Since the start of the novel coronavirus, the stock markets have experienced high volatilities resulting in heavy losses and unprecedented revenues depending on how the market was played. Despite economic stimulus and other strategies to accelerate economic resurgence to pre-pandemic times globally, the effects of the coronavirus have resulted in record inflation rates across the globe.

Coupled with the ongoing Ukraine-Russia war, investors need investment assets that weather the market downturn and can put an extra dime in investor pockets. Large-cap stocks are the answer. However, pouring over financial information to choose individual stocks to make up this portfolio is a pretty daunting and taxing exercise. The solution lies in large-cap ETFs, which give you instant diversification across the large-cap segment for a single investment asset price.

What is the composition of large-cap ETFs?

Large-cap stocks are equities with a market capitalization of $10 billion and above in the investment world. As such, large-cap ETFs pool together equities with the market, as mentioned earlier, capitalization and, in most cases, give a pulse on the economic health of their targeted segment or industry.

The best large-cap ETF portfolio growth in 2022

The financial market’s history shows that large-cap equities outperform the markets in high volatility markets, characterized by high inflation levels and rising interest rates. These three large-cap equities are relatively cheaper, offer more diversification, and are relatively more liquid, ensuring more green bucks in the investor’s pockets despite rising inflation rates. The problem is that most of these funds are very similar, making it difficult to choose between the available choices.

№ 1. SPDR S&P 500 ETF Trust (SPY)

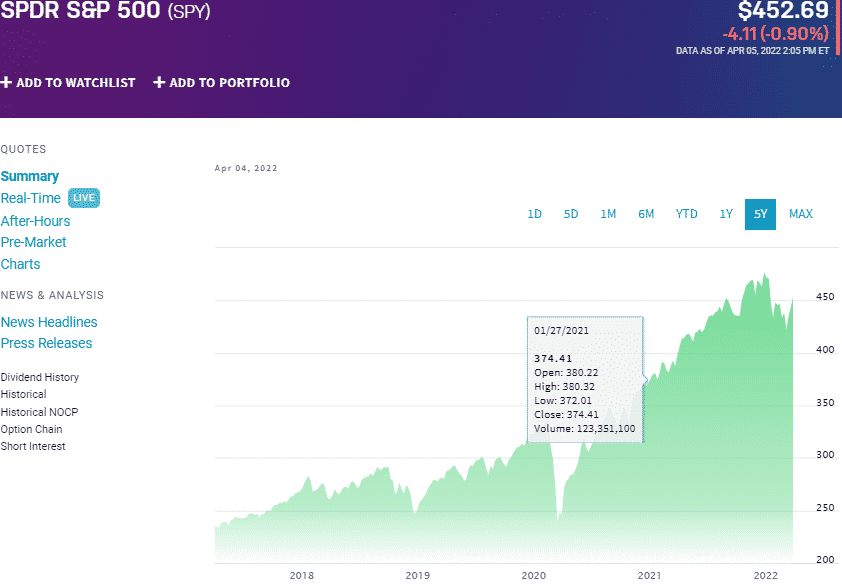

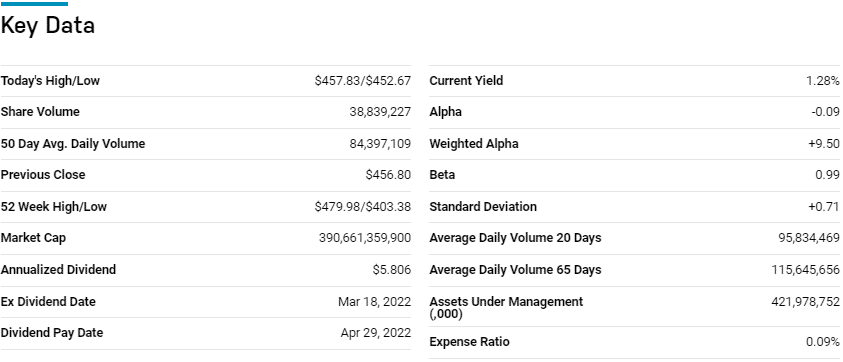

Price: $452.69

Expense ratio: 0.09%

Annual dividend yield: 1.22%

SPY chart

You cannot talk about large-cap ETFs and fail to mention the SPDR S&P 500 ETF Trust. It is the first exchange-traded fund launched in the US and the pioneer large-cap equity fund. This large-cap ETF tracks the oldest index in the investment space, the S&P 500 Index. It invests all of its assets in its composite index, with the holdings’ weightings corresponding to the index’s. It exposes investors to the best and largest fortune 500 companies publicly traded in the US.

In a list of 246 global large-cap funds, the SPY ETF is ranked № 38 for long-term investing.

The top three holdings of this balanced ETF are:

- Apple Inc. – 7.05%

- Microsoft Corporation – 6.02%

- Amazon.com, Inc. – 3.72%

The SPY ETF is one of the largest funds globally, if not the largest, with $420.55 billion in assets under management, with investors parting with $9 annually for a $10000 investment. High liquidity levels, a relatively low expense ratio, and very narrow margins allow easy buying into and out of this fund. This ease facilitates profitable returns in highly volatile markets. The SPY is an ideal investment in 2022; 5-year returns of 109.66%, 3-year returns of 65.42%, 1-year returns of 14.55%, and a decent dividend yield of 1.22%.

№ 2. Vanguard Total World Stock ETF (VT)

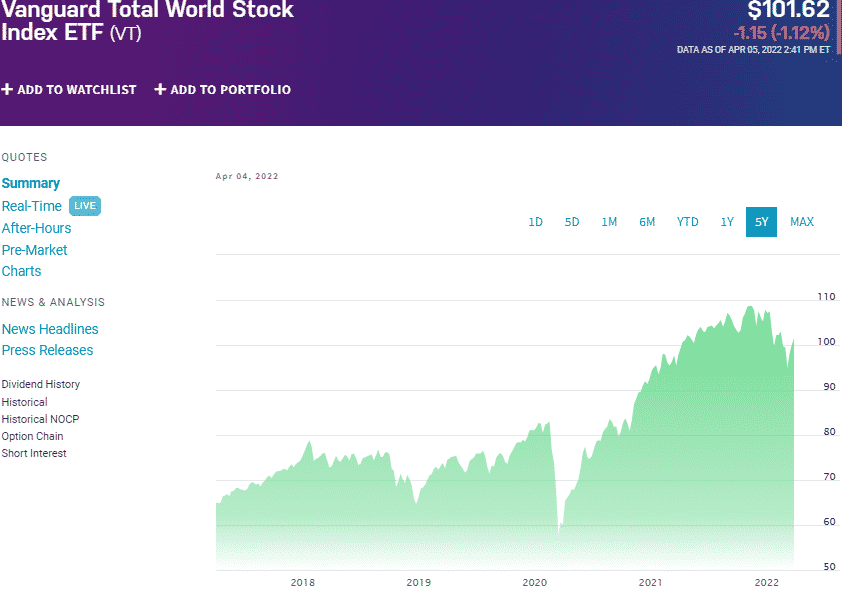

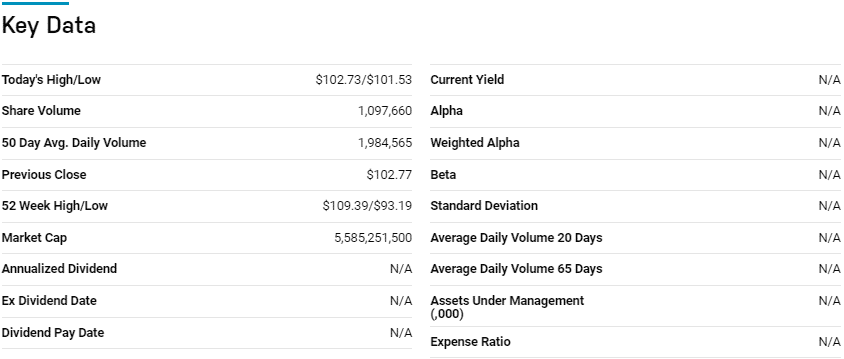

Price: $101.62

Expense ratio: 0.07%

Annual dividend yield: 1.59%

VT chart

The Vanguard Total World Stock ETF tracks the total return performance of the FTSE Global All Cap Index, net of expenses, and fees. It invests almost all of its assets in a representative sample of the composite index by holding securities that represent the tracked index risk factors and other economic variables. It exposes investors to large-cap equities in developed and emerging market economies.

In a list of 45 global large-cap funds, the VT ETF is ranked № 11 for long-term investing.

The top three holdings of this global large cap ETF are:

- Apple Inc. – 3.46%

- Microsoft Corporation – 3.05%

- Amazon.com, Inc. – 1.81%

The VT ETF has $25.79 billion in assets under management, with an expense ratio of 0.07%. This is a one-stop large cap equity product with global exposure, featuring a pretty even weighting, and diversification across regions and sectors provides for a highly resilient fund; 5-year returns of 76.51%, 3-year returns of 46.95%, 1-year returns of 6.25%, and a dividend yield of 1.59%. A low expense ratio than the spy combined with vanguard’s commission-free trading ensures its investors in 2022 end up with heavier pockets.

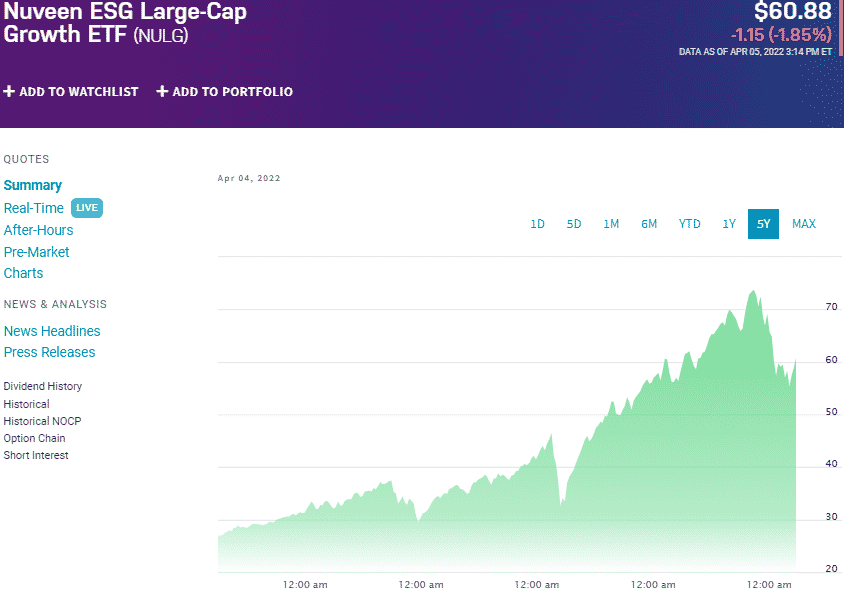

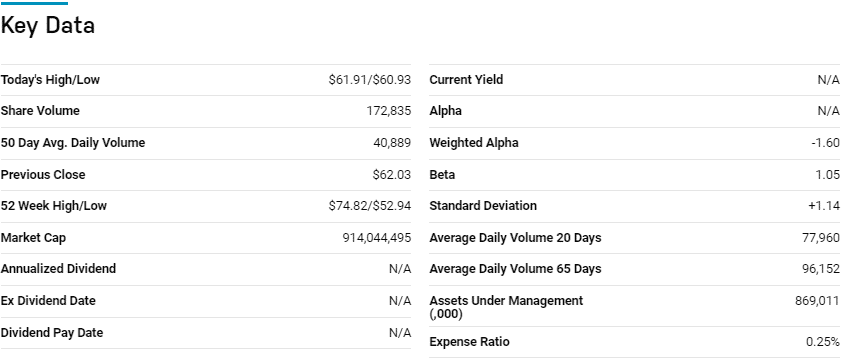

№ 3. Nuveen ESG Large-cap Growth ETF (NULG)

Price: $60.88

Expense ratio: 0.25%

Annual dividend yield: 2.09%

NULG chart

You cannot solely rely on traditional large-cap investment assets in the modern-day world. It pays to have themed ETFs that cater to emerging trends. With the global appetite for ESG investing, investors can ride the ESG wave with a large-cap option with the Nuveen ESG Large-cap Growth ETF. IT tracks the performance of the TIAA ESG USA Large-Cap Growth Index, investing at least 80% of its total assets plus investment credit in securities of large-capitalization equities meeting specific ESG criteria.

In a list of 103 global large-cap growth funds, the NULG ETF is ranked № 21 for long-term investing.

The top three holdings of this large-cap ESG fund are:

- Microsoft Corporation – 11.49%

- Alphabet Inc. Class A – 5.29%

- Alphabet Inc. Class C – 3.94%

The NULG ETF has $905.9 million in assets under management, with an expense ratio of 0.25%. The investment world as well as the global consumers, are now very self-conscious about their spending and how it impacts not only the environment but also governance and society. With the world going green and conscious investing becoming more and more a thing, this ETF is worth holding for the long haul, especially given its habit of outperforming the markets; 5-year returns of 152.08%, 3-year returns of 88.80%, 1-year returns of 10.60%, and a pretty decent dividend yield of 2.09%.

Final thoughts

Large-cap ETFs comprise established blue-chip companies that are leaders in their respective segments. They feature large capital outlays and outstanding debt to equity ratios, facilitating their thriving in highly volatile markets. These three large-cap ETFs expose a portfolio to a potential returns boom in 2022, continuing their decade-long history of outperforming the markets.

Comments