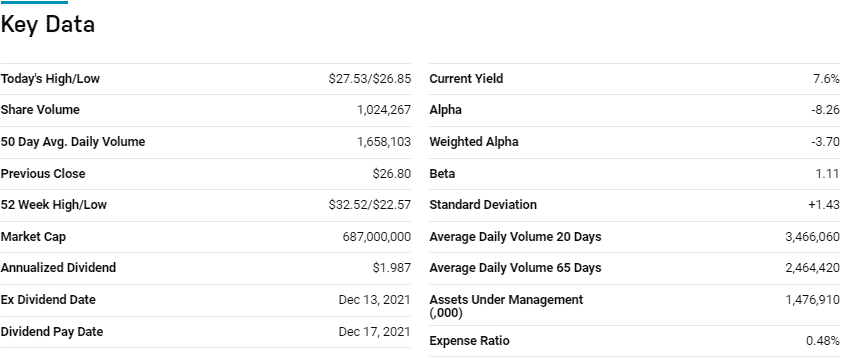

Hollywood might have depicted as the drug hub of the world with an indigent populace but what they don’t show is that it is a developing economy full of potential. The Mexican economy is the 15th largest globally nominal GDP and the 11th largest consumer economy.

This data shows that it is one of the best economies in Latin America and worth an investment. Like with so many developing markets, the problem is the volatility associated with these economies, necessitating the need for risk mitigated exposure to investments. For this reason, ETFs are a prudent investment asset when seeking exposure to the Mexican economy.

What is the composition of Mexican ETFs?

They comprise equities either domiciled in Mexico or those with significant assets or drawing significant revenues off the Mexican economy. As a result, this list will include exchange-traded funds with significant exposure to the Mexican economy, essentially all those with Mexico as part of its top country weightings.

Top 7 Mexican ETFs

The Mexican economy is characterized by developing modern industries and the services sector. Unprecedented stable governance has stabilized this economy’s macroeconomic factors, resulting in low inflation rates and increased per capita income. With 90% of its exports and 55% of imports being with the USA and Canada, it provides an indirect play on these global economies. The seven Mexican ETFs below are in pole to benefit and reap significant rewards.

iShares MSCI Mexico ETF (EWW)

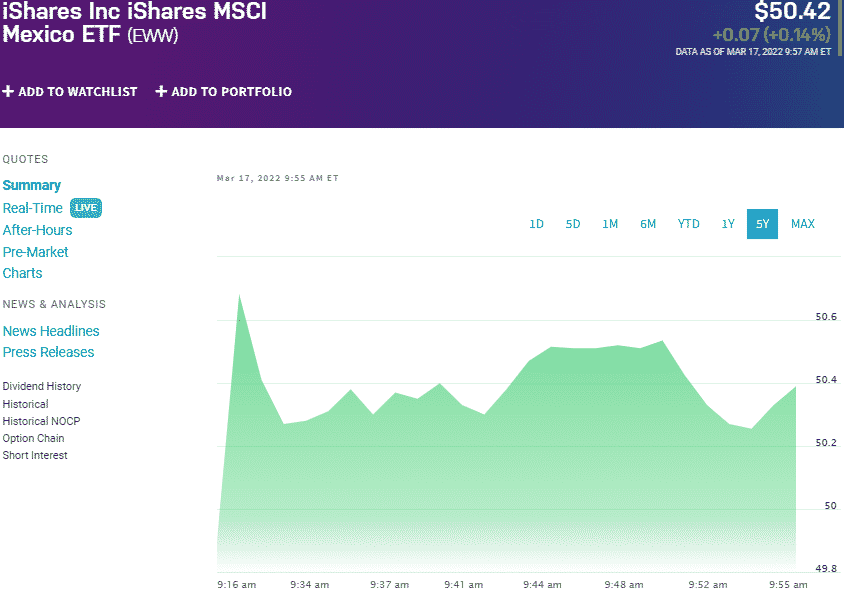

Price: $50.42

Expense ratio: 0.51%

Dividend yield: 1.80%

EWW chart

iShares MSCI Mexico ETF tracks the MSCI Mexico IMI 25/50 Index, investing at least 80% of its assets in the holdings of the tracked index and other investment assets with similar economic characteristics to the composite index holdings.

The EWW is a non-diversified fund exposing investors to the large-cap and mid-cap operating within the Mexican economy.

EWW ETF is ranked № 27 by US News analysts among 78 of the best miscellaneous region funds for long-term investing.

The top three holdings of this fund are:

- America Movil SAB de CV Class L– 17.00%

- Wal-Mart de Mexico SAB de CV – 10.61%

- Grupo Financiero Banorte SAB de CV Class O – 9.70%

EWW ETF boasts $715.3 million in assets under management, with an expense ratio of 0.51%. Concentrating on mega and large-cap Mexican equities has resulted in funs that consistently give investors returns; 5-year returns of 15.22%, 3-year returns of 24.68x%, and 1-year returns of 15.07%. This ETF is the best option available to investors for pureplay exposure to the Mexican large-cap equity market.

Xtrackers Emerging Markets Carbon Reduction and Climate Improvers ETF (EMCR)

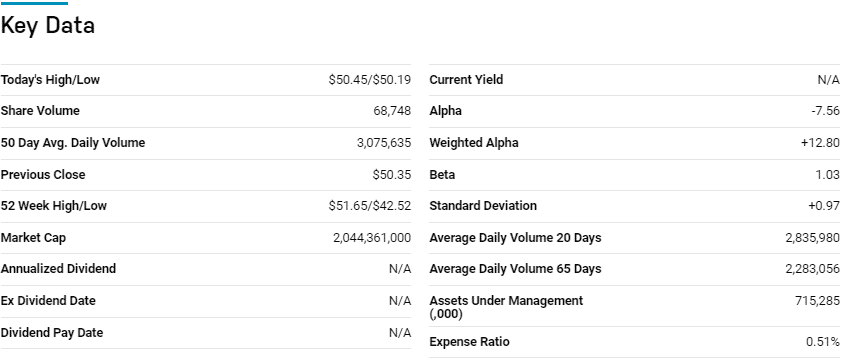

Price: $30.53

Expense ratio: 0.15%

Dividend yield: 1.75%

EMCR chart

Xtrackers Emerging Markets Carbon Reduction and Climate Improvers ETF track the performance of the Solactive ISS Emerging Markets Carbon Reduction & Climate Improvers Index NTR, net of fees and expenses. It invests at least 80% of its assets in emerging market equities committed to reducing greenhouse gas emissions and those that meet specific ESG criteria for zero emissions.

The top three holdings of this fund are:

- Taiwan Semiconductor Manufacturing Co., Ltd. – 9.62%

- Tencent Holdings Ltd. – 5.21%

- Samsung Electronics Co., Ltd. – 3.62%

The EMCR has $665.3 million in assets under management, with a relatively low expense ratio of 0.15%. It’s a diversified play on Mexico since this fund includes other emerging economies. In addition, it offers targeted exposure to equities making their mark in reducing carbon footprint, giving you a chance to invest with a conscience and get returns; 3-year returns of 24.64% and 1-year returns of -5.21%. Inclusion of large and mid-cap equities results in a fund that provides both value and growth to a portfolio.

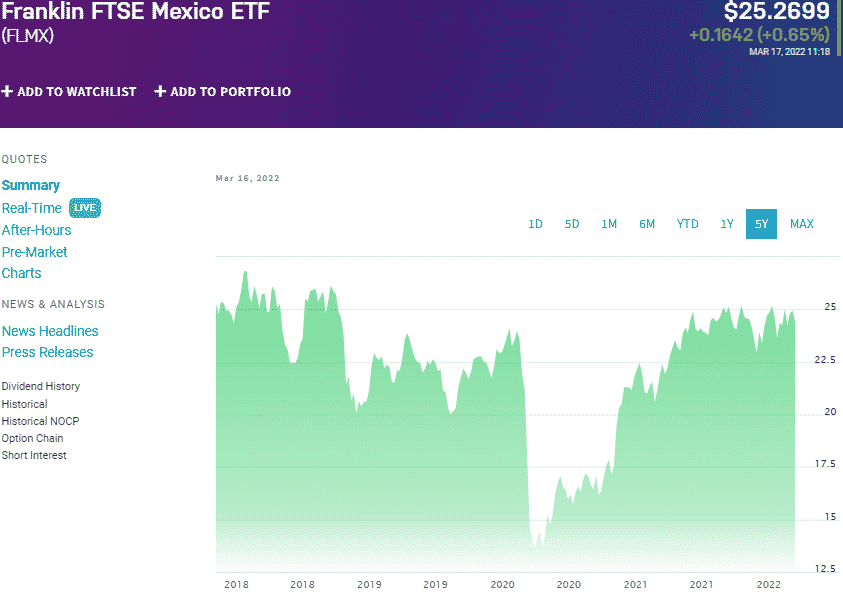

Franklin FTSE Mexico ETF (FLMX)

Price: $25.26

Expense ratio: 0.19%

Dividend yield: 1.80%

FLMX chart

Franklin FTSE Mexico ETF tracks the performance of the FTSE Mexico RIC Capped Index, net of expenses, and fees. It invests, under normal conditions, at least 80% of its assets in the holdings of its composite index and depository receipts representative of the underlying holdings, exposing investors to the best Mexican large-cap and mid-cap segments.

The top three holdings of this fund are:

- America Movil SAB de CV Class L – 16.31%

- Grupo Financiero Banorte SAB de CV Class O – 11.45%

- Wal-Mart de Mexico SAB de CV – 11.41%

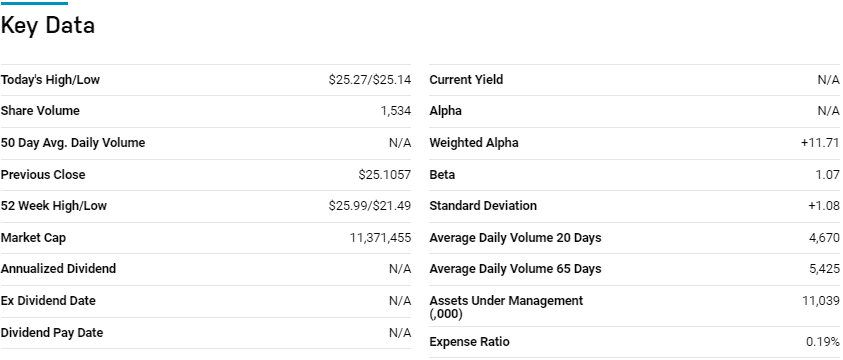

First Trust Latin America AlphaDEX Fund (FLN)

Price: $18.93

Expense ratio: 0.80%

Annual dividend yield: 2.34%

FLN chart

The First Trust Latin America AlphaDEX Fund tracks the performance of the NASDAQ AlphaDEX Latin America Index, net of expenses, and fees. FLN invests at least 90% of its total assets in the REITs, preferred shares, depository receipts, and common stocks included in the composite index. It exposes its investors to Latin American equities chosen via the AlphaDex methodology to generate positive alpha, ensuring risk-adjusted returns.

The top three holdings of this fund are:

- Aurubis AG – 5.86%

- Talanx AG – 4.68%

- Porsche Automobil Holding SE Pref – 4.45%

The FLN ETF has $8.2 million in assets under management, with an expense ratio of 0.80%. The AlphaDex formula and its quant-based methodology avoid large-cap equities resulting in a firm that provides consistent returns for investors; 5-year returns of 9.27%, 3-year returns of -0.33%, 1-year returns of 8.09%. Despite avoiding large-cap equities for stability, a pretty even weighting provides a fund free of concentration bias and a way for the fund to withstand market downturns.

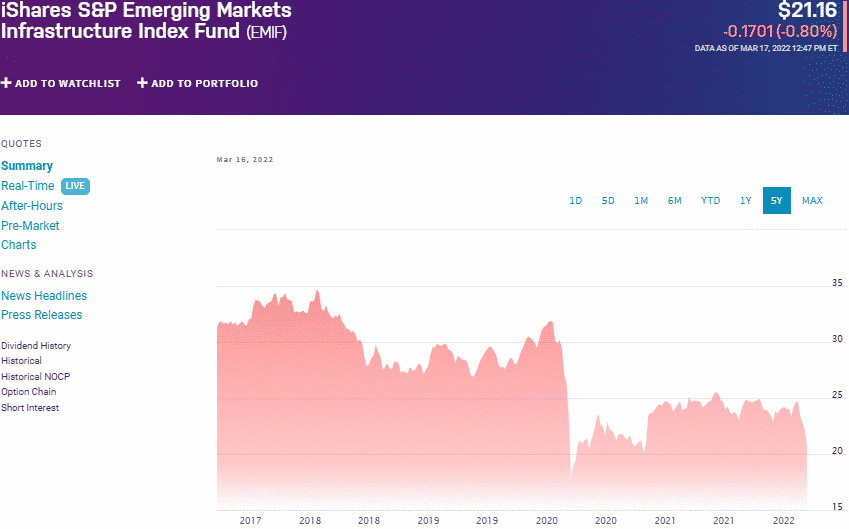

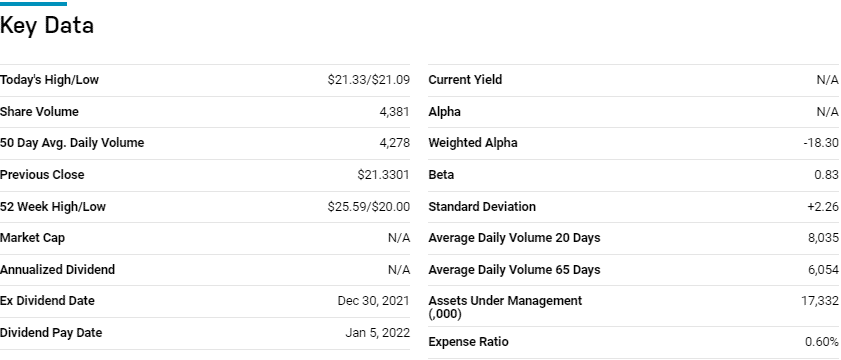

iShares Emerging Markets Infrastructure ETF (EMIF)

Price: $21.16

Expense ratio: 0.60%

Dividend yield: 4.16%

EMIF chart

The iShares Emerging Markets Infrastructure ETF tracks the performance and yield of the S&P Emerging Markets Infrastructure IndexTM, net of expenses, and fees. It invests at least 80% in its underlying index and other securities depicting similar economic characteristics to the tracked index under holdings.

The remaining 20% is invested in cash and cash equivalents, swap contracts, futures, and options, not included in the composite index. The result is exposure to 30 of the largest infrastructure firms in developing economies.

The top three holdings of this non-diversified fund are:

- Airports of Thailand Public Co. Ltd. NVDR – 12.04%

- Grupo Aeroportuario del Pacifico SAB de CV Sponsored ADR Class B – 7.64%

- Grupo Aeroportuario del Sureste SA de CV Sponsored ADR Class B – 6.48%

The EMIF fund has $17.1 million in assets under management, with an expense ratio of 0.60%. For developing economies to get to the next level, infrastructure is critical, and as long as this sector is growing, returns are there for the picking.

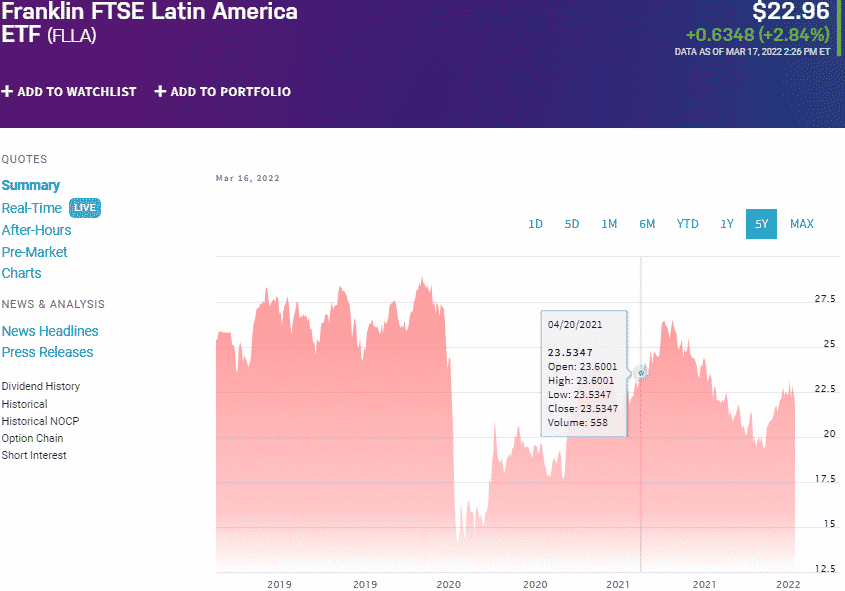

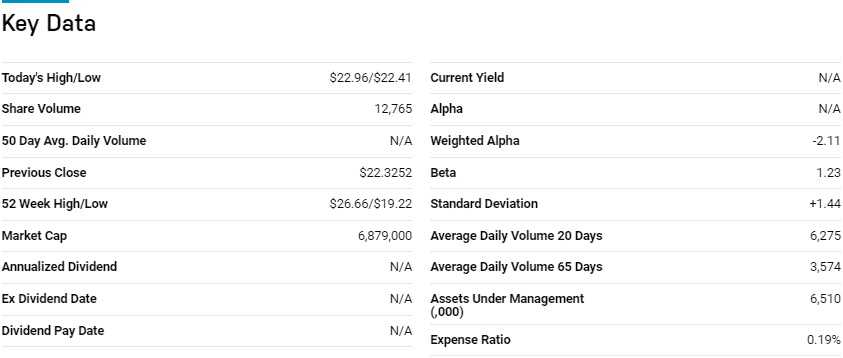

Franklin FTSE Latin America ETF (FLLA)

Price: $22.96

Expense ratio: 0.19%

Dividend yield: 2.96%

FLLA chart

The Franklin FTSE Latin America ETF tracks the FTSE Latin America RIC Capped Index, investing at least 80% in its underlying index and associated depository receipts. It exposes investors to Latin America large and mid-cap equities.

The top three holdings of this fund are:

- Vale S.A. – 11.13%

- Petroleo Brasileiro SA Pfd – 5.30%

- America Movil SAB de CV Class L – 4.34%

The FLLA ETF has $6.5 million in assets under management, with an expense ratio of 0.19%. It offers diversified exposure to the largest Latin America large and mid-cap equities, providing both value, growth, and stability for this fund; 3-year returns of -2.67% and 1-year returns of 12.98%.

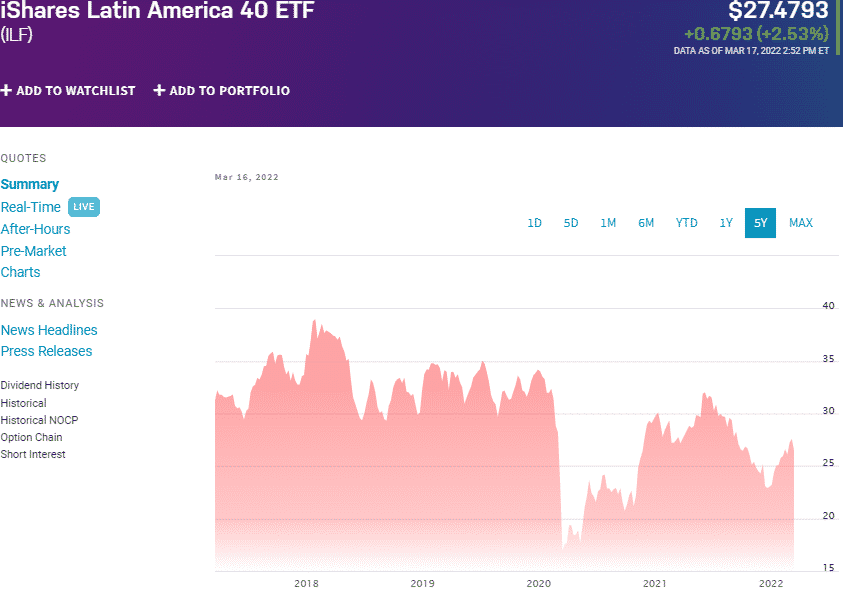

iShares Latin America 40 ETF (ILF)

Price: $27.4793

Expense ratio: 0.48%

Dividend yield: 2.53%

ILF chart

iShares Latin America 40 ETF tracks the performance and yield of the S&P Latin America 40TM, net of fees and expenses. It invests at least 80% in its underlying index and securities of like economic characteristics to the composite index under holdings, exposing investors to the top forty largest equities in Latin America.

USNews evaluated 8 Latin America ETFs, and the ILF is ranked No 3 for long-term investing.

The top three holdings of this fund are:

- Vale S.A. Sponsored ADR – 17.27%

- Petroleo Brasileiro SA Sponsored ADR Pfd – 6.73%

- Petroleo Brasileiro SA Sponsored ADR – 5.90%

The ILF ETF is the largest fund on this list boasting $1.48 billion in assets under management, with an expense ratio of 0.48%. Despite having just 35 holdings and the top made up for two-thirds of the total weight, concentration on the largest Latin America equities resulting in a fund that can hold its own even in a market downturn; 5-year returns of 1.51%, 3-year returns of -11.76%, and 1-year returns of 4.70%. In addition, investors get to enjoy consistent and regular returns as the fund has a dividend yield of 2.53%.

Final thoughts

The Biden administration has resulted in the mending of the US-Mexico relations. As a result, Mexican equities and the economy are expected to grow and overtake pre-pandemic levels. The seven ETFs above have significant exposure to this developing market, giving investors a way to play its expansion.

Comments