Cobalt is the metal that keeps giving by being both an industrial metal and a rare earth strategic metal that will drive green technology adoption. The result of its utility is an $8.57 billion industry in 2021, expected to grow at an annual CAGR of 12.45% by 2026.

Given the recent spike in demand for electric vehicles and the drive-by developed economies for zero emissions, this estimate is low. As long as cobalt provides high energy density, which is critical in boosting the lithium-ion battery capacity and life, the demand for this metal is slowly becoming insatiable, making it a worthy investment. The major challenge of cobalt investment is that its source is concentrated in a few countries making cobalt-related equities.

How then do you invest in this corner of the metal niche efficiently? Cobalt ETFs are the answer.

Cobalt ETFs for returns: how do they work?

Unlike most metals, cobalt straddles the old school economy driver’s space and the new school economic drivers. Therefore, cobalt ETFs comprise organizations involved in disruptive technologies and those of a more traditional industrial nature; steel, tools, superalloys, magnetic materials, lithium-ion batteries, industrial chemicals, petrochemicals, cutting tools, and glaze materials.

The best cobalt ETFs to make money in 2022

Oil is still the most utilized energy source globally, but with the global appetite for green energy, spearheaded by the developed and developing economies’ drive for zero greenhouse emissions, demand for green metals is reaching critical mass, with cobalt as one of the metals driving this change and its other industrial uses, its demand skyrockets. These three ETFs are in pole position to give you exposure and a chance to make significant returns.

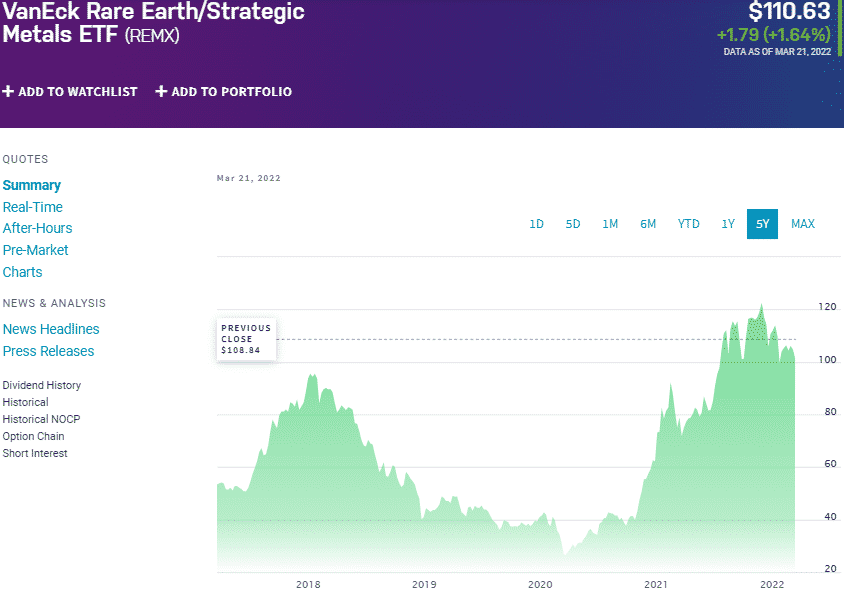

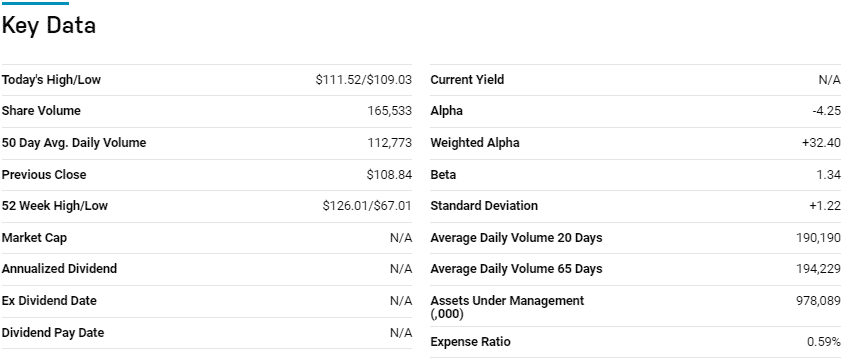

№ 1. VanEck Rare Earth/Strategic Metals ETF (REMX)

Price: $110.63

Expense ratio: 0.59%

Dividend yield: 0.45%

REMX chart

The VanEck Rare Earth/Strategic Metals ETF tracks the performance of the MVIS Global Rare Earth/Strategic Metals Index, net of fees, and expenses. It invests at least 80% of its total assets in the underlying holdings of the tracked index, exposing investors to a corner of the metals and mining industry dealing in global rare earth metals and minerals and strategic metals and minerals.

The REMX ETF is ranked № 7 for long-term investing among 13 of the best equity precious metal funds by USNews.

The top three holdings of this non-diversified rare metals fund are:

- Pilbara Minerals Limited — 7.63%

- Lynas Rare Earths Limited — 6.71%

- Zhejiang Huayou Cobalt Co. Ltd. Class A — 6.56%

The REMX ETF has $978.1 million in assets under management, with investors parting with $59 annually for a $10000 investment. It exposes investors to cobalt and other rare earth metals and minerals, making this a diversified play on all metals driving green technology. The result is a fund that has been a consistent source of return, with the increased demand only adding fuel to an already blazing money source; 5-year returns of 146.01%, 3-year returns of 148.46%, and 1-year returns of 48.66%.

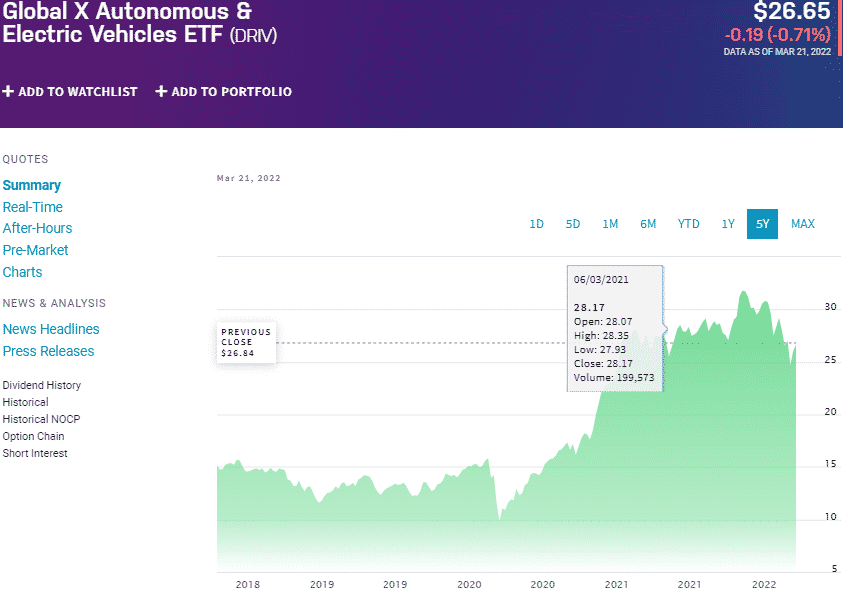

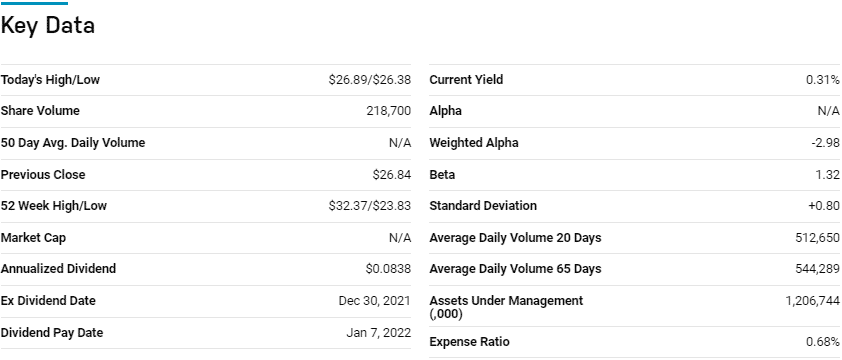

№ 2. Global X Autonomous & Electric Vehicles ETF (DRIV)

Price: $26.65

Expense ratio: 0.68%

Dividend yield: 0.24%

DRIV chart

The Global X Autonomous & Electric Vehicles ETF tracks the performance of the Solactive Autonomous & Electric Vehicles Index, net of fees, and expenses. It invests at least 80% of its total assets in the underlying holdings of the tracked index, exposing investors to organizations involved in the autonomous and electric vehicle value chains.

The DRIV ETF is ranked № 3 for long-term investing among 48 of the best miscellaneous sector funds by USNews.

The top three holdings of this fund are:

- Alphabet Inc. Class A — 3.39%

- Apple Inc. — 3.27%

- NVIDIA Corporation — 3.15%

DRIV ETF has $1.20 billion in assets under management, with investors’ parting with $68 annually for every $10000 invested. This ETF is an indirect play on cobalt by exposing investors to the best equities operating in the following three spaces; electric vehicles-top 15 companies, autonomous vehicle technology-top 30 equities, and the top 30 equities in electric vehicle components.

A modified market capping allows for a pretty evenly weight distributed ETF to withstand market downturn and free of concentration bias; 3-year returns of 106.55% and 1-year returns of -0.32%.

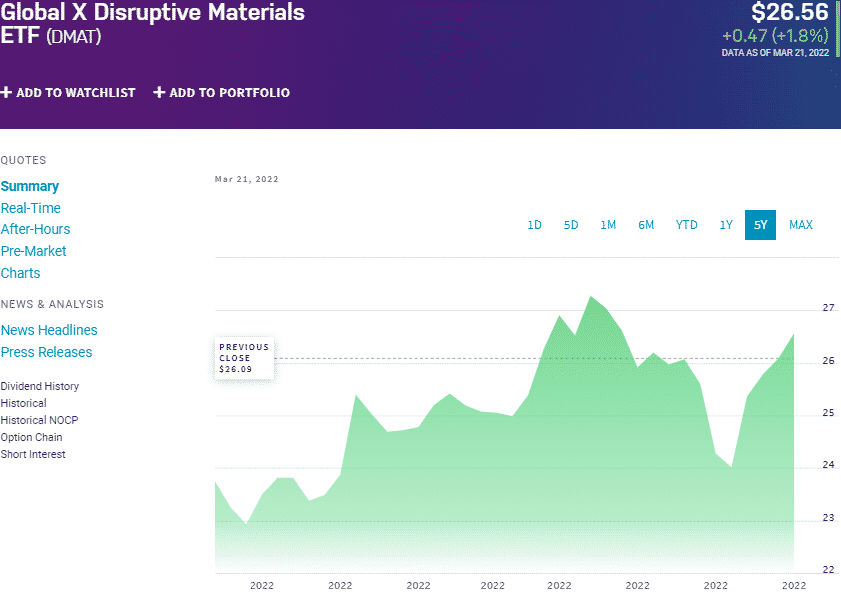

№ 3. Global X Disruptive Materials ETF (DMAT)

Price: $26.56

Expense ratio: 0.75%

Dividend yield: 1.74%

DMAT chart

The Global X Disruptive Materials ETF tracks the performance of the Solactive Disruptive Materials Index, net of fees and expenses. It invests at least 80% of its total assets in the underlying holdings of the tracked index and its associated ADRs and GDRs.

As a result, it exposes investors to organizations involved in producing, refining, and processing raw materials essential to disruptive technologies, lithium-ion batteries, wind turbines, fuel cells, 3D printing, solar panels, and robotics.

The top three holdings of this fund are:

- Sibanye Stillwater Limited — 4.77%

- First Quantum Minerals Ltd. — 4.54%

- Teck Resources Limited Class B — 4.49%

The DMAT ETF is the smallest fund on this list, with $4.9 million in assets under management, at an expense ratio of 0.59%. It achieves diversification by utilizing a modified weight cap and an algorithm that identifies the best equities in our materials, driving disruptive technologies. Having launched at the start of 2022, this diversified ETF gives investors a chance to invest early in the following energy and technology frontier while giving indirect exposure to cobalt.

Final thoughts

Cobalt’s multiple uses in traditional industries and disruptive technologies make it one of those rare commodities currently experiencing insatiable demand. Despite not being pureplay cobalt ETFs, the three funds above offer significant and diversified exposure to cobalt and the potential to make money off its increased demand.

Comments