Index funds began in the 1970s, but they took off only in 2010 because of their low cost, stock market bullish tendency, and passive nature of investing. In 2018, investors injected around 458 billion US dollars into the index fund market.

If you are looking to diversify your portfolio across various markets, consider investing in index funds. This article will give a short primer on what you should know about this investment vehicle. Let’s learn the costs involved in this investing and the actual steps to buy such funds.

What is an index fund?

An index fund is either an exchange-traded fund (ETF) or a mutual fund. An index fund aims to track or match the performance and portfolio of a recognized index. Arguably the most popular index is the S&P 500.

An index fund follows the benchmark index regardless of market conditions. However, there are many other indexes that index funds can follow. One appeal of this fund is a low operating expense and low risk, among others.

Cost in index fund investing

Investing in index funds involves costs that you must understand. The following are the primary costs to take into consideration:

Minimum investment

You can invest in an index fund if you raise a specific capital. The minimum capital to get started can reach thousands of dollars. However, when you reach this threshold, you can add smaller amounts to your account.

Minimum account

The minimum account is not the same as the minimum investment. While you can find brokers with no minimum account requirement, some brokerage firms do set a minimum deposit amount to allow you to open an account. In terms of the account type, you can choose either a taxable account or a traditional account. If you find a broker with no minimum account specification, try to look at the minimum investment requirement and compare it with other options.

Expense ratio

Expense ratio (ER) is a specific percentage deducted from your returns as a fund shareholder. This is among the primary costs associated with index fund investing. Other fund shareholders also get the same deduction, but in varying amounts, depending on the account investment amount.

You can find the value of the ER in the prospectus of the mutual fund. Alternatively, you can get this figure on financial sites such as Nasdaq. Here are the common ERs based on the market type:

- Stock index funds – 0.09 percent

- Bond index funds – 0.07 percent

In comparison, the standard ERs for actively managed funds are the following:

- Managed stock funds – 0.82 percent

- Managed bond funds – 0.58 percent

You can easily see the difference between the costs of investing in index funds versus actively managed funds.

Tax-cost ratio

You may also incur fees other than those associated with fund management and operating expenses. This is the case if you put your shares in a taxable account. The tax cost can eat some portion of your profits. Typically, an index fund carries a 0.3 percent tax-cost ratio.

Steps to index fund investing

There are three steps to take to invest in index funds.

Step 1. Choose your index

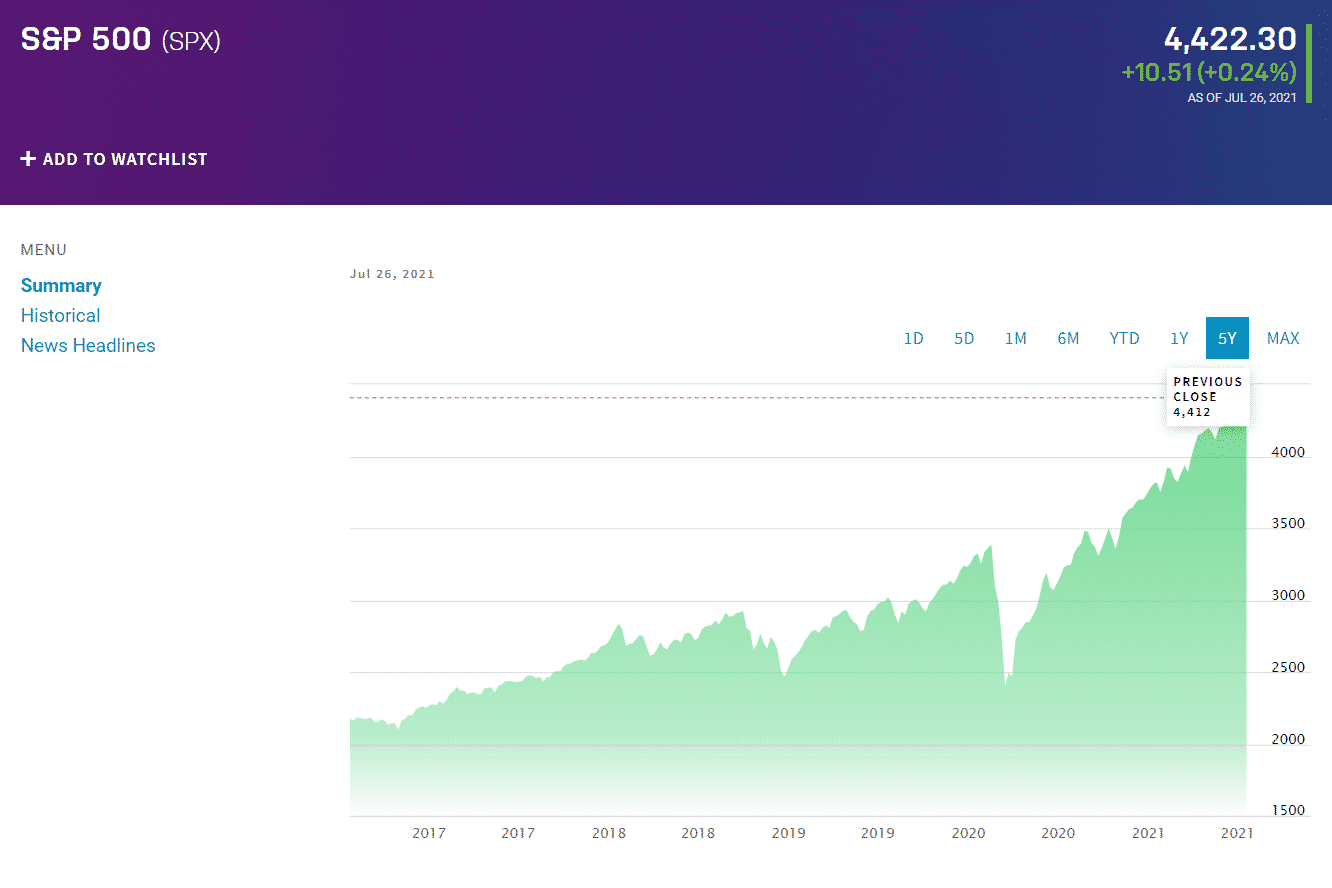

You have to select the index you would like to follow. One of the best options is the S&P 500 because it includes 500 large US companies covering various sectors in its portfolio. The graphic below shows the price of this index as of 26 July 2021.

- Company size

You can categorize companies according to their net worth: small, medium, or large.

- Industry or sector

Some indexes focus on technology, health products, consumer items, etc.

- Geography

Some stocks focus on trading the currency markets.

- Asset type

Some indexes follow commodities, foreign and domestic bonds, cash, etc.

- Market existence

Some indexes track new industries or sectors with great potential. Others focus on fully established markets.

Despite the number of choices available, you might need to invest in one or two index funds only. It all boils down to your financial capacity as an investor. The great investor Warren Buffet said that you could achieve proper diversification by investing in one market index that covers a broad range of sectors.

Step 2. Select the index fund

After deciding which index to focus on, you are now ready to select the index fund to invest in. You will probably base your selection primarily on cost. Low overhead is the main draw of index funds, to begin with. This is chiefly because this fund does not need an investment company to manage the portfolio actively. An index fund follows the performance of an index, and this is done automatically. Nevertheless, not all index funds are cheap.

While not managed by fund managers and advisors, index funds involve administrative fees. The fund will subtract a portion of this fee from your returns, whose amount is a certain percentage of your total investment.

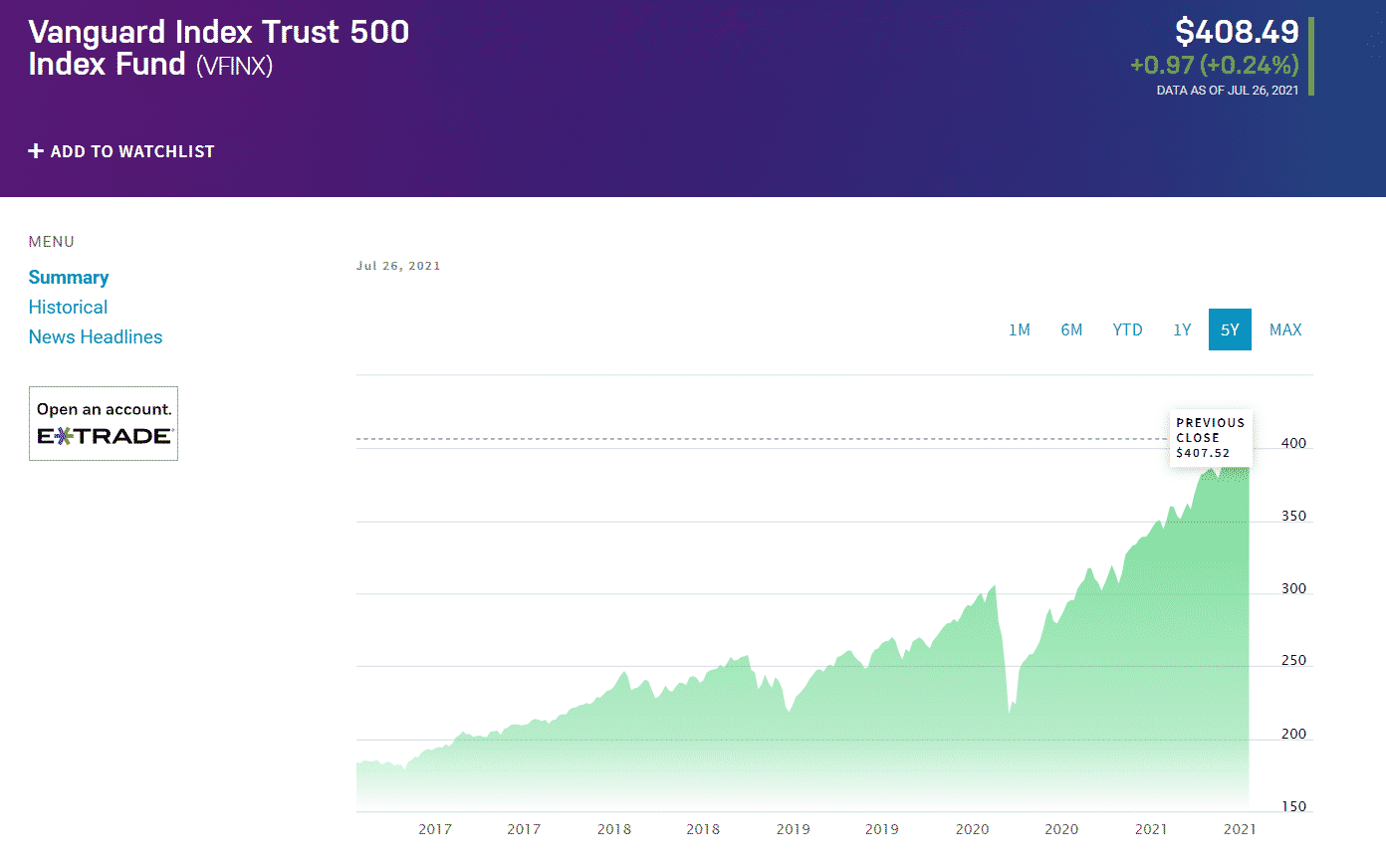

Be aware that two index funds following the same index, such as S&P 500, can have widely different management costs. You might think such costs are inherent in this type of investment and do not matter at all. However, know that they can have a severe toll on your profitability over the long term.

Therefore, you must compare one option against another and find one that has the lowest cost. A slight difference can have a significant impact on your returns. Typically, more enormous funds have lower fees.

Step 3. Decide where to buy an index fund

You have two options as to where to buy an index fund. You can purchase one either from a brokerage firm or from the company owning the index fund. Before you decide which provider to buy an index fund, consider the following things:

- Convenience

Try to find one provider that can serve all your investment needs. If you plan to invest in index funds, along with a mixture of stocks and other funds, one mutual fund company might be capable of providing all this to you.

- Trading cost

If the fund company or broker does not waive the transaction fee or commission, calculate how much you would pay when buying or selling the index fund. Keep in mind that commissions in mutual funds are higher when compared to stocks. The difference could reach twice as much.

- Impact

Do you want to make a positive impact on society and the environment in every share you buy? Consider investing in funds that take the environmental, societal, and governance (ESG) factors into consideration.

- Zero commission

If you consider buying an index fund from a broker, find out if it offers no commission or free transaction fee.

Final thoughts

In this article, you have learned about an index fund, the costs involved, and the steps to take when you are ready to engage. Now you can go much deeper in your search for the fund that will transform your life for good. Since haste makes waste, take your time and be thorough in your research.

Comments