Exchange-traded funds at present are the most widely traded and exchanged investment vehicles in the world. This popularity is attributable to:

- Transparent in how ETFs operate

- The relatively low expense ratio

- Offer a perfect balancing act between investment income outflows and inflows

- The relatively high liquidity

- Enhanced tax advantages as compared to other investment vehicles

What are dividend ETFs?

As the oracle of Omaha says, the economy is bound to grow in the long run. Therefore, exchange-traded funds are primarily long-term investments for wealth creation and growth. The problem is, investors also need regular incoming to take care of the day-to-day expenses as they chase financial freedom down the line.

This need in the investment world is filled by dividend income. How can ETFs, a long-term investment vehicle, provide regular income?

Exchange-traded funds are formed by pooling together several investment vehicles, which then track the performance of a particular index, mirroring the characteristics of the pooled assets.

As such, dividend ETFs refer to an investment asset made up of blue-chip high-yield dividend companies. These funds are often rebalanced based on declared year-on-year dividends and the rate of payout increase. To be a dividend-paying company, the requirement is to have a history of more than five years, distributing earnings to shareholders regularly.

How to be part of the dividend ETFs market?

There are two ways of making money off the dividend ETFs, own shares and hold them for the regular dividend ETFs, or trade-in contract for differences (CFDs), where you speculate on the change in prices of these ETFs. In both instances, an investor looks for a broker who provides dividend ETFs, either traditional call brokers or online brokerage firms.

Once a broker is chosen, being part of this market is a simple three-step process.

| Step 1 | Step 2 | Step 3 |

| Deposit investment capital with the chosen broker. | Screen the broker availed dividend ETFs for their yield, liquidity, and expense ratio. | Buy the dividend ETF that fulfills your income requirements. |

The best dividend ETFs for Q4 2021

In investment, there is nothing better than putting in a small amount of money to gain a tidy amount. Dividend exchange-traded funds are a relatively low-cost investment vehicle that can earn investors a regular income for both wealth accumulation and creation.

Here are three dividend ETFs to get you started on the financial freedom journey in Q4 2021.

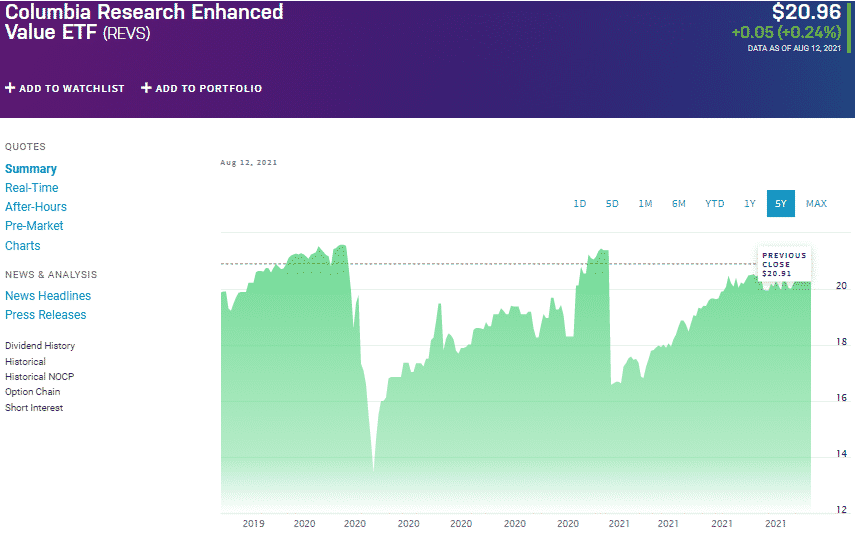

№ 1. Columbia Research Enhanced Value ETF (REVS)

Price: $20.96

Dividend yield: 22.71%

In a pandemic year, this fund managed 38.55% returns. It has $8.35 million in assets under management, with an expense ratio of 0.19%. In simple terms, these ETFs are the epitome of low-cost, high-yield investment.

Holdings

With established companies such as Johnson and Johnson — 4.78%, Citigroup Inc. — 3.05%, and Morgan Stanley — 2.94%, as the top three holdings, it is no wonder that REVS is the top dividend-yielding ETF at present. Investors can expect dividends of $4.16 to the share invested annually.

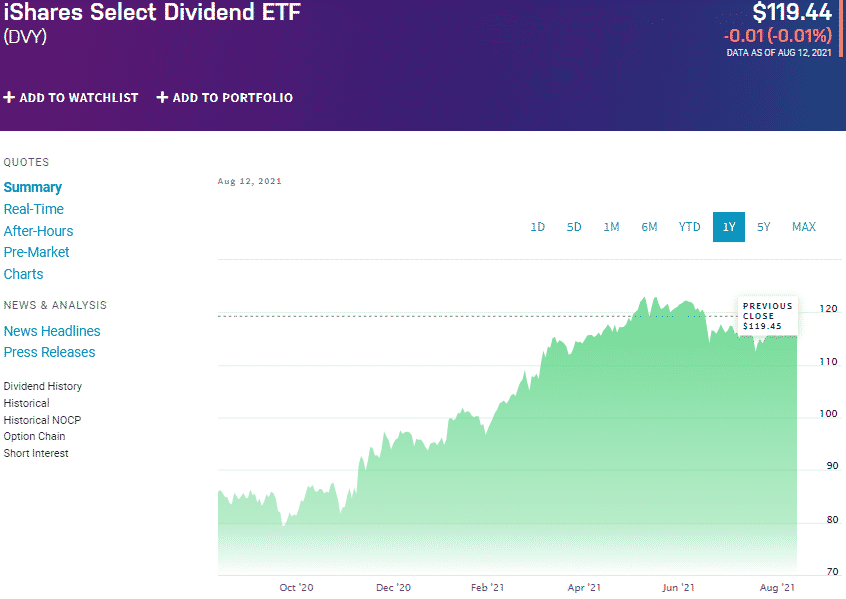

№ 2. iShares Select Dividend ETF (DVY)

Price: $119.44

Dividend yield: 3.6%

With $18.39 in net assets under management, it is the 2nd largest dividend ETF available. To enjoy the quarterly dividends of $0.99 to the share, investors have to part with $39 for every $10,000 invested annually.

Holdings

With its top three holdings being Oneok Inc. — 2.3%, Altria Group Inc. — 2.27%, and AT&T Inc. — 2.02%, it is no surprise that this dividend fund is ranked 50th among large value ETFs by US news.

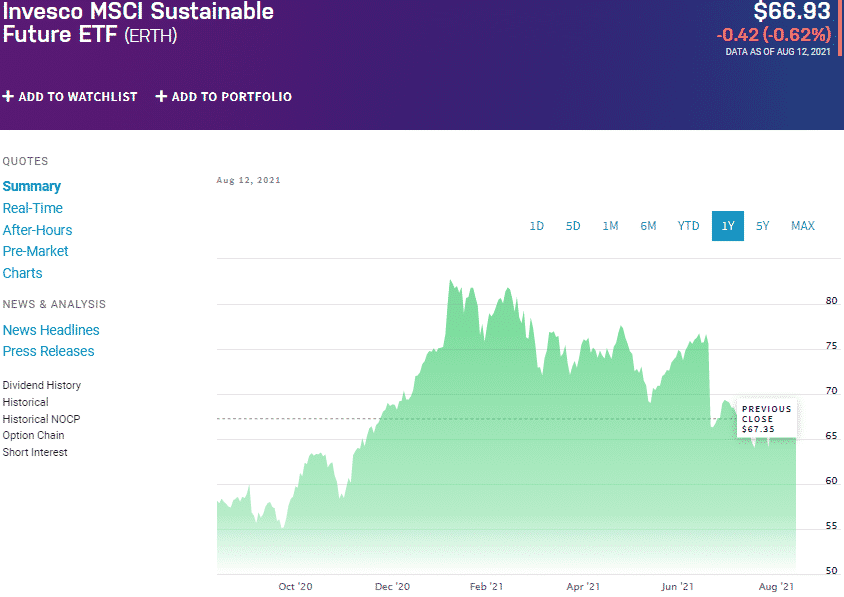

№ 3. Invesco MSCI Sustainable Future ETF (ERTH)

Price: $66.93

Dividend yield: 14.91%

The underlying index of the ERTH comprises organizations with offerings that seek to reclaim the global environment by better utilizing natural resources. The ERTH invests at least 90% on the underlying assets of its base index as long as 75% of its revenues are derived from either energy efficiency, pollution prevention and control, green technology, alternative energy, and sustainable water and agriculture.

The ERTH fund has $420.5 million net assets under management, with an expense ratio of 0.58%. Investors can expect quarterly dividends of $0.3 to the share, and as the world shifts its focus on environmental sustainability, this fund is on the verge of takeoff.

Holdings

The top three holdings of the ERTH fund are NIO Inc. — 5.89%, Tesla Incorporated — 5.56%, and Digital Realty Trust Inc. — 4.78%. With such a lineup among others, it is no surprise that this fund recorded 36.56% returns for its investors in the pandemic year.

Comments