Money almost constantly loses its value. The same $10 that you have in your pocket right now will not be able to buy you the same amount of things in a year as it is now. While, in and of itself, inflation is not that bad, it is crucial to find the right way to protect your assets and your portfolio.

One of the ways you can do it is to buy debt-oriented exchange-traded funds. Today, we will dive into the topic, define the main terms, and see how you can use the best hedge against inflation.

What is inflation

Simply put, inflation is an increase in prices over a specified time. Different systems track and calculate inflation in different countries, but the most common is the CPI, which stands for consumer price index. It is a figure that assesses the weighted average of prices of a group of consumer goods and services to make calculating inflation easier.

Inflation has its upsides, of course, but today, we are not interested in one of the longest-lasting disputes among economists. We are trying to figure out a way to protect our assets from depreciation.

What are bonds

In its essence, a bond is a loan given to a company or a government by an investor. Entities issue bonds when they need extra funding, so it is a good deal for them, but you also stand to benefit, as you get the interest while the bond is in your holding.

Investors usually view bonds as a less risky alternative to shares. Of course, the less risky a security is, the less money you stand to gain. Also, bonds can be viewed as a tangible way to hedge against volatility and any other change that comes into the markets. One of those changes is inflation.

What are the best five inflation-protected bond ETFs?

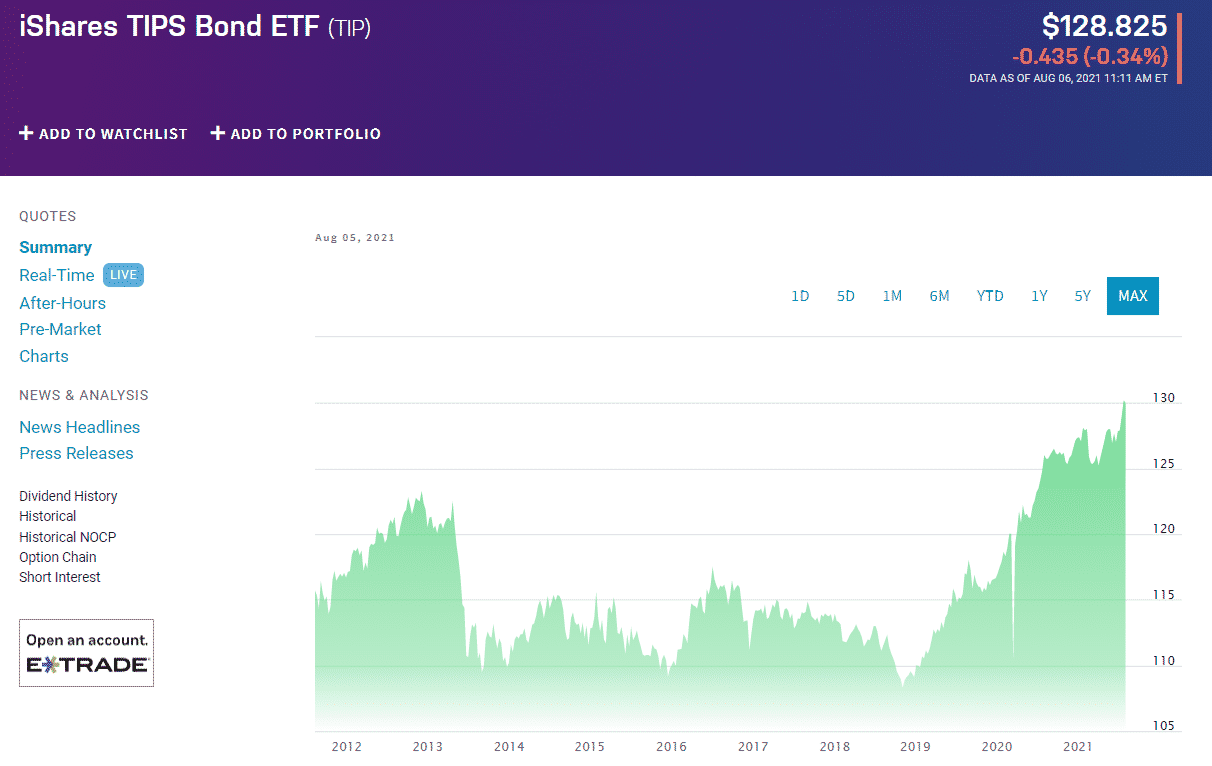

№ 1. iShares TIPS Bond ETF (TIP)

iShares TIPS Bond ETF TIP chart

Over the years, TIP ETF has become very popular, and the exciting thing is that various kinds of investors favor it. It is generally viewed as one of the best ways to protect your portfolio against upticks in inflation. For those reasons, TIP is used both as an inflation hedge and as a long-term asset in investors’ portfolios.

It comprises 50 holdings, issued mainly by the United States Treasury. Its expense ratio stands at 0.19%, while its dividend amounts to $0.83. Its MSCI ESG rating came in at 6.1/10, which is not far from the niche’s standards, while its annualized return amounted to 6.68%, which is on the lower side, but understandably so, given its nature.

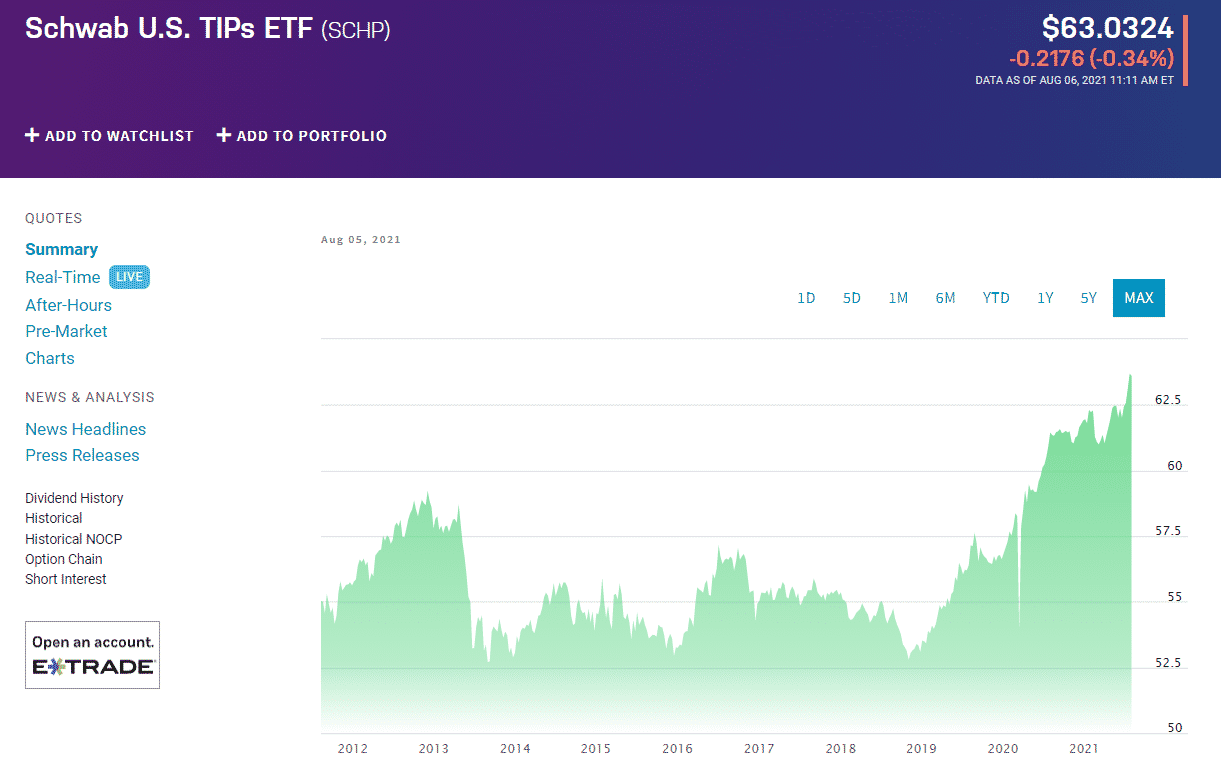

№ 2. Schwab U.S

Schwab US.TIPS ETF SCHP chart

The Schwab US TIPS ETF does a very similar thing to the one done by the fund we just covered. There are two critical differences between SCHP and TIP. The first one is that TIP boasts liquidity unmatched by SCHP and by a long shot. That’s why some investors might see TIP as their choice.

On the other hand, the SCHP ETF has an expense ratio of just 0.05%, which makes it very cost-effective. Its ESG rating is also 6.1/10 on the MSCI scale, while its annual return is similar to TIP at 6.96%.

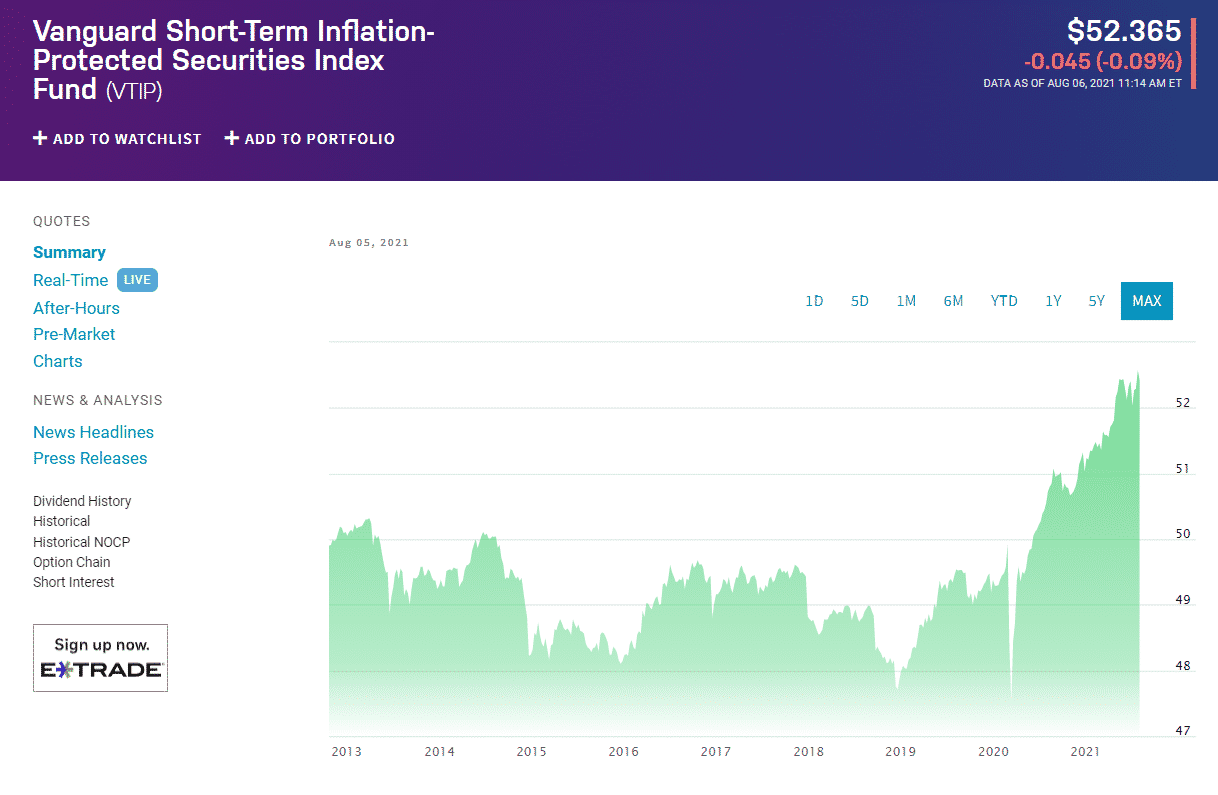

№ 3. Vanguard Short-Term Inflation-Protected Securities ETF (VTIP)

Vanguard Short-Term Inflation-Protected Securities ETF VTIP chart

While it has the same 0.05% interest ratio as the last fund on the list, the VTIP ETF stands out in a different aspect. The key distinction is that the VTIP fund invests in debt with a maturity of under five years.

As such, not only does it provide a solid hedge against inflation, it serves as a counterweight to rising interest rates, also. With so little time on the clock for its holdings, the fund had to trade-off something. In the case of VTIP, it was the size of the returns.

The fund has the same 6.1/10 MSCI ESG holdings as the others on the list, while its dividend amounted to $0.48. It comprises 20 holdings.

№ 4. SPDR Portfolio TIPS ETF (SPIP)

SPDR Portfolio TIPS ETF SPIP chart

Price-wise, the SPIP ETF is somewhere between TIP and SCHP, with an expense ratio of 0.12%. Like all other funds on the list, SPIP cannot be considered a perfect hedge against inflation. Still, it can offer you broad exposure to treasury-inflation-protected securities, also known as TIPS, at a very reasonable price.

It consists of 45 holdings, and its returns came in at 6.8% over the last 12 months. As the fund’s issuer stated, this fund can serve as a good vehicle for investors “particularly worried” about inflation.

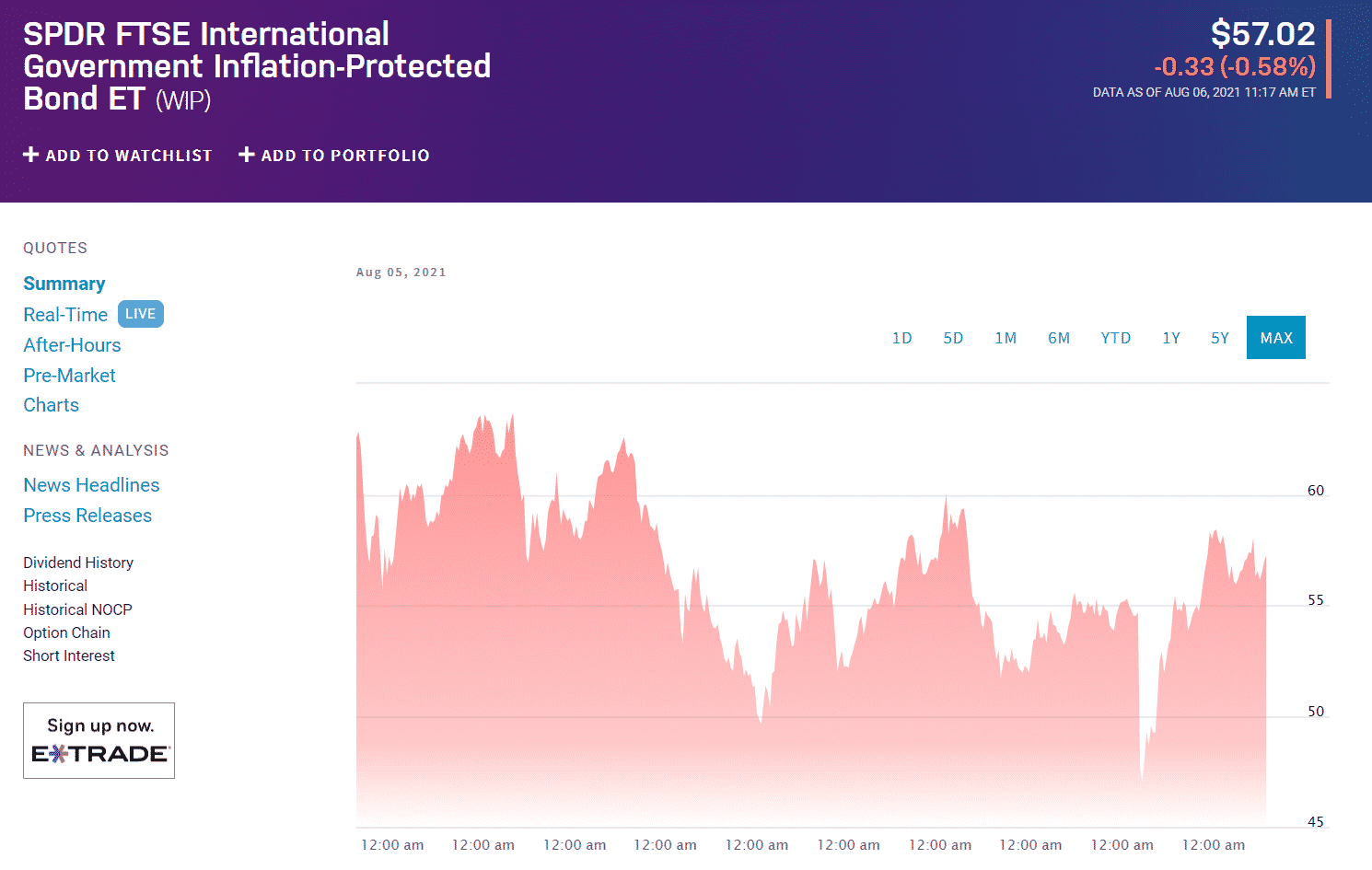

№ 5. SPDR FTSE International Government Inflation-Protected Bond ETF (WIP)

SPDR FTSE International Government Inflation-Protected Bond ETF WIP chart

The SPDR FTSE International Government Inflation-Protected Bond ETF WIP is often referred to as TIP’s international counterpart. That means that this fund offers similar features to the ETF we mentioned first but consists mainly of debt issued by the European governments.

While there are limitations to this approach, the idea behind the WIP fund is undoubtedly a good one. It gives you a chance to diversify assets among types of securities and amid different geographical localities.

The ETF’s expense ratio stands at 0.5%, while its dividend came in at $0.3 during the last trimester. It holds 182 units, and its returns in the previous year amounted to 7.08%.

Final thoughts

Hedging against inflation is, at its core, a bet. What we mean by that is that too much protection against inflation is going to yield sub-par results if inflation doesn’t occur at the anticipated level.

On the other hand, if it does happen and you are unprotected, you are not in for a nice ride. It all boils down to moderation and strategic thinking. Try not to succumb to fears, as hedging against everything will usually leave you with next to nothing. Analyze the situation, and try to get as much information as needed to make an educated decision.

Comments