When thinking about portfolio diversification, everyone seeks to maximize financial returns by reducing risks, which is never wrong. However, investors nowadays have adopted a new paradigm toward investing. They begin to think in terms of how their investment decisions could impact society at large. When you consider adding exchange-traded funds or ETFs investments to your portfolio, selecting those funds that incorporate environmental, social, and governance (ESG) factors is a good idea.

In terms of ESG options, you have a lot to choose from as the number of ESG-centered ETFs is continuously growing. With this new investing mindset, you can continue seeking returns while making a positive impact that would benefit humanity. In addition, ESG funds tend to do better than the traditional ETF options, despite being a newcomer to the field of investing.

What is an ESG?

Before we go deeper into our discussion, it is essential to know what ESG means at this point. It is a type of investment that embraces the principles of environmental, social, and governance practices. It is a mutual fund that combines multiple stocks focusing on a specific ESG theme, such as reducing the use and discharge of carbon to the atmosphere.

Below is an example of the themes where ESG funds may focus on:

- Energy efficiency

- Alternative energy

- Global sanitation

- Education

- Shareholder rights

- Board diversity

An ESG fund is not an individual stock. Instead, it is a set of stocks grouped by theme. In terms of risk, investing in an ESG fund is better than buying an individual stock. With an ESG fund, your investment has more chances to survive the odds than when you buy one stock. Even if one company shuts down its business operations, other companies in the portfolio can keep the investment afloat.

Benefits of ESG investing

If you are a seasoned investor, you already know the importance of portfolio diversification in investing. ESG funds should make your list. If you think ESG funds are significant but are not convinced to invest yet, there are at least three benefits to this investment you should know about.

-

Promote positive change in society

As an investor, you can bring about change in every ETF investment that you make. This is because it shows investors are thinking about the good of society. Once powerful and large corporations notice this trend, it will influence them to do business responsibly. As a result, they will revisit their business practices to check how they impact the world. This means you now have the power as an investor to make meaningful changes in society.

-

Better performance than traditional funds

If making an impact is not enough to convince you to invest in ESG funds, be aware that doing so can significantly improve the performance of your portfolio. As previously mentioned, ESG funds are not inferior to their traditional counterparts in terms of investment return. On the contrary, they often outperform the standard ETF options in this respect.

-

Reduced risk

Compared to traditional funds, ESG funds have lower risks overall. This is already the current scenario despite being a newcomer to this business. Moreover, ESG funds tend to perform well in both ideal and poor market conditions. This resiliency amid challenging market environments shows that ESG funds are promising investments.

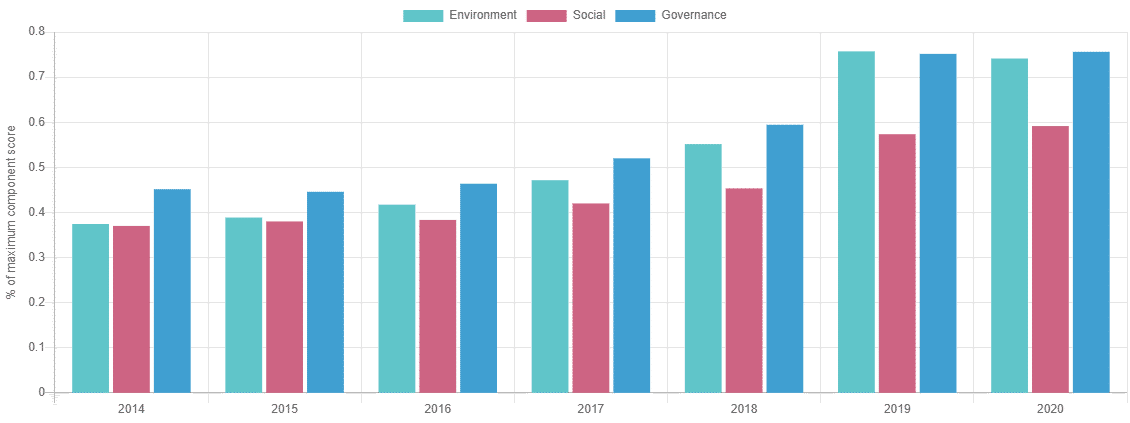

The current trend among companies is that they now give more attention to their potential impact on the environment and society. This makes ESG investing an attractive venture for investors. The above graphic shows the yearly performance of companies in terms of ESG policy and practices from the last seven years. So it shows the growing awareness of the importance of responsible business practices.

ESG metrics

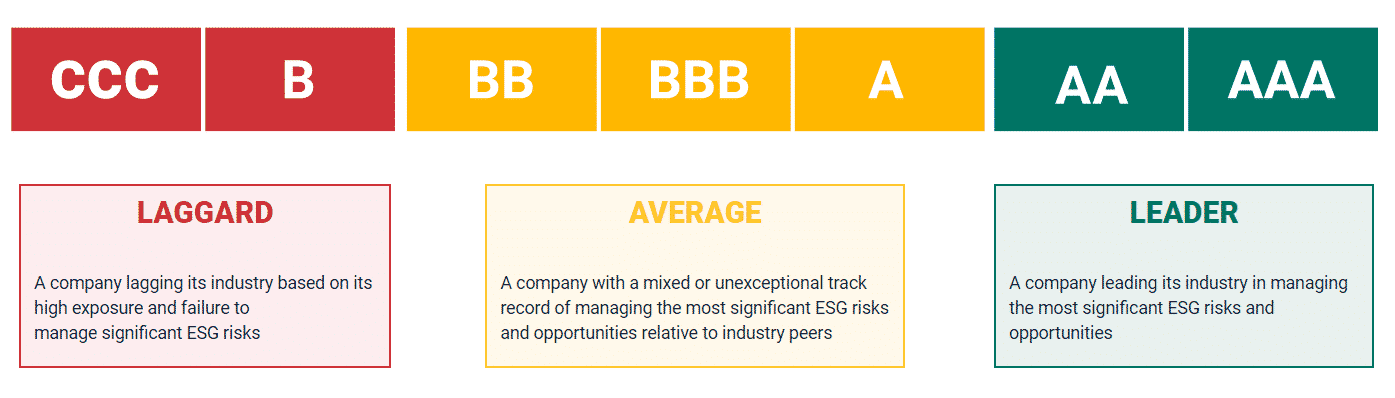

ESG funds are rated on three high-level metrics. This can give you an idea of which ESG funds are worth investing in.

These three metrics are:

-

ESG Score Global Percentile

The figure ranges from 0 to 100. It represents the ESG score of an ETF asset concerning all ESG funds covered.

-

ESG Score Peer Percentile

This figure ranges from 0 to 100. It represents the ESG score of an ETF asset concerning other ESG funds in the same class.

-

ESG Quality Score

This figure represents the overall ESG score. The value defines how an underlying ETF asset manages medium-term and long-term opportunities and risks in terms of the three ESG factors (i.e., environmental, social, and governance).

You can judge the value of an ESG fund by the above metrics. A high value means the fund is a good investment compared to another fund with a lower value.

How do environmental, social, and governance criteria work?

Investors look at various behaviors to evaluate a company based on environmental, social, and corporate criteria.

- Environmental criteria

It includes the company’s energy, waste, pollution, conservation of natural resources, and animal management. The requirements can also be used to assess any environmental risks a company may face and how the company is managing those risks.

- Social criteria

It defines the business relationship of a company. Does it work with suppliers who adhere to the same values she claims? Does the company donate a percentage of its profits to the local community or encourages employees to volunteer there? Are the interests of other stakeholders considered?

- Corporate criteria

It will interest investors in terms of the company’s accurate and transparent accounting methods. They may also need to ensure that companies avoid conflicts of interest when electing board members, do not use political contributions to gain overly favorable treatment, and of course, do not engage in illegal activities.

Of course, no company can pass all the tests in every category, so investors must decide what matters most. For example, Trillium Asset Management, based in Boston and under $2.8 billion in management as of March 2020, uses a set of ESG factors to help identify companies that can deliver strong long-term results.

Which ESG fund to invest in

In addition to having a high-quality score, an ESG asset should carry a mission that you can relate to. Therefore, it is better to invest in those ESG funds whose goals align with yours. For example, what may be necessary to you as an investor is a social impact. This might include equity, diversity, and inclusion. If that is the case, you should find and invest in funds that focus on companies supporting the causes for equity, diversity, and inclusion.

On the other hand, if you are vying for renewable energy and clean water, you must find a fund that focuses on that sector. Then, once you find the industry that resonates well with you, that is where you should invest your dollars, disregarding minor differences in investment costs.

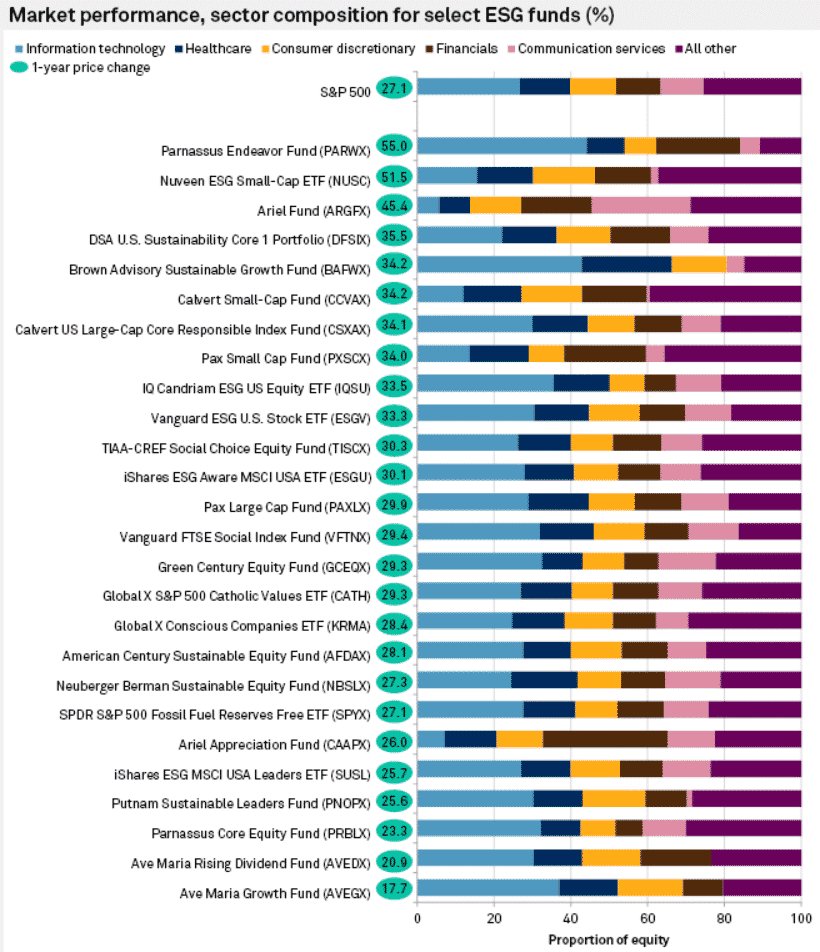

To get started on your ESG investing journey, check out which ESG funds are leading the way. This will give you an idea about the services that investors are primarily interested in. Then you can narrow down your choices by identifying which funds operate on the sectors you have in mind. The above graphic shows the top-performing ESG funds as of March 8, 2021, in terms of return.

Focus on long-term value

Some investors think that investing in ESG funds would mean passing up on getting high returns. Keep in mind that there are always times when ESG funds perform better or more flawed than the market in any type of investment. Therefore, you should not focus on short-term growth. Think about long-term value. While each investment may not produce consistent returns, the overall portfolio should play out well over the long haul. This is to be expected because different funds focus on other sectors.

Final thoughts

When diversifying your portfolio, proper allocation of funds matters. See that you do not overinvest in a specific asset class or industry. If you have particular sectors in mind, but you are not sure which ESG assets to choose, you can seek the help of a financial advisor. If you have the luxury of time to do research, you can pick the ESG funds you dearly love.

Comments