Clean energy has been getting increasingly popular over the last decade. More and more institutions worldwide pledged to cut carbon emissions every month. The cherry on top of the cake came when the Biden administration stepped into the White House.

Electric vehicles, for that reason, became increasingly popular among the general population and investors. Even the United States President Joe Biden intends to have a fully electric federal fleet.

The results of the EV stocks mirror the development of the niche. The electric vehicle equities outpaced the performance of the S&P 500 index twofold when it comes to returns. If all of this sounds promising and appealing, stick with us and learn some of the best options for electric vehicle exchange-traded funds.

Top five electric vehicle ETFs

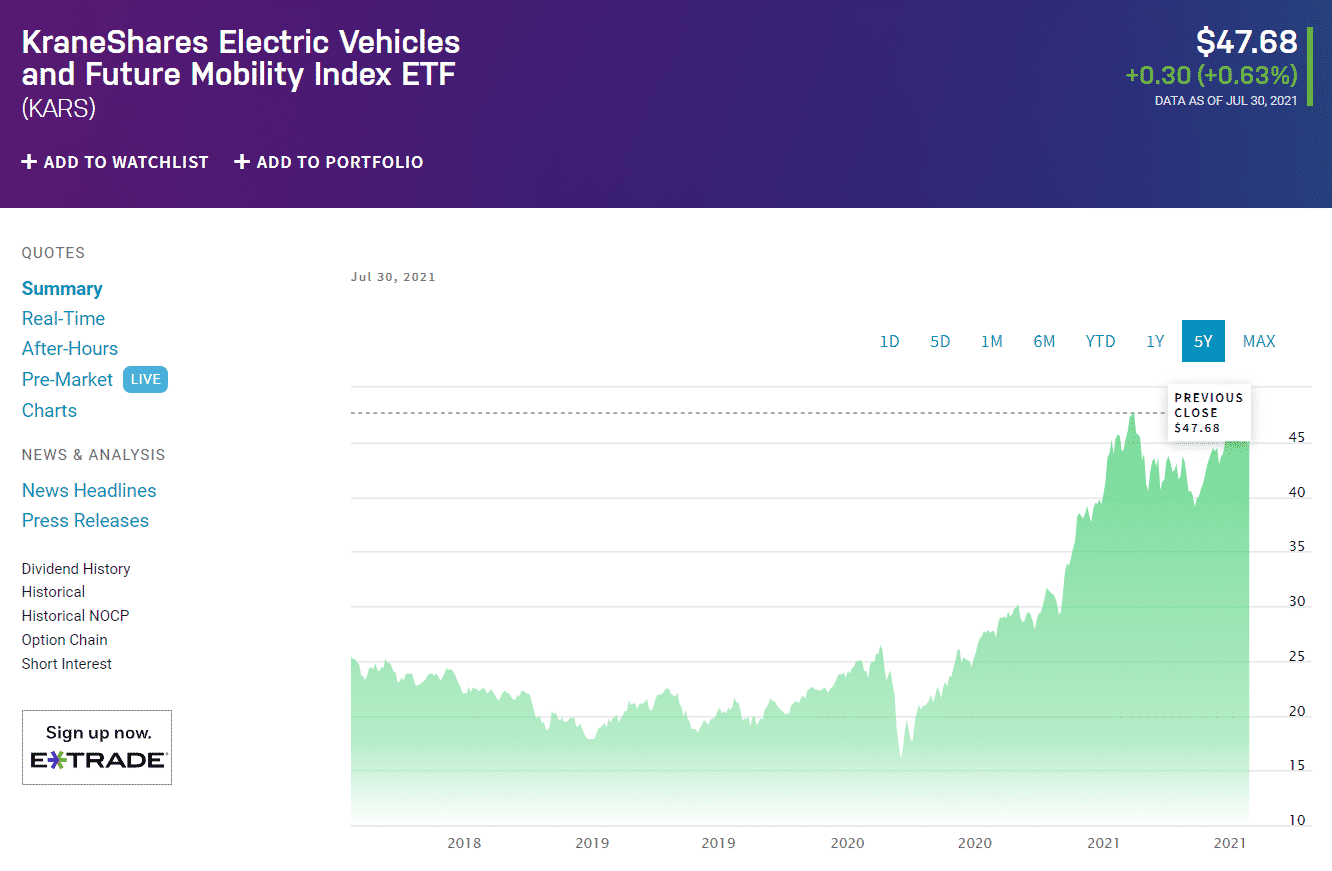

1. KraneShares Electric Vehicles & Future Mobility Index ETF (KARS)

KraneShares Electric Vehicles & Future Mobility ETF chart

KraneShares Electric Vehicles & Future Mobility Index ETF came to be in 2018 and mimics the performance of the Bloomberg Electric Vehicles Index. It comprises 60 holdings, with the two most prominent being American electric vehicle maker Tesla, founded by Elon Musk, and the Chinese up-and-coming carmaker NIO.

As can be seen from the previous statement, this ETF is more focused on specific electric vehicle production. So if you want as direct exposure as possible, choosing KARS could be the right choice for you.

Tesla and NIO account for almost one-fifth of the fund’s pull, but the remaining companies aren’t without their appeal. The fund’s average annualized returns came in at 66.8%, while its expense ratio is on the pricier side, at 0.72%. The ETF has a satisfactory 5.52/10 MSCI ESG rating and is in the ninth percentile by MarketWatch.

While its niche exposure is narrow, KARS also offers a broad range of holdings in terms of geography. Almost one-half of the fund’s holdings are US-based, but many ETF’s units are in Germany, the United Kingdom, France, Australia, China, and Japan.

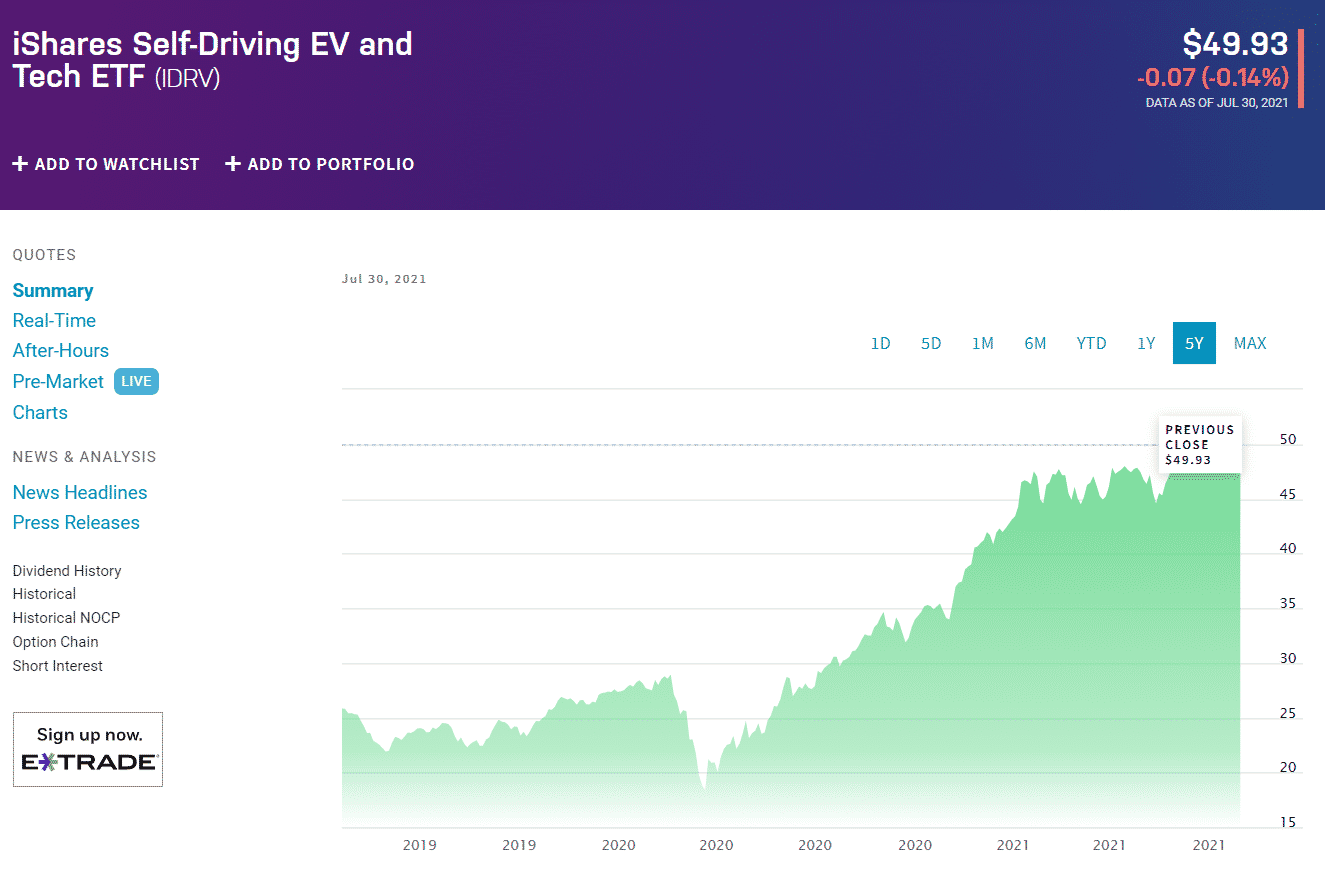

2. iShares Self-Driving EV and Tech ETF (IDRV)

iShares Self-Driving EV and Tech ETF chart

iShares Self-Driving EV and Tech ETF is a fund that offers pretty broad exposure to the electric vehicle industry as it consists of more than 100 holdings. It is characterized by a more general and forgiving approach, as it includes companies that manufacture traditional cars and dabble in electric vehicles. That is why you can find General Motors and Toyota among its holdings.

The way you want to look at a large number of holdings is your own choice. Some see it as a disadvantage, especially if they’re going to get more direct exposure to the niche’s most prominent names. On the other hand, those looking for one EV ETF to cover all their needs might find IDRV more than enough.

The IDRV ETF has a 5.55/10 MSCI ESG rating and ranks in the 47% percentile among its industry peers. It returned 61.22% every year, basically in line with the rest of the EV field. The fund’s last quarterly dividend came in at $0.2 at an expense ratio of 0.47% per share.

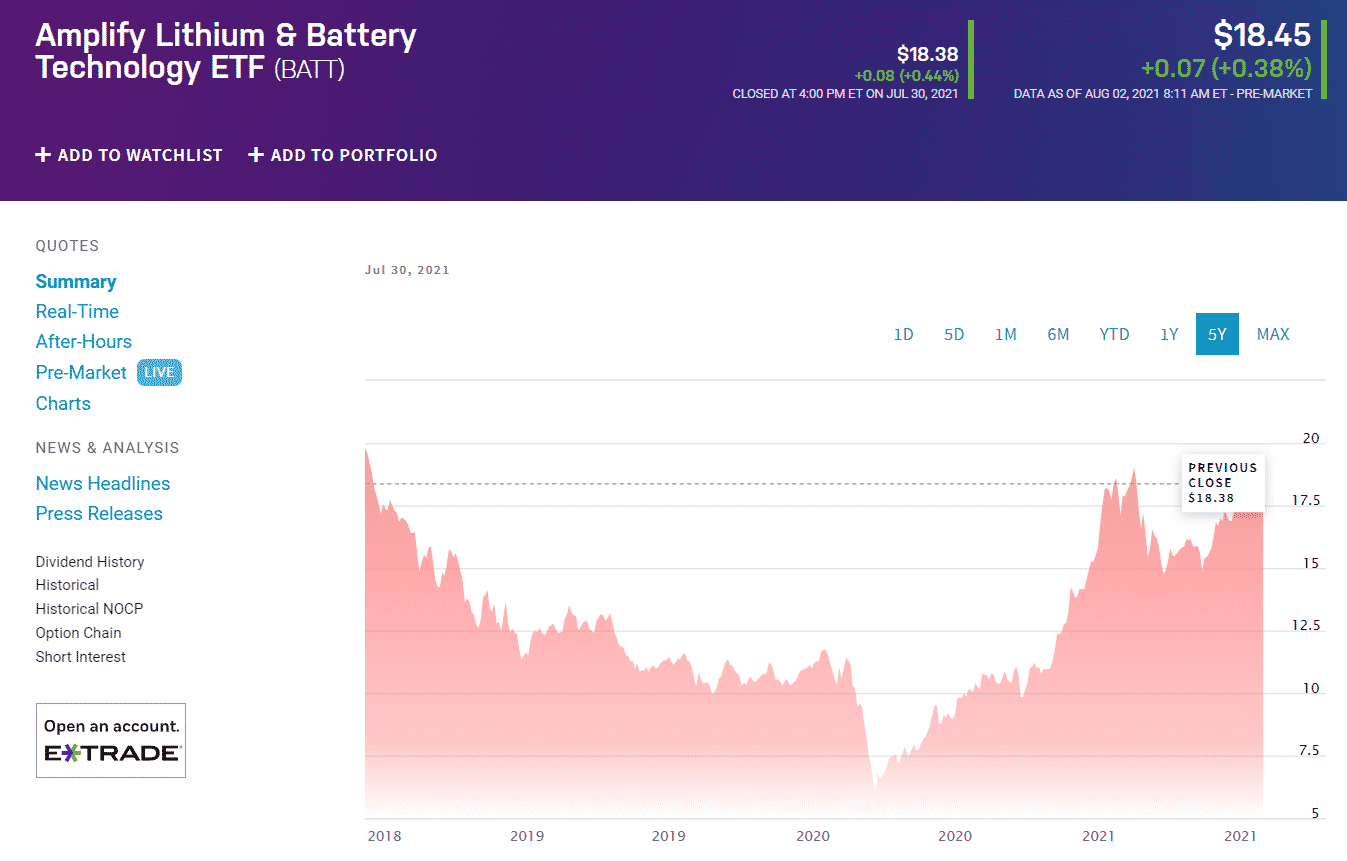

3. Amplify Lithium & Battery Tech ETF (BATT)

Amplify Lithium & Battery Tech ETF chart

Amplify Lithium & Battery Tech ETF BATT was made in 2018 and tracks the movements of the EQM Lithium & Battery Technology Index. According to the fund’s issuer, it represents a portfolio of companies that generate revenues from “the development, production, and use of lithium battery technology,” according to the fund’s issuer.

Tesla is one of the fund’s primary holdings, but not even the one with the strongest pull. It puts your money in firms that mine lithium and other new-technology-precious metals like nickel and manganese. Some of the top ten names include LG Chemicals, Norilsk Nickel, Glencore, and Samsung SDI.

The fund’s dividend amounted to $0.03 at an expense ratio of 0.59%. It has $213.66 million in assets under management. Its MSCI ESG rating is 5.86/10, which placed it in the 24% percentile among its peers.

Aside from those things and facts, the fund’s principal value comes in its prospects. More and more producers are turning to sustainable transport. The demand for lithium is already relatively high, but it only stands to gain in the future. If you are feeling optimistic about the future of green-energy transport, BATT could be the choice for you.

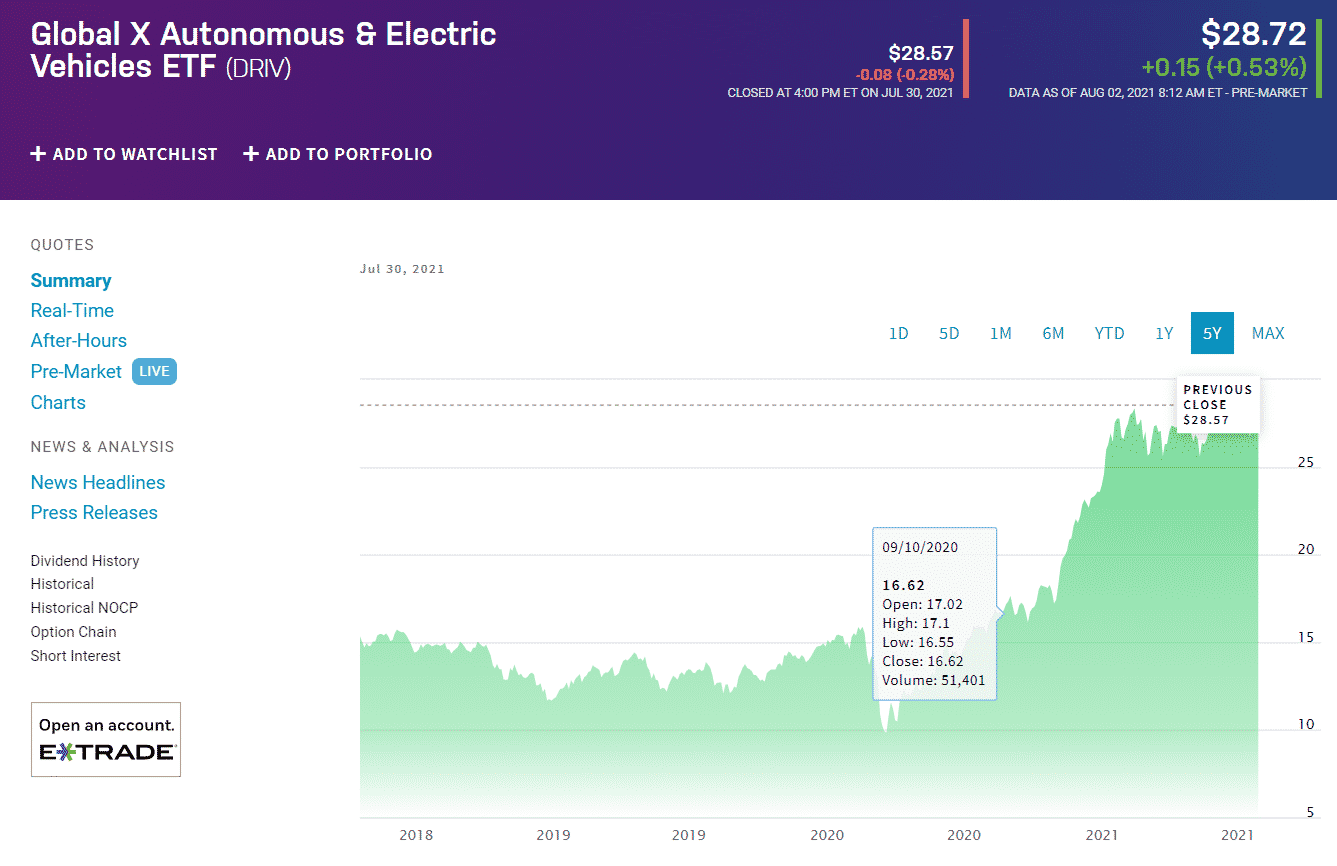

4. Global X Autonomous & Electric Vehicles ETF (DRIV)

The Global X Autonomous & Electric Vehicles ETF chart

The Global X Autonomous & Electric Vehicles ETF DRIV is slightly different from the rest of the funds listed here today. It, of course, includes the electric vehicle makers in the holdings, but it takes it a step further.

This ETF also exposes other, small and large, companies whose ties to the electric vehicle niche are a bit looser. That’s why its holdings comprise Microsoft, Apple, Nvidia, and Google’s parent Alphabet. These companies don’t necessarily come to mind when you think of electric vehicles, but they invest in technologies paramount for the industry.

It is also quite dispersed, geographically speaking. The most significant part of the fund’s constituents is in the United States, but it also invests in Germany, China, Japan, Australia, Hong Kong, Korea, and Italy.

Its returns in the past year came in at a whopping 82.92%, while its ESG rating, dividend, and expense ratio closely follow the rest of its industry peers.

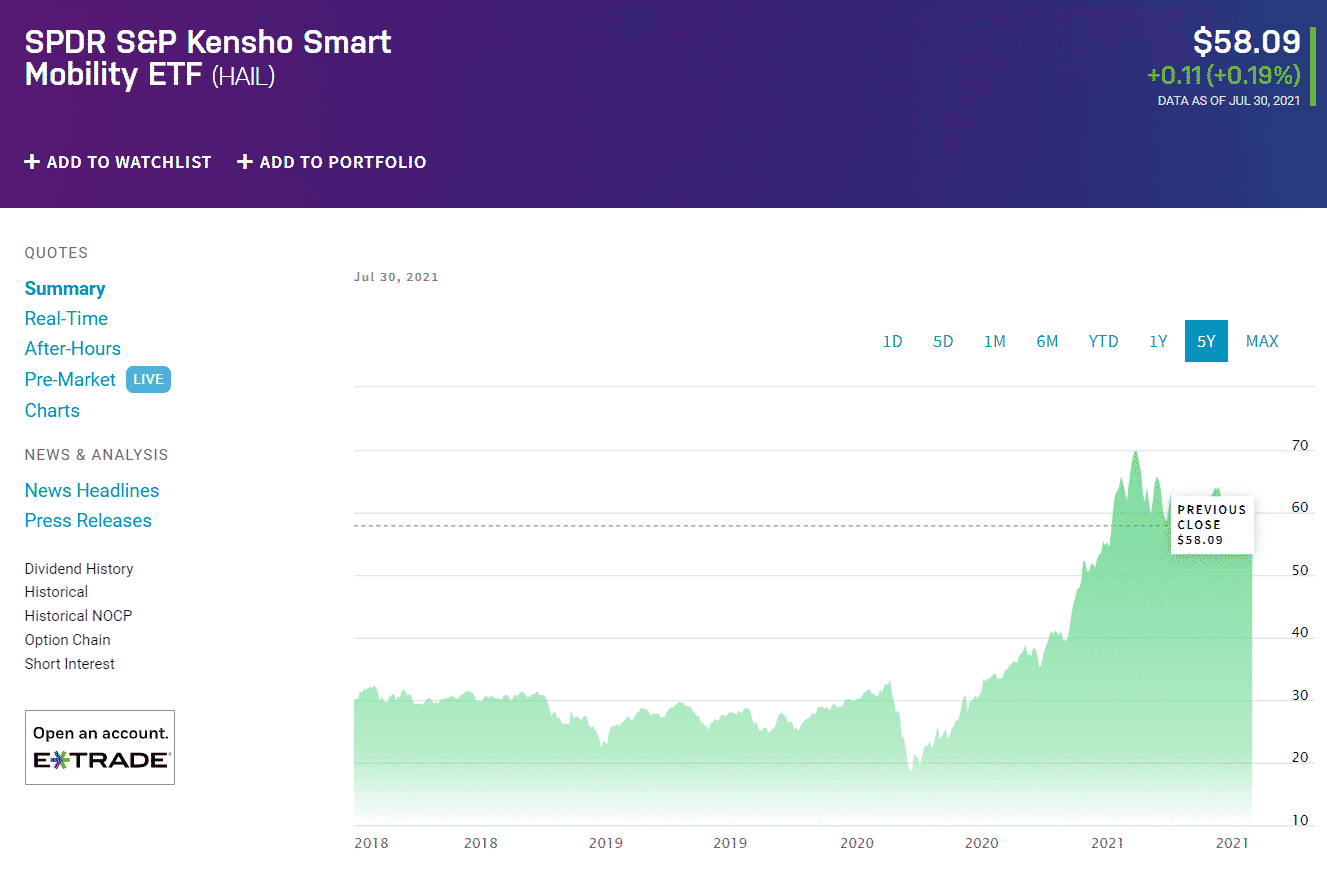

5. SPDR S&P Kensho Smart Mobility ETF (HAIL)

The SPDR S&P Kensho Smart Mobility ETF chart

The SPDR S&P Kensho Smart Mobility ETF was founded in December 2017 and mimicked the movements of the S&P Kensho Smart Transportation Index. Its expense ratio is not as high as those of other funds. It came in at 0.45%, while its dividend stood at $0.15. It has an average 5.88/10 MSCI ESG rating. Its returns are admirable and in line with the rest of the industry’s leaders. They came in at 66.5%.

What separates the HAIL ETF from the rest is its broad range of holdings offered. It doesn’t rely solely on electric car makers or power-supply-oriented companies. This ETF provides exposure to companies specialized in almost every aspect of the so-called smart technology transport. Even if you want automated agricultural tractors or drones, this fund has got you covered.

The HAIL ETF also undergoes more frequent rebalances than other ETFs from the niche, and it does so to avoid one of the holdings having more weight than the fund’s other constituents.

Final thoughts

The most obvious differences among the ETF funds focused on electric vehicles are the widths of the fund’s portfolios. That is in no way a bad thing. It just means that you are free to choose the approach you think will fit your investment goals and strategy best.

IHS Market has previously forecasted that the sales of electric vehicles will soar by 70% in 2021, so the time couldn’t be more perfect to jump on the bandwagon if you are interested in the field.

It is essential to do your research before diving into the pool of EV stocks or ETFs. Be sure to put in the effort to find the perfect fit for your objective.

Comments