The value of a currency is constantly in flux since it is affected by factors specific to a country and the global economic and political environments. The more an asset is exchanged and traded in the investment world, the more volatile it is.

As a result, traders trying to time the currency markets have always had it rough. Approximately 95% of the active market participants are on a losing streak at any given time.

Is there a way to eliminate to some degree the inherent risk in the forex markets? Currency ETFs are the answer.

What are currency ETFs?

In essence, exchange-traded funds pool several investments together to caution against the downturn of individual assets. For currency ETFs, the composition is a little different. These ETFs’ underlying holdings are either a single currency futures contract or a basket of currency pairs. They have passively managed funds that hold their underlying currency either as a single globally accepted currency or a combination of different currencies.

By investing in currency ETFs, investors gain exposure to:

- A stress-free avenue to trade in currencies

- A hassle-free and cost-effective exposure to the globally accepted currencies

- Investment portfolio diversification

- One-stop hedge solution to fluctuating forex value for investments held overseas

How to be part of the currency ETF market?

Like single currencies, investing in currency ETF is done through traditional call brokerage firms or online brokerage firms. The broker’s choice depends on the degree of transparency and control over individual investor portfolios; online brokers provide portfolio accessibility 24/7 while traditional brokerage firms offer statements after an agreed-upon period.

On locking in these decisions, investors decide whether to hold currency ETF shares or speculate on their volatility-driven price changes through the contract for differences, CFDs.

From there, the rest is a simple three-step process to being part of this market.

| Step 1 | Step 2 | Step 3 |

| Deposit investment capital with the chosen broker | Screen the currency ETFs for one that aligns with your investment goals and risk appetites | Invest or trade-in the currency ETF of choice |

Top currency ETFs to hedge against the chaotic forex markets

Exchange rates have proven time over time to be unpredictable. The problem is that a change in the exchange rate also affects all investments held in such a currency. As an investor, how can you hedge against lower exchange rates to ensure overseas investments don’t incur losses?

You invest in a currency ETF of your investment base, and the correlation between the two provides the elimination of currency risk.

These three currency ETFs compositions ensure you sleep easy.

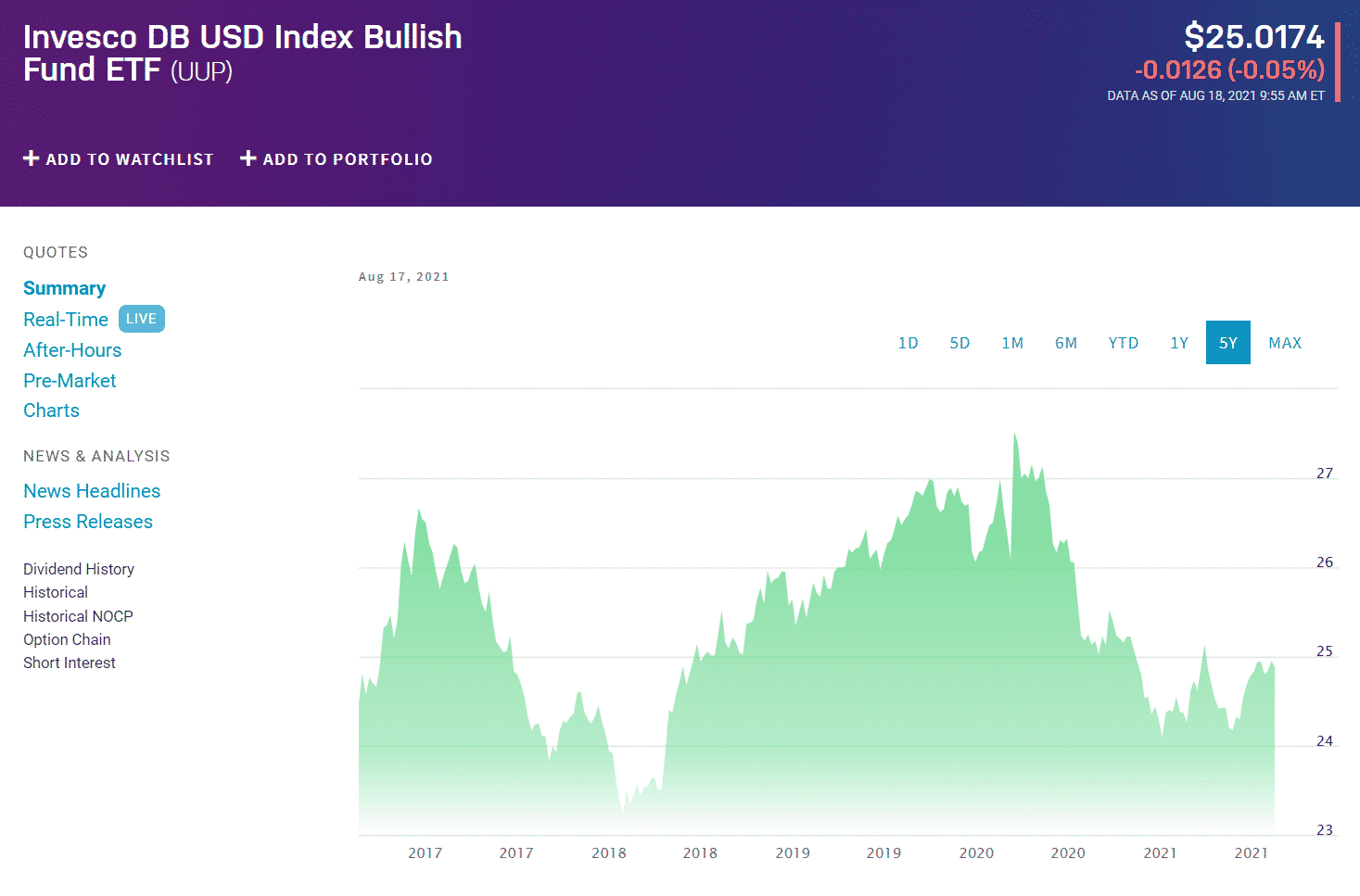

№ 1. Invesco DB US Dollar Index Bullish Fund (UUP)

Price: $25.01

Expense ratio: 0.75%

Invesco DB US Dollar Index Bullish Fund (UUP) chart

The UUP objective is the adoption of bullish positions in the ICE US Dollar index’s future contracts. Investors in the Invesco DB US Dollar Index Bullish Fund gain exposure to a pool of currencies relative to the dollar. It tracks changes in dollar income markets, dollar T-Bill exchange-traded fund income, index treasuries income, and the long portfolio index from Deutsche Bank Long USD Currency.

The coronavirus pandemic effect has been hardest felt in the United States among the leading global economies, evidenced by the UUP -10.64% decline in 2020 and -0.26% in the last 12 months.

However, since the turn of the year and the vaccine availability, the US economy is ahead of all the projections, which is attributable to the year-to-date returns of +3.20%.

Invesco DB US Dollar Index Bullish Fund has $468 million in assets, with an expense ratio of 0.75%, to enjoy quarterly dividends of $0.53 to the share.

As the US economy recovers and the USD gains traction, this currency ETF will ensure investors in the Swedish Krona, Japanese Yen, Swiss Franc, British Pound, and the Canadian dollar make money.

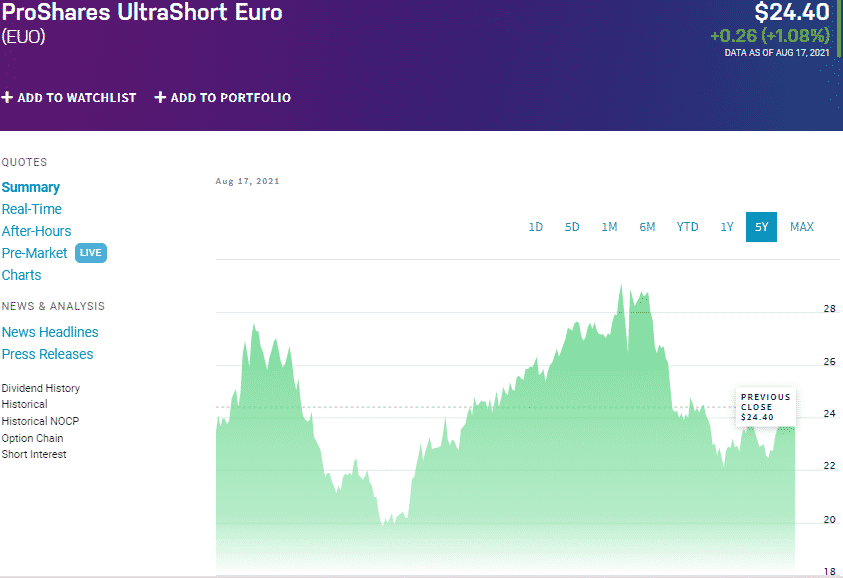

№ 2. ProShares UltraShort Euro (EUO)

Price: $24.40

Expense ratio: 0.4%

ProShares UltraShort Euro (EUO) chart

The EUO is an inverse currency ETF that seeks -2x the dollar’s performance against the euro. Rather than invest in a single currency, this exchange-traded fund hedges investors against rising euro rates by investing in futures contracts of its underlying assets.

The effect of the coronavirus pandemic ravaged countries in the eurozone, but the EUO held steady to record 12-month returns of +2.03%. As the economic resumptions pick up the pace, this currency ETF is in pole position to reap even bigger returns for its investors, given that the year-to-date returns stand at +8.28%.

Invesco DB US Dollar Index Bullish Fund has $48.8 million in assets, with an expense ratio of 0.95%.

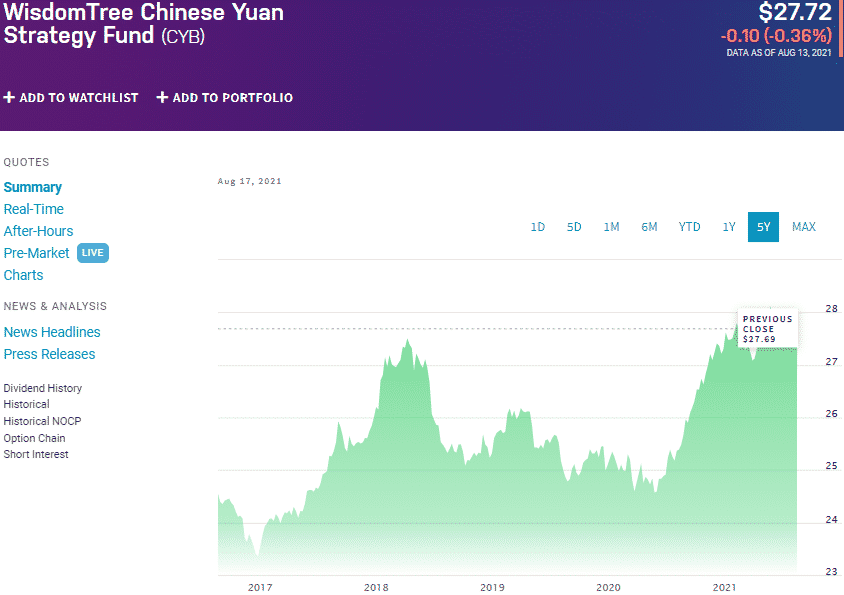

№ 3. WisdomTree Chinese Yuan Fund (CYB)

Price: $27.72

Expense ratio: 0.4%

WisdomTree Chinese Yuan Fund (CYB) chart

The CYB has interests in both the Chinese money markets and the changes in the exchange rate value between the yuan and the dollar. It is a non-diversified actively managed currency fund that invests at least 80%v of its funds on currencies with economic ties to China.

Despite the coronavirus originating in China, this ETF in the last 12 months has recorded +9.32% returns, with the year-to-date returns being +1.89%. It has $49.92 million in assets under management, with an expense ratio of 0.45%-one of the lowest in the currency ETF market.

If there is an undervalued currency in the world, it is the Chinese Yuan. The Chinese government is always putting strategies to ensure their currency value does not appreciate to boost its exports. The coronavirus pandemic has not been kind, and with the massive sell-off of Chinese equities, it might finally be time for the Chinese government to ease the structural policies that keep the yuan value so low.

Comments