The US stock market might be viewed as the safe-haven investment market, but this does not nullify international diversification. After the global economy contracted due to the coronavirus, IMF estimates that it recovered to post a 5.9% growth. With 2022 projected growth being upwards of 4.5%, the international investment market provides an opportunity to make money. How to do this? The world’s investment billionaire’s advice is to buy value stocks for accelerated portfolio growth and wealth creation.

At a global level, screening for such stocks is a nightmare and time-intensive and requires a particular nuance even to have a chance at picking winning stocks. How then do you achieve geographical diversification while creating a value portfolio internationally? Us an investment hack from the Oracle of Omaha, Warren Buffett, international value ETFs.

What is the composition of international value ETFs?

In the investment markets, you create value by buying stocks below intrinsic value and holding them until their price reflects the actual market value. International value ETFs comprise equities whose intrinsic value exceeds the prevailing market prices.

The best international value ETFs to track investment results

High inflation rates, rate hikes, and a looming World War 3 spell tough times for those without the extra income. International value funds gave you geographical diversification. They developed emerging markets but a chance at amplified returns.

№ 1. Leaders Index Fund Legg Mason Intl Low Volatility Hi Div ETF (LVHI)

Price: $27.21

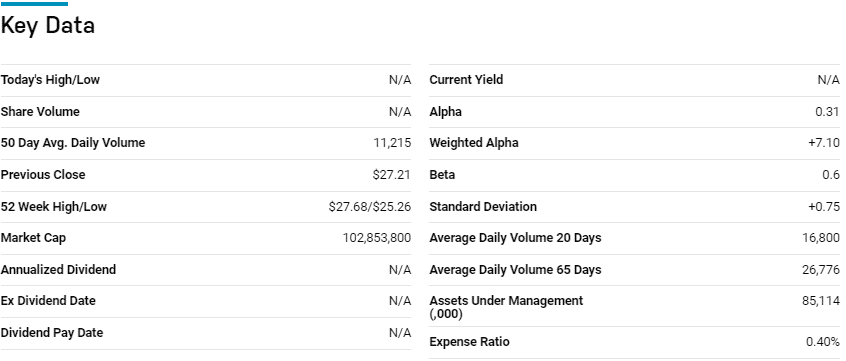

Expense ratio: 0.40%

Annual dividend yield: 5.10%

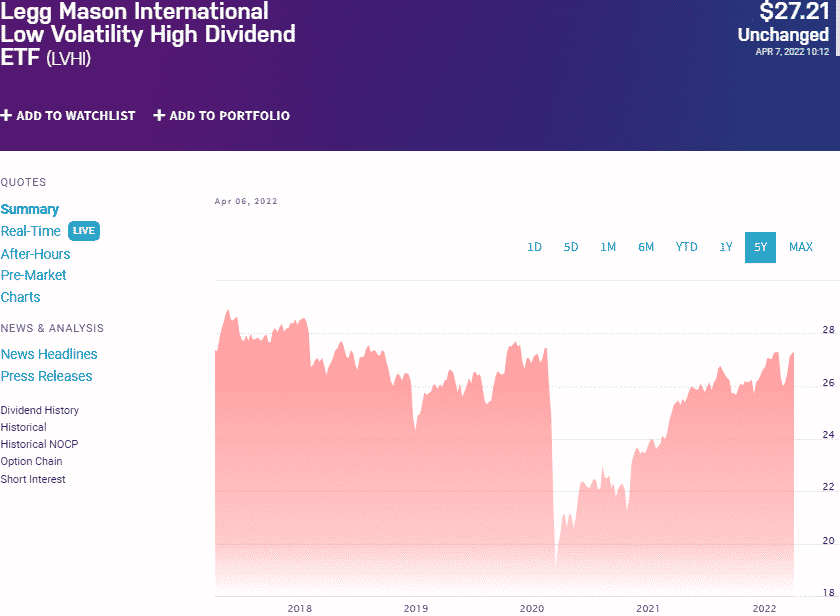

LVHI chart

The Legg Mason Intl Low Volatility Hi Div ETF tracks the QS International Low Volatility High Dividend Hedged Index’s performance, which measures the best and most profitable equities in developed and emerging countries. It invests 80% of its total assets in the tracked index equities.

In a list of 42 global large value funds, the LVHI ETF is ranked № 10 for long-term investing.

The top three holdings of this international ETF are:

- Algonquin Power & Utilities Corp. – 2.90%

- BHP Group Ltd – 2.83%

- Iberdrola SA – 2.76%

The LVHI ETF has $2.10 billion in assets under management, with investors parting with $40 annually for a $10000 investment. Combining fundamental and technical analysis results in a fund that provides both value and growth; 5-year returns of 30.95%, 3-year returns of 17.71%, 1-year returns of 10.76%, and more than the decent dividend yield of 5.10%.

№ 2. Global X MSCI SuperDividend EAFE ETF (EFAS)

Price: $15.46

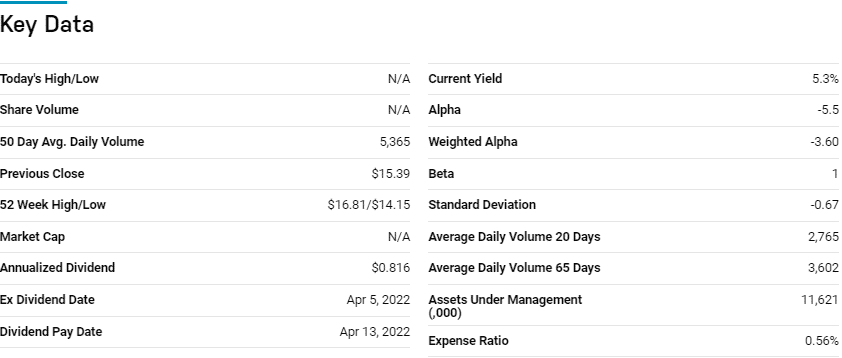

Expense ratio: 0.56%

Annual dividend yield: 4.66%

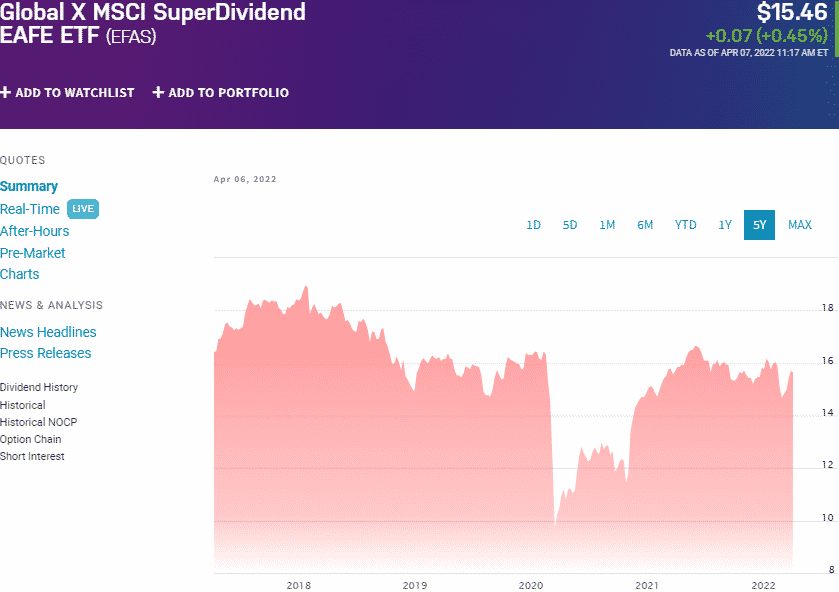

EFAS chart

The Global X MSCI SuperDividend EAFE ETF tracks the total return performance of the MSCI EAFE top 50 Dividend Index, net of expenses, and fees. It invests at least 80% of its total assets, excluding collateral securities, in the tracked index underlying holdings and other investment securities exhibiting similar economic characteristics. It exposes investors to the best 50 companies with a history of high dividend yield across the globe.

The top three holdings of this international value ETF are:

- BHP Group Ltd – 4.63%

- CNP Assurances SA – 2.44%

- Lundin Energy AB – 2.77%

The EFAS ETF has $11.8 million in assets under management, with an expense ratio of 0.40%. Geographical diversification across the globe and strict screening for value results in a fund that consistently generates returns and regular income; 5-year returns of 23.90%, 3-year returns of 11.51%, and 1-year returns of 2.53%, and a decent dividend yield of 4.66%.

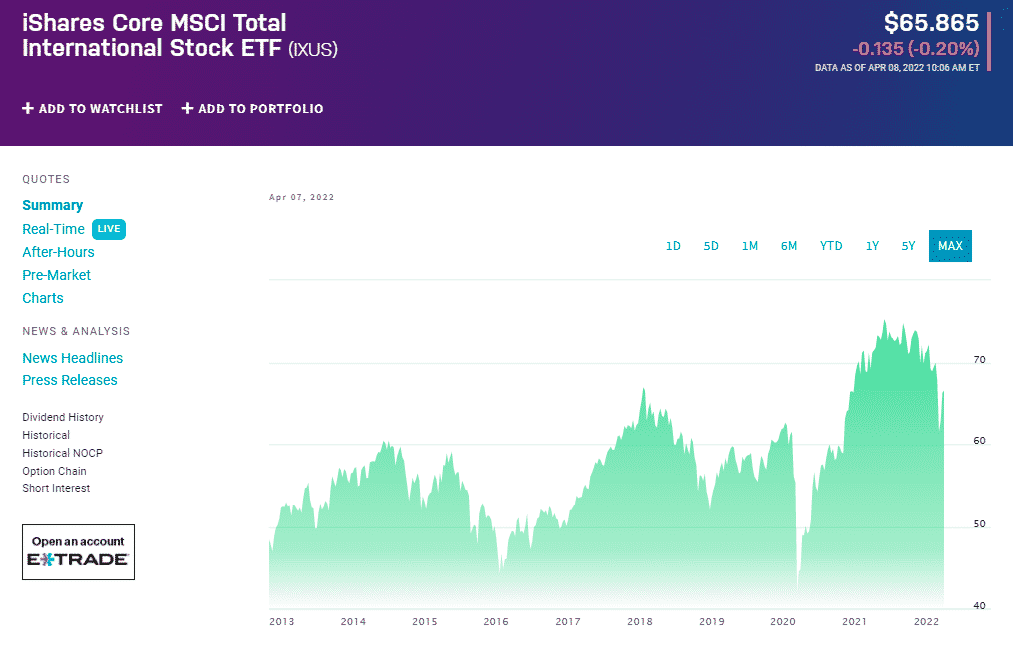

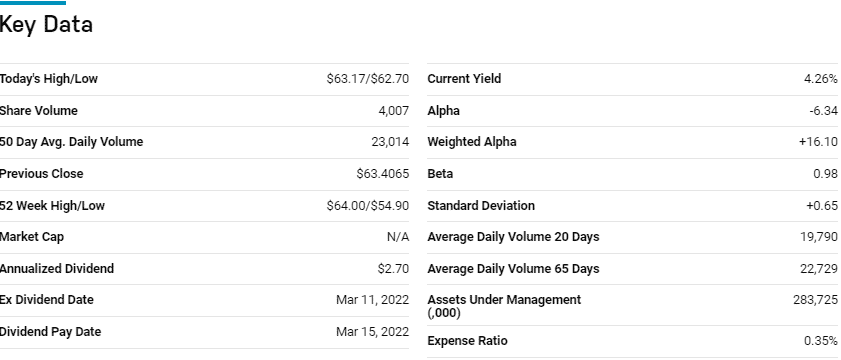

№ 3. iShares Core MSCI Total International Stock ETF (IXUS)

Price: $65.86

Expense ratio: 0.35%

Annual dividend yield: 2.51%

IXUS chart

The iShares Core MSCI Total International Stock ETF tracks the total return performance of the MSCI ACWI ex USA IMI, net of expenses and fees. It invests at least 80% of its total assets in the tracked index underlying holdings and other investment securities exhibiting similar economic characteristics. It exposes investors to the best global equities across the equity divide; large-cap, small, and mid-cap segments.

In a list of 86 foreign large blend value funds, the IXUS ETF is ranked № 2 for long-term investing.

The top three holdings of this global internet fund are:

- Taiwan Semiconductor Manufacturing Co., Ltd. – 1.68%

- Nestle S.A. – 1.24%

- Roche Holding Ltd Dividend Right Cert. – 0.97%

The IXUS ETF has $31.7 billion in assets under management, with an expense ratio of 0.56%. Despite exposure to international equities, a pretty even weighting and diversification between developed and emerging markets results in a balanced fund that can withstand market downturn; 5-year returns of 38.58%, 3-year returns of 20.82%, 1-year returns of 19.03%, and a dividend yield of 2.11%.

Final thoughts

International value ETFs comprise companies across the economic and cap divide with the excellent dent to equity ratios and legroom for growth, which enables them to thrive in interest rising and inflation rising economic conditions.

Given the skyrocketing commodity prices and looming World War 3 that speaks to worsening conditions, these three international value ETFs not only feature relatively low-cost investments that will result in consistent and regular income. These three internationals provide all these and a chance to track portfolio investment results easily.

Comments