As the economy recovers post-pandemic, mid-cap ETFs represent an avenue for reaping colossal cash from the economy. They are an asset class that the pandemic has hit but not so much as the small-cap niche requiring much less stimulus to recover their capacities. It is thus a niche that promises excellent room for improvement but with manageable volatility and within acceptable risk levels.

Data shows that small-cap ETFs outperform large-cap ETFs. However, this performance comes at a steep price in the form of investment risks. Is there a balance between high-risk, high reward and low-risk, low reward? Mid-cap equities are large enough and established to skirt the volatility coupled with small-cap equities, but not so large as to stagnate and lack growth.

The question is, which mid-cap ETFs will offer not only wealth growth but dividend growth? Here we tackle the best mid-cap growth ETFs to invest in for dividend growth and wealth accumulation.

What is a midcap dividend ETF?

Mid-cap equities refer to companies with approximately $2 billion and $10 billion market capitalization. Mid-cap equities, in most cases, represent the best of both worlds between small-cap equities and large-cap equities; they have room for growth without the high volatility of small-cap stocks. Therefore, midcap dividend ETFs are exchange-traded funds comprising a basket of equities whose organizations’ market capitalization is $2-$10 billion and regularly pay dividends.

Historically, mid-cap equities have outperformed large-cap equities for several years after a significant financial crisis. Post the early 2000s recession, the mid-cap sector outperformed the large-cap industry for three consecutive years. The same phenomenon was replicated again after the 2008 recession with the mid-cap sector, outperforming the large-cap sector for five consecutive years, 2009-2013.

Since 2014, mid-cap equities have lagged as compared to large-cap ETFs. Given the past performances and data, the Covid-19 pandemic is the kind of lifeline this sector needed to resurge. In times of unchecked inflation, midcap ETFs have proven to be the go-to investment vehicle to take advantage of an expanding economy while hedging against rising inflation.

The best dividend ETFs for Q4 2021

These are the best mid-cap ETFs to buy in 2021 because they are the investment “goldilocks,” provide growth potential, have a history of dividend growth, and provide stability as the economy regains full operation post-pandemic.

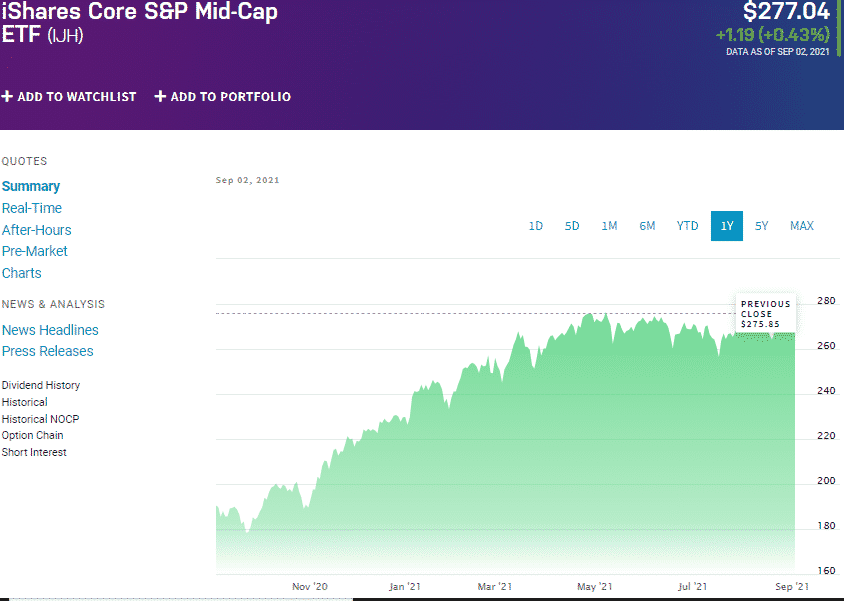

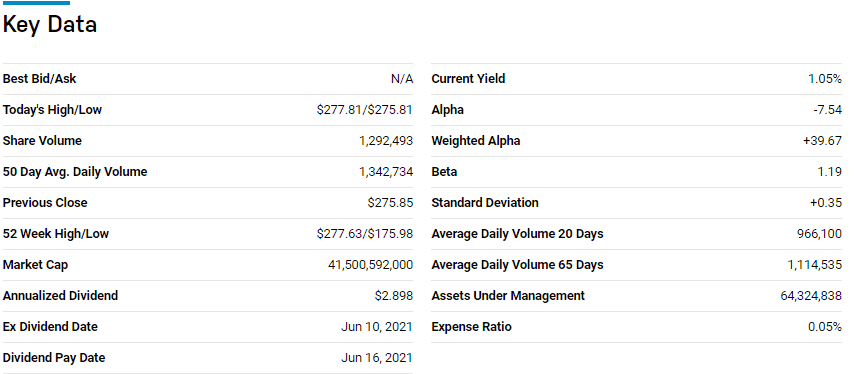

№ 1. iShares Core S&P Mid-cap ETF (IJH)

Price: $277.04

Expense ratio: 0.05%

Dividend yield: 1.05%

IJH

The IJH ETF is the bid body of midcap exchange-traded funds with 64.84 billion in assets under management. It invests at least 80% in its underlying holdings, with the remainder being in assets in swap contracts, cash and cash equivalents, options, and futures. It exposes investors to the best 400 US publicly listed mid-cap companies by tracking the S&P midcap 400 index.

This ETF is ranked #6 by US News analysts among passively managed, mid-cap blend funds. It is no surprise that the top three holdings for the IJH are Molina Healthcare Inc. — 0.66%, Cognex Corp. — 0.65%, and Solaredge Technologies Inc. — 0.63%.

With quarterly dividends of $0.74 to the share, and current dividend yield standing at 1.05%, this ETF is worth crossing the crosshairs for portfolio diversification.

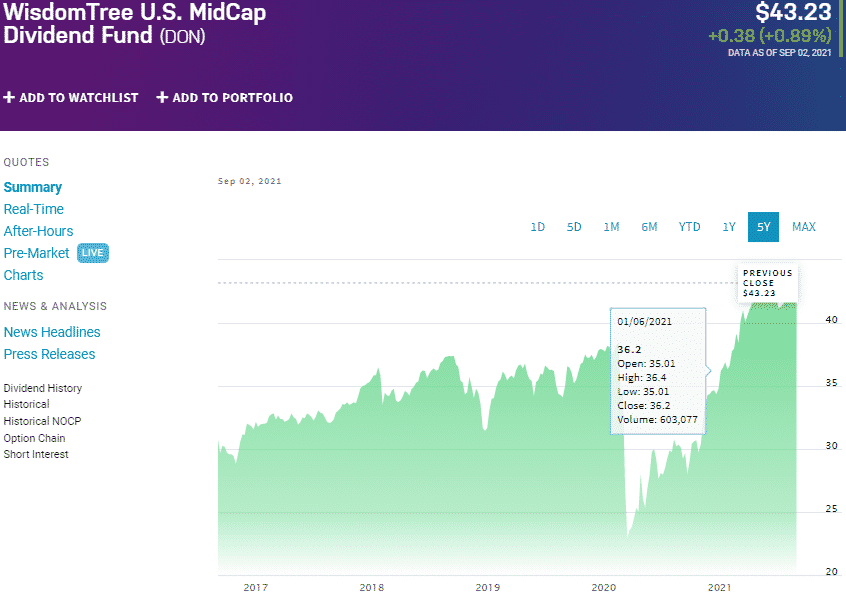

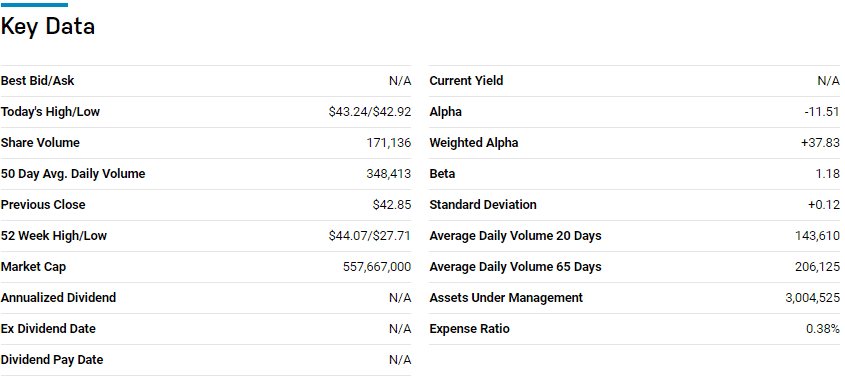

№ 2. WisdomTree US MidCap Dividend ETF (DON)

Price: $43.23

Expense ratio: 0.38%

Dividend yield: 2.07%

DON

The DON ETF is a non-diversified fund comprising US midcap companies that regularly pay dividends. It tracks the performance of the WisdomTree US midcap dividend index and invests at least 95% of its assets in its composite holdings to ensure reduced tracking deviations.

This ETF is ranked #9 by US News analysts among passively managed, mid-cap value ETFs for long-term investing. It is a popular exchange-traded fund for income investing which comes as no surprise given that its top holdings are Antero Midstream Corp. — 1.56%, Interpublic Group of Cos Inc. — 1.44%, and Franklin Resources Inc. — 1.41%.

With quarterly dividends of $0.10 to the share, and current dividend yield standing at 2.07%, this ETF is worth being on the crosshairs, especially for income investing purposes.

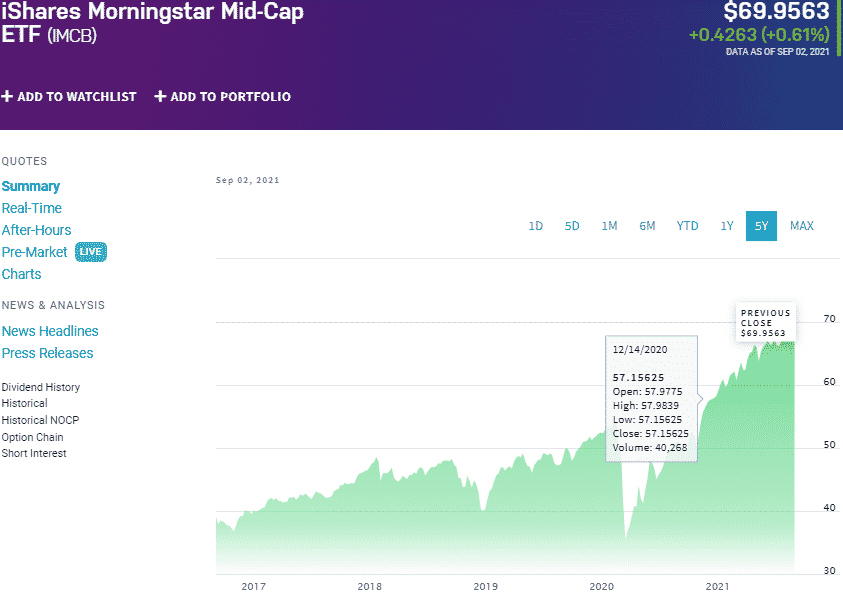

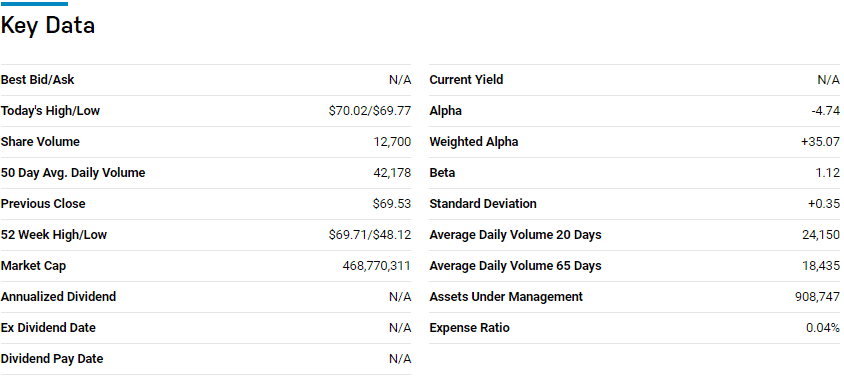

№ 3. iShares Morningstar Mid-Cap ETF (IMCB)

Price: $69.96

Expense ratio: 0.38%

Dividend yield: 2.45%

IMCB

The IMCB ETF tracks the performance of the Morningstar US midcap index and exposes investors to midcap corporations that have a history of providing investors with both growth and value. The underlying holdings vetting is via Morningstar’s Inc proprietary index methodology, which also tracks the performance of stocks issued by mid-cap organizations.

This ETF is ranked #20 by US News analysts among passively managed, mid-cap blend funds. It is no surprise given that the top three holdings for the IMCB are Dexcom Inc. — 0.57%, Marvel Technologies — 0.56%, and Cadence Design Systems Inc. — 0.51%.

With quarterly dividends of $0.16 to the share and current dividend yield standing at 2.45%, this ETF is worth crosshairs for capital appreciation and income investing purposes.

Final thoughts

Midcap ETFs are the go-to investment vehicles for quick capital appreciation while managing risks in a low-interest-rate environment. In times of rising inflation, the midcap growth rate acts as a hedging strategy.

The post-pandemic economy is a mix of a low-interest-rate environment and increasing inflation, with the FED uninterested in changing the situation in the foreseeable future. As such, the mid-cap dividend ETFs above not only offer a steady income but the potential for massive capital appreciation.

Comments