Many are unaware that among the traded metals, steel is the most widely adopted metal of all. Despite being heavily used in the manufacturing industry, steel has proven to be one of the essential engineering materials.

In the post-Covid-19 world, economies are expected to pick up a recovery pace in 2022, resulting in increased infrastructural projects. Thus, the US Senate just passed a bill worth $2 trillion, increased automotive and related components manufacturing and machinery manufacturing, and increased fabrication of metal goods.

All these core economic recovery activities feed into the demand for steel, with data showing a forecasted CAGR growth of the steel market of 4.1% in the next five years.

Therefore, steel provides a haven investment in the post-pandemic rising inflation environment and a pool of opportunities to invest in recovering global economies through the growing steel market. Investors have the option of getting into this market via steel equities, steel ETFs, or buying physical steel for sale.

The problem with steel equities is that not all will thrive; hence, picking a sure winner is complicated with no guarantees. Buying physical steel for sale, on the other hand, comes with a raft of challenges making it quite the hustle. That leaves steel ETFs. They are the perfect steel investment vehicles since they represent the overall steel market, which will grow as the economic capacity returns to 100%.

Steel ETF to buy: how do they work?

ETFs comprise pools of economically like investment assets, tracking an index to replicate its performance. As such, steel ETFs comprise organizations in the steel value chain; those involved in steel mining, those involved in conversion and storage of physical steel, organizations whose primary activity is the use of steel, and firms providing ancillary services to the steel industry.

The best steel ETFs for 2022

Steel is a raw material with diverse uses. In the post-pandemic era, it will be a major beneficiary of a recovering global economy. These three steel ETFs have set the stage not only to shine but to provide returns opportunities.

№ 1. VanEck Steel ETF (SLX)

Price: $55.34

Expense ratio: 0.56%

Dividend yield: 1.48%

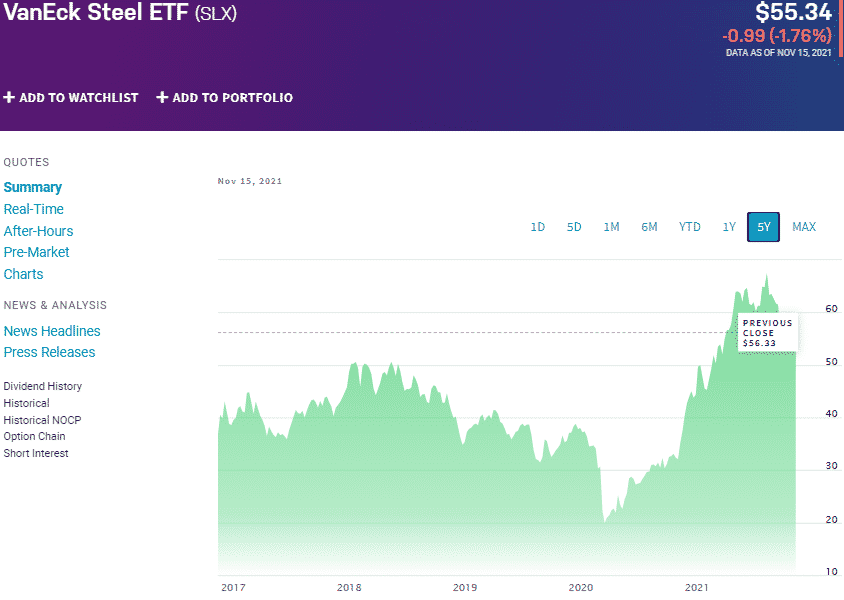

SLX price chart

The VanEck Steel ETF tracks the performance of the NYSE® Arca Steel Index, investing 80% of its total assets in the underlying holdings of the composite index. Through SLX, investors gain exposure to publicly traded companies involved in the operation of steel manufacturing mills, extraction and reduction of iron ore, and steel fabrication.

Despite this ETF trading as a leveraged play on the natural resources sector, USNews has it at rank № 17 among 38 natural resource ETFs for long-term investing.

The top three holdings of this non-diversified ETF are:

- Rio Tinto plc Sponsored ADR — 14.75%

- Vale S.A. Sponsored ADR — 12.36%

- ArcelorMittal SA ADR — 8.24%

SLX has $136.66 million in assets under management, with an expense ratio of 0.56%. SLX historical returns show that while it might not be a super earner, it is consistent and keeps close to the average category earnings; 5-year returns of 75.07%, 3- year returns of 45.44%, and pandemic year returns of 64.84%. The new Biden billion infrastructure coupled with recovering global economy is the best news for this steel ETF, making it one to watch closely in 2022.

№ 2. SPDR S&P Metals and Mining ETF (XME)

Price: $46.26

Expense ratio: 0.35%

Dividend yield: 0.66%

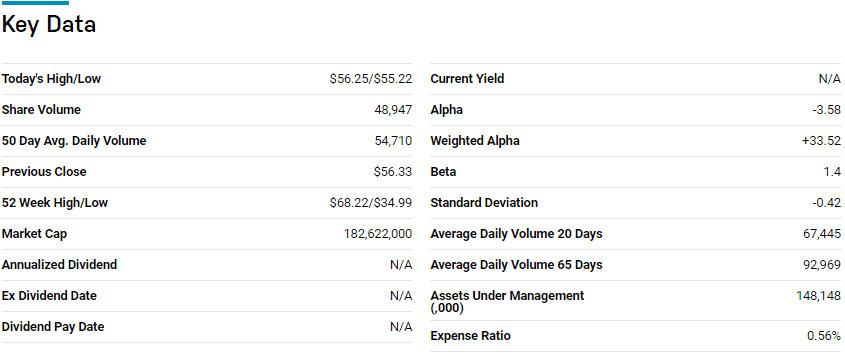

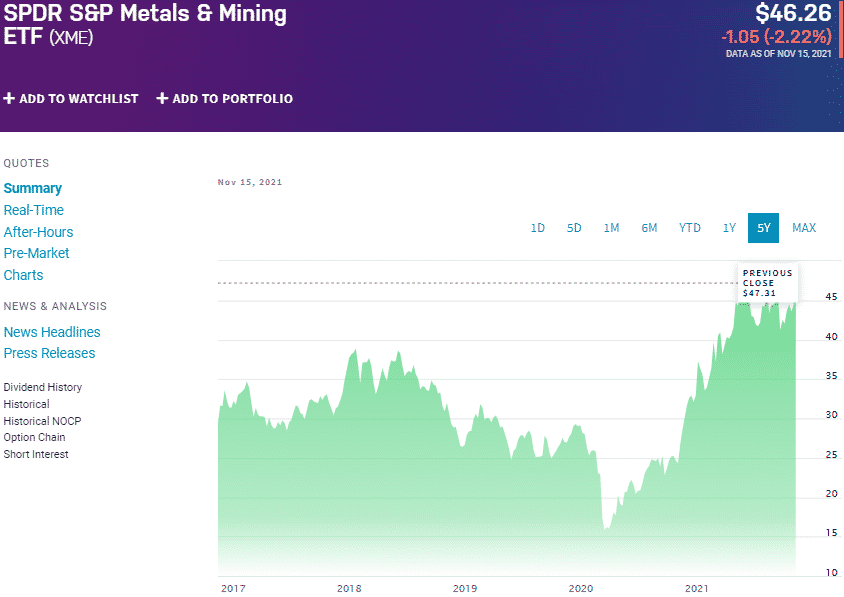

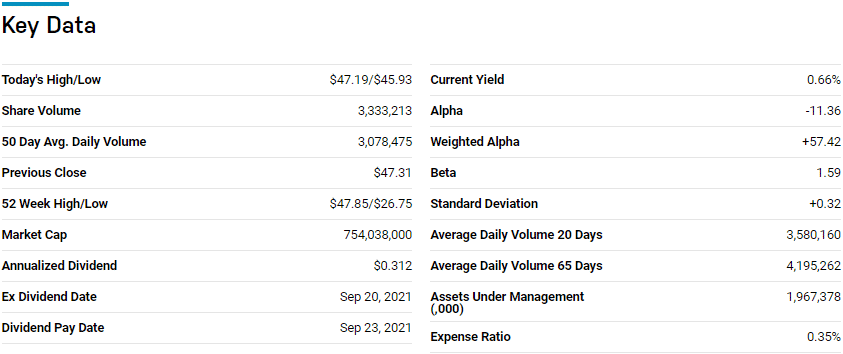

XME price chart

The SPDR S&P Metals and Mining ETF tracks the performance of the S&P Metals & Mining Select Industry Index, investing 80% of its total assets in the underlying holdings of the tracked index. Via a sampling strategy, this ETF exposes investors to the metals and mining segment.

Among 38 natural resource ETFs, the XME is ranked № 6 by USNews.

The top three holdings of this non-diversified ETF are:

- MP Materials Corp Class A — 5.36%%

- Freeport-McMoRan, Inc. — 4.94%

- Commercial Metals Company — 4.80%

XME boasts $2.01 billion in assets under management, with an expense ratio of 0.35%. XME is a diversified way to play the steel industry by gaining exposure to the entire mining and metal universe. With inflation at a record high, coupled with the consistency in returns of this ETF, it is worth a second look; 5-year returns of 77.26%, 3- year returns of 60.95%, and pandemic year returns of 80.04%.

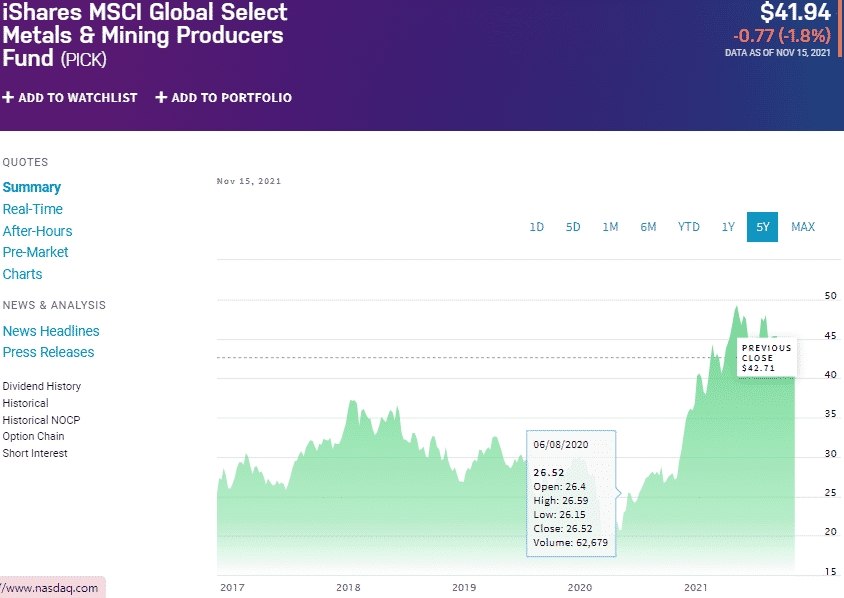

№ 3. iShares MSCI Global Metals and Mining Producers ETF (PICK)

Price: $41.94

Expense ratio: 0.39%

Dividend yield: 2.74%

PICK price chart

iShares MSCI Global Metals & Mining Producers fund tracks the performance of the MSCI ACWI Select Metals & Mining Producers ex Gold and Silver Investable Market Index. It invests at least 80% of its total assets in the underlying holdings of the tracked index. Through PICK, investors gain exposure to the global mining and exploration industry, excluding gold and silver.

Among 13 equity precious metal ETFs, PICK is ranked № 2 by USNews.

The top three holdings of this non-diversified ETF are:

- BHP Group Ltd — 7.49%%

- Rio Tinto plc. — 6.41%

- Freeport-McMoRan, Inc. — 5.55%

In addition, it has a history of posting more than its category average returns; 5-year returns of 96.60%, 3- year returns of 61.70%, and pandemic year returns of 49.86%.

Final thoughts

The world is looking for ways to minimize carbon footprint, and the steel industry is not immune to this global movement. However, leading steel producers are finding ways of producing green steel, and as the world recovers from Covid-19 clutches, steel will be among the most sort after inputs.

The ETFs above are in pole position to benefit from the rising steel demand and can make a quick buck in rising an inflation environment.

Comments