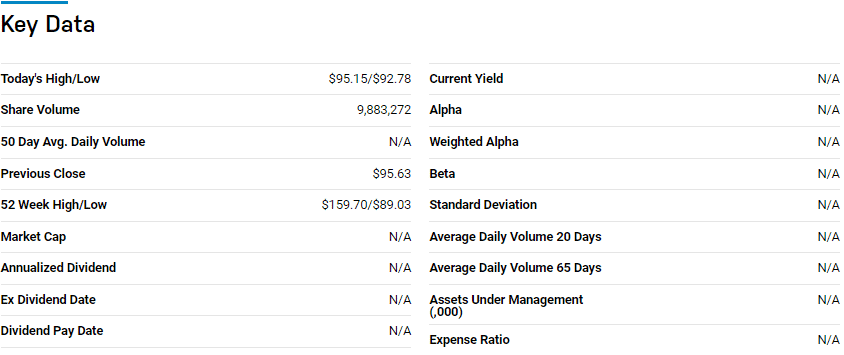

Nickel has been a base metal used in the silver industry as a coating to avoid corrosion. In addition to being in high demand in the stainless-steel space, nickel has been a mainstay in producing electric vehicle batteries due to its green properties.

In addition to being a green metal, nickel is stable at high temperatures providing a more extended driving range for EVs. Tesla is already in talks with several producers to lock nickel supply as the world evolves to EVs. As a result of these factors, analysts see demand for nickel increase at a CAGR of 5% to 2026.

Nickel ETFs for the best opportunities: how do they work?

As the world embarks on decarbonization to save the mother earth from effects that date back to the industrial revolution, the demand for nickel is expected to quadruple for the next 30 years. So how do investors benefit from this rising demand and make money?

Nickel exchange-traded fund is the answer. Nickel ETFs comprise investment securities linked to nickel exploration, mining, conversion, firms who use nickel as their primary input, and firms providing ancillary services to this industry.

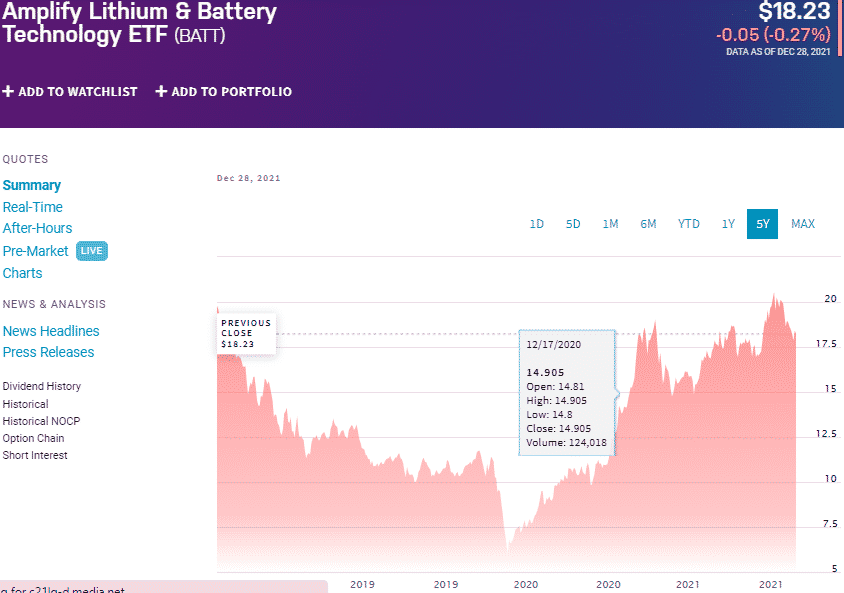

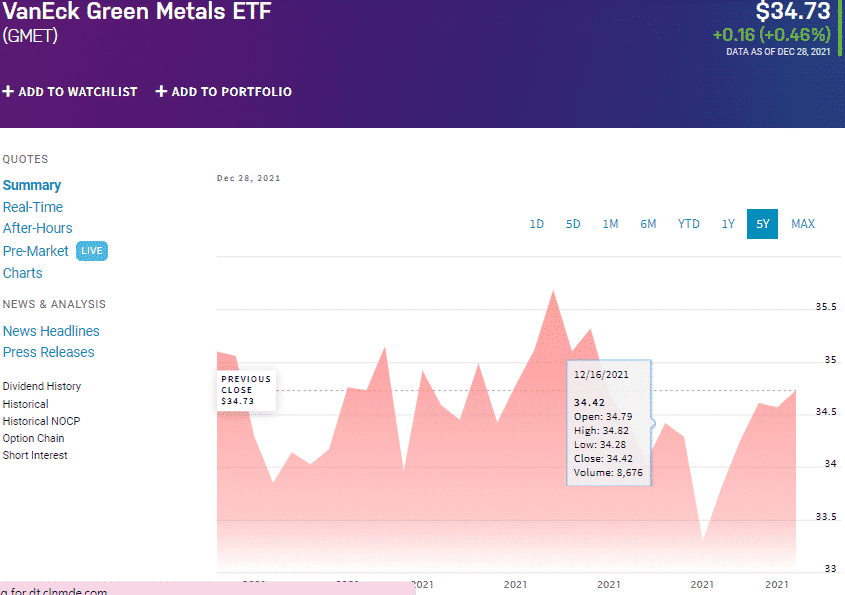

№ 1. Amplify Lithium and Battery Technology ETF (BATT)

Price: $18.23

Expense ratio: 0.59%

Dividend yield: 0.17%

BATT chart

Amplify Lithium & Battery Technology ETF tracks the EQM Lithium & Battery Technology Index, investing at least 80% of its total assets in the underlying holdings of the composite index. This ETF offers diversified and indirect exposure to the nickel market through the global mining equities of all inputs utilized in lithium battery production.

The top three holdings of this non-diversified ETF are:

- Contemporary Amperex Technology Co., Ltd. Class A — 7.20%

- BHP Group Limited Sponsored ADR — 6.68%

- Tesla Inc. — 6.14%

The BATT ETF has $239.2 million in assets under management, with an expense ratio of 0.59%. Unlike most lithium-based ETFs, this ETF concentrates on mining companies exploring and converting EV battery inputs with only 20% allotted for automakers.

This diversification makes BATT an excellent play on nickel as the main lithium battery ingredient. Since its launch, this ETF has also had superior returns putting a strong case for its consideration for a look into in 2022; 3-year returns of 65.11%, pandemic year returns of 18.00%, and current year to date returns of 15.31%.

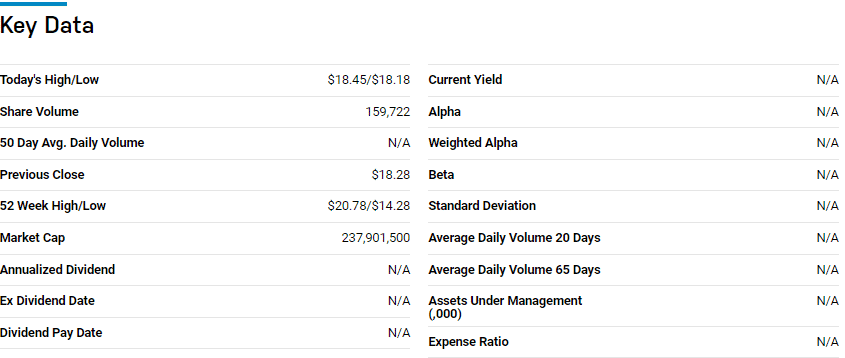

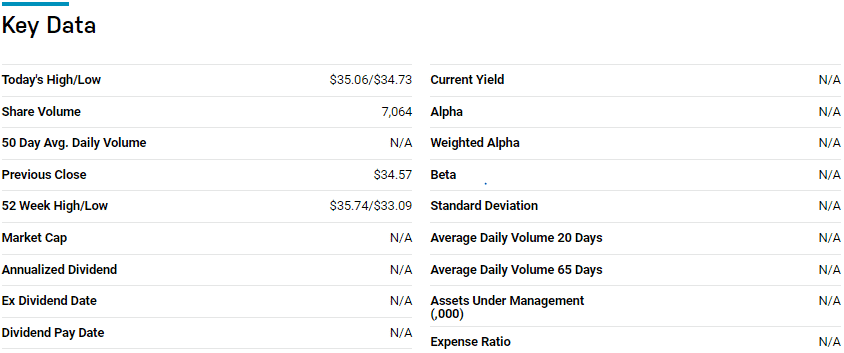

№ 2. VanEck Green Metals ETF (GMET)

Price: $34.73

Expense ratio: 0.59%

Dividend yield: N/A

GMET chart

The VanEck Green Metals ETF tracks the MVIS® Global Clean-Tech Metals Index, investing at least 80% of its total assets in clean metal companies. This non-diversified fund exposes investors to the global companies involved in the exploration, refining, processing, and production of metals for use in decarbonization efforts.

The top three holdings of this non-diversified ETF are:

- Freeport-McMoRan, Inc. — 8.71%

- Glencore plc — 8.45%

- Ganfeng Lithium Co., Ltd. Class A — 5.63%

GMET ETF has $15.5 million in assets under management, with investors’ parting with $59 annually for every $10000 invested. With the global focus on clean energy and technologies that will result in decarbonization, GMET offers nickel investors an early indirect play into the green technology space.

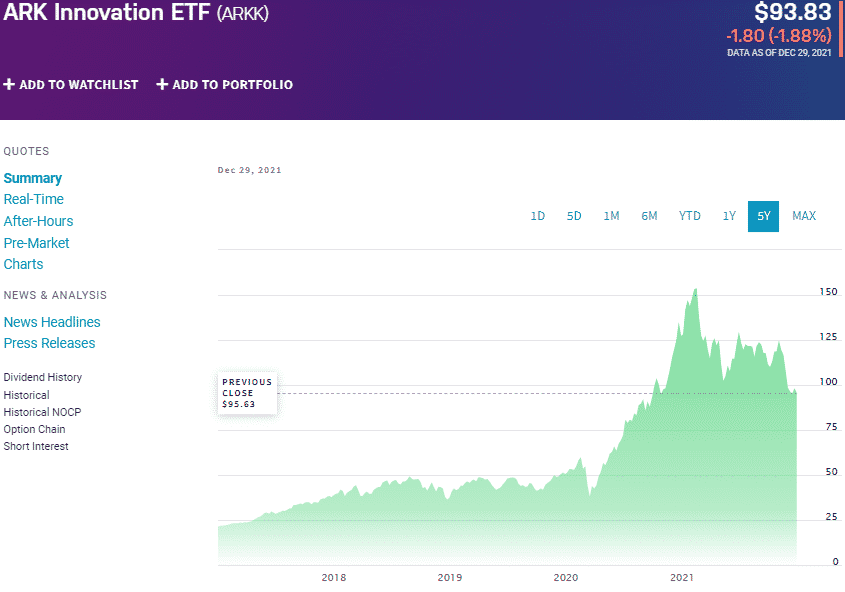

№ 3. ARK Innovation ETF (ARKK)

Price: $93.83

Expense ratio: 0.75%

Dividend yield: 1.74%

ARKK chart

If interested in nickel investment in this age, it’s all about the disruptive technologies it supports. As such, ARK Innovation ETF comes to play. It is an actively managed fund from Cathie Wood and Co. that invests in the enablers, leaders, and leading disruptive technology beneficiaries.

The top three holdings of this non-diversified ETF are:

- Tesla Inc. – 8.49%

- Roku, Inc. Class A – 6.25%

- Teladoc Health, Inc. – 5.80%

ARKK ETF has $16.82 billion in assets under management, with an expense ratio of 0.75%. ARK investment tends to beat the market, which accounts for the phenomenal returns of this fund; 5-year returns of 373.45%, 3- year returns of 168.88%, pandemic year returns of -25.15%, and year to date returns of -23.18%.

Since the start of the coronavirus, ARKK ETF has experienced some tailwinds. Still, it provides an opportunity to buy a deep and has an indirect and diversified play on nickel via its more than 10% concentration on EV technology.

Final thoughts

The global appetite for carbon-conscious products is rising, setting up a platform for flourishing green metals. Nickel is at the forefront of this revolution both as a primary lithium battery ingredient and a decarbonization agent.

In addition, the global appetite for stainless steel is also on the rise, and nickel is a significant component, with China’s insatiable appetite leading to demand for this green metal. The ETFs above are not pure-play nickel funds but have substantial exposure to nickel industries, hence an excellent starting point to benefit from increasing prices.

Comments