The media has focused so much on the automotive side of artificial intelligence that most people don’t realize it is in use across the entire spectrum of what we do. Artificial intelligence is gaining traction with application in social media management, robotics-both industrial and non-industrial, 3D printing, and healthcare.

According to Elon Musk, the pace of artificial intelligence development is exponential, and at worst, incredibly fast. Human nature has been wired inherently to look for ways to live a hassle-free life. Artificial intelligence at its core simulates human intelligence by leveraging powerful algorithms, resulting in increased productivity and zero inefficiencies.

AI technology is poised to be the next disruptive technology given its quick and widespread adoption, ability to evolve exponentially, and the profitability and cost efficiency coupled to its use. The major challenge for investors seeking to go long-term on AI equities is that pure-play AI companies are small and come with a lot of volatility.

Let’s check if investing in AI ETFs is the best option.

What is an AI ETF?

AI ETFs comprise a pool of equities with interests in the artificial intelligence landscape. In the investment circles, some refer to ETFs that use artificial intelligence for picking investment options as AI ETFs but here we focus on those with underlying holdings that have an interest in AI:

- Organizations that generate at least 25% of their revenues from AI-related activities.

- Companies are primarily involved in AI research and development, products, services, and research.

Therefore, the ETFs here have underlying holdings with interests in ETFs used in the industrial sector, healthcare sector, automotive industry, and robotics.

The best growth AI ETFs under $49

With disruptive technologies and emerging markets, investors are sure that there will be growth, but it is difficult to say with certainty which actual equities will go the nine yards. In addition, such technologies call for an investment in low-cost assets, ensuring enough legroom for growth.

As such, the ETFs below expose investors to the phenomenal growth of the AI technological niche for less than $49.

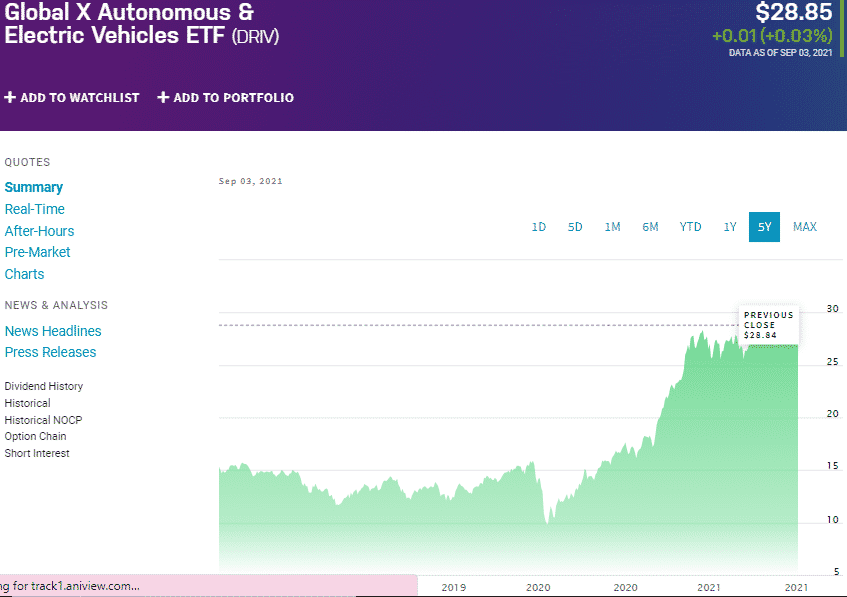

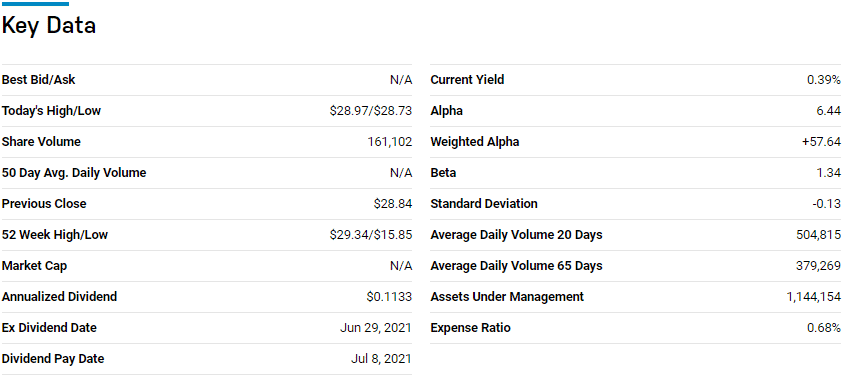

№ 1. Global X Autonomous & Electric Vehicles ETF (DRIV)

Price: $28.85

Expense ratio: 0.68%

The Global X Autonomous & Electric Vehicles ETF tracks the Solactive Autonomous & Electric Vehicles Index, investing on the minimum 80% in its underlying index, ensuring minimal results deviation to the tracked index. It is a non-diversified fund giving investors exposure to organizations involved in autonomous vehicle development, development of electric and hybrid vehicles, networked services for transportation, and the manufacture of electric and hybrid vehicles’ components.

This ETF is ranked #4 by US News analysts among Miscellaneous sector ETFs for long-term investing. The top three holdings for DRIV ETF are NVIDIA Corp. — 3.27%, Tesla Inc. — 3.25%, and Alphabet Inc. Class A Shares — 3.22%.

This ETF has $1.1 billion in assets under management, with an expense ratio of 0.68%. In the last three years, DRIV returns have been 104.21%, with the pandemic year returns 69.87% and the year-to-date returns standing at 20.77%.

With the increased global adoption of electric vehicles, this AI ETF is ideal for portfolio diversification and wealth growth.

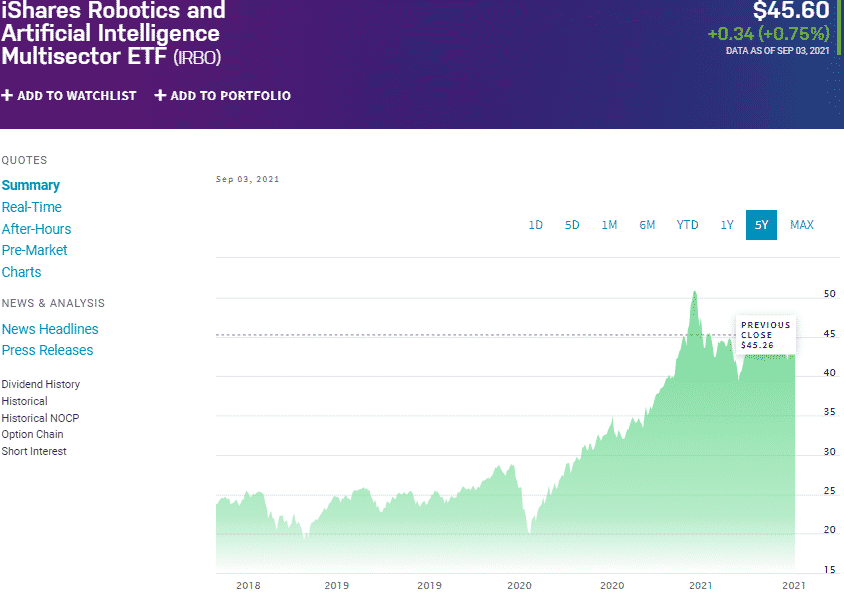

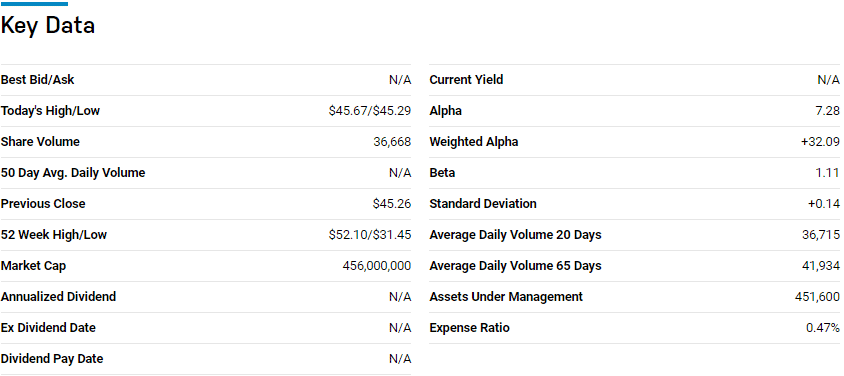

№ 2. iShares Robotics and Artificial Intelligence Multisector ETF (IRBO)

Price: $45.60

Expense ratio: 0.47%

The IRBO ETF tracks the NYSE Factset Global Robotics and Artificial Intelligence index, investing a minimum of 80% in its underlying index to ensure minimal result deviations to the tracked index. It is a diversified fund with tentacles across multiple industries with interests in AI technology across the globe.

The top three holdings of the IRBO ETF include MicroStrategy Inc. Class A Shares — 1.29%, Sohu Com ltd — 1.28%, and Americas Technology Acquisition Corp. — 1.27%.

This ETF has $455.51 million in assets under management, with an expense ratio of 0.47%. In the last three years, IRBO returns have been 83.63%, with the pandemic year returns 37.94% and the year-to-date returns standing at 14.73%.

For a diversified AI portfolio with interests across borders, the IRBO is a great option.

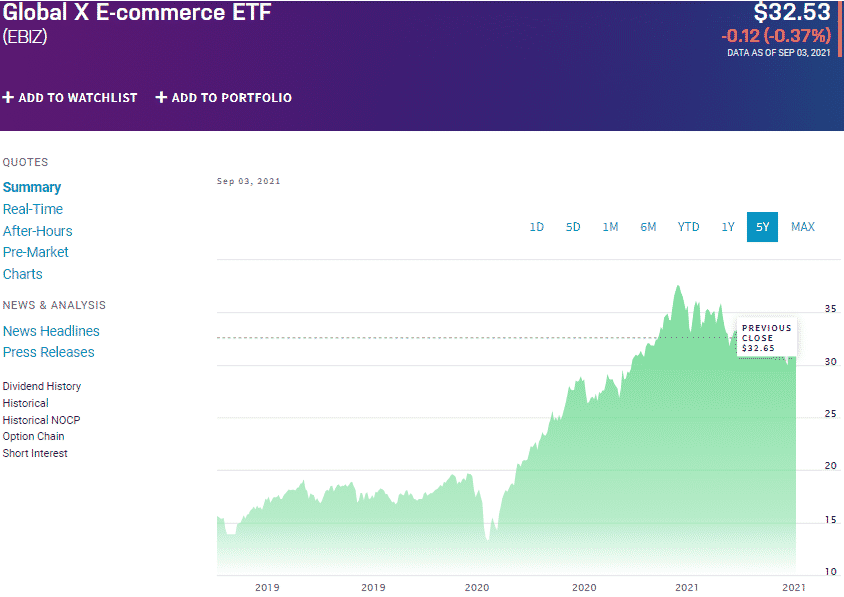

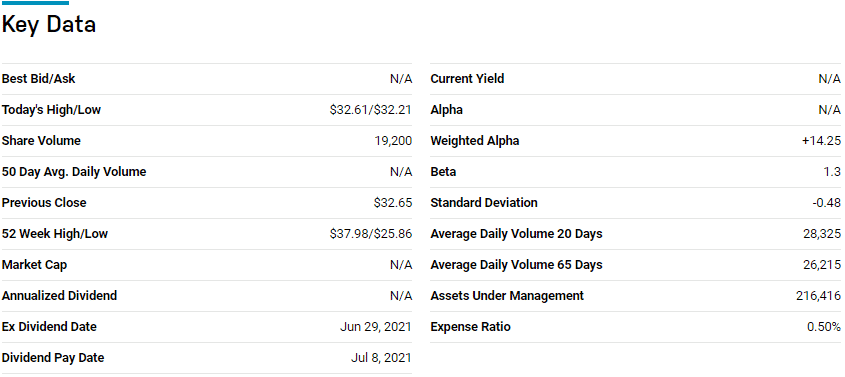

№ 3. Global X E-commerce ETF (EBIZ)

Price: $32.53

Expense ratio:0.5%

The Global X E-commerce ETF tracks the Solactive E-commerce Index, investing, on the minimum, 80% in its underlying index to ensure minimal result deviations to the tracked index. It is a non-diversified fund that exposes investors to the fast-paced e-commerce world, which is at the forefront of AI adoption for online selling, data analytics, and e-commerce distribution models.

An evaluation of 32 exchange-traded funds in the cyclical consumer sector by US News has the EBIZ at rank 10.

The top three underlying holdings of this ETF are MercadoLibre Inc. — 5.23%, Etsy Inc. — 4.77%, and Williams-Sonoma Inc. — 4.63%.

EBIZ ETF has $214.44 million in assets under management, with an expense ratio of 0.5%. Being just over two years old, this ETF still managed returns of 19.97% in the pandemic year, barely a year after launch. The year-to-date returns stand at 2.42%.

If the pandemic revealed anything to the world, anything could be bought and sold online for doorstep delivery. This ETF is a must-watch as the AI technology evolves and is adopted more in the e-commerce niche.

Final thoughts

Artificial intelligence is evolving and taking over industrial functions, but it plays a critical role in our daily lives. Currently, we have autonomous vehicles, smart houses, predictive and interactive internet search algorithms, and hand-held devices.

Rather than hassle with trying to pick individual equities and try to time the markets for profitability, pick AI-focused exchange-traded funds costing less than $49 and watch your portfolio grow as this disruptive technology evolves and gains traction.

Comments