Exchange-traded funds with high yields have always been attractive for investors, in a similar way the stocks with impressive dividends are. While it is easy to understand the appeal that high-yield funds hold, it is essential to remember that not all were created equal or made for everybody.

Stick around, and you will get to learn how to look under the hood and see if an exchange-traded fund is the right choice for you and see how you can become an income investor.

What are high-yield funds?

A dividend is the amount of money that a company carves out of its profits and distributes among shareholders. Most of the shareholders receive dividends quarterly or once every three months.

The tricky part is: how do we measure if an ETF is high yield. With no clear rules on the matter, a good rule of thumb when determining if a dividend is high is to measure it against the yield of the benchmark S&P 500 index.

So what ETFs are a good choice if you want to maximize the gains from dividends?

Top five high yield ETFs

№ 1. The Vanguard High Dividend Yield Index Admiral Shares (VHYAX)

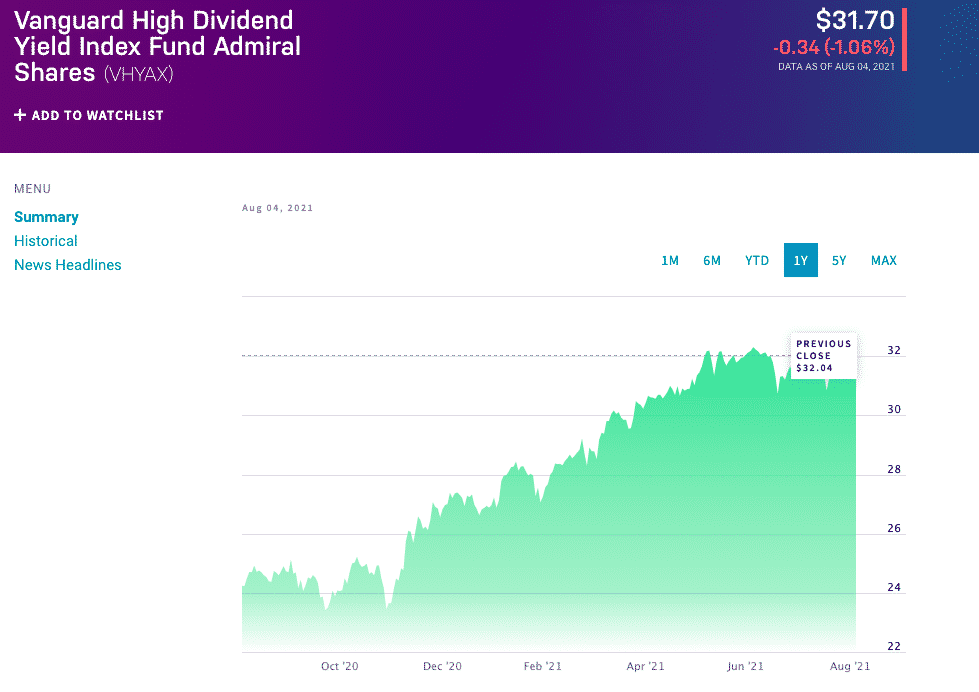

The Vanguard High Dividend Yield Index Admiral Shares (VHYAX)

Initiated on February 7, 2019, the Vanguard High Dividend Yield Index Admiral Shares fund is relatively new. By the words of its issuer, this ETF tracks an index made to provide exposure to companies with above-average dividends.

Meanwhile, the fund’s returns may not be as exciting as those of other growth shares, especially during a bullish market. That’s why this fund is a good choice for investors following a buy-and-hold strategy, as well as for those who can tolerate a bit of equity market volatility.

It has a four-star rating on the Morningstar risk scale and pays a dividend of $0.23. Its dividend yield stands at 2.77%.

As you can see on the chart, apart from a solid yield, the fund did well, price-wise. After recovering from the initial shock, it climbed the $30 mark, where it’s been hovering for a while now.

The fund comprises 412 holdings, 21.8% of which are financial companies. The fund boasts JPMorgan Chase & Co. and the pharmaceutical company Johnson & Johnson among the top ten holdings.

№ 2. Alerian MLP ETF (AMLP)

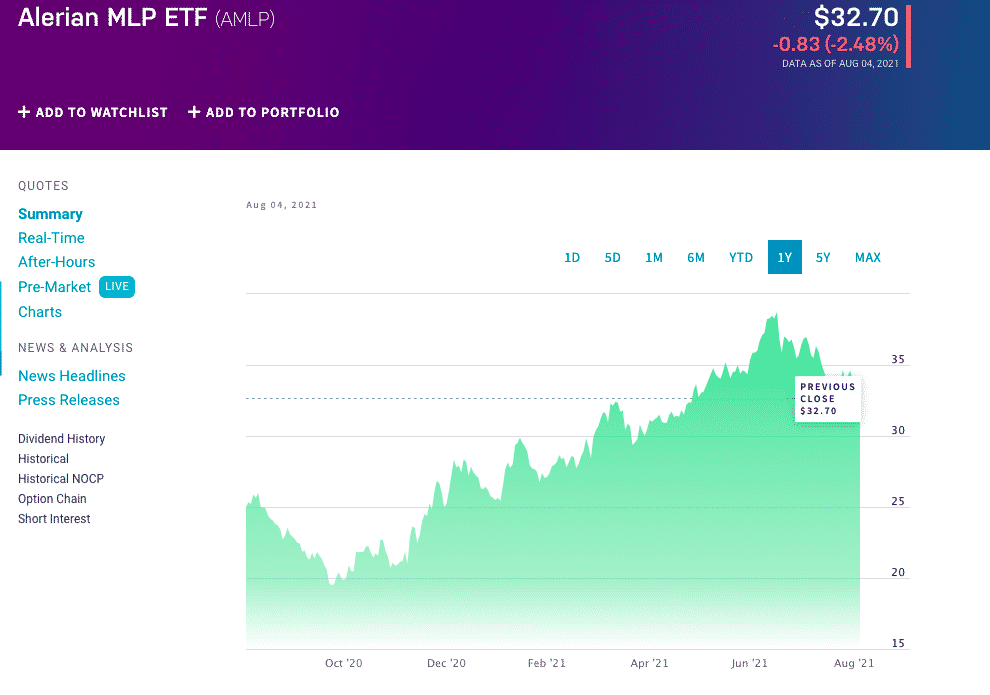

Alerian MLP ETF (AMLP)

The Alerian MLP ETF was founded in August 2010, and it mimics the Alerian MLP Infrastructure Index. The benchmark offers exposure to master limited partnerships that each earn at least half of EBITDA from assets not directly exposed to changes in commodities prices.

It boasts a quarterly dividend of $0.68 and an annual dividend yield of 8.25%. It has a 2.7/10 ESG score, but that should come as no surprise, as you are not looking to make sky-high returns via the fund but reap the benefits of slow and steady dividends.

On the other hand, the ETF’s market capitalization comes in at $16.39 billion. At the same time, its annual returns amount to over 72%, so it might not be a bad growth opportunity if you can stomach the volatility.

Regarding the niche, the Alerian MLP ETF invests in energy infrastructure companies based in the United States.

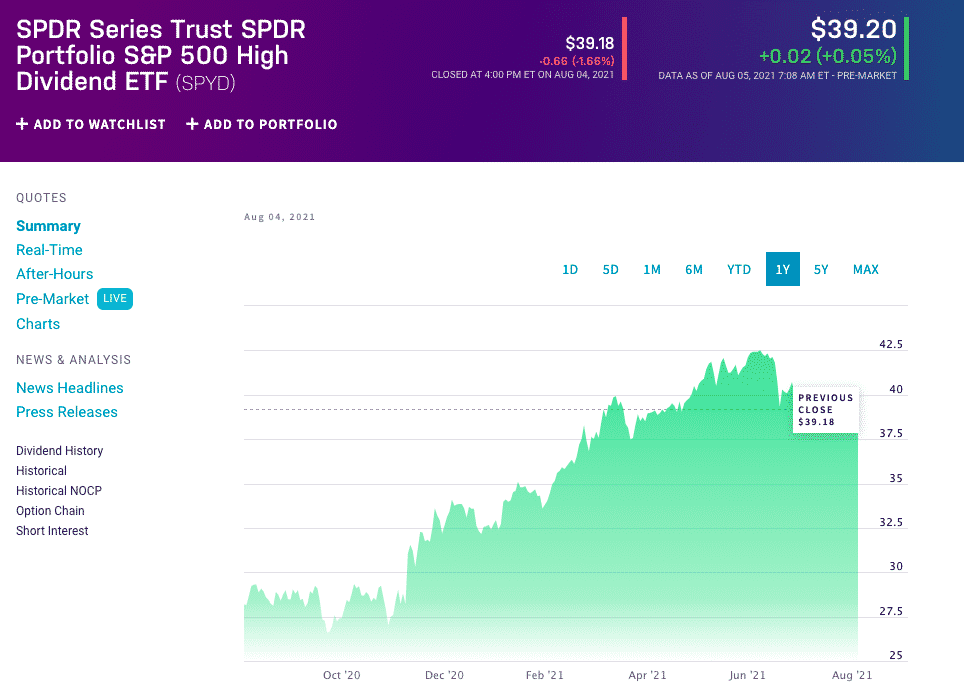

№ 3. SPDR Portfolio S&P 500 High Dividend ETF (SPYD)

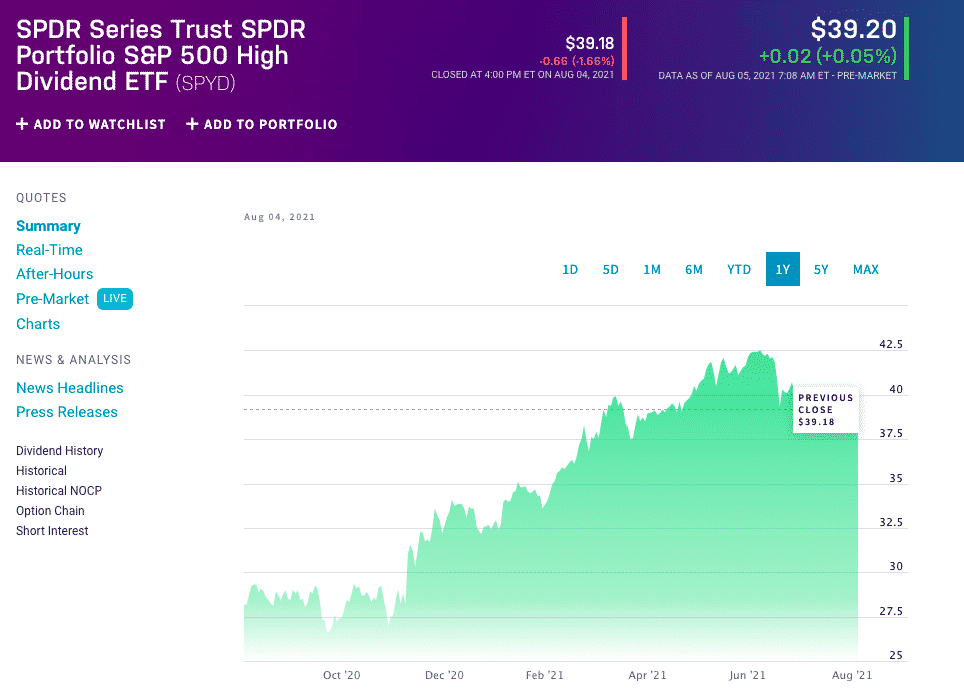

SPDR Portfolio S&P 500 High Dividend ETF SPYD

SPDR Portfolio S&P 500 High Dividend ETF SPYD is very straightforward when it comes to methodology. It quite simply ranks all dividend payers in the S&P 500 benchmark and then selects the top 80. It is as honest as it gets.

It first takes the most recent dividend, multiplies it by its frequency, and divides it by the price of shares. The fund issuer itself calls it “a no-nonsense approach to high yield in the US large-cap space.” And it operates exactly as it sounds.

It is a fund that looks to provide a chance at high capital appreciation accompanied by relatively low costs. It scored 6.72/10 on the ESG scale and was given one star by Morningstar. Its dividend yield amounts to 4.79% at an expense ratio of just 0.07%.

№ 4. Invesco KBW High Dividend Yield Financial ETF (KBWD)

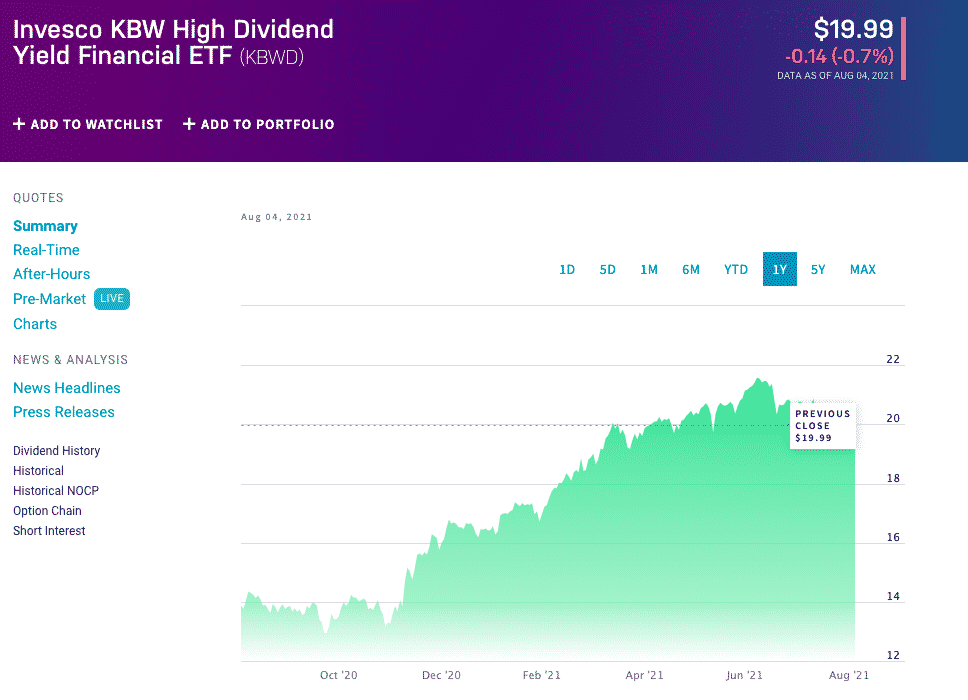

Invesco KBW High Dividend Yield Financial ETF (KBWD)

The Invesco KBW High Dividend Yield Financial ETF mimics the KBW Nasdaq Financial Sector Dividend Yield Index. It got its name from Keefe Bruyette & Woods, Inc. which compiles, and calculates the index.

Its main goal is to provide exposure to high-dividend-yield actors within the American financial sectors. While doing so, the fund goes around the industry giants and the broad financial market and favors smaller companies that offer higher yields.

That being said, investing in KBWD certainly carries its risks because the companies that offer higher dividends usually don’t have the most stable fiscal footing.

The fund rebalances its holdings every three months, much like the index it tracks. On Morningstar, it has a one-star rating. Its most recent dividend yield came in at 7.22%, but it goes as high as 10% from time to time.

№ 5. Global X SuperDividend ETF (SDIV)

Global X SuperDividend ETF (SDIV)

The Global X SuperDividend ETF SDIV has a straightforward goal, to provide exposure to the companies with the highest dividends in the world. It does so by investing in 100 of the highest dividend-yielding equity securities worldwide.

It came to be more than ten years ago, and it can be utilized both as a part of a buy-and-hold strategy and by those looking for attractive risk/return profiles. Its methodology is also pretty cut-and-dried. It chooses 100 highest-yielding stocks based on liquidity and stability screens.

Its current dividend yield amounts to 7.67%, and it boasts a 3.1/10 rating on the MSCI ESG scale. If you are looking for a chance to diversify your high-yielding assets on a global scale, this fund could be the right pick for you.

Final thoughts

While investing in long-term high-yield assets may not be as thrilling as you may think, it certainly comes with various benefits. There is a wide array of ETFs that you can choose from. More than 120 funds revolve around high yields in the United States if we leave out the small ones, the leveraged funds, and the inverse ones.

They also work. The top three high-dividend-yield exchange-traded funds outperformed the S&P 500 index’s total return during the last year. They also come at a lower emotional cost because they are usually less volatile and more suitable for investors looking to reap long-term benefits.

Comments