It is no longer a matter of including exchange-traded funds in an investment portfolio but which one to include. Exchange-traded funds have become the internet of things in the investment world. According to the Oracle of Omaha, investing in ETFs is investing in an economic niche, and in the long run, it has to grow.

No matter your investment style or objective, there is an ideal ETF for you. This, combined with the ease of trading associated with ETFs and their relatively low investment cost, has propelled this investment vehicle into the most exchanged products globally. The result of this popularity is a market worth upwards of $9.5 trillion, with over 7600 different ETF choices.

What are ETF megatrends, and why invest in them?

Disruptive technologies, innovations, and scientific discoveries change how every facet of our lives is conducted. The result is an influx of investment in these fields with the hope of making not only a quick buck but also holding them for the long haul for wealth accumulation.

The problem of investing in such economic niches is knowing which equity stocks will thrive and which will fail. It is for this reason that ETFs exist. Megatrend ETFs comprise equities and other assets economically in an identified disruptive field. Investing in such ETFs ensures that, in the long run, a portfolio gain as that particular market grows. It also ensures instant diversification and reduces the inherent investment risk associated with infant industries if the ETF isn’t preying to concentration bias.

The best megatrends ETFs to buy in 2022

The only constant in life changes, driven by a never-ending human appetite for improvement and making work more accessible. As such, the next frontier is always a high-risk, high-return environment that can create or destroy entire markets and industries.

However, if played right, these megatrends have the potential to take an investment portfolio to the next level. With the globe recovering from the clutches of Сovid-19, the three megatrends below have room for growth and a raft of opportunities to mint money.

№ 1. Active ETFs asset base to double

One of the most endearing attributes of the exchange-traded fund is its passive investment nature-tracks the composite index investing in the underlying assets to replicate its performance.

However, there is a class of ETFs with the management team or an investment advisor who makes decisions on the underlying holdings weighting and the economically like assets to invest in. The result is a dynamic ETF with the ability to adapt to emerging issues and capitalize on the opportunities therein. On the flip side, an average management team without requisite investment savviness can ruin a portfolio by making the wrong decisions.

In most cases, actively managed ETFs outperform the category average because managers use discretion to adopt a fund to emerging market issues; sector allocations, investment assets, and market-time trades. In addition, artificial intelligence has gotten into the investment space and has proven to be more efficient in picking and managing winning investments than individuals.

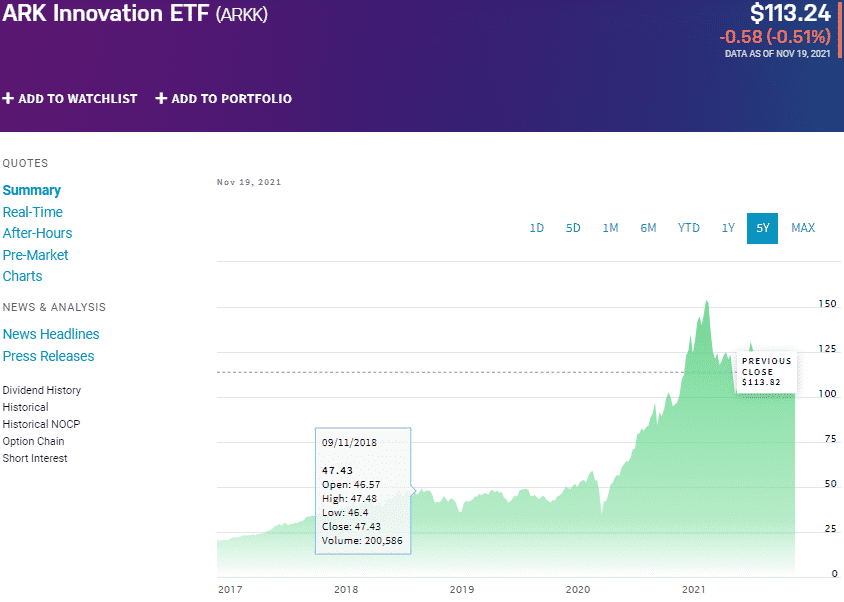

ARKK сhart

Cathy Wood has come up as one of the best fund managers for actively managed ETFs. It shows in the ARK Innovation ETF plying its trade in the tech sector overperforming both the category and sector averages over the last five years as shown below, except the pandemic year.

| ARKK

|

|||

| Period | ARKK Returns | Category Average | Segment Average |

| 1 Year Return | 14.47% | 29.73% | 11.21% |

| 3 Year Return | 166.75% | 47.25% | 20.90% |

| 5 Year Return | 463.51% | 54.49% | 33.11% |

All these factors put in a case for more fund inflows into the active ETF management space and given the uncertainty surrounding the Covid-19 post-pandemic era, ETF agility though active management might prove to be the winning ingredient.

№ 2. The growth of ESG ETFs

Global warming is no longer for scientists to ponder about since its effect are already being felt. The appetite for renewable energy is just picking up with the world populace now cognizant of the importance of reclaiming the environment and trying to reverse damage to the climatic patterns. Organizations are racing to innovate ways to ensure sustainable and affordable green energy and processes, with consumers and governments shifting towards environmental, social, and governmental sustainability. The ESG bond market estimated growth of 85%, from $270 billion in 2020 to $500 billion in 2021, which shows how fast this niche is becoming essential.

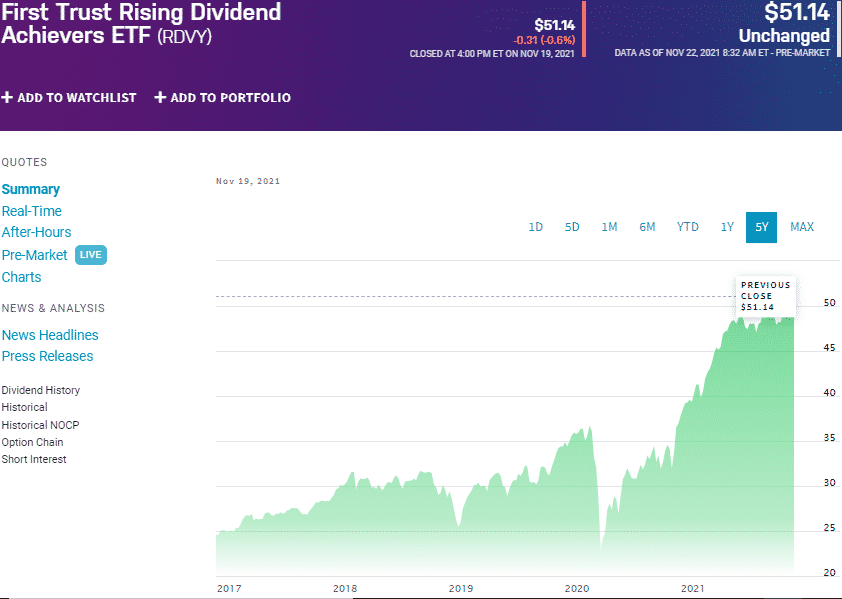

RDVY chart

A look at the chart above and returns below for the First Trust Rising Dividend Achievers ETF, which has one of the highest ESG scores, shows the ESG era is here and ready to explode. Investing in ESG ETFs not only ensures a clear conscience but facilitates the preservation of the globe.

| RDVY | |||

| Period | RDVY | Category Average | Segment Average |

| 1 Year Return | 39.71% | 25.06% | 17.49% |

| 3 Year Return | 82.07% | 35.87% | 24.11% |

| 5 Year Return | 127.89% | 38.71% | 27.44% |

№ 3. ETF tax efficiency will remain unchanged

Exchange-traded fund structure allows for tax-efficient ways and above what is enjoyed by mutual fund investors. With mutual funds, taxation occurs on capital gains with every rebalancing that occurs in addition to taxation on dividend payouts and liquidation of the asset.

In retrospect, ETF taxation is on liquidating the asset or enjoying dividend payouts only, with rebalancing being dealt with through redeeming creation units that don’t attract capital gain taxes. Remember that taxation affects a portfolio’s bottom line; the more the tax, the less the net returns and vice versa.

Final thoughts

All indicators show that the megatrends above are having a significant impact on the globe. As such, their associated ETFs provide an avenue to invest in these markets cost-efficiently broadly, and if played right, they have the potential for phenomenal returns.

Comments