The popularity of equity investing is due to its dividend-paying feature, and this is no surprise given that world investment billionaires advocate investing in dividend-paying assets. Dividend ETFs bring to the table stability and cost-effectiveness while providing regular income through dividends, just like stocks. With international dividend ETFs, you gain all of this plus geographical diversification. What’s more, international dividend-paying assets have historically provided more yield than their US counterparts.

What is the composition of international dividend ETFs?

For an asset to be classified as a dividend-paying asset, the norm is consistent dividend payouts for the last five years. International dividend ETFs comprise blue-chip organizations with a history of dividend payouts over the last five years, combined with mid-cap and small-cap equities that have paid dividends consistently over the same period.

The best international dividend funds for 2022

Market volatility and uncertainty last only a short period before corrections, but for an investment portfolio to endure, it still needs income injection. International dividend ETFs are ex-US Index’scallcall, assle-free way to ensure regular and consistent income for reinvestment and expenditure, even in a market downturn. These three international dividend funds’ profitability and earnings quality, for significant income in 2022.

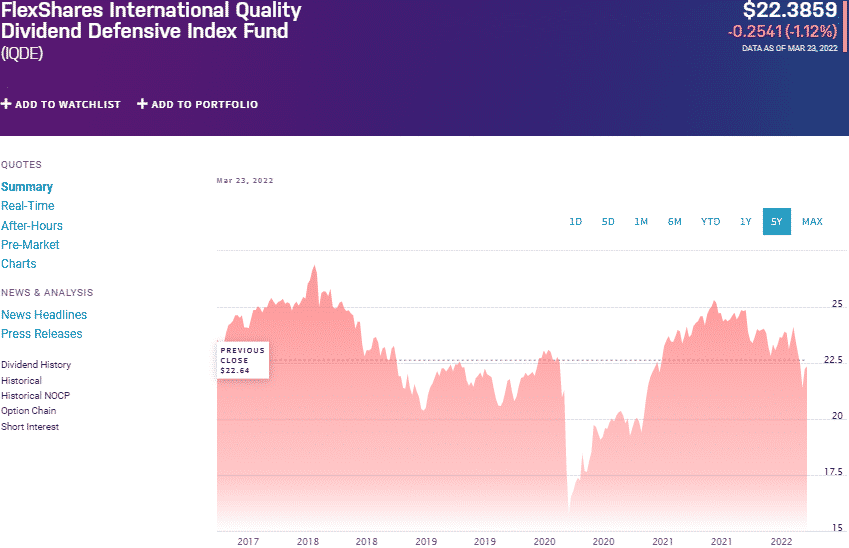

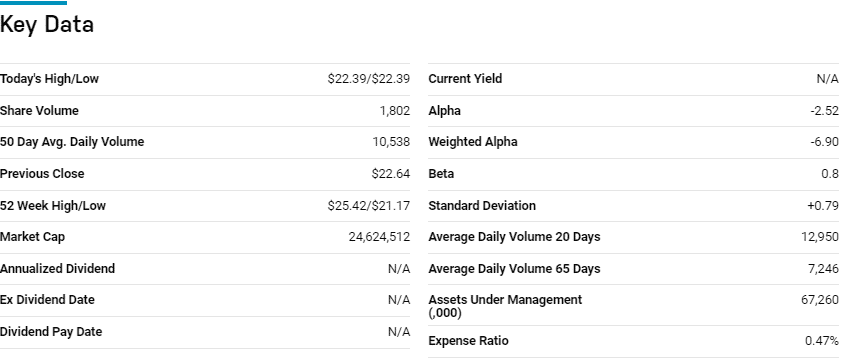

№ 1. FlexShares International Quality Dividend Defensive Index Fund (IQDE)

Price: $22.38

Expense fatio: 0.47%

Annual dividend yield: 3.72%

IQDE chart

IGDE tracks the performance of the Northern Trust International Quality Dividend Defensive IndexSM, exposing investors to global companies exhibiting high levels of stability and financial strength. It invests at least 80% of its total assets in the tracked index underlying holdings and, ex-US Index’s funds’, the composite index holdings’ ADRs and GDRs.

The top three holdings of this ETF are:

- Roche Holding Ltd – 4.15%

- Nestle S.A – 3.46%

- Taiwan Semiconductor Manufacturing Co., Ltd. – 1.84%

The IQDE ETF has $67.3 million in assets under management, at a relatively low expense ratio of 0.47%. It also pays yearly dividends at the rate of $0.89 to the share, with investors expecting annual dividend yields at funds with a $10000 investment, an investor, at the current prices. Would have approximately 447 shares and enjoy an annual dividend worth $397.6.

Combining developed and developing economies equities also provides growth, while a capping on single holding, sector, and region ensures a dose of regular returns; 5-year returns of 20.90%, 3-year returns of 14.38%, and 1-year returns of -1.09%.

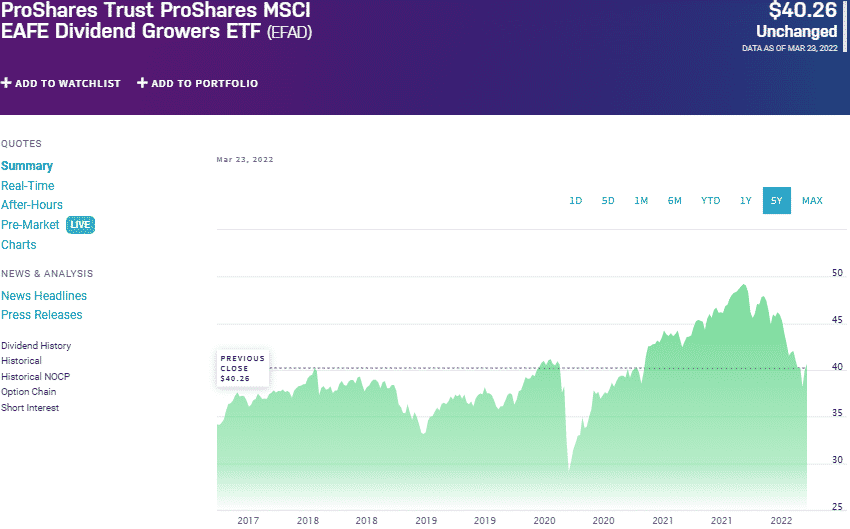

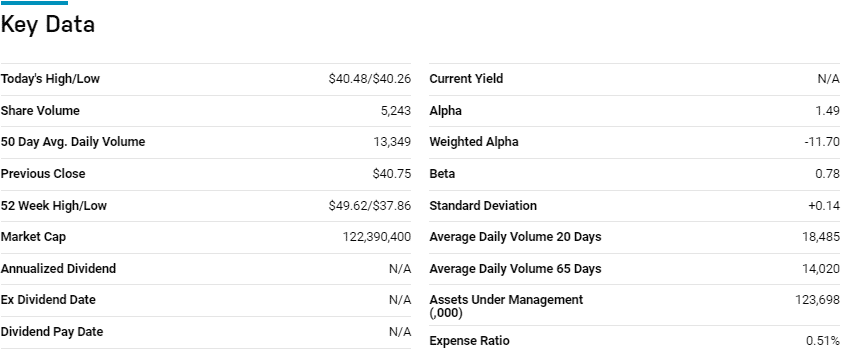

№ 2. ProShares MSCI EAFE Dividend Growers Fund (EFAD)

Price: $40.26

Expense ratio: 0.51%

Annual dividend yield: 1.62%

EFAD chart

The ProShares MSCI EAFE Dividend Growers Fund tracks the performance of the MSCI EAFE Dividend Masters Index, net of expenses and fees. It invests at least 80% of its total assets in the tracked index underlying holdings, exposing investors to EX-US developed economies equities, with a +10-track record of boasted dividend payouts.

In a list of 19 global large growth exchange-traded funds, the EFAD ETF is ranked № 1 for long-term investing.

The top three holdings of this global large blend fund are:

- BAE Systems plc – 1.80%

- UCB S.A. – 1.75%

- Novo Nordisk A/S Class B – 1.60%

The EFAD ETF has $123.7 million in assets under management, with an expense ratio of 0.51%. It pays yearly dividends at $0.77 to the share, with investors expecting annual dividend yields at 1.62%. With a $10000 investment, an investor at the current prices would have approximately 248 shares and, as a result, enjoy $191.3 dividends annually.

Global diversification and concentration on the developed economies provide for a stable fund; 5-year returns of 31.83%, 3-year returns of 11.25%, and 1-year returns of -3.80%.

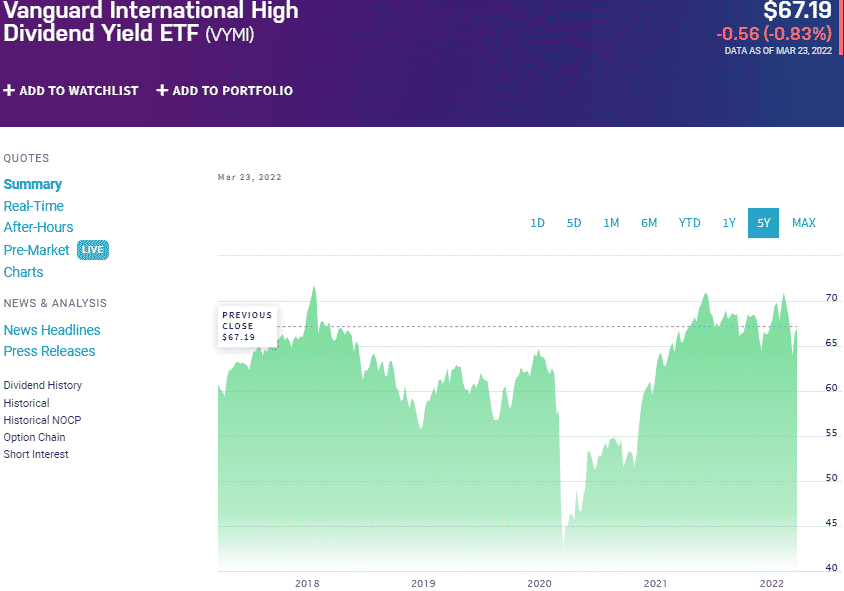

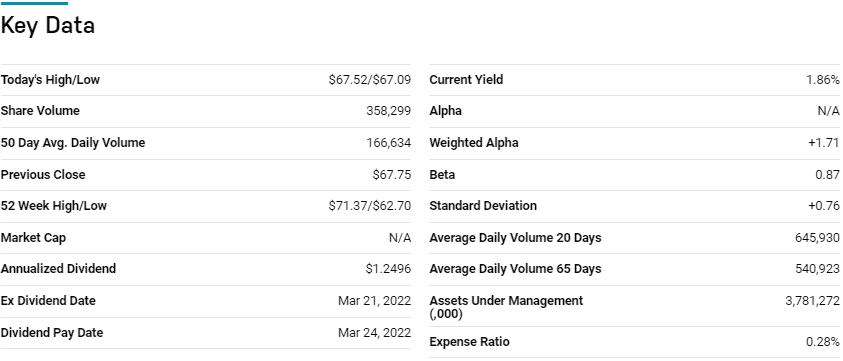

№ 3. Vanguard International High Dividend Yield ETF (VYMI)

Price: $67.19

Expense ratio: 0.28%

Annual dividend yield: 3.67%

VYMI chart

VYMI tracks the FTSE All-World ex-US High Yield Dividend Index, net of expenses, and fees. It invests via index sampling in the index underlying holdings; all of the assets in the composite index in the same weighting. It exposes investors to the best dividend-paying equities in developed, EX-US, and emerging markets.

The top three holdings of this global high dividend fund are:

- Nestle S.A. – 2.94%

- Toyota Motor Corp. – 1.85%

- Roche Holding Ltd – 1.84%

The VYMI ETF is the largest fund on this list boasting $3.77 billion in assets under management, while also the cheapest fund here, featuring an expense ratio of 0.28%. This large-cap inclined value ETF pays yearly dividends at 3.67% to the share, with investors expecting annual dividend yields at $2.51.

With a $10000 investment, an investor at the current prices would have approximately 149 shares and enjoy $373.6 dividends annually. The inclination towards large-caps and equal weight distribution results in a stable fund with consistent returns; 5-year returns of 35.24%, 3-year returns of 25.03%, and 1-year returns of 8.34%.

Final thoughts

The current market volatilities, rising inflation rates, and the resulting rise in consumer products and raw materials call for extra income to maintain good purchasing power. International dividend ETFs provide funds ex-US geographical diversification for the current volatile markets and a chance to pocket additional income.

The three international dividends ETFs here provide a way to weather the volatile markets by investing in large value stable equities while at the same time enjoying more than average income from low-risk investment assets.

Comments