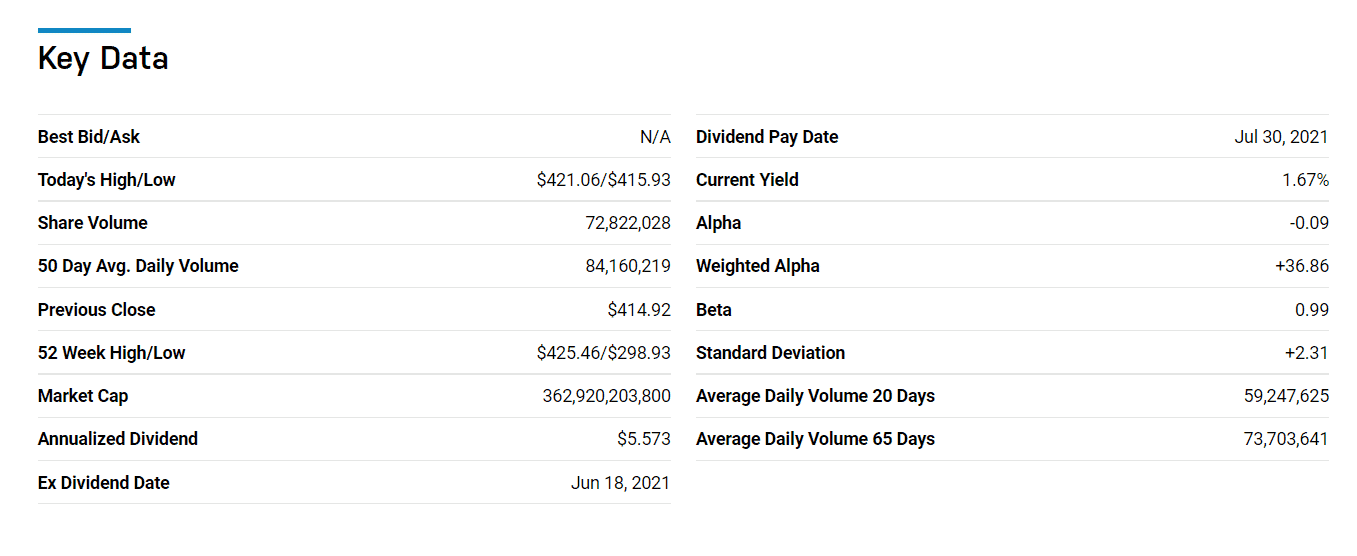

№ 1. SPDR S&P 500 ETF (SPY)

Price: $420.86

Expense ratio: 0.09%

The SPDR S&P 500 ETF is one of the most traded and popular ETFs globally. It gives exposure to the entire US economy by tracking the S&P 500 Index. Therefore, investing in the SPY amounts to having a stake in 500 of the largest companies in the US economy.

Out of 227 large blend companies, this ETF is ranked 35th by USnews analysts as a long-term investment instrument. The SPY exchange-traded fund, since inception, has average annualized returns of 10%. This return consistency, coupled with its low expense ratio of 0.09% and high liquidity, approximately 74 million shares traded daily, make it a must-have ETF in an investment portfolio. The SPY is the top dog ETF with $358.1 billion AUM in terms of net assets under management.

In a year when the pandemic halted almost all economic activities, the SPY ETF still managed yearly returns of 38.38%.

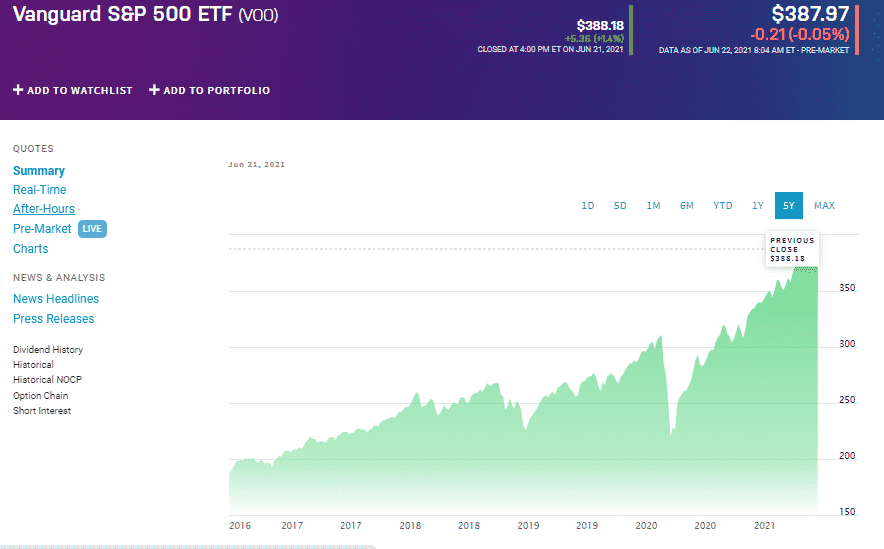

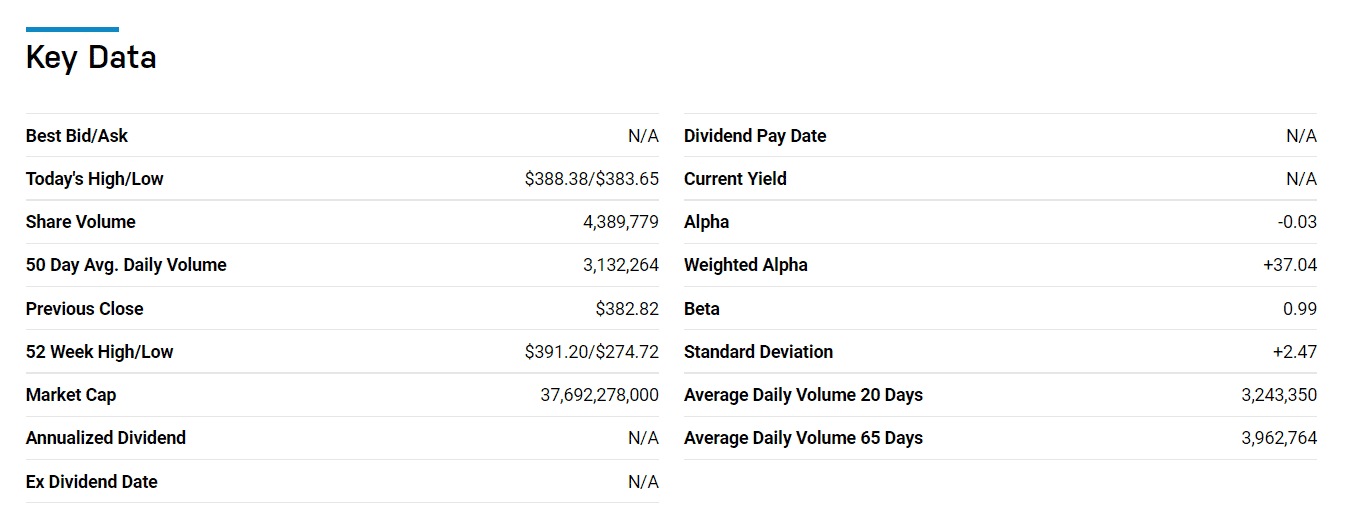

№ 2. Vanguard S&P 500 ETF (VOO)

Price: $387.97

Expense ratio: 0.03%

The Vanguard S&P 500 ETF is a popular exchange-traded fund that gives investors exposure to the entire US economy by tracking the Standard and Poor’s 500 Index. From the ETF provider powerhouse Vanguard, this ETF was launched on 7th September 2010 and gave investors access to the best and most popular blue-chip companies making up the S&P 500 Index.

Surprisingly enough, the VOO is part of USnews analysts’ large blend ETF lists and ranks higher than the SPY, 28th. The higher rating might be due to the VOO’s better expense ratio of 0.03% and its superior average annualized return of +13.87% since its inception.

Similar to the SPY, the VOO ETF showed resilience in the face of the coronavirus pandemic to close the year with 38.51% returns. This ETF boasts $228.01 billion in assets under management.

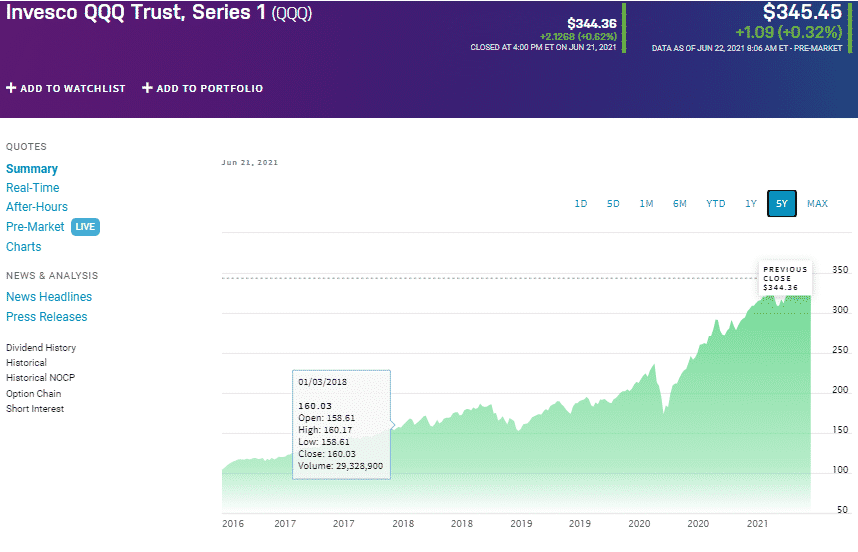

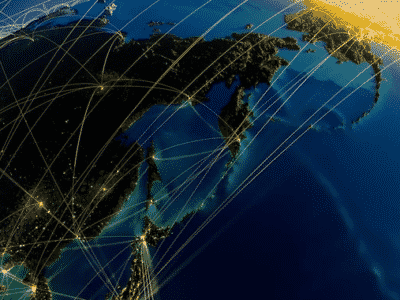

№ 3. Invesco QQQ ETF (QQQ)

Price: $345.45

Expense ratio: 0.2%

Invesco QQQ ETF, unlike the other Index ETFs, has a skewness towards the tech industry. The QQQ tracks the NASDAQ-100 ETF Index and is rebalanced regularly to ensure performance that is as close as possible to that of the Index tracked. Through the QQQ, investors get exposure to 100 of the largest non-financial companies in the US economy.

In an era where the tech industry leads innovation and the way we conduct every facet of our lives, this ETF offers investors a chance at making big money. For example, while the SPY 1-year return during the pandemic was 38.38%, the QQQ investors enjoyed returns of 42%.

In a list of 89 significant growth exchange-traded funds by USnews, this ETF rank is №16. Since its inception in 1999, this exchange-traded fund’s average annualized returns stand at +9.35%. In addition, it boasts $168.49 billion in assets under management.

Comments