When investors put money in a passive investment to replicate the broader market’s performance, it is known as index investing.

Index investing takes different forms, from putting money in index’s component securities and an exchange-traded fund to an indexed mutual fund. The popularity of index investing is attributable to its ability to outperform the actively managed financial instruments and funds.

How profitable is index investing?

Warren Buffet, one of the greatest investors globally, says: “Put 90% of investments in low-cost indexes and only 10% in short-term government bonds.”

Instead of investing in individual stocks or financial instruments and being subject to their volatility, index investing avails investors with an alternative. The index design objective is to track the performance of specific market niches: a basket of financial instruments within a particular segment.

Investors transition from trying to beat and outperform the market to being the market itself through index investing. The result is lower costs for higher returns consistently over the long term. For example, instead of buying stocks in several real estate firms, investors can put their money in a fund tracking the real estate index.

Assuming that investing the average value of real estate stock is $100, the value of the index tracking the sector is one. If the average value rises to $125, the percentage increase in the sector is 25%, and the index value goes to 1.25.

The main 5 Index ETFs

An exchange-traded fund index is primarily due to its diversification within the same market segment or the entire economy. Therefore, they present investors with instant diversification, access to a broad stock pool, lower risks, and all these at relatively low investment costs. The primary index ETFs include SPY, QQQ, DIA, IWM, and SWTSX.

SPY

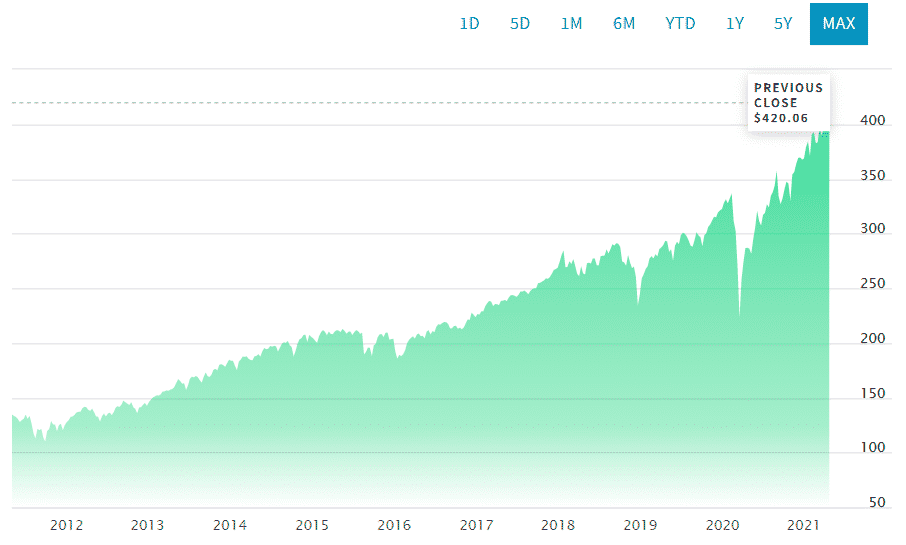

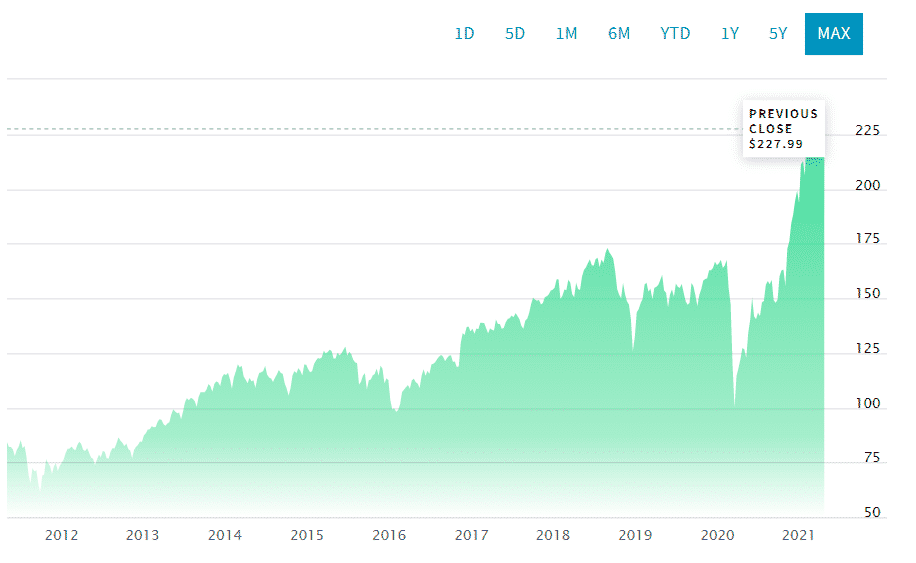

This index fund, SPDR® S&P 500 ETF Trust, is the oldest in the market and one of the most traded funds globally. Through the SPY, investors track the performance of the S&P 500 Index, and hence the five hundred top US companies across the economic divide.

Out of 242 significant blend funds, this index is ranked #36. SPY investors in the last decade have enjoyed returns of 14.24% and 17.08% in the previous five years. The returns come at an expense ratio of 0.09%. SPY controls $404.1 billion in assets under management.

SWTSX

The Schwab Total Stock Market Index Fund, SWTSX, true to its name, tracks the United States stock market; tracks the Dow Jones US Total Market Index. The fund invests not less than 80% of its assets in stock components of its parent Index.

Over the last decade, the fund return is 13.4%, with the previous five-year return standing 17.3%. The potential for such returns at an expense ratio of 0.03%, with no minimum entry requirement, and assets under management worth $15.97 billion.

QQQ

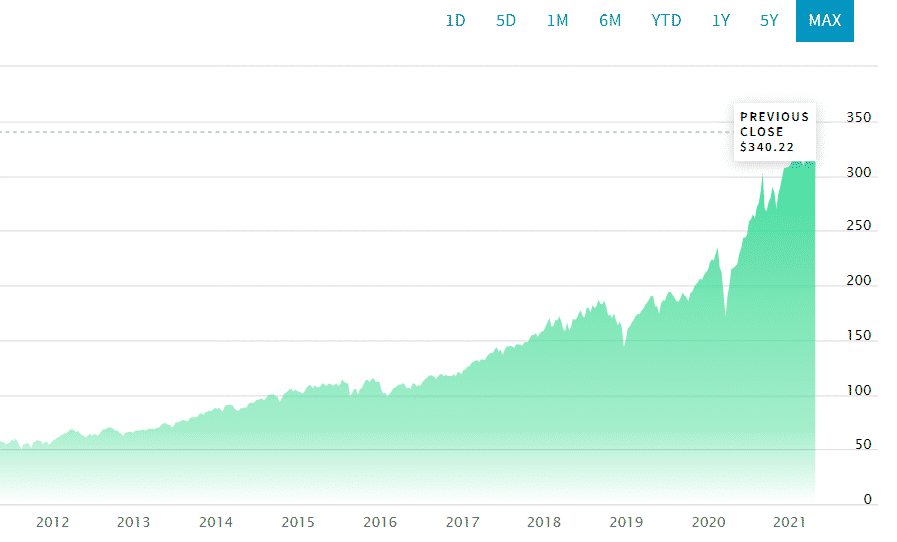

Unlike most ETFs, this Invesco Index is a unit investment trust. It is one of the most traded indexes globally and the major SPY competitor. This index fund tracks the Nasdaq-100 Index. However, it deviates from other funds by entirely exempting a sector component of its underlying index, the financial sector. It also tends to be more volatile than its peers since the top holding takes up a large percentage of its concentration. Despite being heavy on the tech industry, this is not a tech index.

Due to the high volatility, QQQ investors have enjoyed 10-year returns at 20.48%, with 5-year returns of 26.89%. The QQQ index fund has $163.89 billion in assets under management and an expense ratio of 0.2%.

DIA

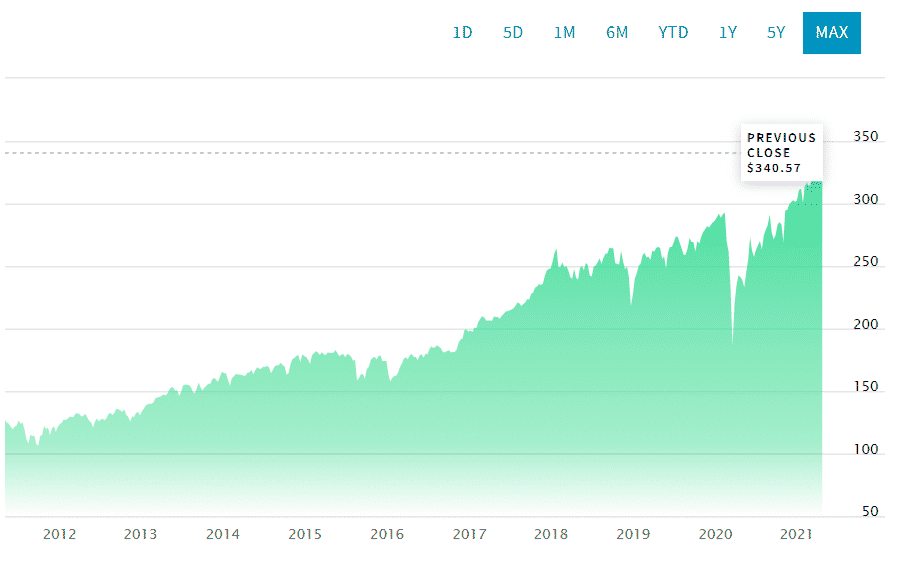

The SPDR Dow Jones Industrial Average ETF, DIA, despite its name, tracks an index of only 30 large-cap companies in the industrial sector. Therefore, investors looking for a diversified industrial sector portfolio should avoid the DIA since it represents only a tiny portion of the industry. However, this index’s tendency to track the performance of the overall industrial sector despite its limited composition is its endearing feature.

DIA investors have enjoyed 10-year returns at 12.95%, with 5-year returns of 16%. The DIA Index fund has $29.9 billion in assets under management and an expense ratio of 0.16%. DIA Index is ranked #32 by US news out of 105 extensive value indexes evaluated.

IWM

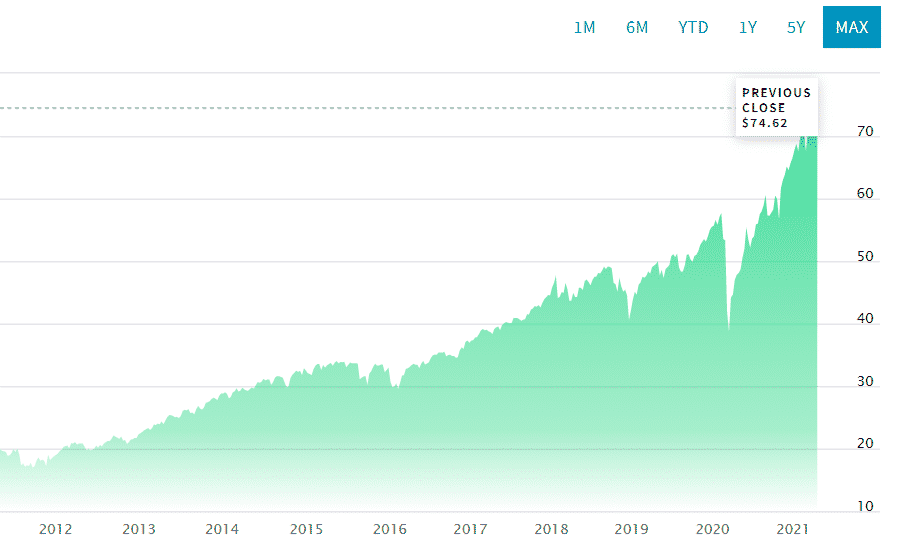

The iShares Russell 2000 ETF, IWM, gives investors access to the small-cap US equity market. It tracks the Russell 200 index. The IWM is one of the most diversified funds in its category and one of the best small-cap indexes.

In the last decade, investors have enjoyed returns of 11.96% and 5-year returns of 16.37%. To invest in IWM, investors contend with an expense ratio of 0.19%. IWM has $68.62 in assets under management.

IPO investing

IPO, Initial Public Offering, refers to the offering of company shares to the public to raise capital. Acquisition of IPO shares is through a bidding process. IPOs are mainly associated with budding companies going public for the first time. These companies offer investors potential high gains over a short period, especially if their forecasted growth trajectory holds steady. To submit an IPO, companies must list with the stock exchange.

The IPO process provides an avenue for private investors to gain profits through share price appreciation as they transition from private to public shares. The price at which private investors acquire shares of a private company is known as the offering price; determined by an underwriter based on company capital demands.

During an IPO, the public shares are offered at market price, guided by demand and supply, which is usually higher than the offer price. Private investors at this point chose whether to hold the higher public shares, convert from the remote, or sell off all or part of their stake. However, to enjoy this higher share price and associated returns, insider shareholders wait for 90-180 days, lockdown period.

The lockdown period applies to all private shareholders having a stake in the company before an IPO; employees, company management, company founders and owners, and any early investor such as venture capitalist. The lockdown period dissuades flooding of the stock market with large volumes, exponentially depressing the share value. It, therefore, allows for demand and supply forces to naturally dictate the share price.

IPO day-1 trading

The jury is not out on whether participating in IPO day-1 is beneficial or not. Empirical data, however, shows that during IPO day-1, most stock behavior is akin to a hot collectible. The stocks that draw in great demands exhibit high price bids and are the most profitable. Unfortunately, this profitability is coupled to an increased loss risk as demand and supply forces seek a balance. The main challenge of investing during IPO day-1 is that shorting is illegal.

Shorting involves speculating on the decline of a stock: borrow stock to sell at a high price and pay it in the future by buying at a low price.

For example, short a stock at $30, and if the price falls to $20, make $10 by buying the stock and closing the short position. To short a stock, you have to borrow it on a futures contract. During IPO day 1, the number of shares on offer is limited, posing a borrowing challenge. The SEC also discourages short selling on IPO shares by restricting underwriters; cannot lend shares for shorting before 30 days lapse after IPO initial trading. To short sell, investors have to go through retail or institutional investors, many of whom during IPO day-1 isn’t willing to lend stocks for short selling.

Investing in IPO: pros and risks

One of the quickest ways for wealth creation and growth is an investment in the right IPO stocks.

The advantages to IPO investors are:

- Potential growth: not all IPO stocks are the next Tesla, but most have the growth potential. The IPO stocks offer investors an opportunity to buy stocks of a budding company and hold them as the company grows and the share value increases. For example, anyone who invested in the Tesla IPO of $17 by putting in $500 would be holding stocks worth $20,423, a return of 4084%.

- Mergers or acquisitions: IPOs finance company expansion in terms of operational scope, mergers, or acquisitions. The successful undertaking of any of these activities results in better financials and fundamentals of a company, and the trickle effect- increased share value.

Despite the advantages of IPO investing, it is a challenging venture because of:

- Inadequate information: investors’ only research is the prospectus which is an internal document. During an IPO, the SEC lists companies for the first time. Therefore, investors have minimal information available for making investment decisions.

- Market unpredictability: IPO shares encounter market supply and demand forces for the first time during the offering, and the public response can be either positive or negative. IPO shares can either rise exponentially during the IPO or tank below the offering price.

Spotting a profitable IPO requires finesse and market experience that takes time to build. To still be part of the IPO market without the risk, IPO ETFs are a more stable investment option.

Comments