Europe is a vast continent despite the concentration with the primary markets in the zone; Russia, UK, Germany, France, Spain, Netherlands, among others. It is home to the most prominent companies across the economic divide; Volkswagen, Royal Dutch Shell, Total, BP, Daimler, Exor Group, Gazprom, to name a few.

In addition to the Covid-19 ravaging most of the European economic powerhouses, investors have shown to have more appetite for the US ETFs than Euro ETFs. In the past year, European ETFs have underperformed the US ETFs by approximately 3%.

However, despite the underperformance, statistics show that Euro equities offer portfolio diversification in the short term since the correlation with US equities is as low as 0.44; the correlation is much higher in the long term.

What is the composition of a European ETF?

European ETFs comprise a pool of investment assets that track an index based in the European region and invests at least 75% of its assets in investment vehicles in the Eurozone. In most cases, such funds expose investors to the most significant economic zones in Europe, including Russia, UK, France, Germany, Netherlands, Switzerland, and Spain.

Emerging markets in eastern Europe also provide investors with room for growth and wealth creation. Wall Street might be the dominant global investment space, but European ETFs provide geographical portfolio diversification and access to the less volatile coupled with developed European economies.

Top 7 European ETFs

Exchange-traded funds headquartered in the US might be the most popular exchange vehicle, but they are not the sole option available to investors. When the US investment market is in turmoil, European ETFs provide a hedge option and an avenue for portfolio diversification.

The European market also tends to be cheaper compared to the US market but at the same time provides better dividends yields. As such, the seven best European ETFs are as follows.

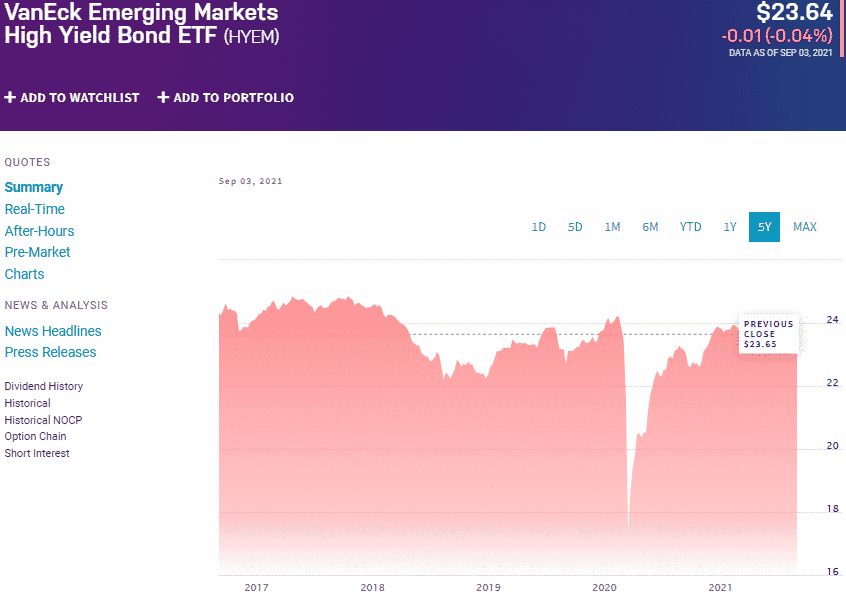

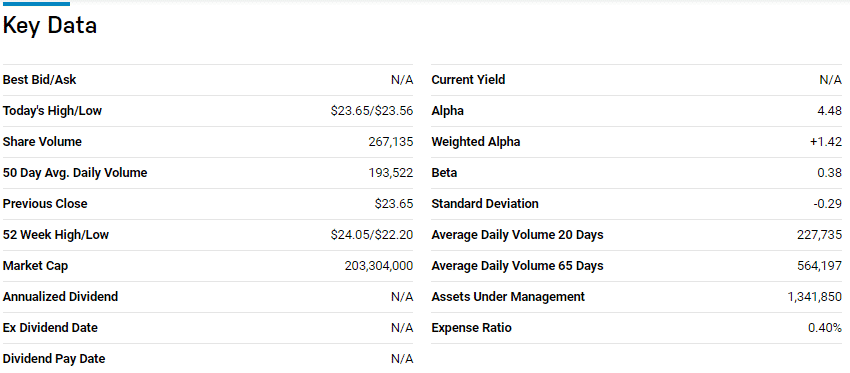

Best emerging Europe bond ETF: VanEck EM High Yield Bond ETF (HYEM)

Price: $23.64

Expense ratio: 0.40%

This ETF is ranked №1 by US News analysts among emerging markets bond ETFs.

With monthly dividends of $0.10 to the share coupled with an average annual dividend yield of 5.21%, this bond ETF is worth eyeing.

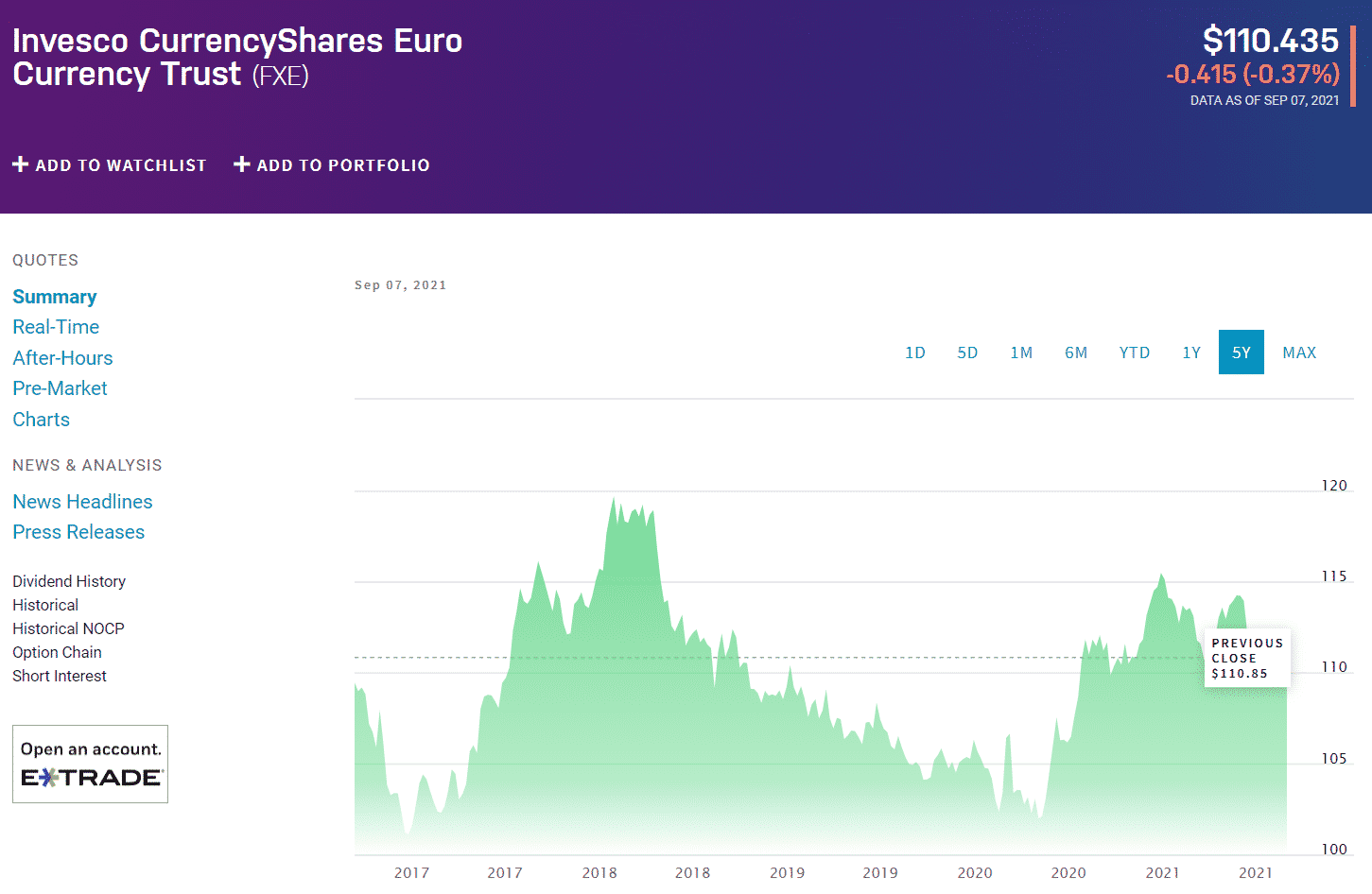

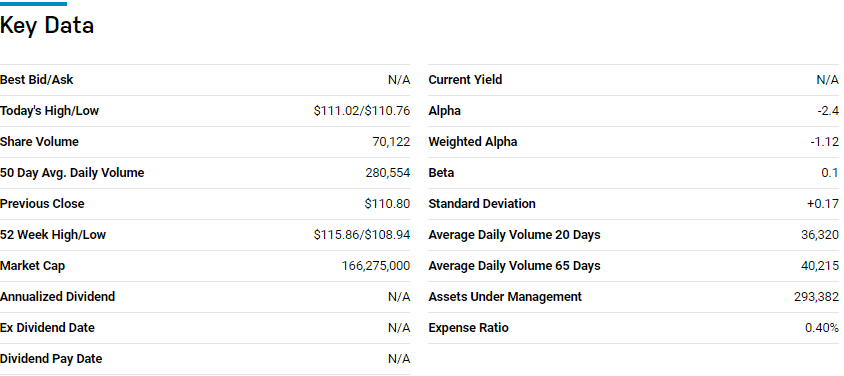

Best Europe ETF for currency hedge: Invesco CurrencyShares Euro Trust Fund (FXE)

Price: $110.43

Expense ratio: 0.40%

The FXE holds euros in deposit accounts to better track the performance of the EUR/USD spot exchange, ensuring an overall view of the Eurozone economic conditions since it is the Eurozone’s common currency.

The FXE has $293.69 million in assets under management, with an expense ratio of 0.40%. This ETF is negatively correlated to the dollar providing a green buck hedge option to investors.

To hold investments in the Eurozone, the FXE is a fund to hedge against investments held across European borders, given that it is the official currency of the zone.

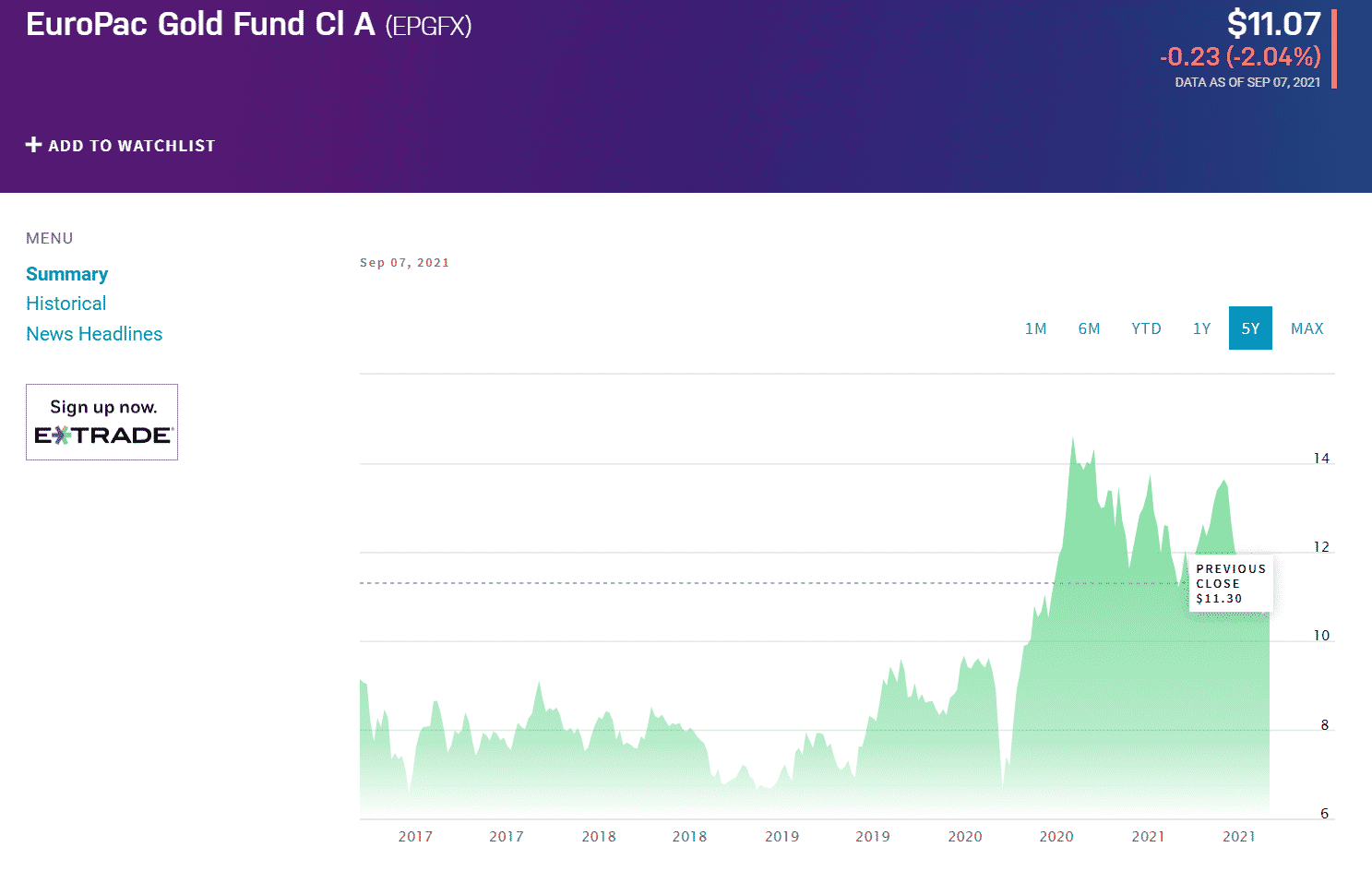

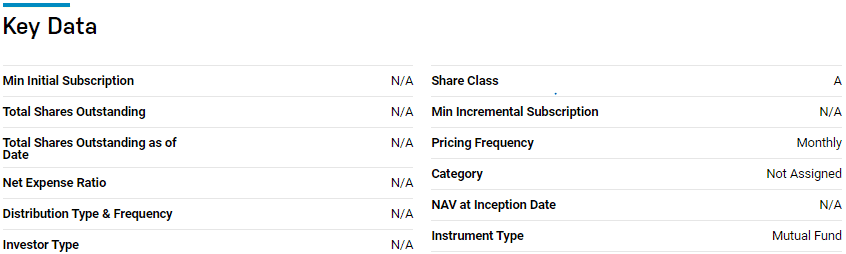

Top Europe gold miners ETF: EuroPac Gold Fund (EPGFX)

Price: $11.07

Expense ratio: 0.5%

An evaluation of 56 exchange-traded funds dealing in precious metals by US News has the EPGFX at rank №12.

The EPGFX fund has $208.45 million in assets under management, with a net expense ratio of 1.4%. This fund’s returns are 15.17% in the last three years, with the 5-year returns being 3.93%.

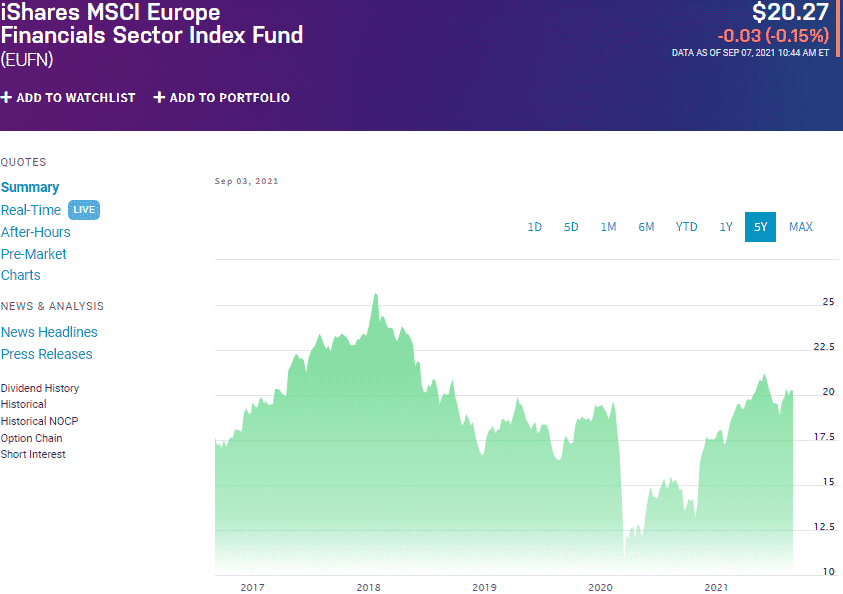

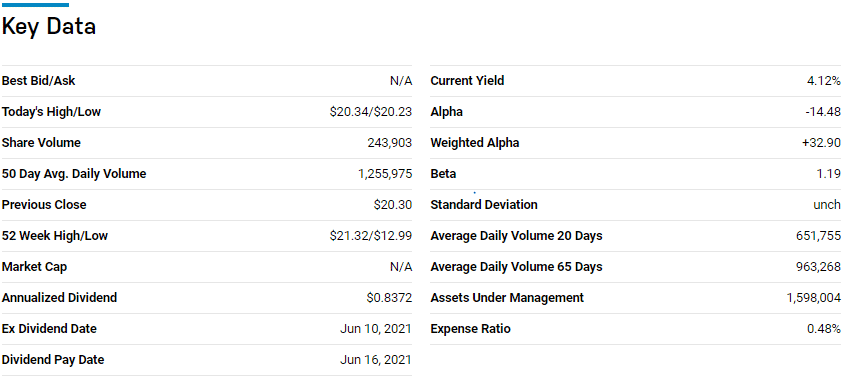

Europe financial ETF: iShares MSCI Europe Financials Sector ETF (EUFN)

Price: $20.27

Expense ratio: 0.48%

An evaluation of 29 global financial exchange-traded funds by US News has the EUFN at rank #18.

In its portfolio, the top three holdings are HSBC Holdings Plc — 6.14%, Allianz SE — 5.45%, and BNP Paribas SA Class A shares — 4.11%.

The EUFN has $1.59 billion in assets under management, with an expense ratio of 0.48%. In the last three years, investors have enjoyed returns of 12.74%, which is a dip compared to five years’ returns of 36.26%.

As the world recovers from the Covid-19 ravages, this financial sector ETF focused on the Eurozone is one to observe given the 40.62% returns in the pandemic year, followed by year-to-date returns of 18.08%.

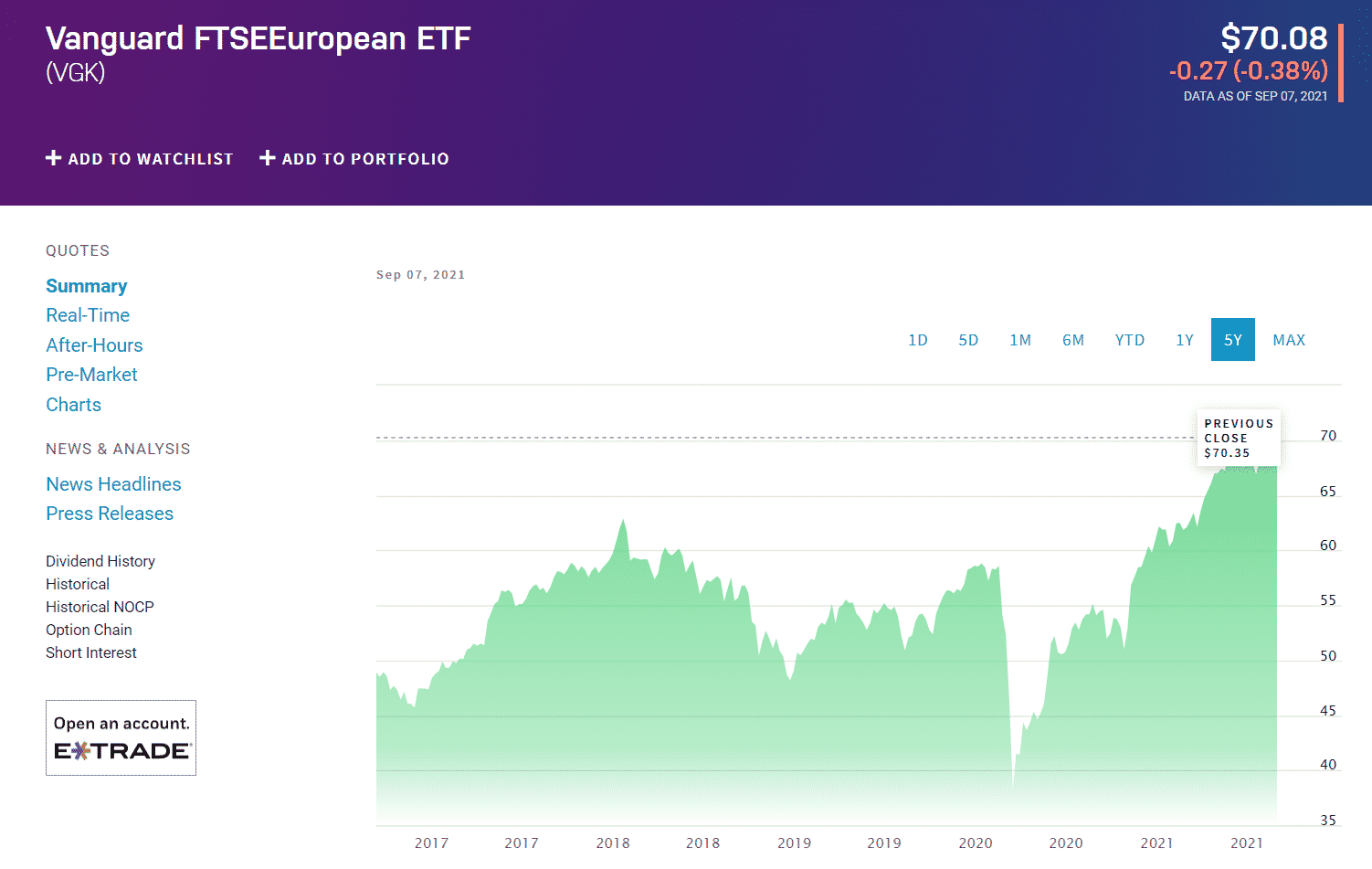

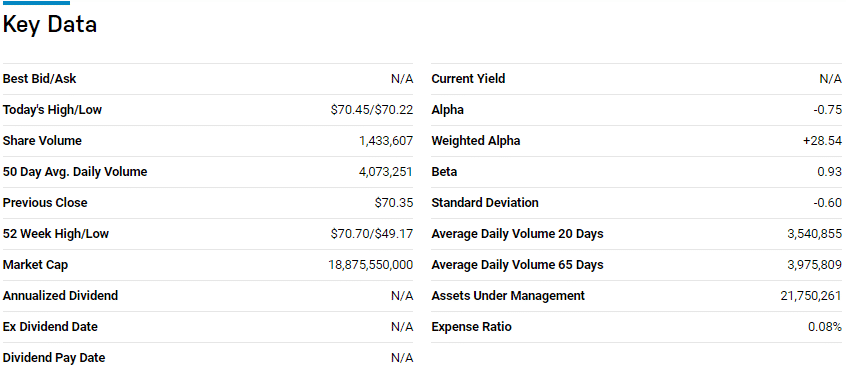

Vanguard fund for Europe: Vanguard FTSE European ETF (VGK)

Price: $70.24

Expense ratio: 0.08%

An evaluation of 29 European exchange-traded funds by US News has the VGK at rank №8. In its portfolio, the top three holdings are Nestle SA — 2.82%, ASML Holdings — 2.20%, and Roche Holdings — 2.13%.

In a pandemic year when almost all sectors were in a dip, this ETF still managed 35.29% returns showing the might of its diversification. With year-to-date returns of 18.58%, this diversified fund is one to keep on the crosshairs.

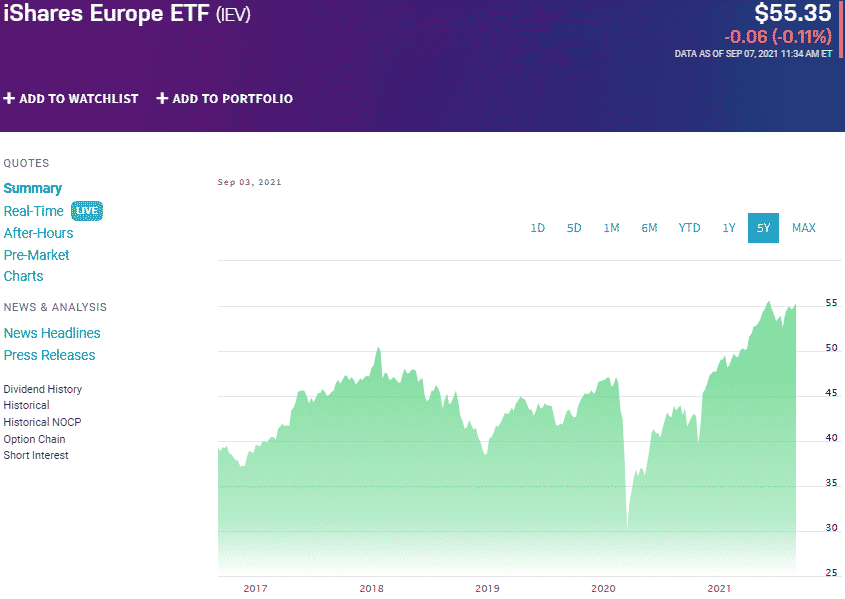

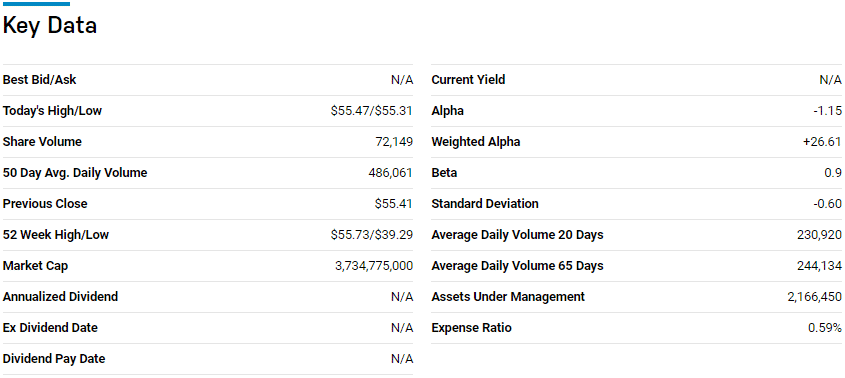

Fund by iShares: iShares Europe ETF (IEV)

Price: $55.35

Expense ratio: 0.09%

The iShares Europe ETF tracks the performance of the S&P Europe 350TM, exposing investors to the top companies in Belgium, France, Austria, Germany, Portugal, UK, Sweden, Luxembourg, Italy, Switzerland, Norway, Ireland, and Finland. The underlying index is part of the S&P 1200, which tracks the global economic performance via the 1200 large-cap organizations.

An evaluation of 29 European stock exchange-traded funds by US News has the IEV at rank №12. In its portfolio, the top three holdings are Nestle SA — 3.35%, ASML Holdings — 2.92%, and Roche Holdings — 2.49%.

The IEV has $2.16 billion in assets under management, with an expense ratio of 0.09%. In the last three years, investors have enjoyed returns of 33.04%, which is a dip compared to five years’ returns of 58.08%.

With post-pandemic year-to-date returns of 17.47%, this fund is worth a second look.

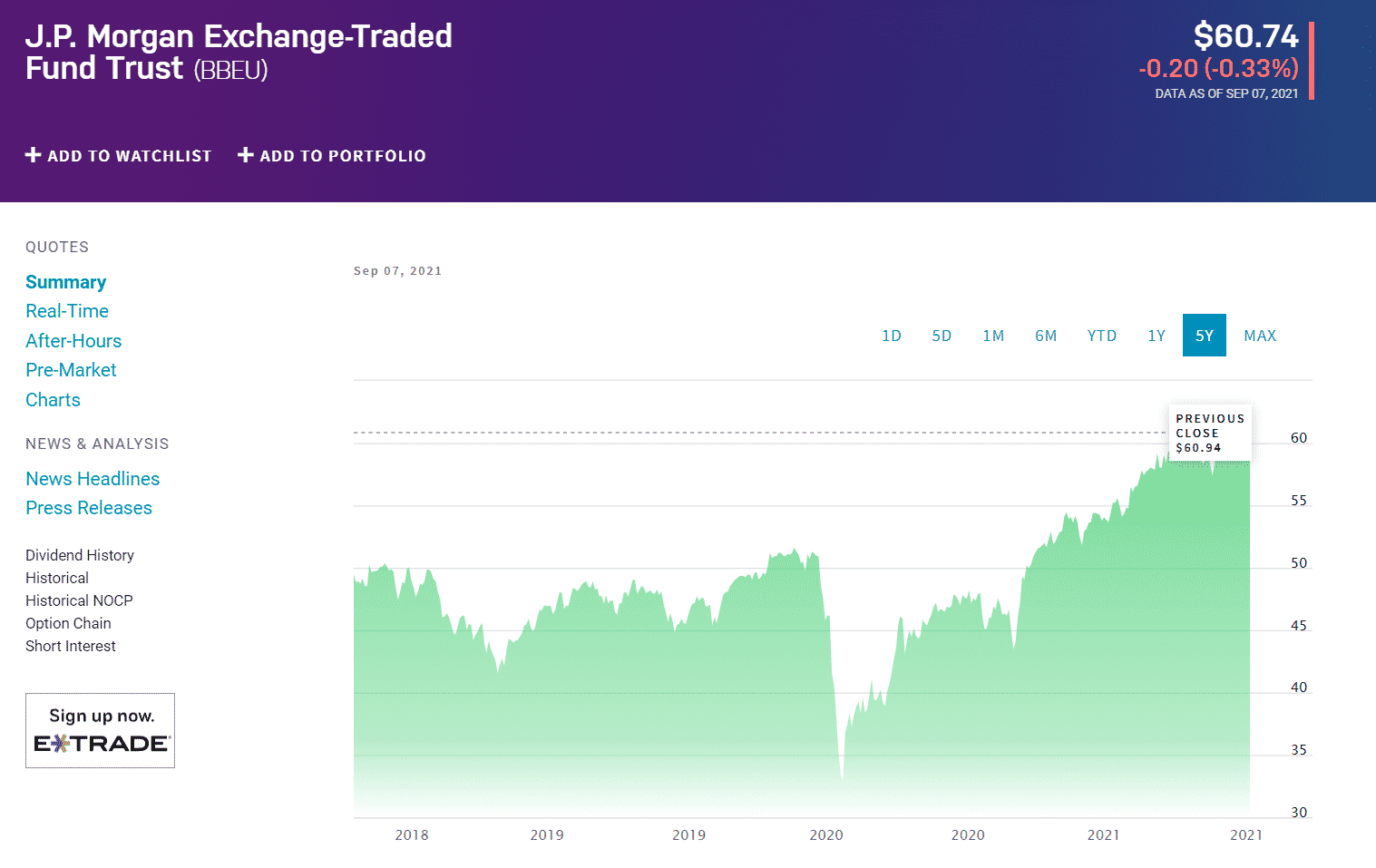

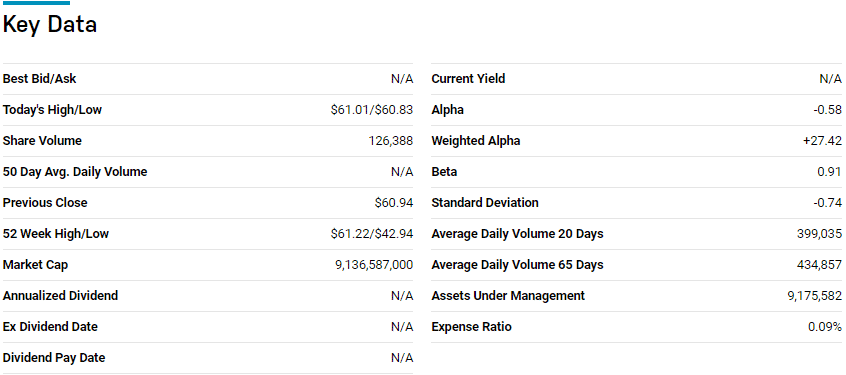

Chasing large and mid-cap: JPMorgan BetaBuilders Europe (BBEU)

Price: $60.89

Expense ratio: 0.09%

An evaluation of 29 European exchange-traded funds by US News has the VGK at rank №4 for long-term investment.

The BBEU has $9.14 billion in assets under management, with a relatively low expense ratio of 0.09%. Historical performance shows that this fund is worth diversifying its investment portfolio with having recorded three years of 35.29%, pandemic year returns of 33.62%, and year-to-date returns of 18.66%.

Final thoughts

Wall Street ETFs are not the only way to go when it comes to investing. European ETFs have enough diversification and low short-term correlation to diversify one’s investment portfolio and make a ton of money.

Comments