When investing in the stock market, equities fall into two broad categories, value ETFs and growth ETFs.

- Value ones are, in most cases, equities of established blue-chip companies with prolonged growth but trading below their intrinsic price value compared to their segment peers.

- Growth ones are equities exhibiting accelerated growth attributes. As a result, growth ETFs are a higher risk, higher return investment asset.

Therefore, to mitigate against the volatility coupled with these funds, you invest in growth ETFs, spreading the risk and cushioning your returns against torpedoing.

What is the composition of growth ETFs?

Growth ETFs are funds that pool together equities with more than average growth potential into a single investment asset. Due to their volatility, most growth ETFs are paired with value ETFs in a portfolio to achieve a desirable risk/reward ratio.

The best 3 growth ETFs sound investment decision in 2022

Historically, growth ETFs underperform the market in times of market downturn. However, in a post-pandemic environment, the economic growth has slowed down, but it still provides a ton of growth potential for growth equities, which provides an updraft for growth ETFs. The markets are still quite volatile, making growth ETFs even riskier, but for those that dare to risk, the three growth ETFs below have the most significant potential to outperform the markets.

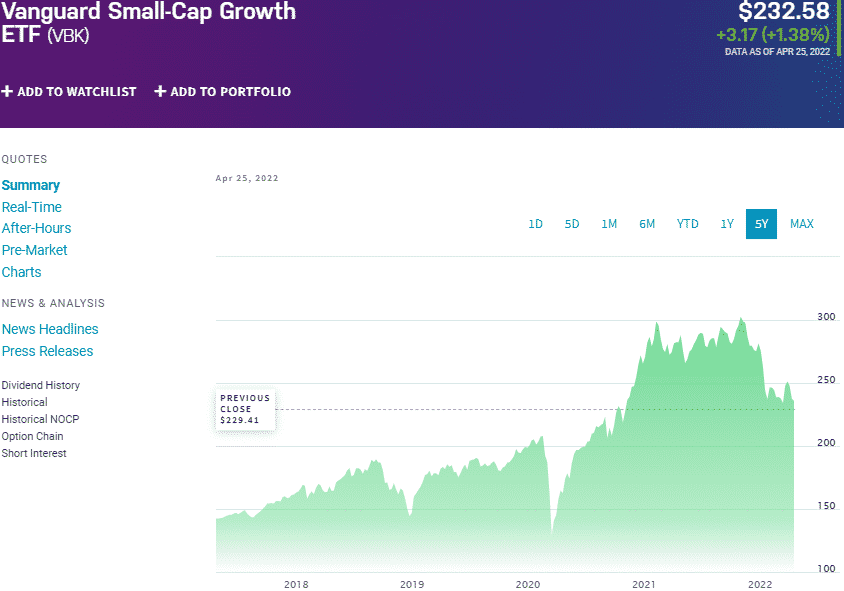

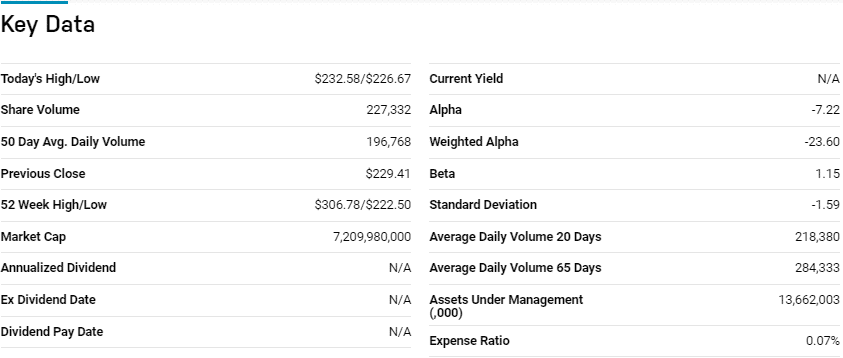

№ 1. Vanguard Small-Cap Growth ETF (VBK)

Price: $232.58

Expense ratio: 0.07%

Annual dividend yield: 0.38%

VBK chart

The Vanguard Small-Cap Growth ETF tracks the performance of the CRSP US Small Cap Growth Index, utilizing an indexing investment strategy that it tries to assign the same weight to holdings as the tracked index. The result is a fund that exposes customers to upwards of 750 small-cap US equities with the potential to be the next Amazon or Tesla.

In a list of 23 global small-cap growth funds, the VBK ETF is ranked № 1 for long-term investing.

The top three holdings of this growth ETF are:

- US Dollar – 2.78%

- Entegris, Inc. – 0.81%

- Bio-Techne Corporation – 0.78%

The VBK ETF boasts $13.67 billion in assets under management, with investors parting with a measly $7 annually for a $10000 investment. Historically, small-cap ETFs outperform the general markets after a downturn market. With the globe recovering from the coronavirus pandemic, having a fund that exposes you to more than 750 small-cap equities provides diversification and a chance to mitigate against individual stock volatility while providing a higher risk/reward ratio than other funds in this segment.

In addition, an ultralow expense ratio leaves investor pockets with more returns for their higher risk tolerance; 5-year returns of 67.46%, 3-year returns of 27.87%, and 1-year returns of -18.80%.

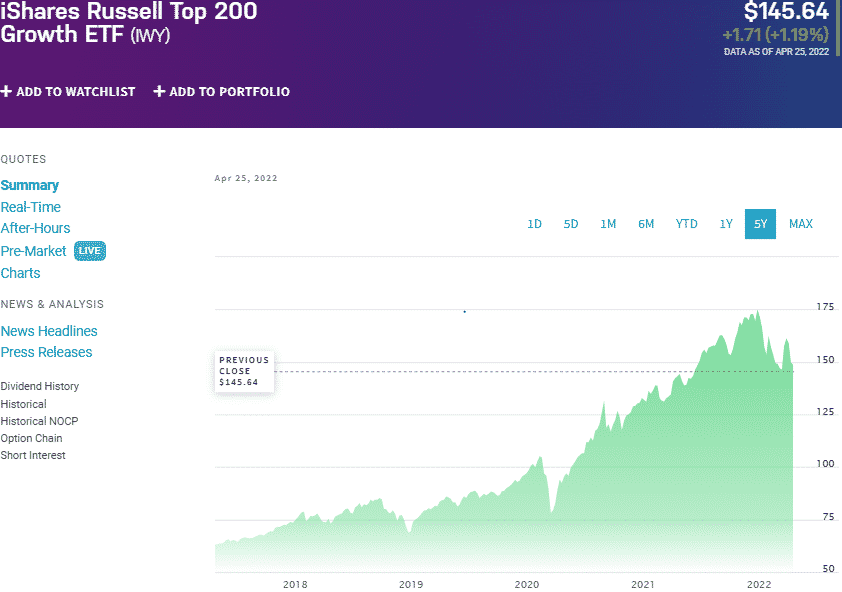

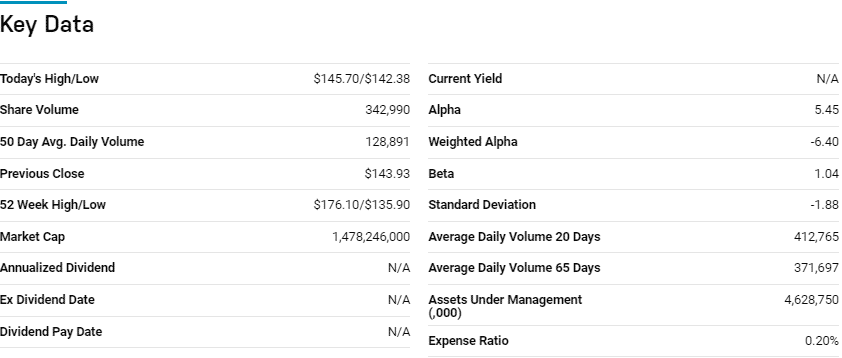

№ 2. iShares Russel Top 200 Growth ETF (IWY)

Price: $145.64

Expense ratio: 0.20%

Annual dividend yield: 0.54%

IWY chart

The iShares Russel Top 200 Growth ETF tracks the total return performance of the Russell Top 200 Growth Index, net of expenses, and fees. It invests at least 80% of its total assets in the tracked index underlying holdings and other investment securities exhibiting similar economic characteristics. The remaining 20% is in certain futures, options, cash, cash equivalents, and swap contracts coupled with the underlying holdings. It exposes investors to the largest capitalization equities exhibiting significant growth attributes.

In a list of 103 large growth funds, the IWY ETF is ranked № 9 for long-term investing.

The top three holdings of this large growth ETF are:

- Apple Inc. – 15.14%

- Microsoft Corporation – 12.66%

- Amazon.com, Inc. – 7.84%

The IWY ETF has $4.69 billion in assets under management, with an expense ratio of 0.20%. Unlike the previous fund on this list which has quite a variety of stocks, this fund picks from among the best 200 equities in the Russel 1000 index and then further distills this to around 110 holdings with the tremendous growth potential.

Despite a significant weighting on tech stocks, its diversification to include equities in the consumer, energy, and industrial segments provides for a resilient fund capable of returns year in year out; 5-year returns of 145.57%, 3-year returns of 74.47%, 1-year returns of 1.56%.

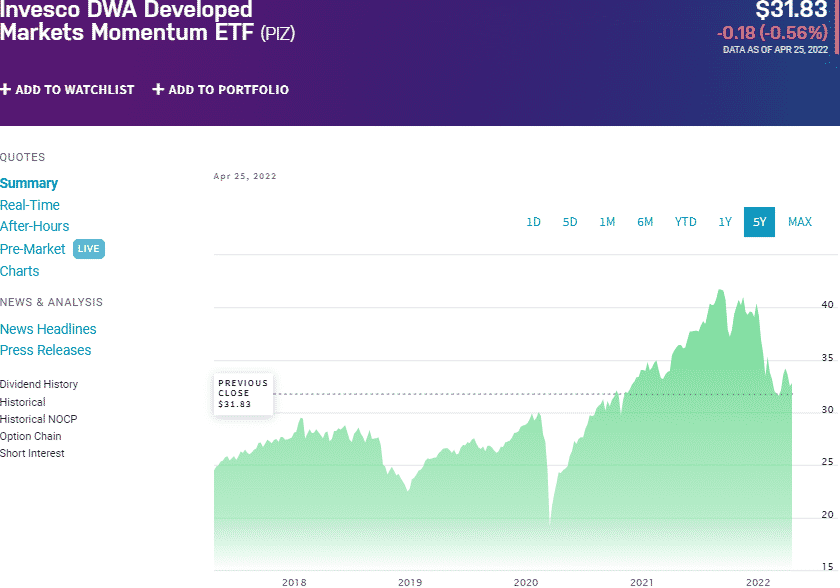

№ 3. Invesco DWA Developed Markets Momentum ETF (PIZ)

Price: $31.83

Expense ratio: 0.80%

Annual dividend yield: 0.41%

PIZ chart

Invesco DWA Developed Markets Momentum ETF tracks the investment performance of the Wright Developed Markets Technical Leaders Index, net of expenses, and fees. It invests at least 90% of its total assets in the tracked index underlying holdings. It exposes investors to developed markets’ large-cap equities with significant growth potential, ex-US.

In a list of 19 global large-cap growth funds, the PIZ ETF is ranked № 9 for long-term investing.

The top three holdings of this global internet fund are:

- Mainfreight Limited – 3.01%

- Constellation Software Inc. – 2.77%

- Novo Nordisk A/S Class B – 2.76%

PIZ chart

The PIZ ETF is the smallest fund on this list, with $176.4 million in assets under management while also having the highest expense ratio at 0.80%. The underlying equity selection methodology is geared towards achieving higher turnovers while still providing portfolio growth; 5-year returns of 43.77%, 3-year returns of 24.71%, and 1-year returns of -10.21%.

Final thoughts

The three ETFs expose you to the hottest growth stocks and provide a way to invest in this segment without the headache involved with individual growth stock analysis. Not all small stocks will be the next Microsoft, Amazon, or Tesla. However, if played right, growth stocks are one of the hottest investment assets, with the ability to double or even triple your portfolio value.

Comments