Until recently, index-tracking mutual funds held the most significant portion of the investment world’s assets under management. However, exchange-traded funds are available for every trader type and investment strategy; they now represent the most exchanged investment asset globally.

The first seven months of 2021 already pushed this market into upwards of $9 trillion, with the net inflows just slightly short of the 2020 $736.5 billion value. This value comes from over 7500 ETFs globally, from different ETF issuers.

The question for investors then is not if they have an ETF that suits their unique investment objectives but which issuer to choose?

Who is an ETF issuer?

To understand who an ETF issuer is and their role, we first define what an ETF is. Exchange-traded funds comprise a basket of like investment assets economically, trading as one investment vehicle. An ETF issuer is a financial firm or any other organization in the investment space that pools like economic assets and offers this basket to investors for trading as one offering.

In addition to creating ETFs, fund issuers are also responsible for their offerings administration, management, marketing, and selling, either directly or through appointees.

Which are the top 5 ETF issuers of 2021 by market capitalization?

Given the risk associated with investing and trading, it is of utmost importance to have a criterion for choosing the ideal ETF provider. While the majority might look at historical performances as the overriding indicator when selecting an ETF issuer, we take a different approach by ranking our issuers on their market capitalization, which informs the assets under management in their control.

Exchange-traded funds are long-term investment assets. Having a significant asset base facilitates shock absorbers in times of market downturn, ensuring that ETFs by the issuers below dominate the markets in the long haul.

№ 1. Blackrock Financial Management

Assets under management: $2.39 trillion

Number of ETFs offered: 389

Average expense ratio: 0.18%

Blackrock Financial Management as a name might not be that popular, but their flagship ETFs are iShares ETFs. This comes as no surprise given that this fund firm presently boasts a whopping three hundred and eighty-nine exchange-traded funds as part of their offering to the investment world. Nevertheless, it is the global leader in asset management, dealing with both mutual funds and exchange-traded funds.

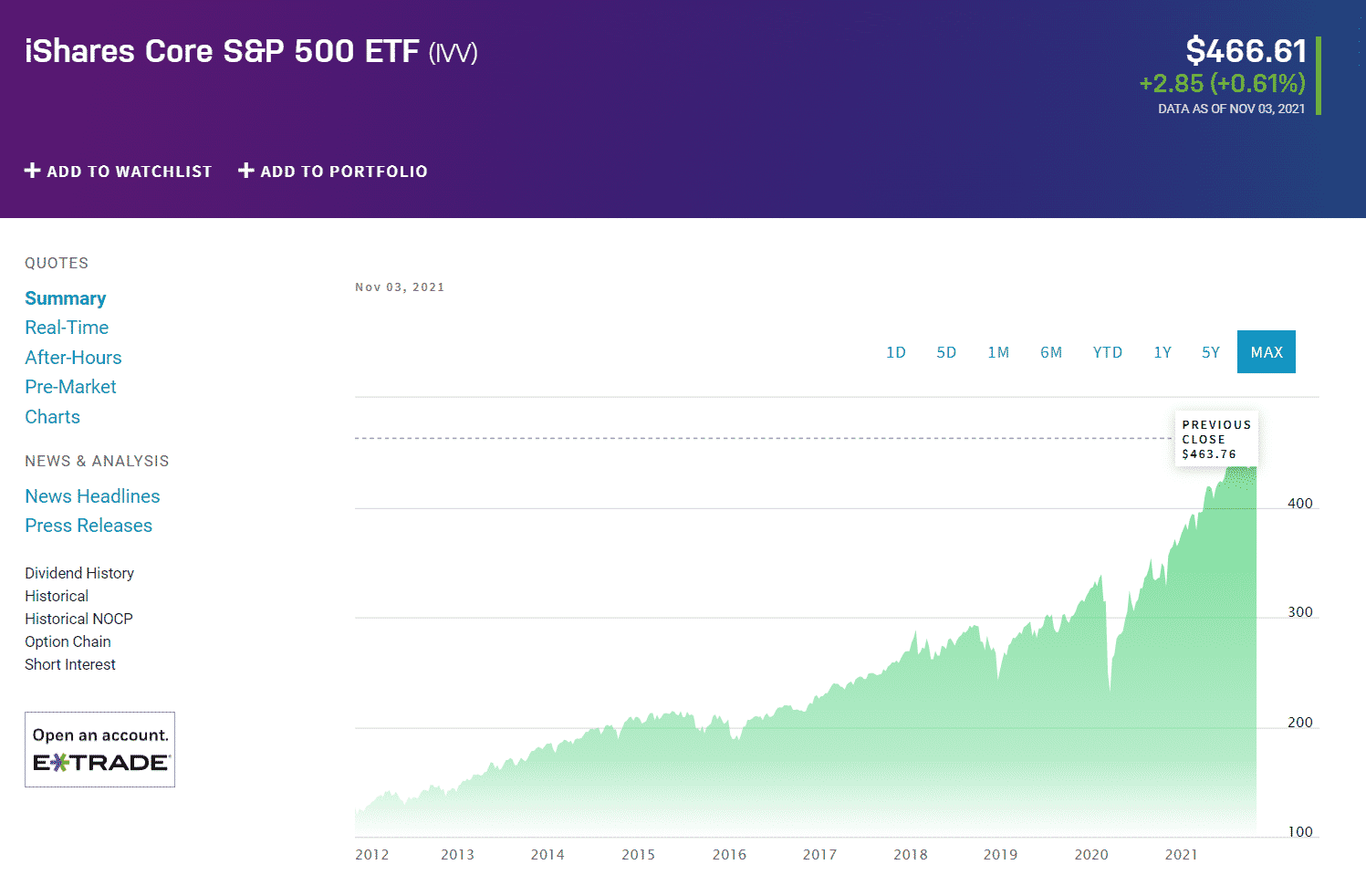

The largest ETF from Blackrock Financial Management is the iShares Core S&P 500 ETF (IVV), with $294.95 billion in assets under management at a relatively low expense ratio of 0.03%.

IVV chart

In addition to tracking the most popular index globally, S&P 500, this ETF by Blackrock Financial Management has historically outperformed its peers; 5-year returns of 138.49%, 3-year returns of 79.88%, and pandemic year returns of 43.05%.

So far, in 2021, this ETF issuer has estimated revenues to the tune of $4.39 billion. Whether a seasoned investor or a beginner, this ETF issuer is worth a visit.

№ 2. Vanguard Total Stock Market ETF

Assets under management: $1.99 trillion

Number of ETFs offered: 82

Average expense ratio: 0.06%

With a tagline that reads, “At Vanguard, you are not just an investor but an owner,” it comes as no surprise that Vanguard is the second-largest ETF provider with assets under management to the tune of $1.994 trillion. Vanguard has accumulated such massive assets with a third of the ETF offerings as Blackrock, only 82 ETFs.

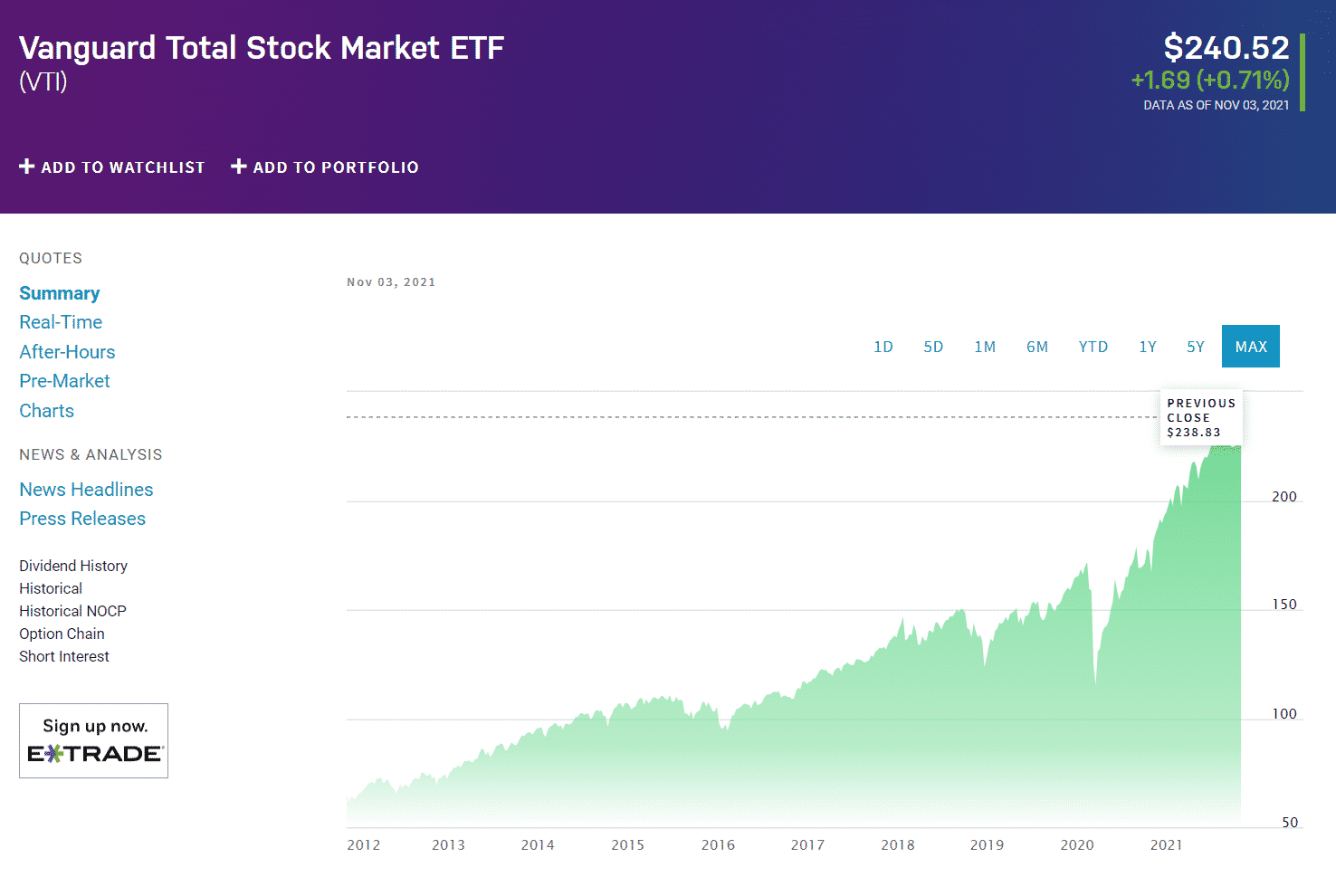

The largest ETF from Vanguard is the Vanguard Total Stock Market ETF (VTI), with $1.26 trillion in assets under management at a relatively low expense ratio of 0.03%.

VTI chart

The VTI, in addition to providing diversification through its numerous holdings, is one of the cheapest ETFs, mainly if the holder of a Vanguard account trades commission-free. Similar to IVV, VTI has also outperformed its category average; 5-year returns of 139.16%, 3-year returns of 81.02%, and pandemic year returns of 44.53%.

So far, in 2021, this ETF issuer has estimated revenues to the tune of $1.13 billion.

№ 3. State Street SPDR

Assets under management: $979.66 billion

Number of ETFs offered: 132

Average expense ratio: 0.14%

This ETF issuer is a subsidiary of the public traded financial services giant State Street Corp. Their State Street Global segment offers some of the most popular ETFs globally, SPDR ETFs. It boasts $979.66 billion in assets under management spread across its 132 offerings. Among this impressive list is the SPY, which is the most traded ETF globally.

SPY chart

SPY is a pioneer exchange-traded fund globally, with $416.43 billion in assets under management with a low expense ratio of 0.09%. With the top 500 US companies making up the SPY, investors look upon it to gauge the US economic temperaments.

In 2021, state street global revenues are already at $1.356 billion.

№ 4. Invesco

Assets under management: $390.49 billion

Number of ETFs offered: 240

Average expense ratio: 0.3%

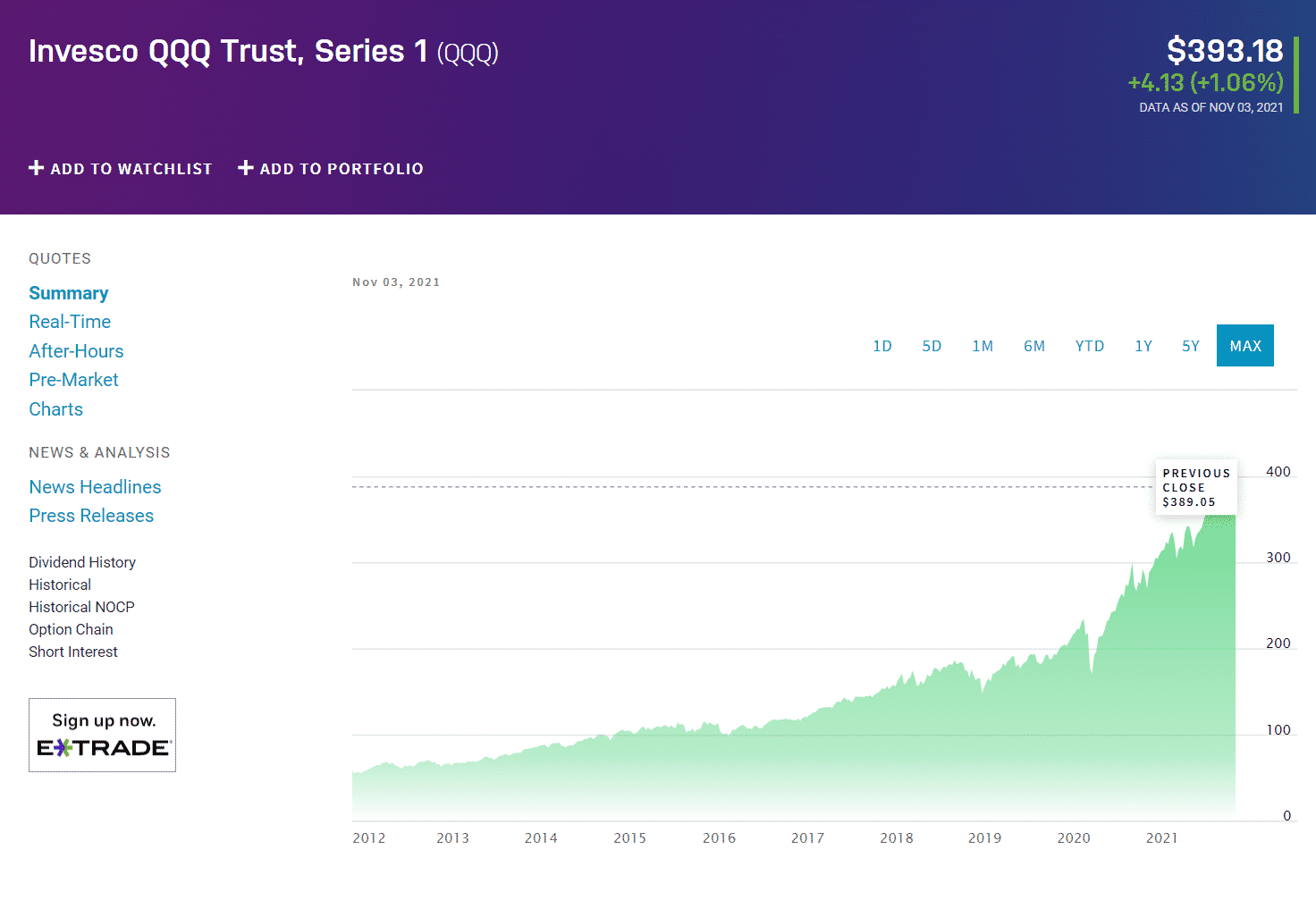

This ETF provider provides investment management services and assets to both institutional and individual investors. Similar to Blackrock, it has an ETF for almost every investment strategy imaginable, if not all. Out of its 240 offerings, the most popular ETF is the Invesco QQQ ETF that tracks the performance of the top 100 non-financial organizations forming the Nasdaq index.

QQQ chart

QQQ has $174.51 billion in assets under management, with an expense ratio of 0.2%. QQQ is worth having on the radar because of its biases towards tech equities as the global community becomes more digitized.

So far, in 2021, this ETF issuer has estimated revenues to the tune of $1.15 billion.

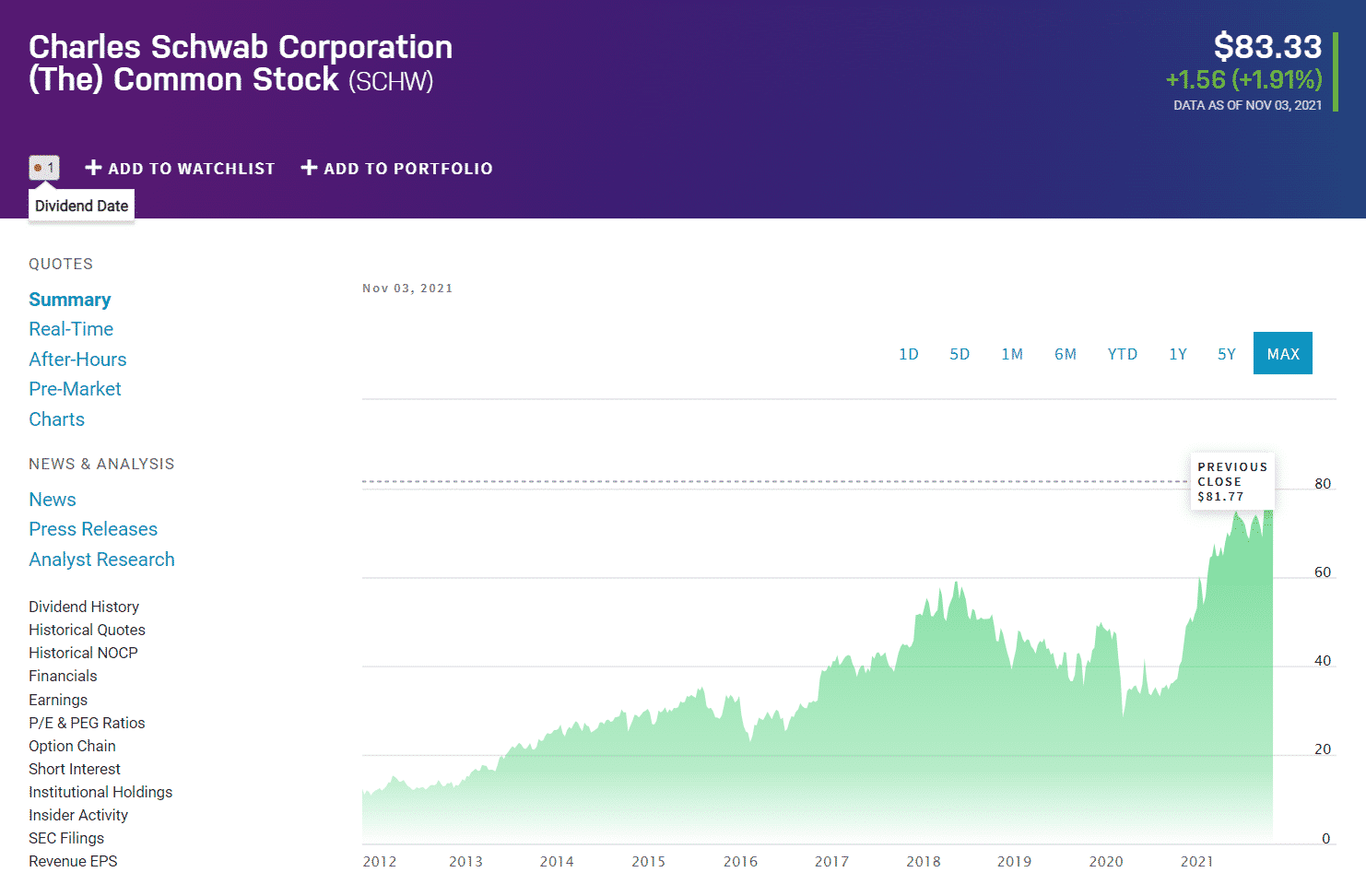

№ 5. Charles Schwab

Assets under management: $264.92 billion

Number of ETFs offered: 26

Average expense ratio: 0.07%

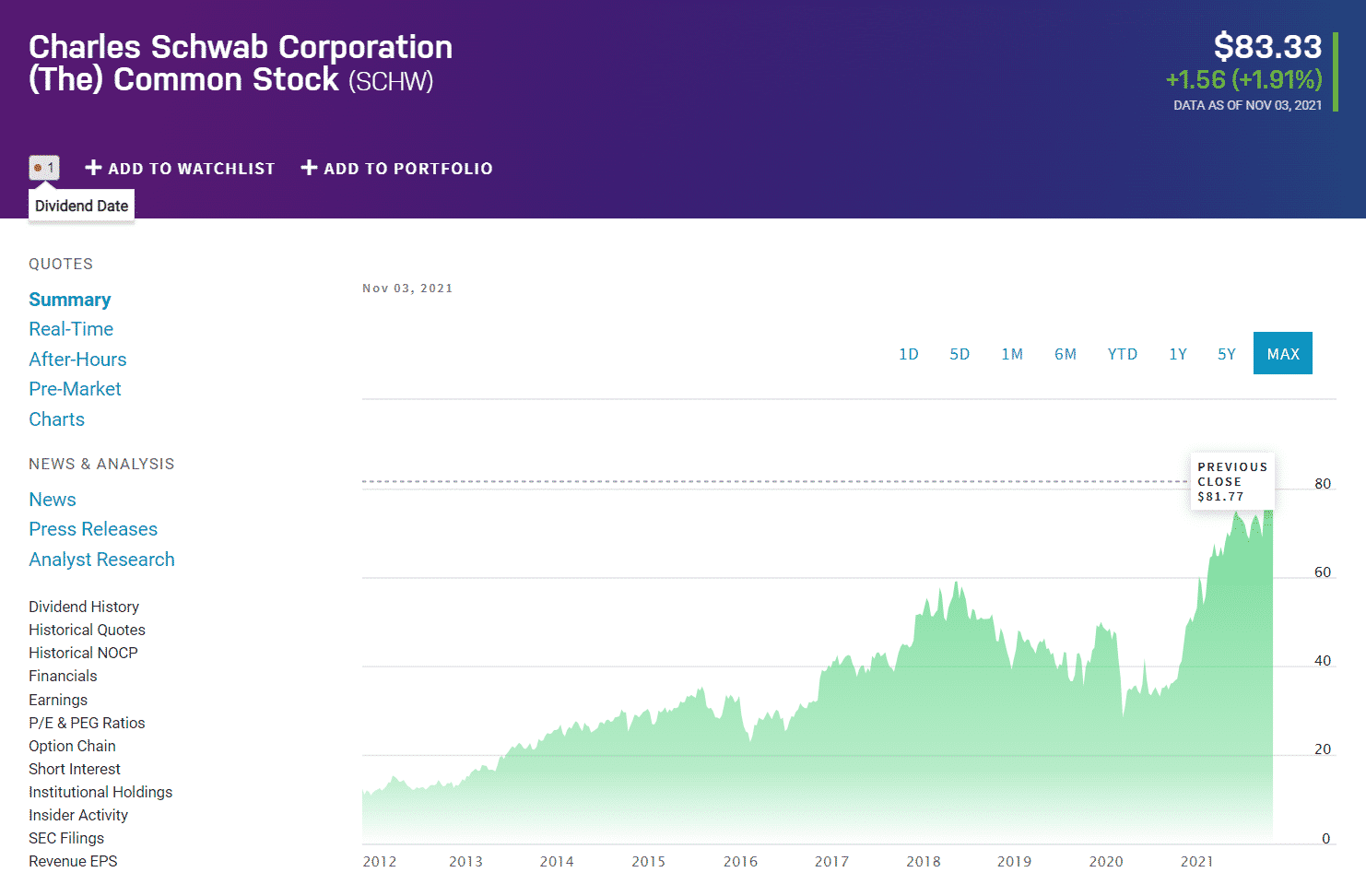

Unlike the other issuers on this list, Charles Schwab Inc is a loans and savings holding company. It provides investors with a choice of 26 ETFs under the Charles Schwab ETFs moniker. The largest ETF by this issuer is the Schwab US Large-Cap ETF (SCHX).

SCHW chart

SCHW has $155.288 billion in assets under management, with an expense ratio of 0.03%. It exposes investors to giant US large-cap and mega-cap equities, blue chips. So far, in 2021, this ETF issuer has estimated revenues to the tune of $197.94 million.

Final thoughts

ETFs have become such a popular investment vehicle in finding one that resonates with individual investment strategies and objectives. This feature extends to the ETF issuers, where the number of issuers allows everyone to find one that aligns with their investment objectives. However, among all these options, the five above are the best issuers in terms of their market capitalization.

Comments